Search

Recent comments

- cow bells....

6 hours 15 min ago - exiled....

11 hours 17 min ago - whitewashing a turd....

12 hours 16 min ago - send him back....

13 hours 46 min ago - the original...

15 hours 35 min ago - NZ leaks....

1 day 1 hour ago - help?....

1 day 2 hours ago - maps....

1 day 2 hours ago - bastards...

1 day 9 hours ago - narcissist.....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

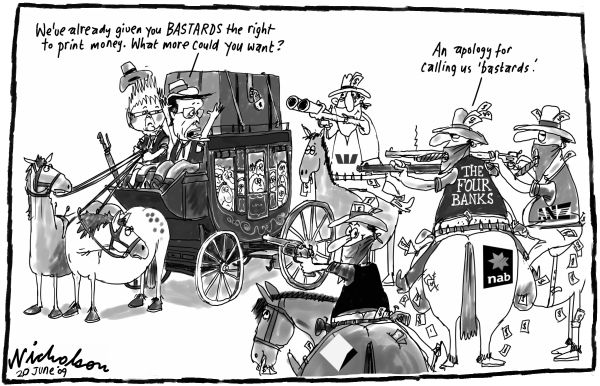

highwaymen .....

Greedy, greedy Westpac. The bank's move in increasing its standard variable home lending rate by 0.45%, almost double the Reserve Bank's rise of 0.25%, was nothing but a grubby grab for cash, dressed up with the usual banking bullsh-t about cost pressures.

''The interest rate changes ... reflect the continuing cost pressures we are experiencing in wholesale funding markets as well as an increase in the official RBA cash rate,'' Westpac group executive, retail and business banking, Peter Hanlon said in the statement. "Credit card rates will also increase by between 0.25%-0.35%."

Westpac said its cost of funding had risen 80% in the past year. So what? It had to make the switch given the disruptions of the global credit crunch. The cheap short-term money disappeared (as Westpac and the other banks found a year ago when they were locked out of their global markets). Westpac was forced to switch from funding its business from short-term deposits and loans to longer-term markets and customer deposits. But it isn't alone, all banks have made the switch because the previous model, which raised very cheap loans, is dead.

Westpac is forcing its home-loan customers to pay for the switch in funding models that the bank management should have sorted out well before the credit crunch, but preferred to do nothing and borrow heavily at the short end and pay low rates and lend it out at much higher rates in Australia. The bank got caught in what's called "rollover risk" and was almost crunched, as were many other banks. Shareholders should be forced to share some of that extra cost with another dividend cut, on top of the cuts already made.

Note how Gail Kelly, the almost "sainted" CEO of Westpac, wasn't around to take the flak on what will undoubtedly be a controversial move. It's the sort of issue where the tough CEOs get going and take the lead and not leave it to their reports to argue the case, indefensible as it is.

According to this report in the Fairfax broadsheets this morning, Kelly wasn't available to talk to the media and Hanlon did not reply to a request for an interview, despite his name being in the release. You know when a corporate knows it's on a hiding to nothing when the executives (especially at banks) go into hiding.

Westpac is pushing up the cost of business loans by 0.25%, and yet the cost of funding those is as expensive as the cost of funding home mortgages, well almost. Home mortgages are higher quality assets and need less capital than loans to business, which have a much higher default rate and a much higher level of arrears. So they cost more in terms of capital and bad debt and loss provisions.

The interest rate changes for home and business loans are effective from Friday. Of course, the deposit rates won't go up straight away.

But the bottom line is another gross 0.20% added to its margins in housing, the only part of the business showing any life. Mortgage lending is growing faster than any other form of lending, according to figures this week for credit from the RBA.

The RBA showed that in the year to October, overall mortgage lending rose 8%, with loans to owner occupiers up 10%. That's the fastest annual growth since the year to July, 2008.

The RBA said investor housing credit rose 0.5% in October, to be up 3.4% for the year. That was the highest annual rise since the 12 months ending May of this year.

"Over the year to October, housing credit rose by 8.0%. Housing credit rose over October due to growth in lending to both owner-occupiers and investors," the RBA said.

Business lending fell in October and was down more than 6% in the year 12 months as business cut their borrowings. Many big companies have restructured debts (as have smaller ones) at the behest of the banks. Many listed companies have raised billions of dollars in new capital to cut their loans and improve their finances (also after intense bank pressure). That's one of the reasons why bank lending to business is weak.

As well, banks have tightened up on lending to business, especially in property. That's why the building approvals figures for October showed a 29% plunge in non-private residential approvals yesterday (which is mostly developer-financed units and apartments). Private owner-occupied dwelling approvals jumped 5% in October and have been rising now for 10 months as the federal government's first-home-buyer scheme boosted activity, and have helped boost bank lending.

And, of course, there's the federal government guarantees on deposits that helped the likes of Westpac ride out the GFC.

But the most egregious reason why Westpac is money grubbing is that it doesn't need it. Taking over St George gave it a huge share in home lending and made it the biggest domestic bank, by some measures.

The bank's November profit statement carried these quotes: "Pro forma core earnings of $10.015 billion, up 19%, pro-forma revenue of $16.755 billion was up 13%, expense growth moderated over the year to 5%."

The bank said its cost-to-income ratio fell to 43.3 cents in every dollar from about 47 cents because revenues grew much faster than costs.

Westpac lifted its net interest margin 0.31%, the best of the big three September 30 banks, up from 2.07% to 2.38%. That's despite the sharp rise in funding costs during the year.

That 0.31% margin rise topped the ANZ's 0.28% and the NAB's rise of 0.17%.

That means Westpac and the ANZ managed to lift their margins by more than a normal Reserve Bank interest rate movement of 0.25%. Westpac came back for another big much yesterday from home-loan customers. And couldn't be bothered defending it.

- By John Richardson at 2 Dec 2009 - 9:45pm

- John Richardson's blog

- Login or register to post comments

I may be wrong but....

Wasn't the recent world financial collapse due to the greed and carelessness of the CEO's of financial institutions? And lack of regulation?

Doesn't that include Banks?

It appears that the regulatory authorities are either unable or unconvinced that they need to do something about the apparent greed and cavalier attitude of the Banks which our government has consistently protected.

This is just another field in which I am uninformed but thoughtful.

Our federal government has asked us to support their plans to avoid too much pain to the people but, isn’t the present attitude of the Banks, especially the American bank Westpac, that the opportunities are there to exploit and exploit they will?

Isn’t this an example of the “money is the root of all evil” which caused the world-wide recession?

Obviously, by my questions, I am not sure but, commonsense prevails.

I worry that the people of Australia may yet again be convinced by the media that the Rudd government has not done anything since their election when, in fact, the exact opposite is true.

The Rudd government’s problem is that they are doing more for the Australian citizen than the foreign corporations.

And that is considered as “socialism” and contrary to the born to rule rights of any business which is prepared to take advantage of a government which has put the welfare of the electorate at least equal to the sometimes obscene profits of the foreign investors.

Yet, as Menzies; Howard and now Abbott have indicated – dictatorship is the answer to combat the fair go desires of the majority population.

I feel constrained to comment that Peter Van Onselen, for whom I had great respect, has almost changed his fair political opinions by 180 % to Liberal bias since accepting employment and control by the world media mogul Rupert Murdoch.

“Everyone has a price” and “money is the root of all evil”? This is why the people, who care about other people, are invariably of the worker class.

After the attack dog election of Tony Abbott, I weep for my country.

God Bless Australia. NE OUBLIE.