Search

Recent comments

- breeding insanity....

4 hours 3 min ago - american "diplomacy"

7 hours 14 sec ago - deceit america....

9 hours 19 min ago - police-state....

18 hours 59 min ago - the war continues....

19 hours 47 min ago - scott is angry.....

1 day 2 hours ago - a catastrophe?....

1 day 6 hours ago - 3Xwars is 3Xpeace?....

1 day 8 hours ago - futile trousers....

1 day 8 hours ago - reading reality....

1 day 9 hours ago

Democracy Links

Member's Off-site Blogs

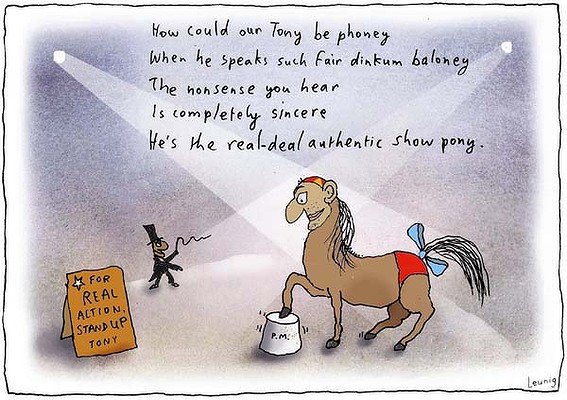

the show pony .....

Tony Abbott's budget attack is shamelessly contradictory. He slams the $2 billion saving from family benefits as ''class warfare'' that will hit ''struggling families'', but he is also blaming the government for looming interest rate rises because he says it is spending too much.

And he has no intention of repeating the mistake he made during the flood levy debate in January of making himself the issue by nominating alternative budget cuts to make up for the savings measures he decides to oppose. Instead he is simply pointing to the $50 billion in savings the Coalition lined up to pay for its election promises, even though the Treasury and Finance departments said between $7 and $11 billion of them did not exist.

Since the last election, at least another $6 billion of those savings have either been implemented by the government or redirected to other things, which might be a partial vindication of the Coalition's savings list but still leaves it short.

For the Coalition's strategy, none of this matters. Its budget response is not about policy detail, it's about furthering the ''Labor is out of touch on cost of living'' attack. If the assault can also be linked to the carbon tax or the asylum seeker issue, better still.

For those still interested in the detail, the budget's savings from family payments are actually achieved by freezing the income threshold for eligibility at $150,000, rather than increasing it in line with inflation.

The Coalition says the 40,000 families likely to slide out of eligibility as their incomes rise above $150,000 aren't rich. Wayne Swan agrees, but says the spending has to be sustainable.

The real question is whether families earning more than $150,000 still need help from the government and whether the nation can afford to pay it.

Leaders' arguments tied up in knots

to underscore the mad monk's cynical hypocrisy .....

Anyone would think the budget had frozen the income limits for getting family tax benefits at $150,000.

Talkback radio was alive with calls about it the day after the budget. Was a family income of $150,000 high or typical?

The shadow treasurer, Joe Hockey, thought it was typical.

"One hundred and fifty thousand a year for a family is certainly not rich Australia, it is very much middle Australia," he told the ABC. "Besides, I want people to aspire to earn $150,000 or more."

The budget documents themselves say that for the next two years the cutoff for getting family tax benefit B, paid parental leave and dependency tax rebates will be frozen at $150,000. That's $150,000 of personal, rather than family income - anything but typical.

The cutoff for receiving the baby bonus will be frozen at $150,000 of family income and the cutoff for family tax benefit A will be frozen at $94,316 of family income, increased by $3796 for each additional child after the first.

What the budget doesn't make clear - but should - is that these cutoffs are already frozen.

Labor introduced the $150,000 ceilings in 2008. Before that, family tax benefit B and other payments could go to the families of millionaires.

In its 2009 budget it froze indexation of those benefits and also for family tax benefit A for three years.

Since then anyone whose income has sailed through the ceiling has lost the benefit.

This budget extends the freeze for a further two years.

- By John Richardson at 12 May 2011 - 9:31am

- John Richardson's blog

- Login or register to post comments

old nag...

Yes john...

... I believe Abbott is an old nag rather than a show pony... You know.... nag nag nag... nag nag nag... relentlessly...

life for the unprincipled .....

So we have the bizarre spectacle of a Labor (immigrant) PM getting tough on boat people while a conservative opposition leader argues for miners' jobs. On the carbon tax alone, Gillard so far stands strong. How wrong we would be, then, to dump her for her first principled stand as PM.

Abbott chose a new suburban development in Canberra, the world's most carbon-profligate city, to declare that a carbon tax will "slug the housing industry", forcing people to shoulder "an even greater mortgage to afford a home".

How? Why, by adding all of $6000 to a new house. Never mind that no one's ever remortgaged their house for six grand, or that for that amount you could install your solar panels and avoid the tax. The obvious remedy for such an impost is to redefine home.

Our houses are the world's biggest; twice the size (and half the occupancy) of those we grew up in and almost four times the size of new houses in Britain. Our carbon footprint per person is also the world's biggest, and our waistlines are up there, too.

Even by Western standards our precious way of life is staggeringly, mind-blowingly wasteful.

Abbott should be helping rein this in. As Garnaut notes, "in much of the world ... global warming is a conservative as much as a social democratic issue". Instead he rides the slick line, "if you don't have a carbon tax you don't need compensation". But in truth, if we weren't so voracious we wouldn't need a carbon tax.

If the median Australian house price is $470,000, $6000 is a mere 1.2 per cent. Lose one (of four) ensuite bathrooms, a quarter of a home theatre or one (of three) car spaces and you're done.

So is that what we're saying? We won't make even this much sacrifice, won't dent our precious lifestyles by even 1 per cent, to ensure a future for our kids?

Change is hard. It's also necessary and inevitable. Our choice is between soon, slow and voluntary, or later, sudden and forced. The adult and intelligent response isn't to gripe and resist but to welcome a carbon tax as an incentive to change; to take the medicine, knowing it will do us good.

Unlike most taxes (except tobacco), a carbon tax is designed not to raise money but to change behaviour. Yet of course it will raise money and the question of how to use it.

Give up an en suite or world goes down toilet