Search

Recent comments

- religious war....

5 hours 29 min ago - underdogs....

5 hours 40 min ago - decentralised....

6 hours 3 min ago - economy 101....

16 hours 20 sec ago - peace....

16 hours 48 min ago - making sense....

19 hours 27 min ago - balls....

19 hours 30 min ago - university semites....

20 hours 18 min ago - by the balls....

20 hours 32 min ago - furphy....

1 day 1 hour ago

Democracy Links

Member's Off-site Blogs

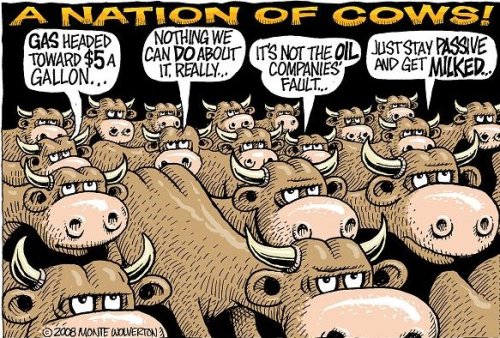

milked .....

The world has never looked better for the Big Five oil companies.

This morning, Exxon Mobil, the world's largest oil company, announced its "second-quarter profit rose 14 percent, to $11.68 billion, the highest-ever profit by an American company. Exxon broke its own record." (Of course, unsurprisingly, the record result still wasn't quite enough to please investors, who marked Exxon’s stock down by 3% in response.)

Joining Exxon Mobil as the only oil companies to "earn more than $10 billion in a single quarter, Royal Dutch Shell said its profit rose to $11.56 billion."

ConocoPhillips and BP last week reported their "massive second-quarter profits."

The fifth oil major, Chevron, will release its earnings report tomorrow.

Yesterday, Interior Secretary Dirk Kempthorne announced "a new five-year leasing plan for offshore oil drilling" to give oil companies a "head start" on attacking protected waters, should the Congress follows President Bush, who recently lifted the presidential moratorium on offshore drilling "first issued by his father in 1990."

Rep. Ed Markey (D-MA) described Kempthorne's announcement as a "Going Out of Business Sale" on behalf of Big Oil.

The unprecedented profits for Big Oil come at the expense of practically everyone else in the form of a collapsing economy, international instability, rampant commodity inflation, and deadly climate change.

However, Big Oil's windfall has also meant largesse - and criminal levels of corruption - for some in Washington.

Record Prices, Record Profits: Since 2001, gasoline prices have more than doubled, and oil companies have made more than half a trillion dollars in profits.

The price of oil has surged from below $30 a barrel to over $125, a fourfold increase. The Big Five oil companies could make a "projected $168 billion in profits" this year alone.

The United States has only two percent of the world's oil reserves but consumes 25 percent of the world's oil. "At current oil prices," conservative oil man T. Boone Pickens argued, "we will send $700 billion dollars out of the country this year alone."

If we continue on the same path for the next ten years, "the cost will be $10 trillion -- it will be the greatest transfer of wealth in the history of mankind," he added.

The surging price of oil is due in part to demand growing faster than supply, but also to factors such as "the war in Iraq and the value of the dollar" and unregulated, Enron-like speculation.

Instead of investing in 21st century energy, the oil companies are plowing most of their profits into stock buybacks, a windfall for their rich investors.- By John Richardson at 2 Aug 2008 - 1:27am

- John Richardson's blog

- Login or register to post comments

guzzlers .....

A bureaucratic oversight has allowed 24 oil companies to avoid more than $1.3 billion in royalties for the privilege of extracting oil & natural gas from US territory in the Gulf of Mexico - with foreign companies responsible for 55 percent of that total.

But this US$1.3 billion in forgone royalties pales in comparison to the US$60 billion that Americans stand to lose in royalty revenue over the life of these leases.

And if Congress repeals the moratorium on Outer Continental Shelf (OCS) drilling that has existed since 1982, these freeloading oil companies will be eligible to bid on new leases, providing them with more record profits while American families are left holding the bag.

These 24 companies have posted a combined US$365 billion in profits since 2006.