Search

Recent comments

- a catastrophe?....

11 min 16 sec ago - 3Xwars is 3Xpeace?....

2 hours 10 min ago - futile trousers....

2 hours 32 min ago - reading reality....

3 hours 4 min ago - colonel blimp....

3 hours 14 min ago - ambassador, please!

11 hours 28 min ago - yuckraine is corrupt....

14 hours 18 min ago - reviving bucha....

14 hours 39 min ago - US complaints.....

17 hours 14 min ago - worse than worst.....

20 hours 39 min ago

Democracy Links

Member's Off-site Blogs

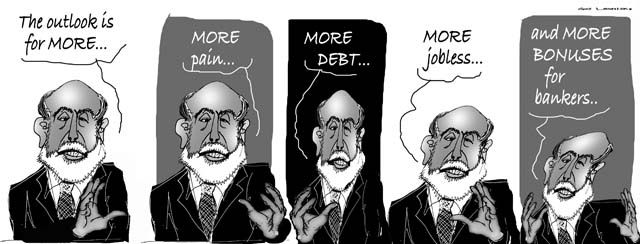

no stimulation needed...

Share markets in the United States and Europe have dipped after US Federal Reserve Chairman Ben Bernanke all but ruled out more economic stimulus.

The Dow Jones Industrial Average lost 0.4 per cent to 12,952, the S&P 500 dropped 0.5 per cent to 11,366 and the Nasdaq Composite Index retreated 0.7 per cent to 2,967 after rising above the 3,000 mark earlier in trade for the first time in 12 years.

In his testimony to Congress Mr Bernanke said climbing energy costs were likely to push inflation higher, and the decline in the nation's jobless rate had been more rapid than expected, delaying the need for more stimulus.

These comments kept the market lower, despite official figures showing the US economy grew faster than expected in the fourth quarter, expanding at an annual rate of 3 per cent.

http://www.abc.net.au/news/2012-03-01/world-shares-close-lower/3861864

- By Gus Leonisky at 1 Mar 2012 - 9:09am

- Gus Leonisky's blog

- Login or register to post comments

the price of stimulation....

The Australian share market has dipped following weak leads from European and United States markets overnight after Federal Reserve chairman Ben Bernanke dashed hopes of more economic stimulus.

Mr Bernanke issued a cautious outlook for the US economy, saying recent falls in unemployment were unlikely to continue, but made no mention of chances for further quantitative easing.

This saw equity markets and precious metals tumble, and the Australian market has followed suit; at 11:50am (AEDT) the ASX 200 was 0.7 per cent lower at 4,267 and the All Ordinaries Index was matching that fall to to 4,355.

Shares in coal miner New Hope slumped 10 per cent after it cancelled a planned $5 billion sale of the company. It has since recovered somewhat and was down 3.7 per cent.

http://www.abc.net.au/news/2012-03-01/australian-share-market-opens-lower/3862250

Apparently some nasty someone referred to the fall in US unemployment being due to the fact that chronically unemployed were not counted anymore in the tally — see after two years on the scrap heap one is not eligible to still be counted as "unemployed"... Who knows?

no viagra for the US economy...

Federal Reserve chairman Ben Bernanke on Thursday stopped short of signalling any new action to help the fragile US economy, saying the recovery was continuing but warning of potential pitfalls ahead.

"Economic growth appears poised to continue at a moderate pace of over coming quarters," Bernanke told the congressional joint economic committee. He said the Fed "remains prepared to take action as needed to protect the US financial system and economy."

http://www.guardian.co.uk/business/2012/jun/07/ben-bernanke-stimulus-fed-economy