Search

Recent comments

- murdering kids....

38 min 48 sec ago - saving....

1 hour 7 min ago - a speech never made....

14 hours 38 min ago - wardonald...

16 hours 11 min ago - MAGA fools

1 day 1 hour ago - the ugliest excuse to go to war.....

1 day 11 hours ago - morons....

1 day 13 hours ago - idiots...

1 day 13 hours ago - no reason....

1 day 14 hours ago - ask claude...

1 day 18 hours ago

Democracy Links

Member's Off-site Blogs

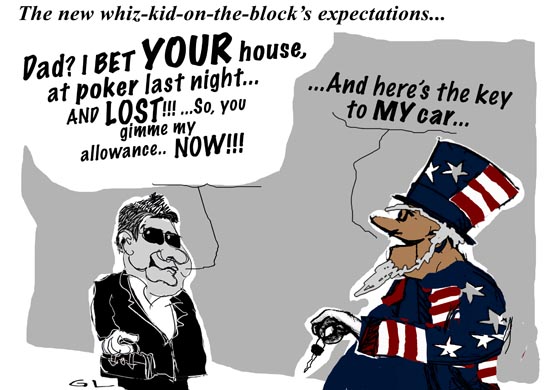

raising junior .....

Senate Democratic leaders demanded on Tuesday that the insurance giant American International Group reverse the $165 million in bonuses that the firm had paid to executives after receiving more than $170 billion in bailout money. Alternatively, lawmakers said they would seek to reclaim the money by adopting new tax legislation.

The demand by Senate leaders, made in a letter to the chief executive of A.I.G., Edward Liddy, came as lawmakers in both parties raged against the insurance company. There was angry finger-pointing across Washington on Tuesday, as Congress, the Obama administration and the Federal Reserve all sought to avoid blame.

In Congress, Representative Barney Frank, Democrat of Massachusetts and chairman of the Financial Services Committee, said that it was time for the government to exercise its rights as the owner of nearly 80 percent of A.I.G., and he said he believed that the bonuses could be reversed on that authority alone, or by court action if necessary.

“We’re the owner of the company, in fact,” Mr. Frank declared at a news conference. “I think the time has come to exercise our ownership rights - we own most of the company - and then say as owner, ‘No, I’m not paying you the bonus. You didn’t perform. You didn’t live up to this contract.’”Mr. Frank added: “In other words, I think we are in a stronger case to try and get those bonuses back if we bring them as the owner of the company, rather than as the regulator interfering with a contract between two other parties.”

A.I.G. has insisted that it was obligated to pay the bonuses under employment contracts with executives in its financial products division.

http://www.nytimes.com/2009/03/18/business/18bailout.html?_r=1&hp=&pagewanted=print

- By Gus Leonisky at 18 Mar 2009 - 9:46pm

- Gus Leonisky's blog

- Login or register to post comments

pilloried...

Scorn Trails A.I.G. Executives, Even in Their Driveways

By JAMES BARRON and RUSS BUETTNERThe A.I.G. executive who was nicknamed “Jackpot Jimmy” by a New York tabloid walked up the driveway toward his bay-windowed house in Fairfield, Conn., on Thursday afternoon. "How do I feel?” said the executive, James Haas, repeating the question he had just been asked. “I feel horrible. This has been a complete invasion of privacy."

Mr. Haas walked on, his pink shirt a burst of color on a slate-gray afternoon. The words came haltingly. "You have to understand,” he said, “there are kids involved, there have been death threats. ..." His voice trailed off. It looked as if he was fighting back tears.

"I didn’t have anything to do with those credit problems,” said Mr. Haas, 47. “I told Mr. Liddy” — Edward M. Liddy, the chief executive of A.I.G., the insurance giant — “I would rescind my retention contract.”

He ended the conversation with a request: “Leave my neighbors alone.”

Too late. Jean Wieson, who has lived down the block for 24 years, had stopped her car in front of Mr. Haas’s house before he arrived home. She was angry about the millions of dollars in bonuses paid to its executives, the credit-default swaps that brought American International Group to its knees, the $170 billion the federal government has spent to prop it up. "It makes me absolutely sick," she said. "It’s despicable. It’s disgusting what these people have done. They should be forced to give every cent back."

see toon at top.

bail out of the bonuses...

Nine of the 10 executives who received top bonuses from US insurance giant AIG have agreed to return them, New York's attorney general says.

Andrew Cuomo said he hoped to recoup $80m (£55m) of bonus payments - which amounts to about half of the $165 million paid by AIG on 15 March.

The US rescued AIG with bail-out funds totalling $170bn since September 2008.

AIG's decision to pay bonuses despite being bailed out by the government had sparked widespread outrage in the US.