Search

Recent comments

- the ugliest excuse to go to war.....

3 hours 32 min ago - morons....

5 hours 24 min ago - idiots...

5 hours 26 min ago - no reason....

6 hours 31 min ago - ask claude...

9 hours 52 min ago - dumb blonde....

17 hours 15 min ago - unhealthy USA....

17 hours 48 min ago - it's time....

18 hours 10 min ago - pissing dick....

18 hours 29 min ago - landings.....

18 hours 40 min ago

Democracy Links

Member's Off-site Blogs

cock-a-doodle .....

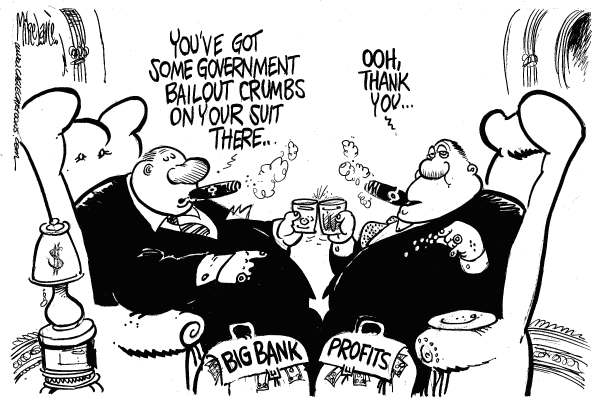

Wall Street bankers are strutting around like little banty roosters these days, crowing about the phenomenal profits their banks are raking in.

Citigroup has just announced that its profits for just the first three months of this year totaled an incredible $4.4 billion, Goldman Sachs' haul was $3.5 billion, JPMorgan Chase grabbed $3.3 billion and Bank of America took $3.2 billion. Top bankers are cock-a-doodle-doing over these numbers, claiming that such results prove what geniuses they are, how essential they are to America's financial health and, of course, how deserving they are of their multimillion-dollar bonuses.

Before they choke on their own hubris, however, let's note that a huge chunk of these profits are taken directly from a massive, little-known subsidy slipped to them by Ben Bernanke and other regulatory sweethearts in our country's Federal Reserve system. The Fed has deliberately held short-term interest rates to historic lows - less than one half of a percent. Meanwhile, the Treasury Department is paying almost 4 percent interest on longer-term loans that banks make to the government.

This might sound complicated, but it's really a very simple transfer of public wealth to the giant banks. The Fed loans, let's say, a billion dollars to a bank at a half-percent interest. The bank then turns right around and loans that billion dollars to the Treasury Department, collecting 4 percent interest. In short, boys and girls, the banks take our money and loan it back to us for a sweet 3.5 percent profit. Sheer genius!

One wonders: Do bankers wear ski masks when they make these transactions?

- By John Richardson at 6 May 2010 - 7:49pm

- John Richardson's blog

- Login or register to post comments

panic on wall street...

Memories of the stock market plunges of 2008 resurfaced overnight after a massive slide on Wall Street.

Panic appeared to set in as the Dow Jones Industrial Average suddenly nosedived to be down 1,000 points or nearly 9 per cent.

The index bottomed out at 9,875 points and within an hour the market had rebounded but remained 400 points lower.

There are questions over whether a technical problem was to blame for the fall and the New York Stock Exchange is investigating.

Proctor and Gamble fell 47 per cent at one stage and there are reports this could have been the result of a trader mistakenly entering a B for billion instead of an M for million.

But fears about Europe's debt problems are also worrying the market, and investors have been flocking to the traditional safe havens, like gold and US Treasuries.

--------------------------

A B for an M?.... Ah Goldilocks...