Search

Recent comments

- RC into A....

32 min 22 sec ago - destabilising....

1 hour 36 min ago - lowe blow....

2 hours 7 min ago - names....

2 hours 44 min ago - sad sy....

3 hours 10 min ago - terrible pollies....

3 hours 20 min ago - illegal....

4 hours 31 min ago - sinister....

6 hours 54 min ago - war council.....

16 hours 39 min ago - flying saucers....

16 hours 49 min ago

Democracy Links

Member's Off-site Blogs

it’s the housing, stupid.....

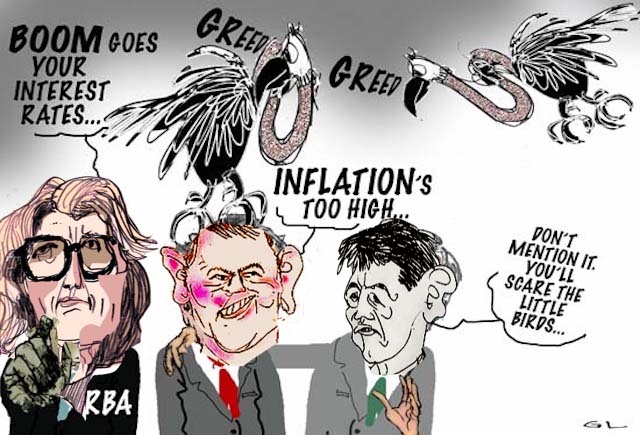

As predictable as Pauline Hanson’s racism, the commentariat leapt on Thursday’s labour market figures as more evidence of fiscal doom and monetary policy gloom. Michael Pascoe worries that the RBA will too.

Isn’t it great to have an economy where unemployment is low without causing an inflationary wages breakout?

Beware the wages bogeyman – it’s the housing, stupid

by Michael Pascoe

Apparently not, according to the main fishwrappers that greeted the unemployment rate remaining steady at 4.1 per cent in January as a bad

bad thing requiring higher interest rates forthwith.

The Reserve Bank monetary policy board three weeks ago wasn’t waiting for more figures, happy to wish for higher unemployment on the back of the rate falling to 4.1 in December. The minutes of the February 3 meeting, released on Wednesday, showed the board wasn’t pussyfooting about labour market tightness the way the bank’s staff and Governor tended to do.

It’s been a feature of the past year or so for the RBA to call the labour market “a bit tight” without every quite spelling out if it was “too tight”.

Being “a bit tight” is actually a good thing as it encourages lazy management to seek productivity improvements instead of just hiring another body. It’s “too tight” when the laws of supply and demand have their way, pushing up wages to fuel an inflationary spiral.

When is tight too tight?According to the board minutes: “The staff’s overall assessment was that the labour market was a little tighter than consistent with full employment.”

“Full employment” is the euphemism the RBA uses for the rate of unemployment that doesn’t push up inflation. It is a little nonsense of the bank having “twin mandates” of targeting 2.5 per cent inflation and “full employment” when “full employment” is merely whatever the unemployment rate is when inflation is in the zone.

Thus we don’t have “full employment” now with a 4.1 per cent unemployment rate, we have overfull employment with the RBA board looking forward to unemployment rising to 4.5 per cent in the bank’s forecasts after another couple of interest rate rises.

The monetary hawks cherry pick various numbers to make their case, especially unit labour costs that reflect slack management as much as labour demand and pricing.

What they prefer to ignore or downplay is the headline figure and achievement of this economic cycle, the wage price index showing wages growth is consistent with the inflationary target range, not galloping out of control.

Wednesday’s December quarter wage price index release was mainly greeted with the headline that real wages had again turned negative, CPI inflation for 2025 being 3.8 per cent while the WPI grew by 3.4 per cent.

The tax impactThis wasn’t really news, as regular MWM readers would have read back in December. Readers also know it’s actually worse than the rest of the commentariat ever report as everybody else ignores the tax impact.

For example, to repeat myself repeating myself, someone on a median full-time wage this year of $90,000 before tax who gets a 3 per cent pre-tax raise will only receive a 2.6 per cent increase in their after-tax pay packet.

But I digress. The important part of the December quarter WPI was confirmation that private sector wages, the area that best reflects market forces, grew by a steady 0.8 per cent. Annualise the past two quarters and private wages growth is running at a healthy 3.2 per cent, a figure in keeping with the RBA’s inflation target as the workers are supposed to share a little of our productivity growth.

That’s not what we keep being told though by the lobby most interested in minimising wages and maximising profits.

The tradies windInstead, the example most often cited as representing our “too tight” labour market is the cost and availability of tradies. Construction workers “on the tools” make up only about six per cent of the workforce, but that six per cent wags the policy and commentariat dog.

In November when asked about who was to blame for the uptick in inflation, RBA Governor Bullock went straight for the ute drivers:

“Well, I guess there’s a couple of things. The first is that it’s possibly telling us that there’s a little more excess demand in the economy than we had thought, and it’s sometimes hard for people to understand that, but if you take just a very – a microcosm, a very sort of simple example, I don’t know how many people have tried to get a tradie, perhaps, to work on their house. It’s difficult.

“What that’s telling you is that in that particular microcosm of the Australian economy that the demand for these services is above the ability of this to supply it.”

Bullock right on housingAnd Ms Bullock is right, our core inflation problem comes back to housing which just happens to also be our core political problem when we’re not distracted by parties imploding and racist grandstanding and/or dog whistling.

It’s the housing, stupid.

Three decades of both parties and all levels of government thinking “the market” could look after providing adequate shelter for the population have landed us in our current crisis of both affordability and availability.

And policy overwhelmingly promises to at best maintain the present unsatisfactory status quo, as explained two years ago, and, more likely, worsen it.

This month’s board minutes allude to it:

“The staff judged that the larger part of the increase had reflected less-persistent factors, including price volatility in categories such as electricity, travel and groceries, and some sector-specific demand and price pressures that had affected prices of new dwellings and durable goods. Inflation in administered prices (excluding electricity) was only a little above its historical average and had picked up only modestly.”

The “sector-specific” bit is housing.

Housing and the cost of livingIt was the area that showed the biggest growth in the CPI over 2025, 5.5 per cent, and that’s without the ABS even measuring all housing inflation as it underplays what rent is doing.

It’s housing that is the key factor in our “cost of living” crisis, the cost of renting, buying and building. It’s housing that is at the root of much of our social division, giving rise to One Hanson.

To help both the RBA and Australia, much more is needed than fiddling with capital gains tax in the May budget, if Albanese is game enough to do even that.

We need to much more seriously target the building trades in our immigration policy and we need governments to commit to doubling the percentage of housing stock that is social/public. We have created a swathe of Australians who will never be able to afford their own home and cannot be adequately cared for by private landlords.

Otherwise, interest rates and unemployment will rise, the population will become more disgusted with both mainstream parties and living standards will continue to go backwards.

https://michaelwest.com.au/beware-the-wages-bogeyman-its-the-housing-stupid/

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 21 Feb 2026 - 5:44am

- Gus Leonisky's blog

- Login or register to post comments

lowe blow....

Jim Chalmers and Anthony Albanese have responded with contempt after former Reserve Bank governor Philip Lowe suggested government "handouts" were fuelling inflation and rate hikes.

Mr Chalmers said he had "respect" for the former governor but impugned his motives, implying his criticism was motivated by his disappointment that the government had not extended his tenure when it expired in 2023.

"Phil Lowe would have liked to have been reappointed by the government. After he wasn't reappointed he's become a fairly persistent critic of the Labor government," the treasurer told reporters.

"I think to some extent that's just human nature. I understand that. I have a very respectful view of Phil Lowe."

In comments first reported by the Financial Review, Mr Lowe, who now heads an advisory body to the Australian Securities Exchange, said the federal government should be more "ambitious" about boosting the economy's productive capacity.

Without such change, he said that if the government wanted to "keep offering people handouts" then interest rates would "have to go up".

Phil Lowe the Manly player?The treasurer's unprecedented rebuke of a former central bank governor came after the prime minister earlier suggested Mr Lowe's comments were irrelevant.

"Phil Lowe the footballer, former Manly player, or former RBA governor? You know … you have people who are exes, who get their name in the paper. I haven't seen his comments," Mr Albanese said.

Mr Chalmers took a veiled swipe at Mr Lowe's tenure at the helm of the Reserve Bank, saying that "out of respect" he had refrained from "any public criticism of his record as RBA governor or the forward guidance he gave or any of the decisions he took".

The mention of "forward guidance" is a reference to comments Mr Lowe made during the COVID pandemic that interest rates would not rise, which turned out to be wrong and drew criticism from a subsequent independent review of the bank.

Mr Chalmers has pointed to the fact that public demand has grown more slowly than private demand over the last year as evidence that the government is not the primary cause of persistent inflation, although the handouts Mr Lowe referred to count as private.

"We know there's more work to do, plainly, on productivity. We have a very big, bold, broad, ambitious agenda of productivity we've been rolling out," Mr Chalmers said.

The treasurer was speaking after the release of new wages data from the Australian Bureau of Statistics, which showed that wage growth lagged inflation in the last three months of 2025 and that public sector wages grew slightly faster than private sector wages.

New Shadow Treasurer Tim Wilson said the government was "pump priming" the economy and it was "clear" this was "the key driver of inflation".

"The treasurer's engaging in a form of demand denial about his responsibility to drive inflation exceeding wages," he said.

https://www.abc.net.au/news/2026-02-18/chalmers-dismisses-criticism-from-philip-lowe/106359398

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.