Search

Recent comments

- sicko....

11 hours 42 min ago - brink...

11 hours 58 min ago - gigafactory.....

13 hours 45 min ago - military heat....

14 hours 27 min ago - arseholic....

19 hours 11 min ago - cruelty....

20 hours 27 min ago - japan's gas....

21 hours 8 min ago - peacemonger....

22 hours 5 min ago - see also:

1 day 7 hours ago - calculus....

1 day 7 hours ago

Democracy Links

Member's Off-site Blogs

irony .....

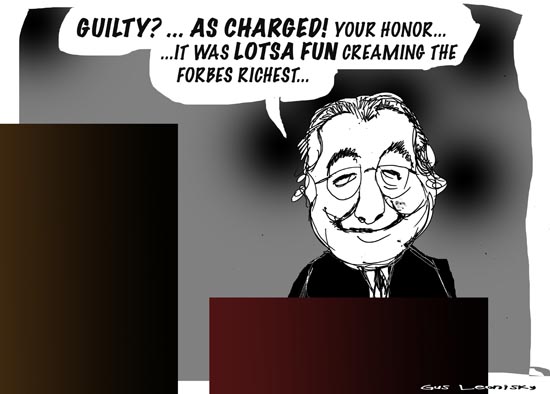

Bernard Madoff apparently ripped off everyone - retirees, celebrities and some of the richest people in America.

A list featuring the names of thousands of probable victims of Bernard Madoff was filed in federal bankruptcy court yesterday, revealing a staggering number of billionaires and celebrities who were caught up in what is believed to be a $50 billion Ponzi scheme.

Among those said to have been ripped off: several members of the Forbes list of the 400 richest Americans, including money manager and Berkshire Hathaway (nyse: BRK - news - people) board member David Gottesman and art collector Norman Braman.

http://www.forbes.com/2009/02/05/bernard-madoff-billionaires-business-billionaires-0205_madoff.html

- By Gus Leonisky at 14 Mar 2009 - 5:21am

- Gus Leonisky's blog

- Login or register to post comments

sore tax point...

Madoff Had Accomplices: His Victims

By JOE NOCERAOnly the willfully ignorant could have seen Bernard Madoff’s fund as a good investment.

Standing in the security line Thursday morning, waiting to get into the federal courthouse in Manhattan, I started chatting with the man behind me. He looked to be in his early 60s, and though he was well dressed, he looked a little haggard. I asked him if he was a victim of Bernard L. Madoff, who would soon be pleading guilty to masterminding the greatest Ponzi scheme in history. He said he was.

Did he want to talk about it? He wasn’t sure, he said. I asked his name. “I’m not going to give my name unless there is some benefit for me,” he said dourly. “I haven’t had too many benefits lately.”

How much had he lost? I asked. He grimaced. “I don’t really want to say,” he replied, but conceded that it was a lot.

What was he hoping for today? He shrugged.

As we passed through security, I asked him what role he thought the government should be playing. It was as if I had flipped a switch. Suddenly, his reticence fell away.

“The S.E.C.,” he said, referring to the Securities and Exchange Commission, which muffed multiple opportunities to catch Mr. Madoff, “they played a big role in this. They have a lot to answer for.” He said that the tax code should be changed so that Madoff victims can recoup taxes they paid on profits that turned out to be illusory — no matter how far in the past those taxes were paid.

-------------------------

stung twice: once by the master of ponzy scheme — Mr Madoff himself — and then stung again by the great grand world master of ponzi scheme — the US government ...

He had accomplices, didn't he?

The lawyers of disgraced US financier Bernard Madoff have appealed against a judge's decision to revoke his bail and send him to jail, a US court says.

On Thursday, he pleaded guilty to a $50bn (£35bn) fraud and was sent to jail to await sentencing in June.

His lawyers said he should be released until sentencing because he never made any attempt to flee while under house arrest at his Manhattan penthouse.

An appeals court will hear the case on March 19.

Mr Madoff's lawyers filed papers with a federal appeals court on Friday.

"The District Court erroneously failed to release Mr Madoff because the evidence clearly shows that Mr Madoff is not a flight risk and does not pose a threat to the community," a court document said.

Mr Madoff, 70, faces up to 150 years in prison.

---------------

That's only 3 years' penitentiary per billion...

Some used to get life for stealing a loaf of bread... One does not need a gang to steal 3 pennies, but to clean up 50 billions? He must have had a small horde of accounting fairies working the round-about swindles of income versus illusion payouts? Yes... apparently, the investors were so happy with the results on paper, they left him the virtual gains to reinvest into his scheme, so they'd paid taxes on money they never saw...

Brilliant... And until the last day before exposure, they were his marvelous buddies...

the I-did-not-know excuse...

US prosecutors have called for Bernard Madoff to be locked up until his trial after it emerged he had been sending valuables to family and friends.

The prosecutor said that a single one of the packages sent in the post was worth more than $1m (£685,000).

They included jewellery, watches, pens, cufflinks and a $200 pair of mittens.

Mr Madoff's lawyer, Ira Sorkin, said that his client had not realised that the mailings violated the freezing of his assets.deceiving investors by falsely certifying....

From the NYT

The acting United States attorney, Lev L. Dassin, who announced the charges in a statement with Joseph M. Demarest Jr., the head of the New York F.B.I. office, said that while Mr. Friehling was not accused of knowing about Mr. Madoff’s scheme, he was charged with deceiving investors by falsely certifying that he audited the financial statements of Mr. Madoff’s business.

“Mr. Friehling’s deception helped foster the illusion that Mr. Madoff legitimately invested his clients’ money,” Mr. Dassin said in the statement.

Indeed, Mr. Demarest said that the accountant, abrogating his fiduciary responsibility to investors and his legal obligation to regulators as an independent auditor, did little or no testing and verification of the material he was hired to certify.

“His job was not merely to rubber-stamp statements he didn’t verify,” Mr. Demarest said. “Simply put, Friehling failed to do his job and lied to investors and regulators in saying he did.”

Moments after the criminal case was disclosed, the New York regional office of the S.E.C. filed a related civil action against Mr. Friehling and his accounting firm.repo men

from the BBC

Earlier, regulators in Massachusetts brought civil fraud charges against the Fairfield Greenwich Group, saying company officials had been coached by Madoff on how to answer questions by federal investigators about his investment practices.

Fairfield Greenwich - which had reportedly invested some $7bn (£5bn) with the disgraced financier - denied the allegations, saying it would "vigorously" contest them.

Last month, Madoff was remanded to prison until his sentencing in June. He could be jailed for up to 150 years.

Madoff has said he acted alone in masterminding the Ponzi scheme, whereby early investors were paid off with the money injected by new clients.

A former chairman of the Nasdaq stock market, Madoff had been a player on Wall Street for more than 40 years.

While Madoff said the scheme only started in the early 1990s, prosecutors say it began in the 1980s.

unfancied fraudulent financier...

Financier Bernard Madoff is to be sentenced on Monday for plotting a $50bn (£30.3bn) investment fraud.

The disgraced financier, who pleaded guilty in March, could face a sentence of up to 150 years.

see toon at top...

max'ed sentence...

The 71-year-old was sentenced to 150 years after he, 10 of his victims and lawyers on both sides had addressed the court.

Dozens of those who lost fortunes in his pyramid-based Ponzi investment fraud that lasted decades filled the New York courthouse having spent hours queueing to get seats.

Madoff, a former Nasdaq chairman, pleaded guilty to securities fraud and other charges in March and has since been held in jail.

Victims who lost millions of dollars had described their ruined lives to judge Denny Chin.

------------------------

Now to jail all the presidents (in all countries) and other unfunny clowns who have done worse things than Madoff. That would be the day. See toon at top.

Meanwhile:

By Lucy Komisar

March 17, 2009

There’s a mysterious “Bank Madoff, New York” that U.S. authorities don’t appear to know about.

International securities clearing houses move trillions of dollars a year for banks and brokerages and are a natural way for crooks to launder and hide ill-gotten gains. So it would be natural for investigators to check the paper trails of Madoff accounts in CSDs (central securities depositories) around the world.

They already know about the one listed in the name of “Bernard L. Madoff Investment Securities LLC New York, US broker/dealer.”

But they don’t seem to know about “Bank Madoff, New York.” It appears on a list published by Clearstream, the international clearing and settlement house in Luxembourg. That “bank” has not been publicly mentioned by investigators.

no appeal

Imprisoned fraudster Bernard Madoff will not appeal the 150-year sentence he received for orchestrating a worldwide multibillion-dollar investment fraud.

"We are not going to be appealing," Madoff's lawyer Ira Lee Sorkin said.

"That's our decision and we have no further comment."

Madoff, 71, was sentenced on June 29 by US district court judge Denny Chin and had the right to appeal to the US court of appeals for the second circuit in New York.

All fictitious

Frank DiPascali, the former chief financial officer of Bernard Madoff, has pleaded guilty for his role in his boss's $65bn (£40bn) fraud.

Mr DiPascali, who admitted all 10 of the fraud charges he faced, apologised to the court in Manhattan. He said he knew what he had done was "wrong".

The 52-year-old, who worked for Madoff for 33 years, added that he had followed his boss too loyally.

Madoff, 71, was jailed for 150 years at the end of June.

Last month he decided not to appeal against his sentence.

'All fictitious'

Mr DiPascali told the court that all the transactions of Madoff's business were "fake".

-------------------

see toon on top and comment about accomplices...

a bunch of investigative bananas...

The US financial watchdog mishandled a string of probes into the business of convicted fraudster Bernard Madoff, an investigation has found.

It said the Securities and Exchange Commission bungled five investigations despite many complaints over 16 years about the $65bn (£40bn) fraud.

However, the SEC inspector general's report found no evidence of improper ties between the agency and Madoff.

Madoff, 71, was jailed for 150 years at the end of June.

He admitted defrauding thousands of investors through a Ponzi scheme which he said had been running since the early 1990s.

'Regret'

SEC enforcement staff had "almost immediately caught [Madoff] in lies and misrepresentations, but failed to follow up on inconsistencies", the report said.

---------

see toon at top. And now the irony is that Madoff does not have to pay for his retirement... The state is doing that...

hush money...

By DIANA B. HENRIQUES

Two computer programmers who worked for Bernard L. Madoff’s brokerage firm were arrested on Friday and accused of helping him sustain his long-running Ponzi scheme.

The two men — Jerome O’Hara of Malverne, N.Y., and George Perez of East Brunswick, N.J. — were also named in a civil case filed on Friday by the Securities and Exchange Commission.

Securities regulators said that the two men created the computer software that generated the elaborate paper trail that Mr. Madoff used to conceal his fraud from investors and regulators for more than 15 years.

According to the complaints, both men grew uneasy about their role in the fraud three years ago and closed their own Madoff accounts in April 2006, withdrawing hundreds of thousands of dollars.

After a confrontation with Mr. Madoff in September 2006, they demanded pay raises and bonuses — what securities regulators called “hush money” — and agreed to remain silent about the fraud, according to the complaints.

Mr. O’Hara, 46, and Mr. Perez, 43, were each arrested at their homes on Friday and taken to federal court in Manhattan for arraignment. Both were released on a $1 million bail, to be secured by cash and property and co-signed by three financially responsible people within the next week. If convicted, they face up to 30 years in prison.

---------------------

see toon at top...

a ponzi jab....

Bernard Madoff, the swindler who orchestrated a multibillion dollar fraud, was attacked by another inmate at the US prison where he is serving a 150-year sentence, the Wall Street Journal reported, citing three people familiar with the matter.

The report said that the attack occurred last December. After it, Madoff was moved to a low-security medical center for treatment, where he was treated for a broken nose, fractured ribs and cuts to his head and face, according to a felon currently at the prison in Butner, North Carolina.

--------

see toon at top...

A Test of Intention?

Now would be a good time for the Massad to do another illegal kidnapping for which they are famous.

Organize the jail in which Madoff is "waiting"; use the tried and true methods of massive bribes and have a route planned to take the thief to ocupied Palestine. Whose to stop them?

That, as I have so often guessed, would be at least one of the reasons that they want a land of their own - "purely" Jewish and under Jewish laws only. No international interference would be tolerated (some 200 nuclear weapons worth).

Remember Netanyahu's boast.."No one will hurt the Jewish people again" - and this Jew has been sentenced by a Goyim/Gentile Court to 150 years - now that could hurt by jingo.

The opportunity is there, let's be patient.

God Bless Australia. NE OUBLIE.

stealing from gamblers...

Fallen Australian IT entrepreneur Daniel Tzvetkoff, who filed for bankruptcy early this year, has been arrested in Las Vegas on charges that he helped gamblers and illegal internet gambling companies launder $US500 million ($540 million).

In a case unsealed in New York, prosecutors accused Mr Tzvetkoff, 27, of processing gambling proceeds and making them appear legal to banks, starting in early 2008.

He created dozens of so-called shell companies in a scheme that he once wrote was "perfect," prosecutors said.

Mr Tzvetkoff was charged on four counts, including bank fraud, money laundering, and conspiracy to operate and finance an illegal gambling business.

If convicted, he could face up to 75 years in prison.

Prosectors said Mr Tzvetkoff stopped processing transactions in March 2009 after leading gambling websites accused him of stealing $US100 million.

Mr Tzvetkoff, who had a penchant for exotic cars and mansions, has also been sued by a former business partner for failing to keep accurate financial records.

------------------------

Gus: we may all have "penchant" for exoctic cars and mansions... but this does not mean we steal to get there or not get there... Sure some gambling on the market can bring rewards but since the loot is finite someone else has to suffer a loss somewhere... that someone is usually the poor honest workers who toil to help maintain the addiction of the betting swifties...

hero fraudster...

Ponzi schemer Bernard Madoff, serving a 150-year sentence for masterminding Wall Street's biggest fraud, has total contempt for his victims and is considered a hero by his fellow inmates, New York Magazine said Monday.

In a profile of the 72-year-old fraudster, a year into his sentence at Butner federal prison, in North Carolina, the weekly said Madoff's feelings for the people he scammed were overheard one day when he said: "F--- my victims. I carried them for 20 years, and now I'm doing 150 years."

The magazine said Madoff enjoyed celebrity status from the moment he arrived at the penitentiary under security escort complete with circling helicopters and a bevy of reporters.

-----------

see toon at top...

laughing all the way to the end of his life...

see toon at top.

Did Bernie Madoff, instigator of the biggest Ponzi scheme in history, show remorse when he turned up in jail to serve a 150-year term for swindling his victims of $65 billion? Apparently not, if his fellow inmates are to be believed.

"Fuck my victims," Madoff exploded on one occasion. "I carried them for 20 years, and now I’m doing 150 years."

That outburst came within a month of his arrival at the federal correctional complex in Butner, North Carolina last summer. He let rip in front of about 100 fellow prisoners after being badgered by an inmate about the victims of his scheme.

The story is told by a bank robber in a new report by New York magazine, which claims to have interviewed 24 current and former inmates about life inside Butner with prisoner number 61727-054.

“Everybody was trying to kiss his ass,” Shawn Evans, a former Butner prisoner, said. “It was like the president was visiting,” said a visitor to the jail on the day Madoff arrived last July.

As The First Post reported just before Christmas, Madoff has tried to maintain a low profile in jail, keeping busy with his cafeteria job and playing chess and checkers in his spare time.

But clearly he remains unrepentant. "People just kept throwing money at me,” he apparently told a prison consultant who advised him on how to endure prison life. "Some guy wanted to invest, and if I said no, the guy said, ‘What, I’m not good enough?’”

Meanwhile Shannon Hay, a drug dealer imprisoned in the same unit in Butner as Madoff, told New York said that Madoff, now 72, believed his victims got what they deserved. "He took money off of people who were rich and greedy and wanted more.”

Read more: http://www.thefirstpost.co.uk/64225,people,entertainment,fuck-my-victims-says-bernie-madoff-in-jail-outburst#ixzz0qL7ITIid

kickbacks for looking the otherway...

Bernie Madoff was able to con thousands of extra investors by using a British bank which "looked the other way" and ignored repeated warnings that he was engaged in a sophisticated fraud, according to the man charged with recovering their losses.

HSBC and its staff were accused of receiving "kickbacks for looking the otherway while legitimising BLMIS (Bernard L Madoff Investment Securities) through their name and brand, making it attractive to investors".

The accusations were levelled in a $9bn (£6.4bn) US lawsuit filed on behalf of Madoff's victims by Irving Picard, the New York lawyer liquidating the convicted fraudster's empire. Madoff is serving 150 years for the $65bn fraud, one of the biggest in history. Madoff's pyramid investment or Ponzi scheme "could not have been accomplished or perpetuated unless the HSBC defendants agreed to look the other way and to pretend they were ensuring the existence of assets and trades when, in fact, they did no such thing", Mr Picard said in the filings.

http://www.independent.co.uk/news/business/news/hsbc-took-kickbacks-to-keep-madoff-in-business-2153027.html

see toon at top...

expensive home run...

The trustee representing the victims of Bernard L. Madoff’s multibillion dollar Ponzi scheme is seeking hundreds of millions of dollars from the owners of the Mets, alleging that they, as longtime and successful investors, knew or should have known Madoff was operating a fraud, according to two lawyers involved in the case.

The trustee’s lawsuit against the Mets takes aim at roughly 100 financial entities owned or controlled in part by the Mets owners Fred Wilpon and Saul Katz, and could imperil the assets held by the two men, an array of holdings that includes the baseball team, the regional cable sports network that televises its games, as well as commercial real estate holdings and investment funds.

The lawsuit seeks to recover not only $300 million in what the trustee, Irving H. Picard, calls “fictitious profits” — the difference between what the Wilpon and Katz entities put into Madoff’s investment firm and what they took out over their many years of investing — but also additional millions, according to the two lawyers, who would not be identified because of the secrecy surrounding the case.

On Friday, Mr. Wilpon, who has long portrayed himself and his family as victims of Mr. Madoff’s and who had insisted his personal finances were stable, announced that he would be seeking one or more “strategic partners” to buy a share of the Mets. In a statement, he asserted that he and his family would not give up principal ownership of the team, estimating that he would be willing to sell up to 25 percent of the club.

“To address the air of uncertainty created by this lawsuit, and to provide additional assurance that the New York Mets will continue to have the necessary resources to fully compete and win, we are looking at a number of potential options including the addition of one or more strategic partners,” the statement said.

One person involved in the Madoff proceedings said it was possible Mr. Picard was seeking as much as $1 billion.

http://www.nytimes.com/2011/01/29/sports/baseball/29mets.html?_r=1&hp=&pagewanted=print

see nofin', hear nofin, cashalot...

By DIANA B. HENRIQUES

BUTNER, N.C. — Bernard L. Madoff said he never thought the collapse of his Ponzi scheme would cause the sort of destruction that has befallen his family.

In his first interview for publication since his arrest in December 2008, Mr. Madoff — looking noticeably thinner and rumpled in khaki prison garb — maintained that family members knew nothing about his crimes.

But during a private two-hour interview in a visitor room here on Tuesday, and in earlier e-mail exchanges, he asserted that unidentified banks and hedge funds were somehow “complicit” in his elaborate fraud, an about-face from earlier claims that he was the only person involved.

Mr. Madoff, who is serving a 150-year sentence, seemed frail and a bit agitated compared with the stoic calm he maintained before his incarceration in 2009, perhaps burdened by sadness over the suicide of his son Mark in December.

Besides that loss, his family also has faced stacks of lawsuits, the potential forfeiture of most of their assets, and relentless public suspicion and enmity that cut Mr. Madoff and his wife Ruth off from their children.

In many ways, however, Mr. Madoff seemed unchanged. He spoke with great intensity and fluency about his dealings with various banks and hedge funds, pointing to their “willful blindness” and their failure to examine discrepancies between his regulatory filings and other information available to them.

“They had to know,” Mr. Madoff said. “But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know.’ ”

While he acknowledged his guilt in the interview and said nothing could excuse his crimes, he focused his comments laserlike on the big investors and giant institutions he dealt with, not on the financial pain he caused thousands of his more modest investors. In an e-mail written on Jan. 13, he observed that many long-term clients made more in legitimate profits from him in the years before the fraud than they could have elsewhere. “I would have loved for them to not lose anything, but that was a risk they were well aware of by investing in the market,” he wrote.

http://www.nytimes.com/2011/02/16/business/madoff-prison-interview.html?_r=1&hp=&adxnnl=1&adxnnlx=1297825204-jow1zRSf08HiCOHvnfGK6g&pagewanted=print

see toon at top...

not in the same ponzi league...

Frantic investors are worried that missing Dover Heights woman Melissa Caddick may have misappropriated between $25 million and $40 million, with one victim entrusting her with $5 million.

"She is the con-artist of the century," said one victim whose extended family invested with Ms Caddick. "I was dry-retching when I found out."

Another said, "This lady's robbed from genuine hard-working families that are less wealthy than she is. She's taken from elderly and young people. It's just sick, it's really sick."

For the past six years, the 49-year-old was allegedly operating a Ponzi scheme whereby money from later investors was used to pay earlier investors. Not that many investors wanted to remove their funds which – on paper – were showing astonishing returns.

Read more:

https://www.smh.com.au/national/nsw/con-artist-of-the-century-investors-fear-melissa-caddick-stole-40m-20201204-p56kn8.html

Read from top.