Search

Recent comments

- bully don.....

3 hours 28 min ago - impeached?....

8 hours 15 min ago - 100.....

16 hours 28 min ago - epibatidine....

22 hours 20 min ago - cryptohubs...

23 hours 18 min ago - jackboots....

23 hours 26 min ago - horrid....

23 hours 34 min ago - nothing....

1 day 1 hour ago - daily tally....

1 day 3 hours ago - new tariffs....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

pass the parcel....

- By Gus Leonisky at 27 Apr 2010 - 3:56pm

- Gus Leonisky's blog

- Login or register to post comments

reeling from a fraud case

US Republican senators have blocked moves to start debating a bill to introduce the most significant reforms to financial regulations for 60 years.

Needing 60 votes in the 100-seat Senate to begin debating the bill, Democratic leaders fell three votes short.

Democratic Senator Ben Nelson joined 39 Republicans in voting against it.

Republicans says the bill does not go far enough in its reforms, while Democrats say their opponents want to protect wealthy corporate interests.

Both parties say they expect the overhaul will eventually be approved.

Correspondents say that with Wall Street reeling from a fraud case against Goldman Sachs they are eager to act before November's Congressional elections.

Goldman executives are due to appear before a Senate committee later. On Monday, the committee said the bank had made billions of dollars at its clients' expense during the housing market collapse.

---------------------

Gus: I dream of a large bucket of gold...

sour grapes...

Goldman Sachs made billions of dollars at the expense of its clients during the collapse of the housing market, a US Senate investigation has found.

The investigation - which obtained Goldman e-mails - said bank executives had misled investors over mortgage-related investments that turned sour.

The Senate panel released its findings ahead of its hearing on Tuesday into the Goldman affair.

Goldman vigorously denies any wrongdoing.

The Permanent Subcommittee on Investigations has been sifting through e-mails and other Goldman documents obtained in an 18-month investigation.

Excerpts from the documents were published Monday, a day before Goldman chief executive Lloyd Blankfein and other top Goldman executives appear before the committee.

---------------------------------

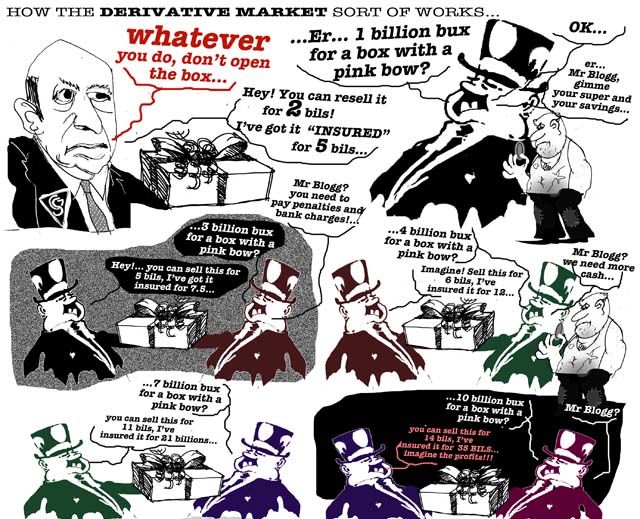

Ah, greed with a pinch of salt.... see toon at top...

a shitty deal...

http://www.washingtonpost.com/wp-dyn/content/video/2010/04/27/VI2010042702650.html

...Ah GUS! where do you get your images BEFORE they are exposed in the news??? See toon above...

exposed taxpayers' butt...

From the NYT

It’s amazing that we’ve gotten to 8 p.m. without a lengthy discussion of A.I.G., that insurance giant that did so many deals with Goldman. But here we are. Let’s go.

Senator Levin, the subcommittee, asks Mr. Blankfein why Goldman received taxpayer money related to its contracts with A.I.G.

Sharply, Mr. Blankfein replies, “No, we got money from A.I.G.”

Mr. Levin retorts, “That was taxpayers.”

Mr. Blankfein says A.I.G. received money from the government that paid it over to Goldman. But the senator doesn’t buy it. He says this logic is circular and then asks if the payments made to Goldman — at 100 cents on the dollar — were justified, given the bailout of A.I.G. “Why isn’t that unjust enrichment?” Mr. Levin asks.

-----------------------

Gus: this is unfair... The problem is a system that allows financial "crookery" of the geatest order... A system where derivative "insurance" is actually extortion in disguise. The smart cookies always end up in front while the government and the public end up holding the pissing baby.

remember:

"The days when a major insurance company could bet the house on credit default swaps with no one watching and no credible backing to protect the company or taxpayers from losses must end."

Timothy Geithner - Treasury Secretary [about one year ago]

--------------------

Gus: so far nothing has been done and the republicans are farting around with "freedom this freedom that" arguments that do not hold water. The next freedom will be for a crazy poor taxpayer starting kneecapping all the bushrangers and highway gangsters involved in this financial farce.

Remember the World GDP is around 60 trillion dolars, the financial kitty is about 140 trillion and at present the derivative market may have reached 1000 trillion. It grows like cancer... And what are derivatives? Some call them "insurance", but they're actually rolling bets on the value of things, in which the face value of things has no part but bets are on whether the face value is up or down at a particular time. Overall one can be thankfull that most of the derivative markets is 50/50 balanced by counter bets. But in this process the value of the original parcel becomes far removed from the values of the bets. Thus should one of the parcels be EXPOSED as having been rotted from the start or should one bet not be properly counterbetted, the whole edifice of derivatives can shift a mere percentage point one way or the other — and the derivative market (hence the banking system) is in trouble by 10 trillion dollars... This represents wiping out 10 per cent of the world's kitty or 20 per cent of the world's GDP in one swoop.

Meanwhile as the money flows from one bet to another — whether there is a win or a loss — bank executive, hedge funds and other financial groovies take their cuts of the money-flow in form of BONUSES... or hard cash, mostly coming from "the economy"... The more flow, in wins or in losses regardless, the more THEY TAKE in THEIR CUTS...

The "credible" backing has long gone and to create a "credible" backing one would need an increase in the world GDP of about ten fold to 500 trillion dollars. Impossible to do without instantly wreaking the planet (which we're doing slowly anyway). End of story. What has to happen is to replace the derivative bets with valueless chips. "Not in a million years" will say the banks. All bank executives may have to be send to Siberia, eventually. Who knows... I have my real solutions for all this mess but who cares.

I'd be surprised if Goldman Sachs even gets a knuckle rap in this "court case"...

deport wall street .....

"... any illegal immigrant they catch in Arizona, they should let him keep doing his job because he's adding to the economy. For every one they catch, they should send one Goldman Sachs guy to Mexico." - Michael Moore on Larry King Live, Tuesday, April 27th, 2010.

Michael Moore, VIDEO: "Deport Wall Street"

"our customers. they don't care..."

Blankfein: “In the context of market making, that is not a conflict. The thing we are selling them is supposed to give them the risk they want. They shouldn’t care what our views are. There are parts of the business where we are fiduciaries.”

Levin: “That’s the part that confuses people. You don’t explain that you're betting against them.”

Blankfein: “They don’t care.”

Levin: “They don’t care that there’s an inherent conflict that you don’t disclose to your client that you’re short on that security? You don’t think that’s relevant?”

Blankfein: “Just think of buying in the stock market. You could be buying from the biggest mutual fund in the world, and you would never know it. Our clients wanted exposure to the market, and that’s what they got.”

http://blogs.barrons.com/stockstowatchtoday/2010/04/27/goldman-sachs-next-up-blankfein/

-------------------------

Gus: what he means in short: "our clients wanted to take a bath" and we "drowned them beautifully"...

banking wanking...

One month before he goes on trial, former French trader Jerome Kerviel is making his case in a tell-all book that likens trading to prostitution and hits out at the "big banking orgy".

Now an employee at a computer firm outside Paris, Kerviel depicts himself as a scapegoat of an out-of-control banking world in L'Engrenage: Memoires d'un Trader (The Spiral: Memoirs of a Trader) that hits bookshops on Wednesday.

The 33-year-old ex-trader at Societe Generale bank describes the money-crazed atmosphere of trading rooms where managers congratulate top earners at the end of the day by comparing them to prostitutes.

"Bravo, you have been a good hooker today," is what bank managers would tell Kerviel on most nights, the ex-trader wrote in the book, excerpts of which have been released in the French press.

"In this big banking orgy, traders have the right to the same consideration afforded to any low-level prostitute: a quick recognition that the day's earnings were good."

Kerviel goes on trial on June 8, accused of gambling away billions of euros of SocGen's money in risky dealings that ended up costing the French bank 4.9 billion euros ($7 billion) in losses.

-----------------

see toon at top...

stock bath...

New analysis of the Dow's mysterious 1,000-point drop last Thursday suggests that a large trade by a hedge fund advised by Nassim Taleb, author of Black Swan: The Impact of the Highly Improbable, was itself behind this 'Black Swan' - the term for a rare, unforeseen event.

According to the Wall Street Journal, soon after 2.15pm Eastern time, the hedge fund Universa Investments LP placed a big bet in the Chicago options trading pits that stocks would continue their sharp declines.

On a day when the markets were less strained, a $7.5 million trade for 50,000 options would scarcely have been felt. But less than 20 minutes later indexes were tumbling.

As the market fell, those declines are likely to have forced even more "hedging" sales, creating increased pressure that fed into a market already coloured with fear. As the selling accelerated and spread, exchanges became clogged with volume.

Then superfast-trading hedge funds that now provide much of the liquidity for the stock market pulled to the sidelines. "We had reached a critical point in the market, and it was poised to collapse," said Mark Spitznagel, Universa's founder, who denies that his fund started the decline.

As more evidence emerges, it is becoming far less probable that a "fat-finger error" - like ordering 16 billion trades instead of 16 million - was the cause.

Read more: http://www.thefirstpost.co.uk/63175,business,was-world-dow-jones-stock-market-crash-started-by-75m-bet-in-chicago-nassim-taleb#ixzz0nlnkx1lc

inflated ratings...

from the NYT

The New York attorney general has started an investigation of eight banks to determine whether they provided misleading information to rating agencies in order to inflate the grades of certain mortgage securities, according to two people with knowledge of the investigation.

The investigation parallels federal inquiries into the business practices of a broad range of financial companies in the years before the collapse of the housing market.

Where those investigations have focused on interactions between the banks and their clients who bought mortgage securities, this one expands the scope of scrutiny to the interplay between banks and the agencies that rate their securities.

The agencies themselves have been widely criticized for overstating the quality of many mortgage securities that ended up losing money once the housing market collapsed. The inquiry by the attorney general of New York, Andrew M. Cuomo, suggests that he thinks the agencies may have been duped by one or more of the targets of his investigation.

Those targets are Goldman Sachs, Morgan Stanley, UBS, Citigroup, Credit Suisse, Deutsche Bank, Crédit Agricole and Merrill Lynch, which is now owned by Bank of America.

----------------------

see toon at top...

more pass the parcel...

By Economics Correspondent Stephen Long

Economists are concerned Europe may send itself into a prolonged recession that could dampen growth across the globe, despite its trillion-dollar pledge to bankroll ailing European states.

Earlier this month, European leaders and the International Monetary Fund (IMF) pledged more than $1 trillion to bail out failing countries in the eurozone.

But fear is now turning from the imminent risk of default in southern European nations to the possibility of a prolonged recession.

Kommerzbank spokesman Joerg Kraemer says Europe faces a Catch-22.

"You can't solve this debt crisis without, more or less, going into recession. This is the price you have to pay," he said.

In the United States, a former Federal Reserve chief and now an influential adviser to the president, Paul Volcker, says the value of the euro may be in jeopardy.

"The essential elements of discipline, economic policy and fiscal policy that was hoped for and expected as part of the euro ... well, that hope has, at least so far, not been rewarded in some countries," he said.

see toon at top...

speculation and starvation...

Speculators set up a casino where the chips were the stomachs of millions. What does it say about our system that we can so casually inflict so much pain?

By now, you probably think your opinion of Goldman Sachs and its swarm of Wall Street allies has rock-bottomed at raw loathing. You're wrong. There's more. It turns out that the most destructive of all their recent acts has barely been discussed at all. Here's the rest. This is the story of how some of the richest people in the world – Goldman, Deutsche Bank, the traders at Merrill Lynch, and more – have caused the starvation of some of the poorest people in the world.

It starts with an apparent mystery. At the end of 2006, food prices across the world started to rise, suddenly and stratospherically. Within a year, the price of wheat had shot up by 80 per cent, maize by 90 per cent, rice by 320 per cent. In a global jolt of hunger, 200 million people – mostly children – couldn't afford to get food any more, and sank into malnutrition or starvation. There were riots in more than 30 countries, and at least one government was violently overthrown. Then, in spring 2008, prices just as mysteriously fell back to their previous level. Jean Ziegler, the UN Special Rapporteur on the Right to Food, calls it "a silent mass murder", entirely due to "man-made actions."

...

Most of the explanations we were given at the time have turned out to be false. It didn't happen because supply fell: the International Grain Council says global production of wheat actually increased during that period, for example. It isn't because demand grew either: as Professor Jayati Ghosh of the Centre for Economic Studies in New Delhi has shown, demand actually fell by 3 per cent. Other factors – like the rise of biofuels, and the spike in the oil price – made a contribution, but they aren't enough on their own to explain such a violent shift.

To understand the biggest cause, you have to plough through some concepts that will make your head ache – but not half as much as they made the poor world's stomachs ache.

For over a century, farmers in wealthy countries have been able to engage in a process where they protect themselves against risk. Farmer Giles can agree in January to sell his crop to a trader in August at a fixed price. If he has a great summer, he'll lose some cash, but if there's a lousy summer or the global price collapses, he'll do well from the deal. When this process was tightly regulated and only companies with a direct interest in the field could get involved, it worked.

Then, through the 1990s, Goldman Sachs and others lobbied hard and the regulations were abolished. Suddenly, these contracts were turned into "derivatives" that could be bought and sold among traders who had nothing to do with agriculture. A market in "food speculation" was born.

So Farmer Giles still agrees to sell his crop in advance to a trader for £10,000. But now, that contract can be sold on to speculators, who treat the contract itself as an object of potential wealth. Goldman Sachs can buy it and sell it on for £20,000 to Deutsche Bank, who sell it on for £30,000 to Merrill Lynch – and on and on until it seems to bear almost no relationship to Farmer Giles's crop at all.

If this seems mystifying, it is. John Lanchester, in his superb guide to the world of finance, Whoops! Why Everybody Owes Everyone and No One Can Pay, explains: "Finance, like other forms of human behaviour, underwent a change in the 20th century, a shift equivalent to the emergence of modernism in the arts – a break with common sense, a turn towards self-referentiality and abstraction and notions that couldn't be explained in workaday English." Poetry found its break with realism when T S Eliot wrote "The Wasteland". Finance found its Wasteland moment in the 1970s, when it began to be dominated by complex financial instruments that even the people selling them didn't fully understand.

So what has this got to do with the bread on Abiba's plate? Until deregulation, the price for food was set by the forces of supply and demand for food itself. (This was already deeply imperfect: it left a billion people hungry.) But after deregulation, it was no longer just a market in food. It became, at the same time, a market in food contracts based on theoretical future crops – and the speculators drove the price through the roof.

--------------------

see toon at top and read more at the independent...

misidentified...

Geithner Struggles to Escape a Past He Never HadBy JACKIE CALMES

WASHINGTON — Timothy F. Geithner has been misidentified as a former Wall Street insider from Goldman Sachs so many times since he became the Treasury secretary that he and his advisers had taken to joking about it. Then the joke backfired.

Earlier this month, Mr. Geithner had breakfast in Manhattan with Mayor Michael R. Bloomberg and Robert Steel, a deputy mayor and former Treasury official in the Bush administration who had previously worked at Goldman. Facetiously, a Geithner aide said Mr. Steel and Mr. Geithner knew each other from the investment bank.

Later that day at a public event, the mayor in all seriousness referred to Mr. Steel and Mr. Geithner, and added, “They both worked at Goldman.”

Oops.

Just as the Geithner aide’s humor fell flat, likewise newspaper corrections, Mr. Geithner’s objections to TV news interviewers and his staff’s work to spread the boss’s résumé have failed to dispel the belief that Mr. Geithner is a former Wall Street banker, or more specifically, a Goldman guy.

That perception over the last 20 months has united liberal and conservative critics but reflects a broader antagonism against the government bailouts for which Mr. Geithner has been a frontline architect. With many Americans viewing those policies as benefiting only Wall Street, its rich chief executives and Goldman in particular, the belief that Mr. Geithner came from the firm — as his predecessor in the Bush administration did — has easily taken root, further undermining support for those policies.

--------------------------

Gus: I hope I was not guilty of this misindentification... I have made sure Paulson was, though... not misindentified but finger pointed as a former insider of Goldman...

wrongly evicted from their homes...

Fresh evidence is emerging in the United States of fraud and unethical behaviour that helped trigger the subprime mortgage crisis.

Some of the biggest names in American banking are accused of using false or unverified data to fast-track foreclosures on people who default on their mortgage payments.

London-based stockbroker Jeremy Bateson-Carr says some big banks have been forced to suspend foreclosures, while consumer advocates are preparing for the possibility of multi-billion dollar lawsuits.

"Bank of America, JPMorgan Chase and GMAC Mortgages - all major mortgage providers and major proponents in the foreclosure process - have suspended foreclosure activity in 23 states after saying that employees may have mishandled foreclosure documents," Mr Bateson-Carr told the BBC.

In the heady days of low interest rates and loose regulation, mortgage brokers spruiked the American dream of affordable housing to people known as NINJAS - no income, no job, no assets.

Now parts of the industry stand accused of "robo-trading" where bankers are accused of electronically rubber-stamping documents used to evict people who fall behind with their mortgage payments.

Bank of America believes an investigation into its paperwork could be completed within a fortnight, claiming it is a "processing issue".

Mr Bateson-Carr says the allegations, if proven, would have major implications on the already tarnished reputation of US banks.

http://www.abc.net.au/news/stories/2010/10/12/3036288.htm

burger king kids...

At JPMorgan Chase & Company, they were derided as “Burger King kids” — walk-in hires who were so inexperienced they barely knew what a mortgage was.

At Citigroup and GMAC, dotting the i’s and crossing the t’s on home foreclosures was outsourced to frazzled workers who sometimes tossed the paperwork into the garbage.

And at Litton Loan Servicing, an arm of Goldman Sachs, employees processed foreclosure documents so quickly that they barely had time to see what they were signing.

“I don’t know the ins and outs of the loan,” a Litton employee said in a deposition last year. “I’m not a loan officer.”

As the furor grows over lenders’ efforts to sidestep legal rules in their zeal to reclaim homes from delinquent borrowers, these and other banks insist that they have been overwhelmed by the housing collapse.

But interviews with bank employees, executives and federal regulators suggest that this mess was years in the making and came as little surprise to industry insiders and government officials. The issue gained new urgency on Wednesday, when all 50 state attorneys general announced that they would investigate foreclosure practices. That news came on the same day that JPMorgan Chase acknowledged that it had not used the nation’s largest electronic mortgage tracking system, MERS, since 2008.

That system has been faulted for losing documents and other sloppy practices.

The root of today’s problems goes back to the boom years, when home prices were soaring and banks pursued profit while paying less attention to the business of mortgage servicing, or collecting and processing monthly payments from homeowners.

Banks spent billions of dollars in the good times to build vast mortgage machines that made new loans, bundled them into securities and sold those investments worldwide. Lowly servicing became an afterthought. Even after the housing bubble began to burst, many of these operations languished with inadequate staffing and outmoded technology, despite warnings from regulators.

When borrowers began to default in droves, banks found themselves in a never-ending game of catch-up, unable to devote enough manpower to modify, or ease the terms of, loans to millions of customers on the verge of losing their homes. Now banks are ill-equipped to deal the foreclosure process.

“We waited and waited and waited for wide-scale loan modifications,” said Sheila C. Bair, the chairwoman of the Federal Deposit Insurance Corporation, one of the first government officials to call on the industry to take action. “They never owned up to all the problems leading to the mortgage crisis. They have always downplayed it.”

--------------------

see toon at top...

"selling" dodgy mortgage-backed securities ...

The Bank of America has paid almost $US17 billion to settle allegations about its role in the events leading up to the global financial crisis.

US regulators had been probing claims that the bank misled investors into buying dodgy mortgage-backed securities which exploded when America's housing boom went bust more than six years ago.

It is a record payout, but Bank of America was not on its own in spruiking these risky subprime mortgages.

There were trillions of dollars of bets that US housing prices would continue to rise.

However, at almost $US17 billion, Bank of America is paying a much bigger price than other banks to resolve around a dozen state and federal investigations.

This morning, the US attorney-general Eric Holder said Bank of America's unlawful, unethical and immoral behaviour in marketing dodgy products had taken to US economy to the brink of collapse.

"These loans contained material underwriting defects. They were secured by properties with inflated appraisals. They failed to comply with the federal, state and local laws and they were insufficiently collateralised," he said.

"Yet these financial institutions knowingly and fraudulently marked and sold these loans as sound and reliable investments."

read more: http://www.abc.net.au/news/2014-08-22/bank-of-america-fined-17-billion-us-dollars-over-gfc-products/5688974

See cartoon at top... then you will know how WORTH is calculated.

Oh... and on the subject of derivatives, there are "articles' that the worth of the derivative market "has shrunk" to about 700 trillion dollars... But since no-one really knows how much is bet and that the statistical analysis data was very small, the smoke and mirror finance market rules.

forced to buy back shit subprime...

Goldman Sachs Group Inc. (GS) agreed to pay $3.15 billion to repurchase residential mortgage-backed securities to resolve federal claims tied to the sale of the bonds to Fannie Mae and Freddie Mac.

The buyback represents a premium of about $1.2 billion and makes the two U.S.-owned mortgage-finance companies whole on the securities, the Federal Housing Finance Agency, the firms’ government overseer, said yesterday in a statement. The cost of the settlement is “substantially covered” by Goldman Sachs’s reserves, the New York-based bank said in a separate statement.

Goldman Sachs is the 15th bank to settle all claims after the FHFA sued 18 firms in 2011 seeking to recoup taxpayer costs from when the U.S. took control of Fannie Mae and Freddie Mac in 2008, at the height of the financial crisis. The $1.2 billion cost surpasses Goldman Sachs’s $550 million payment in 2010 to end a Securities and Exchange Commission suit over the marketing of a synthetic collateralized debt obligation dubbed Abacus 2007-AC1.

read more: http://www.bloomberg.com/news/2014-08-22/goldman-to-buy-mortgage-debt-for-3-15-billion-to-end-fhfa-probe.html

See toon at top...

not enough cash in the parcel...

Malaysia has rejected an offer from Goldman Sachs of less than US$2bn in compensation over the 1MDB scandal, in contrast to the country’s publicly stated demand of US$7.5bn.

Malaysia has charged Goldman and 17 current and former directors of its units for allegedly misleading investors over bond sales totalling US$6.5bn that the US bank helped raise for the sovereign wealth fund 1Malaysia Development Bhd (1MDB).

“Goldman Sachs has offered something like less than $2bn,” the Malaysian prime minister, Mahathir Mohamad, told the Financial Times on Friday. “We are not satisfied with that amount so we are still talking to them … If they respond reasonably we might not insist on getting that $7.5bn.”

Read more:

https://www.theguardian.com/world/2019/nov/02/malaysia-rejects-goldman-s...

Read from top.