Search

Recent comments

- patriotism....

3 hours 39 min ago - belittling russia......

4 hours 7 min ago - Запад толкает Украину на последнюю битву....

4 hours 21 min ago - fourteen points....

4 hours 30 min ago - der philosophische glaube....

4 hours 41 min ago - seriously?...

4 hours 55 min ago - AfD....

5 hours 22 min ago - undesirables...

5 hours 39 min ago - assistant spies......

6 hours 4 min ago - brics.....

9 hours 12 min ago

Democracy Links

Member's Off-site Blogs

the inside job...

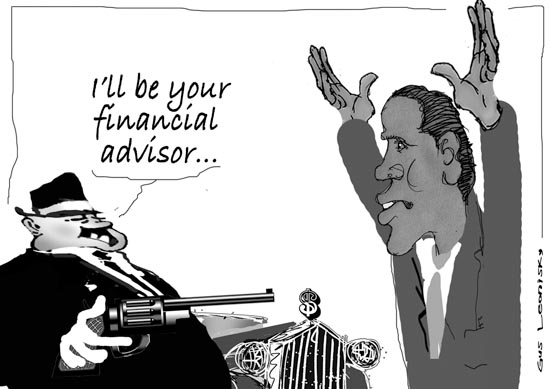

What Happened to Change We Can Believe In?

By FRANK RICH

PRESIDENT Obama, the Rodney Dangerfield of 2010, gets no respect for averting another Great Depression, for saving 3.3 million jobs with stimulus spending, or for salvaging GM and Chrysler from the junkyard. And none of these good deeds, no matter how substantial, will go unpunished if the projected Democratic bloodbath materializes on Election Day. Some are even going unremembered. For Obama, the ultimate indignity is the Times/CBS News poll in September showing that only 8 percent of Americans know that he gave 95 percent of American taxpayers a tax cut.

The reasons for his failure to reap credit for any economic accomplishments are a catechism by now: the dark cloud cast by undiminished unemployment, the relentless disinformation campaign of his political opponents, and the White House’s surprising ineptitude at selling its own achievements. But the most relentless drag on a chief executive who promised change we can believe in is even more ominous. It’s the country’s fatalistic sense that the stacked economic order that gave us the Great Recession remains not just in place but more entrenched and powerful than ever.

No matter how much Obama talks about his “tough” new financial regulatory reforms or offers rote condemnations of Wall Street greed, few believe there’s been real change. That’s not just because so many have lost their jobs, their savings and their homes. It’s also because so many know that the loftiest perpetrators of this national devastation got get-out-of-jail-free cards, that too-big-to-fail banks have grown bigger and that the rich are still the only Americans getting richer.

This intractable status quo is being rubbed in our faces daily during the pre-election sprint by revelations of the latest banking industry outrage, its disregard for the rule of law as it cut every corner to process an avalanche of foreclosures. Clearly, these financial institutions have learned nothing in the few years since their contempt for fiscal and legal niceties led them to peddle these predatory mortgages (and the reckless financial “products” concocted from them) in the first place. And why should they have learned anything? They’ve often been rewarded, not punished, for bad behavior.

The latest example is Angelo Mozilo, the former chief executive of Countrywide and the godfather of subprime mortgages. On the eve of his trial 10 days ago, he settled Securities and Exchange Commission charges for $67.5 million, $20 million of which will be footed by what remains of Countrywide in its present iteration at Bank of America. Even if he paid the whole sum himself, it would still be a small fraction of the $521 million he collected in compensation as he pursued his gambling spree from 2000 until 2008.

http://www.nytimes.com/2010/10/24/opinion/24rich.html?ref=general&src=me&pagewanted=print

-----------------------------------

- By Gus Leonisky at 25 Oct 2010 - 4:11pm

- Gus Leonisky's blog

- Login or register to post comments

buying the result of elections...

We can blame much of this turn of events on the deep pockets of oil billionaires like the Koch brothers and on the Supreme Court’s Citizens United decision, which freed corporations to try to buy any election they choose. But the Obama White House is hardly innocent. Its failure to hold the bust’s malefactors accountable has helped turn what should have been a clear-cut choice on Nov. 2 into a blurry contest between the party of big corporations and the party of business as usual.

http://www.nytimes.com/2010/10/24/opinion/24rich.html?ref=general&src=me&pagewanted=print

---------------------------

jumping a deep puddle

Falling Into the Chasm

By PAUL KRUGMAN

This is what happens when you need to leap over an economic chasm — but either can’t or won’t jump far enough, so that you only get part of the way across.

If Democrats do as badly as expected in next week’s elections, pundits will rush to interpret the results as a referendum on ideology. President Obama moved too far to the left, most will say, even though his actual program — a health care plan very similar to past Republican proposals, a fiscal stimulus that consisted mainly of tax cuts, help for the unemployed and aid to hard-pressed states — was more conservative than his election platform.

A few commentators will point out, with much more justice, that Mr. Obama never made a full-throated case for progressive policies, that he consistently stepped on his own message, that he was so worried about making bankers nervous that he ended up ceding populist anger to the right.

But the truth is that if the economic situation were better — if unemployment had fallen substantially over the past year — we wouldn’t be having this discussion. We would, instead, be talking about modest Democratic losses, no more than is usual in midterm elections.

The real story of this election, then, is that of an economic policy that failed to deliver. Why? Because it was greatly inadequate to the task.

When Mr. Obama took office, he inherited an economy in dire straits — more dire, it seems, than he or his top economic advisers realized. They knew that America was in the midst of a severe financial crisis. But they don’t seem to have taken on board the lesson of history, which is that major financial crises are normally followed by a protracted period of very high unemployment.

http://www.nytimes.com/2010/10/25/opinion/25krugman.html?hp=&pagewanted=print

-------------------------

the dream died...

The realities of American politics don't change much from year to year. The "politics of division" which Obama denounced are the faithful reflection of national divisions of wealth and resources which are wider today than they have been at any time since the late 1920s.

In fact the "dream" died even before Obama was elected in November 2008. Already in September that year Senator Obama, like his opponent, Senator McCain, had voted, at the behest of Treasury Secretary Hank Paulson (formerly of Goldman Sachs) and of Fed chairman Ben Bernanke, for the bailout of the banks. Whatever the election result, there was to be no change in the architecture of financial power in America.

Two events are scheduled for next Tuesday. If we are to believe the polls, the voters will install Republicans as the new majority in the House of Representatives. A longer shot - they may even win the Senate.

If that happens, Obama will be in exactly the situation that Bill Clinton found himself on November 9, 1994, the day after the Republicans won control of both houses of Congress for the first time in 40 years.

Also on Tuesday, chairman Bernanke and the Open Market Committee of the Federal Reserve Board will convene in Washington and decide on how much money to create – "quantitative easing" - and hand to the banks, in order to lift the country out of a Depression which has 30 million Americans either without a job, or working part-time. Their deliberations will be more consequential, at least in the short term, than the verdicts of the voters in the democratic contest.

Read more: http://www.thefirstpost.co.uk/70738,news-comment,news-politics,november-2-goodbye-to-the-age-of-barack-obama-mid-term-elections-tea-party#ixzz13iBQH7Zj