Search

Democracy Links

Member's Off-site Blogs

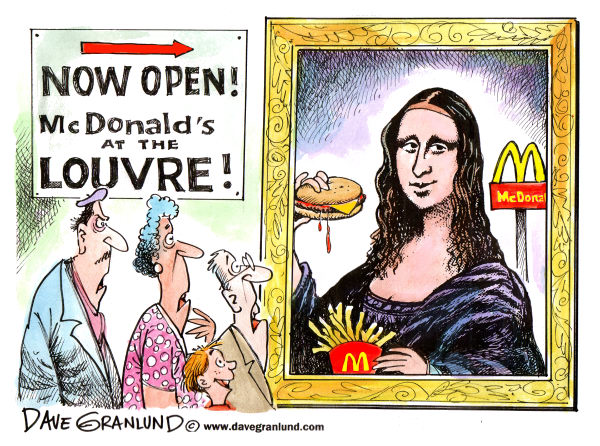

the art of greed .....

It has tried every avenue of marketing, from TV ads to sponsorship of sport. Now McDonald's is opening up a new front: its own TV show.

- By John Richardson at 31 Mar 2012 - 7:49am

- John Richardson's blog

- Login or register to post comments

- Read more

from the glass house .....

- By John Richardson at 31 Mar 2012 - 7:47am

- John Richardson's blog

- 1 comment

hoodies .....

- By John Richardson at 31 Mar 2012 - 7:17am

- John Richardson's blog

- Login or register to post comments

- Read more

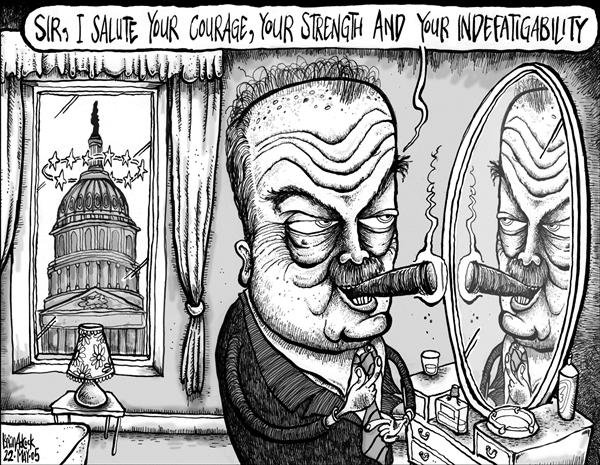

the cat got the cream .....

The former Labour MP, George Galloway, one of the most divisive figures in Westminster politics, has created political history by winning yesterday's Bradford West by-election for his Respect party with a stunning majority of 10,140, grabbing a seat held by Labour since 1974.

- By John Richardson at 31 Mar 2012 - 7:13am

- John Richardson's blog

- Login or register to post comments

- Read more

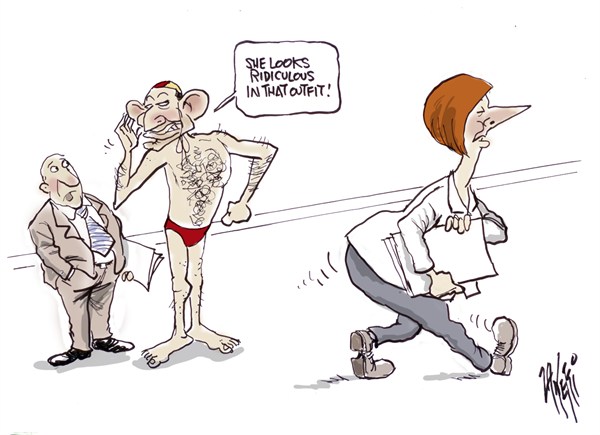

fashion parade

TONY Abbott has been caught agreeing with Germaine Greer's nasty comments about Prime Minister Julia Gillard's dress sense.

- By Gus Leonisky at 30 Mar 2012 - 9:39am

- Gus Leonisky's blog

- 5 comments

- Read more

tony pops in...

There are a lot of very confused feminists out there right now. Tony Abbott, long seen by the sisterhood as Australia's foremost manifestation that we're all just monkeys in clothing - some more hirsute, and scantily-clad, than others- now wants to help women get back to work after childbirth.

- By Gus Leonisky at 30 Mar 2012 - 8:00am

- Gus Leonisky's blog

- Login or register to post comments

- Read more

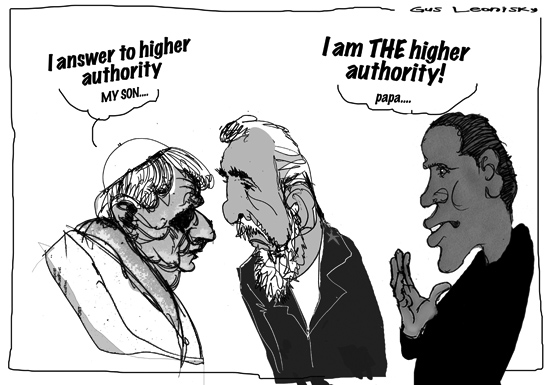

the pope does cuba...

Pope Benedict has slammed America's economic embargo on Cuba, saying it unfairly burdens the Cuban people.

- By Gus Leonisky at 29 Mar 2012 - 1:47pm

- Gus Leonisky's blog

- 5 comments

- Read more

the light on the hill .....

Electricity companies are refusing to tell struggling families and businesses exactly how much the carbon tax will add to their power bills.

They have rejected state government demands for transparency on power prices, claiming it is impossible to provide accurate itemised billing to every home and that it would put them squarely in the sights of the ACCC.

However, the O'Farrell government will this week announce its intention to force all energy retailers to provide an "averaged" carbon tax liability on every consumer's bill starting from July 1.

- By John Richardson at 29 Mar 2012 - 1:19pm

- John Richardson's blog

- 3 comments

- Read more

turnkey...

Americans often ascribe to economics effects that are in fact caused by politics. Before the Espionage Act, for instance, there were hundreds of radical newspapers, many of them socialist or communist - or just sympathetic to the plight of workers. After the war, most disappeared. That wasn't the result of market forces. The US government went to great pains at great expense to persuade Americans to embrace an approved ideology while it silenced dissidents with old-fashioned censorship. The Masses, along with 70 other radical publications, went out of business, because the US Post Office wouldn't deliver it.

Yet they were the lucky ones.

'A turnkey totalitarian state'

- By Gus Leonisky at 29 Mar 2012 - 8:14am

- Gus Leonisky's blog

- 2 comments

- Read more

down and ups about the death penalty...

A report into executions has found capital punishment decreased by a third over the past decade worldwide, but spiked last year in the Middle East and North Africa.

- By Gus Leonisky at 28 Mar 2012 - 4:36pm

- Gus Leonisky's blog

- 6 comments

- Read more

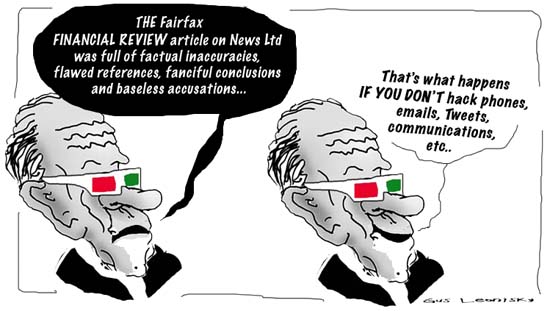

accountability .....

A secret unit within Rupert Murdoch's News Corporation promoted a wave of high-tech piracy in Australia that damaged Austar, Optus and Foxtel at a time when News was moving to take control of the Australian pay TV industry.

The piracy cost the Australian pay TV companies up to $50 million a year and helped cripple the finances of Austar, which Foxtel is now in the process of acquiring.

A four-year investigation by The Australian Financial Review has revealed a global trail of corporate dirty tricks directed against competitors by a secretive group of former policemen and intelligence officers within News Corp known as Operational Security.

- By John Richardson at 28 Mar 2012 - 2:41pm

- John Richardson's blog

- 2 comments

- Read more

amen & pass the cash .....

Paul Crouch, 77, and his wife Jan Crouch, 73, run the Trinity Broadcasting Network which delivers the Christian message to every continent except Antarctica 24 hours a day, seven days a week. It bills itself as "the world's largest religious network and America's most watched faith channel".

The network broadcasts prosperity gospel programming, which promises that believers will be materially rewarded, and raked in $92 million in donations in 2010.

- By John Richardson at 28 Mar 2012 - 1:02pm

- John Richardson's blog

- Login or register to post comments

- Read more

winning hearts & minds .....

The March 11 Massacre of the 17 Afghan citizens, including at least nine children and four women, raises many fundamental issues about the nature of a colonial war, the practices of a colonial army engaged in a prolonged (eleven-year) occupation and the character of an imperial state as it commits war crimes and increasingly relies on arbitrary dictatorial measures to secure public compliance and suppress dissent.

- By John Richardson at 28 Mar 2012 - 1:00pm

- John Richardson's blog

- 1 comment

- Read more

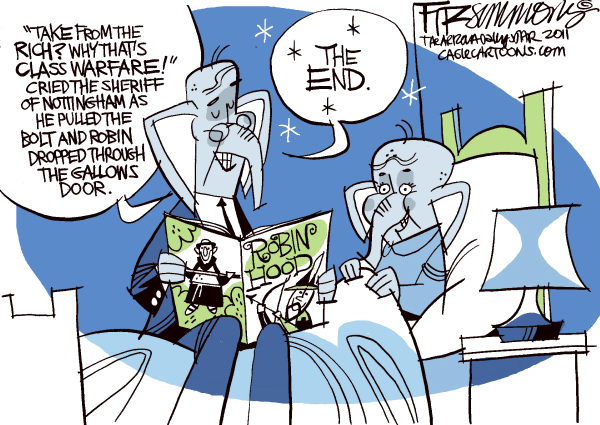

more fractured fairytales .....

New statistics show an ever-more-startling divergence between the fortunes of the wealthy and everybody else - and the desperate need to address this wrenching problem. Even in a country that sometimes seems inured to income inequality, these takeaways are truly stunning.

- By John Richardson at 27 Mar 2012 - 11:00am

- John Richardson's blog

- Login or register to post comments

- Read more

Recent comments

6 hours 10 min ago

6 hours 29 min ago

6 hours 50 min ago

7 hours 49 min ago

8 hours 15 min ago

11 hours 12 min ago

11 hours 33 min ago

12 hours 5 min ago

12 hours 31 min ago

13 hours 19 min ago