Search

Recent comments

- epibatidine....

4 hours 1 min ago - cryptohubs...

5 hours 8 sec ago - jackboots....

5 hours 8 min ago - horrid....

5 hours 16 min ago - nothing....

7 hours 39 min ago - daily tally....

9 hours 1 min ago - new tariffs....

10 hours 52 min ago - crummy....

1 day 5 hours ago - RC into A....

1 day 6 hours ago - destabilising....

1 day 8 hours ago

Democracy Links

Member's Off-site Blogs

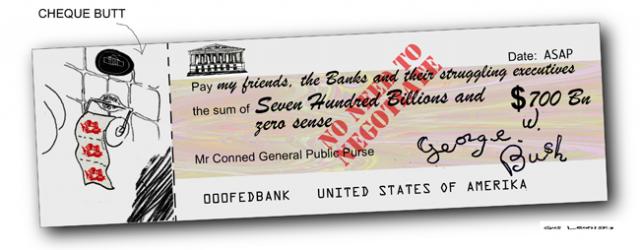

welfare cheque .....

Americans’ anger is in full bloom, jumping off the screen in capital letters and exclamation points, in the e-mail in-boxes of elected representatives in the nation’s capital.

“I am hoping Congress can find the backbone to stand on their feet and not their knees before BIG BUSINESS,” one correspondent wrote to Representative Jim McDermott of Washington.

“I’d rather leave a better world to my children — NOT A BANKRUPT NATION.

Whew! Pardon my shouting,” wrote another.

Mr. McDermott is a liberal Democrat, but his e-mail messages look a lot like the ones that Representative Candice S. Miller, a conservative Republican from Michigan, is receiving.

“NO BAILOUT, I am a registered republican,” one constituent wrote. “I will vote and campaign hard against you if we have to subsidize the very people that have sold out MY COUNTRY.”

The backlash, in phone calls as well as e-mail messages, is putting lawmakers in a quandary as they weigh what many regard as the most consequential decision of their careers: whether to agree to President Bush’s request to spend an estimated $700 billion in taxpayer money to rescue the financial services system.

read more at the NYT...- By Gus Leonisky at 26 Sep 2008 - 8:33pm

- Gus Leonisky's blog

- Login or register to post comments

THIz TRANSACTIN eez 100% SAiFE

From the NYT

Nigerian Scammers, You’ve Met Your Match

An e-mail making the rounds:

MY DEAR AMERICAN FRIEND:

I AM NEEDING TO ASK YOU TO SUPPORT AN URGENT SECRET BUSINESS RELATIONSHIP WITH A TRANSFER OF FUNDS OF GREAT MAGNITUDE.

I AM MINISTRY OF THE TREASURY OF THE REPUBLIC OF AMERICA. MY COUNTRY HAS HAD CRISIS THAT HAS CAUSED NEED FOR LARGE TRANSFER OF FUNDS OF 700 BILLION OF YOUR DOLLARS (US). IF YOU WOULD ASSIST ME IN THIS TRANSFER IT WOULD BE MOST PROFITABLE TO YOU.

I AM WORKING WITH HIGHLY REPUTABLE MR. PHIL GRAM, LOBBYIST FOR UBS, WHO WILL BE MY REPLACEMENT AS MINISTRY OF THE TREASURY IN JANUARY IF MY POLITICAL PARTY WINS UPCOMING ELECTION, WHICH WE CERTAINLY WILL BECAUSE WE ARE IN CONTROLING OF THE HIGHEST SUPREME COURT. YOU MAY REMEMBER HIM AS A SENATOR AS LEADER OF THE AMERICAN BANKING DEREGULATION MOVEMENT IN THE 1990S.

THIS TRANSACTIN IS 100% SAFE. YOU MUST TRUST ME COMPLETELY AND NOT ASK QUESTIONS ABOUT THE TRANSACTION. YOU HAVE MY WORD NO ONE WILL DO ANYTHING WRONG WITH THE MONEY.

THIS IS A MATTER OF GREAT URGENCY. WE NEED YOUR BLANK CHECK. WE NEED THE FUNDS AS QUICKLY AS POSSIBLE. WE CANNOT DIRECTLY TRANSFER THESE FUNDS IN THE NAMES OF OUR CLOSE FRIENDS BECAUSE WE ARE CONSTANTLY UNDER SURVEILLANCE. MY FAMILY LAWYER ADVISED ME THAT I SHOULD LOOK FOR A RELIABLE AND TRUSTWORTH PERSONAGE WHO WILL ACT AS A NEXT OF KIN SO THE FUNDS CAN BE TRANSFERRED. YOU ARE THAT PERSONAGE.

-------------

read more at the NYT and see toon at top...

distressed money...

Lawmakers Hope Small Changes Will Spur Bailout

By CARL HULSE and EDMUND L. ANDREWSWASHINGTON — Congressional leaders and the White House indicated Tuesday that small changes in the stalled financial rescue package might be enough to win over enough lawmakers to get the bill through the House.

As they studied the vote tally from the surprising defeat of the bill in the House on Monday, strategists said they were identifying lawmakers who they thought could be persuaded to back a revised plan.

One idea, an increase in federal bank deposit insurance, gained momentum after it was endorsed early Tuesday by both Senators John McCain and Barack Obama, the presidential candidates. Another idea under discussion was to extend jobless benefits for people who had been out of work for months.

As President Bush, Mr. McCain and Mr. Obama called for Congress to act, all sides indicated that any revisions would be modest to a plan to spend up to $700 billion to buy distressed securities.

---------------------

see toon at top and read more at the NYT

golden parachutes...

How finance, insurance, and real estate lobbyists bought a bailout.

By Kelley Beaucar VlahosThere was little in the federal bailout bill that most Americans could wrap their arms, much less their minds, around. What did strike a chord—and one of the rare notes of consensus—was that greedy executives of failed institutions should have to give up their high salaries and golden parachutes before getting a life raft from Uncle Sam.

But the CEO’s needn’t be too alarmed. The $2 billion their industry has invested in Washington politicians over the last 20 years will likely bring healthy returns. Pesky details like “who” and “how much” to penalize were kicked down the road or left wide open for interpretation—nothing a few fat friends on the right committees and a team of crack lobbyists can’t handle.

The hard lesson here will be that hard lessons are for chumps who can’t afford otherwise.

“The money always pays off,” said Melanie Sloan, head of the Center for Reform in Elections in Washington. “It’s all about being there, being in the room” when the details take shape behind closed doors on Capitol Hill. “And you’re not in the room if you’re not making these contributions or having highly-paid lobbyists well placed.”

read more at the American Conservative and see toon at top...