Search

Recent comments

- graham's crap....

4 min 7 sec ago - hypocrisy....

18 min 54 sec ago - blinded....

50 min 16 sec ago - falling for the US propaganda....

1 hour 16 min ago - MbS calls china...

2 hours 4 min ago - albosux....

2 hours 15 min ago - maths....

2 hours 25 min ago - delusional....

5 hours 1 min ago - precious water....

9 hours 36 min ago - black gold....

9 hours 51 min ago

Democracy Links

Member's Off-site Blogs

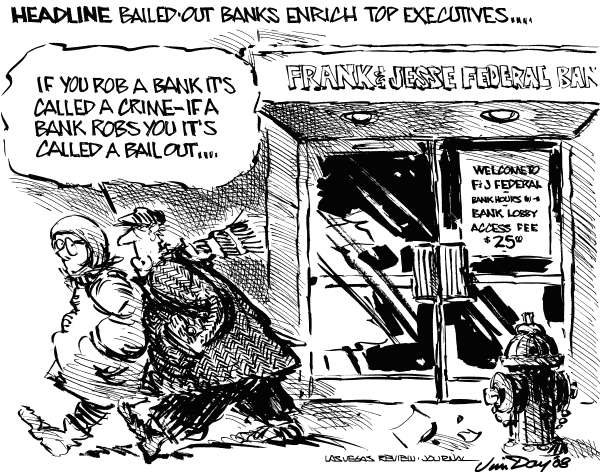

banksters .....

The SEIU wants Bank of America to kick CEO Ken Lewis to the curb because the company approved $4 billion in bonuses for Merrill Lynch executives after accepting $25 billion in bailout funds last October.

Is there any wonder why Bank of America is bad for America?While the nation's largest bank was handing out hefty bonus checks, they were drawing up plans to layoff 35,000 of their 247,000 employees; investing billions in overseas banks and Washington lobbyists; flying executives around on corporate jets; foreclosing on homes; cutting credit to consumers; and refusing to pay employee health care. To top it off, they had the nerve to request $20 billion more from our Treasury.

But wait, there's more!The SEIU's calls for Lewis's ouster come on the heels of the story today in the Huffington Post that Bank of America was involved in a conference call just three days after their first bailout, in which they urged conservative activists to make huge contributions to anti-union groups fighting the Employee Free Choice Act, as well as vulnerable Republican Senators like Norm Coleman, Gordon Smith and Elizabeth Dole.

This was a desperate attempt to prevent Employee Free Choice from passing in the Senate, which will likely happen with President Obama and a Democratic majority in power.- By John Richardson at 28 Jan 2009 - 10:57pm

- John Richardson's blog

- Login or register to post comments

an exceptional year .....

Just when you thought Bank of America couldn't abuse the bailout any more than they already have, the nation's largest bank threw a lavish 5-day Super Bowl extravaganza worth $10 million, according to ABC. Apparently, the tents alone for this party alone cost $800,000. And the The Huffington Post reports that this is just the tip of the iceberg when it comes to Bank of America's multi-million dollar professional sports sponsorships.

Now, Bank of America claims that they were contractually obligated to throw this event, considering they're the official bank of the NFL. But as Tom Schatz, president of Citizens Against Government Waste, told ABC, "This is an exceptional year and it's a time to say we're not going to do business as usual. We're going to say no, we're going to show some restraint, and we're going to cut back on something that really isn't absolutely necessary."Show some restraint? What a novel idea! One would think that after taking $45 billion from taxpayers, you might consider a little prudence by scaling back on the excessive parties--or not throwing them at all. You might also want to stop giving your executives millions in bonuses and flying them around on corporate jets.

And maybe, just maybe, show some gratitude by giving your workers adequate health care instead of laying off 35,000 of them, not to mention curbing your nasty predatory lending practices that helped cause this economic meltdown in the first place.http://www.alternet.org/blogs/workplace/124704/

bankster's bluff .....

Last week, President Obama called it "shameful" that the bank executives, who took taxpayer money through the bailout last fall, paid themselves large bonuses. While the vast majority of the public agrees with this view, there is little that President Obama can directly do about these bonuses at this point.

However, with more bailout money on the way (probably much more), President Obama will be in a position to seriously constrain executive compensation in the future at the banks that are subsisting on government largess. However, before we even get to Round II of the bailout, there is some quick business that he should attend to right here in Washington.Last month, on the day before Christmas, Fannie Mae announced that it had reconstituted its board of directors. According to The Washington Post, the nine directors will receive annual pay of $160,000 each (more if they chair a committee), while the chair of the board will take home $290,000 a year.

This pay seems rather high for two reasons. First, being a director is a very part-time job. A director's duties almost certainly require an average of less than one day a week. This means that the $160,000 annual salary for board members would translate into a full-time salary of more than $800,000.The other reason this pay package is so disturbing is that Fannie Mae is currently in conservatorship. It is being run as a government company, with most of the oversight responsibilities of a corporate board being handled by the Federal Housing Finance Agency. In other words, Fannie Mae's new directors are effectively getting paid $160,000 a year at a part-time government job, which is even more part-time than usual, because a government agency is actually doing most of their work.

http://www.truthout.org/020209Arobbing the treasuries...

Prosecutors in Denmark have charged three Britons and three Americans with defrauding the Danish treasury of more than 1.1bn kroner ($175m; £130m; €150m) through a German bank.

Two British citizens have already been charged as part of a "cum-ex" trading fraud that swindled the treasury of a total of 12.7bn Danish kroner.

Prosecutors believe the six charged are "the central principals" in the fraud.

If found guilty, they could face 12 years in jail.

How the scam workedDenmark's Serious Economic and International Crime (SEIC) fraud squad said that for more than a year, between 2014 and 2015, hundreds of fake share trades were carried out via the Mainz-based North Channel Bank in Germany.

The aim was to defraud the Danish treasury of 1.1bn kroner through refunds for tax dividends. The bank made a substantial sum in fees and was eventually fined in 2019.

Denmark's was just one of a number of European treasuries caught up in the so-called "cum-ex" scandal, in which tax refunds on share sales were claimed by both parties on tax that had only been paid once.

In total, 12.7bn kroner was paid out to foreign-based people or companies, exploiting a loophole that allows foreigners to avoid the tax on dividends that Danes have to pay.

Two other Britons were charged in January for their alleged role in the Danish fraud. Among them is hedge-fund investor Sanjay Shah, who is reportedly in Dubai and denies any wrongdoing. He is also being prosecuted by German authorities.

Two British bankers were given suspended sentences by a German court last year for what the judge called a "collective case of thievery from state coffers". The cum-ex scam is estimated to have cost Germany's treasury €5bn.

Denmark has worked with UK, German and Belgian authorities on the scandal for the past five years.

Fraud prosecutors in Copenhagen said in February they were looking into a variety of networks of people and companies that had sought dividend tax refunds. They froze Sanjay Shah's mansion in London's Hyde Park last year as part of their case.

Prosecutors say they have now charged suspects linked to 10bn kroner out of the total defrauded from the Danish treasury.

Read more:

https://www.bbc.com/news/world-europe-56731339

Read from top.

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!