Search

Recent comments

- loneliness....

1 hour 34 sec ago - insight....

1 hour 31 min ago - conspiracy....

21 hours 18 min ago - brutal USA....

23 hours 13 min ago - men....

23 hours 34 min ago - oil....

1 day 11 min ago - system....

1 day 57 min ago - not invited....

1 day 1 hour ago - whistleblow.....

1 day 14 hours ago - demosocialism....

2 days 7 min ago

Democracy Links

Member's Off-site Blogs

making ends meet .....

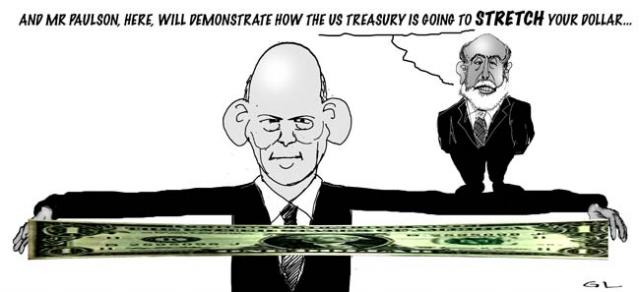

The financial crisis that began in the United States spread to many corners of the globe. Now, the American bailout looks as if it is going global, too, a move that could raise its cost and intensify scrutiny by Congress and critics.

Foreign banks, which were initially excluded from the plan, lobbied successfully over the weekend to be able to sell the toxic American mortgage debt owned by their American units to the Treasury, getting the same treatment as United States banks.

Foreign Banks Hope Bailout Will Be GlobalGus: as long as the US government pays for it, in kind, tears and better regulations, okay... The US public owes this to the world. For years they have supported a shonky system with little or no control that allowed USURY. Time to put a stop to it...

- By Gus Leonisky at 22 Sep 2008 - 10:55pm

- Gus Leonisky's blog

- Login or register to post comments

scam

From Unleashed (ABC)

But it is also important to look at what caused the mess in the first place. While many are blaming greed, derivatives, short sellers, etc, a number of economists are laying the blame at overregulation. They argue that misguided laws helped create the housing bubble in which the financial crisis has its genesis.

Professor of Economics at George Mason University, Tyler Cowen, blames legislation like the Home Mortgage Disclosure Act and the Community Reinvestment Act (which made banks show they were lending to sub-prime borrowers) for helping "encourage the proliferation of high-risk mortgage loans". He also believes tax deductions for mortgage interest encouraged overinvestment in real estate.

Legislation has also given banks incentives to hide balance sheet risk. Allan Meltzer, professor of political economy at Carnegie Mellon University, said: "Mistaken regulation contributed greatly to the current problems in financial markets."

------------------------------

Gus: er... That's passing the dummy.

Someones cleverly greedy saw an opportunity to milk the system and milk they did, regulations or no regulations. Actually should there had been no regulations, the market would have imploded with the force of a massive black hole... So far the damage is limited.

Say, the financial institution played a little game of let's give "hope" to some poor bastard by selling cheap credit for housing, then push the interest rates and penalties (including penalty for repaying loan early, making it out of reach) till the poor bastard can't pay anymore...

So let's take his assets away and flog them with same terms credit to some other poor bastard who gets crushed as well, all ad infinitum. pleasant little scam. That's only the start. The priming pump...

Then when the scam is well primed and large enough, the financial sector bundled all these little ventures into bigger packages that are on-sold for twice the value (shiny wrapping paper with a pink bow). The buyer then on-sell the packages to other "cashed up" lending institutions for twice the value again presented inside a bigger gift box... Eventually the packages are dropped back at the feet of the banking system in another format, with whistles, bells and tinsels to boot, until some people starting to panic when they realise what they've bought, largely "unfathomable bad credit".

Yes, They bought the same smelly stuff but with far greater overvalue. They knew the stuff was worth next to nothing... Oooooops!!!! They had to say sorry, can't pay... or something of the kind.

Of course by that time the rotten overvalued goods had gone ten times around the world in a fantastic game of pass the bundle... or a game of musical chair for thousand of people with only one single chair. Result: massive scramble, fist fights and many people sitting on top of each other till the chair collapses. Further more since there were a limited number of poor pigeons to which the orginal assets could have been resold to, the original scam collapsed as well.

Boom went the building industry... Bam went the banking industry, etc....

The problem was not because there was too much regulation. The problem was there was too many loopholes in the regulations — loopholes designed to help greedy people push their greedy trade...

Furthermore, the financial system was using our savings to play the game and it's the first thing that's usually goes up in smoke...

Please, shut the gate.

a towering edifice of irrational financial faith

A Bailout or a Bonanza?

By Eugene Robinson

Tuesday, September 23, 2008; A21

The uber-capitalists of Wall Street are all socialists now. Free- market ideology, it turns out, doesn't pay the mortgage. That appears to be a job for, ahem, Big Government.

Let's be clear about why we're facing a crisis that could pull down the global financial system. The irresponsibility of individuals who bought houses they couldn't quite afford pales in comparison with the irresponsibility of the financial wizards who built on those shaky mortgages a towering edifice of irrational faith.

---------------------

September 23, 2008 Retirees Filling the Front Line in Market Fears

By JOHN LELAND and LOUIS UCHITELLEOlder Americans with investments are among the hardest hit by the turmoil in the financial markets and have the least opportunity to recover.

As companies have switched from fixed pensions to 401(k) accounts, retirees risk losing big chunks of their wealth and income in a single day’s trading, as many have in the last month.

“There’s a terrified older population out there,” said Alicia H. Munnell, director of the Center for Retirement Research at Boston College. “If you’re 45 and the market goes down, it bothers you, but it comes back. But if you’re retired or about to retire, you might have to sell your assets before they have a chance to recover. And people don’t have the luxury of being in bonds because they don’t yield enough for how long we live.”

------------------