Search

Recent comments

- humanoids....

2 min 3 sec ago - refugees....

1 hour 43 min ago - tonight....

1 hour 53 min ago - 10 days?....

2 hours 3 min ago - MI6 parrot.....

2 hours 57 min ago - not sorry....

3 hours 22 min ago - trump's law.....

3 hours 30 min ago - confiscation....

4 hours 33 min ago - mocking....

5 hours 39 min ago - never met....

6 hours 38 min ago

Democracy Links

Member's Off-site Blogs

more smoke & mirrors .....

Senator Hillary Rodham Clinton said that if she became president, the federal government would take a more active role in the economy to address what she called the excesses of the market and of the Bush administration.

In one of her most extensive interviews about how she would approach the economy, Mrs Clinton laid out a view of economic policy that differed in some ways from that of her husband, Bill Clinton. Mr Clinton campaigned on his centrist views, and as president, he championed deficit reduction and trade agreements.

Reflecting what her aides said were very different conditions today, Mrs Clinton put her emphasis on issues like inequality and the role of institutions like government, rather than market forces, in addressing them.- By Gus Leonisky at 21 Jan 2008 - 10:29pm

- Gus Leonisky's blog

- Login or register to post comments

puncture, panic and plunge...

Stocks Plunge Worldwide on Fears of a U.S. Recession

By MARK LANDLER and HEATHER TIMMONS

Published: January 21, 2008

FRANKFURT — Fears that the United States is in a recession reverberated around the world on Monday, sending stock markets from Frankfurt to Bombay into a tailspin and puncturing the hopes of many investors that Europe and Asia will be able to sidestep an American downturn.

On a day when United States markets were closed in observance of Martin Luther King’s Birthday, the world’s eyes were trained nervously on the United States. Investors reacted with what many analysts described as panic to the multiplying signs of weakness in the American economy.

Shares of banks led the decline in many countries, underscoring that the subprime crisis continues to hobble the global financial system. On Monday, a big German state bank, WestLB, said it would report a loss of $1.4 billion in 2007 because of its exposure to deteriorating mortgage assets.

-----------

Gus: puncture, panic and plunge... "it could be a bear market..." Like a polar bear on the melting ice floes... no-bloody-where to go to, except swim the freezing waters. But keep swimming: that will keep you warm... Let's hope the markets can survive without the US hollywoodian cold tap dancing... A recession? Usually the fat gets trimmed off... and the con artists have less opportunity to exercise their craft...

The Yankee presidential elections are about one year too late... Bushit should have gone by now. The US economy woes show his grand ineptitude (or his magical ways at robbing the system to feed his follies) to manage anything... When Bill Clinton left, the coffers were solidly brimming... Now the ruins of war inflicted by lying Bush on Iraq have infected the whole system. Warmongers have profited... the rest of us are paying for it.

Investigating the con artists

FBI investigates sub-prime crisis

The FBI is investigating 14 companies embroiled in the sub-prime mortgage crisis as part of a crackdown on improper lending.

It did not identify the companies but said the investigation encompassed developers, sub-prime lenders and investment banks.

FBI officials said the agency was looking at instances of accounting fraud and insider trading.

The cases could lead to potential civil or criminal charges, the FBI said.

The FBI said it viewed mortgage fraud as an increasing threat to the national economy.

---------------------

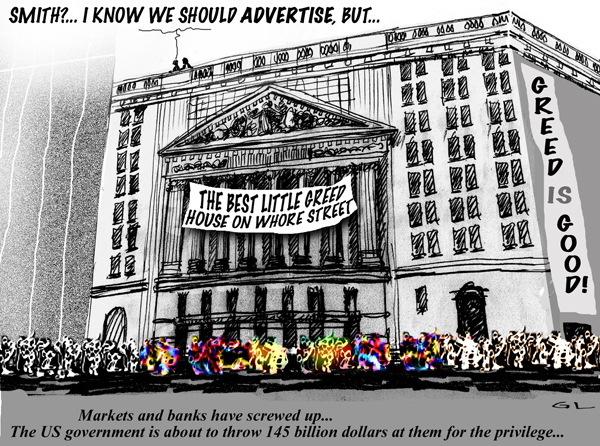

Gus: don't know if the FBI will get far with this but I would not be surprise if these "fourteen" institutions are the tip of a mega iceberg... Everyone on the food chain had to know the heist at the beginning of the "pyramid"... No-one was buying "sureties", every one knew there was a "risk"... That's why there was a "consolidation of risk sharing" across the world, but in the long run with every one taking their cut in hard cash of growingly inflated fictitious values... All these people should at least get the sack, but they will get promoted as usual to the higher floors... These con artists would have thought there was always another mug to flog the same thing to when the original poor mugs defaulted...

Except these morons forgot the first natural law of survival: never destroy your food supply by over grazing or by too much killing... If my memory serves me right, the "discrete Ricker system" explains this xn+1=xnexp[r(1-xn)] was used by professor May in the 1970s in his approach to Chaos theory... (I need to read the book again...) The Ricker curve (and system, I believe) was used to calculate the dynamics of biological population... Money, in a true system of supply and demand, should follow a similar process of evolution and balance, but oh no, we keep massaging the illusion as money really has no nutritional value except what we want it to be. We usually add too much fish food in the fish tank... We get fat as we consume and fake a lot...

Fair enough but even in an illusionary monetary system, there are limits of trust that should not be transgressed. The subprime saga was a con trick from the beginning, enacted with the intention to suck the system... That system died. Bother. So the little general says let's revive the general system with a bit more "stimulus"... Sounds like an advertisement for Viagra.

Note: Bummer! The subtype in the equation did not work so it could appear wrong... In short the equation means that the "next" is influence by the precedent and itself, in a relationship that involves a set environment in which the next and the precedent live. We, humans, are slightly different from fish stocks, we're more like beavers as we "modify' our environment to suit. Actually we destroy a lot in the process.

at last?

Rescues for Homeowners in Debt Weighed

By EDMUND L. ANDREWS and LOUIS UCHITELLE

Published: February 22, 2008

WASHINGTON — Prodded in part by some of the nation’s biggest banks, the Bush administration and Congress are considering costly new proposals for the government to rescue hundreds of thousands of homeowners whose mortgages are higher than the value of their houses.

Not since the Depression has a larger share of Americans owed more on their homes than they are worth. With the collapse of the housing boom, nearly 8.8 million homeowners, or 10.3 percent of the total, are underwater. That is more than double the percentage just a year ago, according to a new estimate of the damage by Moody’s Economy.com.

----------------

Gus: isn't this where the subprime rescue package — that has now uselessly mopped up half a trillion dollar in US Fed interest downgrade, tax cuts and dollops of gravy for the stock market and the banks — should have started? Then redrawing the shonky contracts to stop banks for profiting from outrageous usury should have been the next step? Sure it would kill a bit of the free enterprise spirit — that of robbing people blind — but it could have make sure everyone got a bit of cake, without burning it?

creative accounting

Banking on banks

Recently, banks stocks lead the stock market down as the ANZ Bank reported a much larger than expected bad debts write off. It was also announced that the Northern Rock Bank in England was to be nationalised, an unprecedented move following failure of private sector suitors to buy the bank at an acceptable price.

There have been other recent shocks in the global banking system: the losses by a rogue trader from SocGen in France; the reconstruction of two smaller German banks, IKB and West LB AG, after over-exposure to the subprime crisis; and in Australia, increasing business and mortgage loans in excess of official central bank changes.

All this taken together is indicative of a banking system in trouble, one which has misjudged risks, has mispriced risk, and has been unable to assess the creditworthiness of individual banks.

Is this just a case of banks having overextended themselves and making poor calls at critical points? I would argue that it is changes in international banking regulation that has allowed this to occur.