Search

Recent comments

- energy vs energy....

29 min ago - killing kids....

3 hours 25 min ago - the die is cast....

5 hours 17 min ago - SICKO.....

5 hours 38 min ago - be brave, albo....

8 hours 9 min ago - epstein class....

9 hours 13 min ago - in writing....

9 hours 25 min ago - hoped....

11 hours 25 min ago - murdering kids....

12 hours 26 min ago - saving....

12 hours 54 min ago

Democracy Links

Member's Off-site Blogs

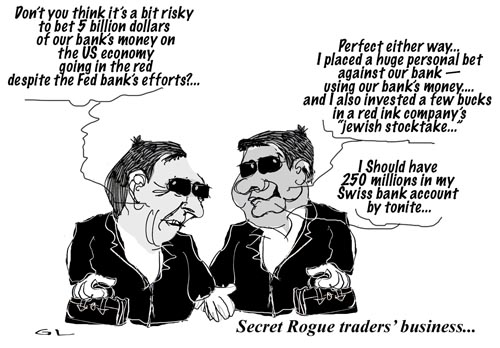

risky business .....

Credit Suisse faced a double whammy of bad news yesterday, revealing it is almost certain to plunge into loss during the first quarter of this year and admitting a group of rogue traders in its London office had forced it to write down the value of its assets by SFr2.86bn (£1.43bn).

Brady Dougan, the investment bank's chief executive, said that, even after the effect of the rogue traders' activities, Credit Suisse had remained profitable until the end of February but warned difficult market conditions in March had plunged it into losses for the first three months of 2008.

While Credit Suisse's disappointing announcement was in contrast to the better-than-expected earnings updates from leading US investment banks this week, Mr Dougan said there was no question of any shortfalls in liquidity or capital at the bank. "We are one of the world's best-capitalised banks and our funding is conservative," he insisted.

--------------------------------------------

Gus: How can "traders" get away with this caper is beyond belief... either the banks are lax or accomplices... All in all, the banks whichever they are, display an uncouth attitude towards the value of what they suppose to hold, all in the name of greed, hedges and wedges....Rogue Traders Force Credit Suisse Into 1.4Billion Pound Write-down

- By Gus Leonisky at 22 Mar 2008 - 7:43am

- Gus Leonisky's blog

- Login or register to post comments

pipe the mirlitons...

By PAUL KRUGMAN

Published: March 21, 2008

If Ben Bernanke manages to save the financial system from collapse, he will — rightly — be praised for his heroic efforts.

But what we should be asking is: How did we get here?

Why does the financial system need salvation?

Why do mild-mannered economists have to become superheroes?

The answer, at a fundamental level, is that we’re paying the price for willful amnesia. We chose to forget what happened in the 1930s — and having refused to learn from history, we’re repeating it.

Contrary to popular belief, the stock market crash of 1929 wasn’t the defining moment of the Great Depression. What turned an ordinary recession into a civilization-threatening slump was the wave of bank runs that swept across America in 1930 and 1931.

the alphabet noodle canoodle donkey

....

TWO months before he resigned as chief executive of Citigroup last year amid nearly $20 billion in write-downs, Charles O. Prince III sat down in Washington with Representative Barney Frank, the chairman of the House Financial Services Committee. Among the topics they discussed were investment vehicles that allowed Citigroup and other banks to keep billions of dollars in potential liabilities off of their balance sheets — and away from the scrutiny of investors and analysts.

“Why aren’t they on your balance sheet?” asked Mr. Frank, Democrat of Massachusetts. The congressman recalled that Mr. Prince said doing so would have put Citigroup at a disadvantage with Wall Street investment banks that were more loosely regulated and were allowed to take far greater risks. (A spokeswoman for Mr. Prince confirmed the conversation.)

It was at that moment, Mr. Frank says, that he first realized just how much freedom Wall Street firms had, and how lightly regulated they were in comparison with commercial banks, which have to answer to an alphabet soup of government agencies like the Federal Reserve and the comptroller of the currency.

“Not only did Wall Street have so much freedom, but it gave commercial banks an incentive to try and evade their regulations,” Mr. Frank says. When it came to Wall Street, he says, “we thought we didn’t need regulation.”

meanwhile at the very high end of town...

Hedge fund managers reap billions amid slump

Millions of people are facing foreclosure on their homes, banks are going belly up, tens of thousands are being put out of work, America is on the brink of recession — it's another fantastic year to make money as a hedge fund manager.

The top managers pocketed more personal wealth last year than at probably any time in history. Top of the league table came John Paulson, whose pay packet in 2007 reached $3.7bn (£1.87bn).

Close behind him were George Soros and James Simons who made $2.9bn and $2.8bn respectively. The poorest individual listed among the 50 top earning hedge fund managers made $210 million.

...

Annual earnings of $30m would have got you into the top 25 in 2002; now it takes $360m. In 2003, the wages of the top 25 put together amounted to less than the amount made by the top three last year.

Inequality of wealth is more extreme in America today than for decades. According to Jared Bernstein of the Economic Policy Institute in Washington, the gulf is greater than at any time since 1928, when a similar proportion of US national income — 23% — went to the top 1% of earners.

"The similarity between 1928 and today is that both were periods of unbridled excess where an ideological allegiance to market forces got us into all kinds of hot water," Bernstein said.

------------

see toon at top...

more holes than cheese...

Credit Suisse bank loses billions

Credit Suisse has reported a loss for the first three months of the year, hit by its exposure to the credit markets.

The bank made a net loss of 2.1bn Swiss francs ($2.1bn; £1.0bn) after writing down 5.3bn Swiss francs in mortgage securities and big buyout loans.

It had made a net profit of 2.7bn Swiss francs in the same period of last year.

Credit Suisse had already warned it was likely to make a loss, which it blamed partly on the "intentional misconduct" of a number of traders.

----------------

Gus: "Intentional misconduct"? Hum... sounds like... see toon at top...

Ah, the sweet dream and the power of making money out of money rather than having to make solid state products that a fickle public may not want to buy...

Meanwhile, on the raiders' chariots...

From the SMH

PRESSURE is building on the nation's corporate regulator to renew the ban on short selling shares amid speculation that foreign hedge funds are waiting to pounce and drive down the share prices of the big four banks.

The Australian Securities and Investments Commission must decide by Friday whether to renew the ban that has split the financial community.

Speaking on the condition of anonymity from an Asian financial capital, an industry source told the Herald of a co-ordinated plan by about three hedge funds to target Australian banks should the ban be lifted.

Australia is the only nation still with a ban on short selling.

Short selling involves investors borrowing shares from fund managers, selling them with a view to pushing the price down, and then buying them back at a cheaper price. The fund manager receives a fee in return.

-------------------------

Thus, someone will be robbed legally, will lose their pants legally and will have to live under a bridge illegally. And NOTHING OF VALUE CONTRIBUTING TO GROWTH has been created. Smile, it's only YOUR money being taken for a ride...

... Parasites of the financial system... and there is no cure for these than to tell them to bugger off. But they should be swatted like fruit flies, with a wet towel — wet, because there is less chance for the flies to see the danger coming (gus' discovery)...

But to be sure of a 100 per cent kill, I used the added technique of TWO wet SWATS... Say two hands coming from near opposing directions, confusing the fly as to where the danger is really coming from... Only one hand of course hits the poor insect(s)... That's what we need in our financial regulation, confusion of what's legal or not and BANG, whatever they do is illegal. That'd teach 'em...

see toon on top