Search

Recent comments

- new dump....

1 hour 55 min ago - incoming disaster....

2 hours 2 min ago - olympolitics.....

2 hours 7 min ago - devil and devil....

5 hours 45 min ago - bully don.....

9 hours 41 min ago - impeached?....

14 hours 29 min ago - 100.....

22 hours 41 min ago - epibatidine....

1 day 4 hours ago - cryptohubs...

1 day 5 hours ago - jackboots....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

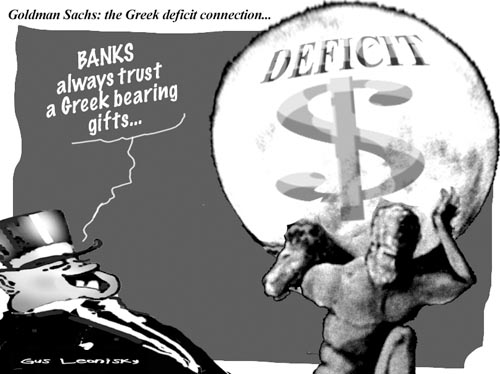

Heracles and the windy deals with banks....

Am I on my lonesome to believe that for the last 60 years the US has been trying to stop the formation of Europe?...

A strong Europe would pose a "challenge" to the US.

I have noted that at every opportunity, the US Administration does "little things", such as making deals with some countries of Europe and counter-deals with others, messing up the European affairs while touting to "help". They have often tried to push the Germans against the French and vice verso... The previous US Administration has managed to make sure that the English "Pound" does not become a Eurozone currency by making deals with Tony Blair who lied and lied to go to war and brown nose with mad Dubya. Now we see that some US "private" bank has made SECRET deals with a country (probably countries) of the Eurozone — namely Greece — illegal deals akin to highway robbery, with derivatives and SECRET secured usury LOANS. Since no-one knows the depth of this market and the sub-surface manipulation to achieve maximum profit for the banks, one can only think that these illegal secret deals were made a) for profit and b) as a continuation of trying to damage Europe without appearing to do so... If these were isolated incidents one would be weary of claiming conspiracy, but I have seen too many crummy pokes from the US for too long not to think there is not a secretly orchestrated device to weaken Europe without being too obvious.

The only way for the Europeans to deal with this problem is to become firm and a) expel any country found to do secret unaccounted deals and b) force the UK to abandon the Pound and go with the Euro or be expelled from Europe. It might suit the Poms for a while, but they'll soon cry in their porridge. The fact that the Poms were "sharing" intelligence with the US on Saddam but did not properly share with their European partners is indication of double play enough...

As well, European countries should not be able to make any armament deals with the US, especially the former Russian satellites that have joined Europe.

-------------------------------

The euro membership rules place strict caps on the size of government deficits relative to a national economy, but Goldman Sachs and other banks helped Greece raise cash earlier in the decade in ways that did not appear in the official statistics. With the current recession causing even official budget deficits to balloon all across the continent, fears of further hidden liabilities have been contributing to the crisis of confidence in Greek debt and pulling down the value of the euro.

Goldman Sachs has been the most important of more than a dozen banks used by the Greek government to manage its national debt using derivatives.

The bank's traders created a number of financial deals that allowed the country to raise money to cut its budget deficit now, in return for repayments over time or at a later date.

In one deal, Goldman channelled $1bn of funding to the government in 2002, in a transaction called a cross-currency swap. There is no suggestion of any wrong-doing by Goldman Sachs. Such deals are an expensive way of raising money, but they have the advantage of not having to be accounted for as debt.

The eurozone rules dictate that governments must keep a country's deficit below 3 per cent of its Gross Domestic Product (GDP) and must take on total debt of no more than 60 per cent of GDP – rules that Greece did not keep to, even during the economic boom. Goldman Sachs, the world's most powerful investment bank, is already under intense scrutiny in the ongoing controversy over banking practices, pay and profits. President Barack Obama last month launched an assault on Wall Street, proposing to cap the size of the biggest US banks and clamp down on their trading activities. On the same day, Goldman began distributing nearly £10bn in pay and bonuses to its staff for their 2009 performance, just a year after the financial system was bailed out by governments.

Reflecting the importance of the Greek government as a client, and the scale of the fees to be generated from derivatives deals, Goldman sent Gary Cohn, who as chief operating officer is second-in-command of the global group, to Athens last November to pitch for new business with the debt management office.

According to a report yesterday, Goldman suggested a way that Greece could push healthcare liabilities further out into the future. The bank has refused to comment. Other eurozone countries have been discovered using cross-currency swaps similar to one causing concern in Greece, including Italy, which did a controversial transaction with JP Morgan before it joined the euro.

The size and scale of the use of derivatives is not fully understood, even by Eurostat, the European Union's official statistics body, which has complained that member nations' finances are opaque and that the information it is given about derivatives deals is incomplete.

-----------------------

Wall St. Helped to Mask Debt Fueling Europe’s Crisis

By LOUISE STORY, LANDON THOMAS Jr. and NELSON D. SCHWARTZ

Wall Street tactics akin to the ones that fostered subprime mortgages in America have worsened the financial crisis shaking Greece and undermining the euro by enabling European governments to hide their mounting debts.

As worries over Greece rattle world markets, records and interviews show that with Wall Street’s help, the nation engaged in a decade-long effort to skirt European debt limits. One deal created by Goldman Sachs helped obscure billions in debt from the budget overseers in Brussels.

Even as the crisis was nearing the flashpoint, banks were searching for ways to help Greece forestall the day of reckoning. In early November — three months before Athens became the epicenter of global financial anxiety — a team from Goldman Sachs arrived in the ancient city with a very modern proposition for a government struggling to pay its bills, according to two people who were briefed on the meeting.

The bankers, led by Goldman’s president, Gary D. Cohn, held out a financing instrument that would have pushed debt from Greece’s health care system far into the future, much as when strapped homeowners take out second mortgages to pay off their credit cards.

It had worked before. In 2001, just after Greece was admitted to Europe’s monetary union, Goldman helped the government quietly borrow billions, people familiar with the transaction said. That deal, hidden from public view because it was treated as a currency trade rather than a loan, helped Athens to meet Europe’s deficit rules while continuing to spend beyond its means.

Athens did not pursue the latest Goldman proposal, but with Greece groaning under the weight of its debts and with its richer neighbors vowing to come to its aid, the deals over the last decade are raising questions about Wall Street’s role in the world’s latest financial drama.

As in the American subprime crisis and the implosion of the American International Group, financial derivatives played a role in the run-up of Greek debt. Instruments developed by Goldman Sachs, JPMorgan Chase and a wide range of other banks enabled politicians to mask additional borrowing in Greece, Italy and possibly elsewhere.

In dozens of deals across the Continent, banks provided cash upfront in return for government payments in the future, with those liabilities then left off the books. Greece, for example, traded away the rights to airport fees and lottery proceeds in years to come.

Critics say that such deals, because they are not recorded as loans, mislead investors and regulators about the depth of a country’s liabilities.

Some of the Greek deals were named after figures in Greek mythology. One of them, for instance, was called Aeolos, after the god of the winds.

-----------------------

Contemplating the Future of the European Union

By LIZ ALDERMAN

In 1870, the French novelist Victor Hugo had a vision. Planting an oak tree in his yard, he predicted that by the time it matured, a “United States of Europe” would have sprung up, strengthened by a common currency that would one day make the Continent a force to be reckoned with.

One hundred and forty years later, the dream, like Hugo’s tree, is alive — if a little twisted.

Around Europe, 27 nations now fly the flag of the European Union next to their own. Sixteen have ditched the drachmas, marks and other bills that symbolized their sovereignty to embrace a single currency, the euro, lending new power to their economic and trade bloc.

All that is now being called into question, however, as European leaders struggle to prevent ruinous spending by Greece from spiraling into a wider crisis or even breaking up the euro union. How they handle this problem could either propel Europe to greater economic and political clout in the decades ahead, or downgrade it to a sideshow in a global economic theater directed by China and the United States.

For the moment, things don’t look comforting for the euro. As the troubles in Greece drove the currency ever lower against the dollar last week, Europe’s politicians did what everyone has by now come to expect: they talked about a bailout for Greece, then talked some more about the need to take “coordinated action.”

Yet details of a rescue plan were put off to a future date. No mention was made of how they would prevent Portugal, Spain or other deficit-saddled economies from falling like dominoes. And questions about who would pay for any future blowups were answered with silence.

“Now is the time when Europe needs to speak as one voice,” said Simon Tilford, chief economist at the Center for European Reform in London. “The crisis should lead to political unity, but it could just as easily lead to a divided Europe.”

What explains this inertia? Even as the euro was being conceived, Germany, Europe’s sturdiest economy, was fretting about Europe’s tendency to freeze during a crisis. The German chancellor at the time, Helmut Kohl, and Otmar Issing, a German who was then the chief economist for the European Central Bank, feared that unless they set strict rules on euro membership, the new currency union could stumble.

Germany and other wealthy northern European nations might one day even find themselves transferring taxpayer money to support their poorer kin in the south, among them Greece, Portugal, Spain and Italy. Britain, one of Europe’s wealthiest nations, saw the writing on the wall and never surrendered its pound.

----------------------------

see my drift?...

- By Gus Leonisky at 15 Feb 2010 - 4:04pm

- Gus Leonisky's blog

- Login or register to post comments

zorba the greek

zorba the greek

piddley legalities...

From the NYT

Greece’s problems deepened on both sides of the Atlantic Thursday as the Federal Reserve disclosed it was investigating Goldman Sachs and other banks that helped the country mask its debts, and investors grew increasingly leery of lending any more money to a nation flirting with default.

Wall Street’s role in the run-up to the debt crisis has generated criticism and calls for an inquiry from European leaders. The Fed examination is the first time American regulators will examine the highly profitable if little-known business of supplying custom-made financial instruments to strapped countries on the Continent.

While Greece’s economic troubles have transfixed world markets for weeks, its problems have snowballed in recent days as workers went to the picket lines to protest budget cuts and the government struggled to raise cash to cover what is Europe’s largest budget deficit. Last year, Greece’s deficit equaled 12.7 percent of gross domestic product.

---------------------

Gus: obviously, the bank(s) helped Greece to hide its true owings by fiddling the books... In times gone by, when honesty, rectitude and reputation was paramount, the bank(s)' licence to operate would have been revoked forthwith or war would have been declared on the country at the origin of the heist. Terminated thus with a pyre and the directors be brought to court, quartered and piloried — or slowly cooked with onions — for the kingdom's pleasures...

But we live in the times of the supreme fiddleschtick in which money — legal, illegal or virtually tainted by stealth — is more important than piddley legalities, as the smart con men of the financial world construct a clever house of derivative cards that would collapse all, should one card be touched by a feather or looked at the wrong way...

colossus of credit...

As calls for a bail-out - or at least some kind of financial assistance - for Greece mount amongst financial analysts and commentators, some may wonder what is stopping the eurozone from swinging into action.

After all, last month's EU summit became devoted to Franco-German efforts to create a mechanism to reassure the markets that Greece would not be left to swing.

But the deal that was agreed was pretty much written by Germany. And the German government - mindful of deep popular hostility towards any help for Greece - put in two major caveats to any assistance.

The first was that any decision to help Greece would have to be unanimous; so Germany has a veto.

And the second was that lending to Greece could not be subsidised; that means at market rates.

Which makes many - including those in the financial markets - wonder what Greece might gain from any EU/IMF package.

----------------------

Gus: although I'm a dummy in these matters, I believe the Europeans are trying to understand which way the rescue money is going to flow back to the US banks — banks that made an illegal deal with the Greek Government (previous government I believe) now siphoning off moneys at usury-style interest rates... The Europeans do not want to see the cash helping some "crooks" in the US who would be profiteering from what is a serious breach of trust and accounting. To some extend the Europeans should tell the banks to shove it and they rescue Greece on proper terms...

euro blues...

At the top of this line of blog below the cartoon I wrote:

Am I on my lonesome to believe that for the last 60 years the US has been trying to stop the formation of Europe?...

A strong Europe would pose a "challenge" to the US.

I have noted that at every opportunity, the US Administration does "little things", such as making deals with some countries of Europe and counter-deals with others, messing up the European affairs while touting to "help". They have often tried to push the Germans against the French and vice verso... The previous US Administration has managed to make sure that the English "Pound" does not become a Eurozone currency by making deals with Tony Blair who lied and lied to go to war and brown nose with mad Dubya. Now we see that some US "private" bank has made SECRET deals with a country (probably countries) of the Eurozone — namely Greece — illegal deals akin to highway robbery, with derivatives and SECRET secured usury LOANS. Since no-one knows the depth of this market and the sub-surface manipulation to achieve maximum profit for the banks, one can only think that these illegal secret deals were made a) for profit and b) as a continuation of trying to damage Europe without appearing to do so... If these were isolated incidents one would be weary of claiming conspiracy, but I have seen too many crummy pokes from the US for too long not to think there is not a secretly orchestrated device to weaken Europe without being too obvious.

--------------------------

And I mean it.

Cracks appear in EU unity as fears spread for future of the eurozoneEurope's governments struggled to mask sharp differences yesterday even as they backed new sanctions for indebted countries in the battle to prevent a debt crisis from spiralling into an emergency that threatens the very survival of the euro.

Germany's two houses of parliament rubber-stamped the country's contribution to the €750bn (£652bn) package of loans and guarantees, the so-called "shock and awe" package hammered out by European leaders this month to prevent a Greek-style debt crisis from afflicting any other nation in the euro area with threatened bankruptcy. Germany's backing, despite a mood of public anger over the cost of bailing out Greece, was a clear signal to the markets that the biggest eurozone economy is strongly committed both to ending the debt crisis and to propping up the single currency in the longer term.

----------------------

In the end, the US profit... That is the name of the game... Until Europe understand the role played by the UK in the whole sordid affair by not joining the Euro, the rest of Europe will be conned by the US via the UK (sometimes directly sometimes not). Europe has no choice to get the pound out of its hair. But, doing so presently would be giving the UK a ten pace ahead run... So be it. UK join the Euro or get the boot out of the European Union.

Do the sums, open your eyes... see toon at top.

The Euro versus the rest of the world...

http://www.abc.net.au/news/video/2010/05/20/2905304.htm

---------------------

Can the Euro be Saved? Joseph E. StiglitzOne proposed solution is for these countries to engineer the equivalent of a devaluation – a uniform decrease in wages. This, I believe, is unachievable, and its distributive consequences are unacceptable. The social tensions would be enormous. It is a fantasy.

There is a second solution: the exit of Germany from the eurozone or the division of the eurozone into two sub-regions. The euro was an interesting experiment, but, like the almost-forgotten exchange-rate mechanism (ERM) that preceded it and fell apart when speculators attacked the British pound in 1992, it lacks the institutional support required to make it work.

There is a third solution, which Europe may come to realize is the most promising for all: implement the institutional reforms, including the necessary fiscal framework, that should have been made when the euro was launched.

It is not too late for Europe to implement these reforms and thus live up to the ideals, based on solidarity, that underlay the euro’s creation. But if Europe cannot do so, then perhaps it is better to admit failure and move on than to extract a high price in unemployment and human suffering in the name of a flawed economic model.

-----------------------

Gus: the good Jewish professor is defeatist and I believe humoringly mischievous... When the first dollar was minted (or printed) it was decided by its maker to make it the "best" currency in the world, the only one to pitch against all others. To achieve this, despite some ups and down, the belief has held strong and the forces of covert and overt dollar spin got to work. One of the recent events comes to us via Saddam Hussein who had decided to trade oil in Euros. It was more profitable. But the US went to war to squash this concept. That has been the principal underlying reason to go to war in Iraq. Defeat the Euro.

And the US got help from a two-faced country still playing with the Pound.

The sinking of the Greek economy did not happen by chance. It was a double-cross from some US banks that cajoled the previous prime minister of Greece to borrow money from their rigged casinos, without declaring to the central financial institution of Europe. Other countries in Europe have borrowed from the same casinos in lesser bet values... The US system of going to the jugular has worked well. Sure, they claim to be friends and so forth, but all they want is domination, not equal partnership. The money trail has to be chased and anything not conform to the European regulations has to wiped, and the Pound has to be dissolved into the Euro or the UK has to be thrown out of the European Union. Strong sentiments, but that's where the good Jewish professor — another Greenspan clone — is hoping his good Jewish mates can still gouge money out Europe. Make it bleed. Like the West was trying to make Russia bleed in the 1990s, using "oligarchs" and double-crossing banks run by the CIA and MI6, till Putin saw through the game.

Wake up, Europe. Unite fast. Kick Yamericka and its lackey in the curlies, covertly... See toon and article at top.

And US Plots unveiled yet again.

I quote you gus....

Am I on my lonesome to believe that for the last 60 years the US has been trying to stop the formation of Europe?...

A strong Europe would pose a "challenge" to the US. (Here here).

I can only speak for myself but yes, I agree with you wholeheartedly and wish we still had some method to control these de-regulated market forces. They can only be punished by lack of money and already the Republicans are fighting against Obama's reported intention of introducing responsible regulations.

I too am convinced that Goldman Sachs, just to mention one of the culprits, have manipulated Greece and possibly others by corrupting their governments to the point of financial collapse. It is already widely reported that the Jewish Financial Institutions are working together to achieve that goal. IMHO that is because those very institutions have enormous control over the American Government.

So - America now - along with its slavish allies and then - whose next?

Once a power such as the Jewish financial institutions decide to pool their strengths, without genuine competition against one another, their concerted strength exerted over greedy incompetent governments is enormous. This is exactly what the foreign mining exploiters are doing to Australia and it's people at this very time.

While the identities of the Foreign Mining Corporations in Australia are only identifiable by the Registered names, they are never-the-less banding together to use their wealth to challenge the Government of the Australian people into daring to tax them fairly - and specifically for the benefit of the Australian people. Struth.

Whoever considers this as no different to the financial manipulation in which Europe finds itself at risk – is absolutely right. In our case it is even worse because while the political ramifications in Greece etc can rightly be directed against governments who have betrayed their people for personal benefit, that is the opposite to Australian Government being the target at election time.

The intention is crystal clear, blackmail the incumbent Government by using Abbott and the Howard “New Order” remnants into obeying their demands or risk the return of the Capitalist Liberals. This Media Corporation-led is a direct attempt to deny one Australian political party from fair governing for the people who elected them.

God Bless Australia and may our people understand the sell out to foreign interests by the Abbott Liberals. NE OUBLIE.