Search

Recent comments

- figurehead....

1 hour 36 min ago - jewish blood....

2 hours 35 min ago - tickled royals....

2 hours 42 min ago - cow bells....

16 hours 34 min ago - exiled....

21 hours 37 min ago - whitewashing a turd....

22 hours 36 min ago - send him back....

1 day 6 min ago - the original...

1 day 1 hour ago - NZ leaks....

1 day 12 hours ago - help?....

1 day 12 hours ago

Democracy Links

Member's Off-site Blogs

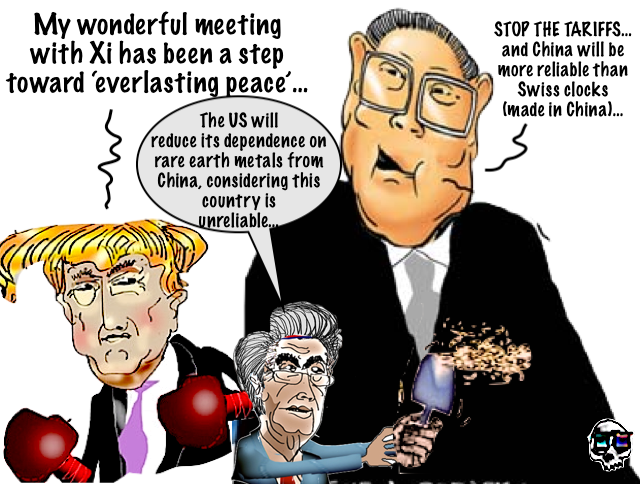

rare earths refining and tariffs war....

The US will work to reduce its dependence on rare earth metals from China, considering the country unreliable, said US Treasury Secretary Scott Bessent.

In an interview with the Financial Times on October 31, Bessent expressed confidence that Washington would find an alternative to Chinese sources of rare earth metals within two years.

According to him, China’s influence over the US in the rare earth metals sector will last no longer than 12 to 24 months.

"We're going to go at warp speed over the next one, two years, and we're going to get out from under the sword that the Chinese have over us," Bessent said in an interview with CNN.

He added that both Eastern and Western US allies are working to establish their own supply chains to avoid reliance on Chinese rare earth metals, as China plans to impose export restrictions.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

The lanthanides or lanthanoid series is a group of transition metals located on the periodic table in the first row (period) below the main body of the table. The lanthanides are commonly referred to as the rare earth elements (REE), although many people group scandium and yttrium together under this label as well. Therefore, it's less confusing to call the lanthanides a subset of the rare earth metals.

The LanthanidesHere's a list of the 15 elements that are lanthanides, which run from atomic number 57 (lanthanum, or Ln) and 71 (lutetium, or Lu):

- Lanthanum: symbol Ln, atomic number 57

- Cerium: symbol Ce, atomic number 58

- Praseodymium: symbol Pr, atomic number 59

- Neodymium: symbol Nd, atomic number 60

- Promethium: symbol Pm, atomic number 61

- Samarium: symbol Sm, atomic number 62

- Europium: symbol Eu, atomic number 63

- Gadolinium: symbol Gd, atomic number 64

- Terbium: symbol Tb, atomic number 65

- Dysprosium: symbol Dy, atomic number 66

- Holmium: symbol Ho, atomic number 67

- Erbium: symbol Er, atomic number 68

- Thulium: symbol Tm, atomic number 69

- Ytterbium: symbol Yb, atomic number 70

- Lutetium: symbol Lu, atomic number 71

Note that sometimes lanthanides are considered to be the elements following lanthanum on the periodic table, making it a group of 14 elements. Some references also exclude lutetium from the group because it has a single valence electron in the 5d shell.

Properties of the LanthanidesBecause the lanthanides are all transition metals, these elements share common characteristics. In pure form, they are bright, metallic, and silvery in appearance. The most common oxidation state for most of these elements is +3, although +2 and +4 are also generally stable. Because they can have a variety of oxidation states, they tend to form brightly colored complexes.

Lanthanides are reactive—readily forming ionic compounds with other elements. For instance, lanthanum, cerium, praseodymium, neodymium, and europium react with oxygen to form oxide coatings or tarnish after brief exposure to air. Because of their reactivity, pure lanthanides are stored in an inert atmosphere, such as argon, or kept under mineral oil.

Unlike other most other transition metals, the lanthanides tend to be soft, sometimes to the point where they can be cut with a knife. Additionally, none of the elements occurs free in nature. When moving across the periodic table, the radius of the 3+ ion of each successive element decreases; this phenomenon is called lanthanide contraction.

With the exception of lutetium, all of the lanthanide elements are f-block elements, referring to the filling of the 4f electron shell. Although lutetium is a d-block element, it's usually considered a lanthanide because it shares so many chemical properties with the other elements in the group.

Surprisingly, even though the elements are called rare earth elements, they aren't particularly scarce in nature. However, it's difficult and time-consuming to isolate them from each other from their ores, adding to their value.

Lastly, lanthanides are valued for their use in electronics, particularly television and monitor displays. They are also used in lighters, lasers, and superconductors, and to color glass, make materials phosphorescent, and even control nuclear reactions.

https://www.thoughtco.com/lanthanides-606652

MOST OF THE SEPARATION PROCESS IS "GRAVITY BASED" AS THE RARE EARTHS METALS HAVE VERY SIMILAR CHEMICAL PROPERTIES... "it's difficult and time-consuming to isolate them from each other from their ores" IS AN UNDERSTATEMENT...

CERIUM IS USED TO POLISH GLASS AS ITS POWDER FORM IS ATOM THIN.

WHEN GUS WAS WORKING IN A RARE EARTH FACTORY IN THE 1950s, EUROPIUM WAS VERY POPULAR AND VERY VERY EXPENSIVE....

- By Gus Leonisky at 3 Nov 2025 - 5:55am

- Gus Leonisky's blog

- Login or register to post comments

god bless....

US President Donald Trump has said his meeting with his Chinese counterpart, Xi Jinping, earlier this week will pave the way for lasting peace between the nations.

The two leaders met for the first time in six years Thursday on the sidelines of the APEC summit in Busan, South Korea. Beijing said they reached a consensus to resolve “major trade issues.”

China agreed to suspend its latest rare-earth export controls in exchange for reciprocal US tariff cuts. The agreement also includes a US pledge to reduce tariffs on Chinese imports and suspend investigations into Beijing’s maritime and logistics sectors.

“My G2 meeting with President Xi of China was a great one for both of our countries,” Trump wrote on Truth Social on Saturday. “This meeting will lead to everlasting peace and success. God bless both China and the USA!”

Bilateral relations have been strained by years of trade tensions that began when Trump imposed sweeping tariffs on Chinese goods during his first term. Under the new deal, the US will lower tariffs on Chinese products from 57% to 47% and suspend export restrictions targeting some Chinese companies. The US will also reduce fentanyl-related tariffs, while China adjusts its retaliatory measures.

Beijing said it will lift its rare-earth export restrictions for one year while it studies long-term plans. The materials used in electronics and military technology were targeted after the US tightened its own controls on exports of advanced semiconductors and chipmaking equipment.

China also agreed to resume purchases of US soybeans and other agricultural products, which were paused during the recent trade standoff, while most other trade restrictions remain in place.

https://www.rt.com/news/627252-meeting-with-xi-will-lead/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

oil blessed....

BY OLEG ARTYUKOV

Washington Aims to Fully Substitute Russian Oil and Gas for China

US Energy Secretary Chris Wright told Bloomberg that the United States could completely replace Russia in China’s oil and gas market if Beijing decided to reduce imports from Moscow.

"Absolutely. Today the US produces 50 percent more oil than Russia or Saudi Arabia. That puts not only the US, but the entire world, in a better position," Wright stated.He added that even if Russia’s supplies to the global market were cut in half, the balance could be maintained through American exports. According to him, China—being the world’s largest importer of oil and gas—could find a reliable supplier in the US, while Washington would gain both economic and geopolitical advantages.

Differences in Export StructuresIndeed, US oil production is at record levels of about 13.3 million barrels per day. But behind these bold statements lies a number of factors that cast doubt on the feasibility of such a scenario.

First, the structure of American hydrocarbon exports is vastly different from Russia’s. The United States focuses primarily on liquefied natural gas (LNG) exports, whereas China traditionally relies on pipeline gas and long-term contracts at stable prices.

Transitioning from one type of supply to another would require large-scale infrastructure investments—from building LNG terminals to developing new transportation corridors and processing capacities.

Economic Barriers and Pricing ChallengesSecondly, American companies are not always willing to sell raw materials at prices favorable to Beijing. Most US energy exports go to Europe and Latin America, where logistics are simpler and prices are higher.

Redirecting large volumes of oil and gas to Asia would inevitably increase transportation costs, making American crude less competitive compared to Russian or Middle Eastern supplies.

Political Context and Strategic MotivesWright’s statements cannot be viewed outside of their political context. The US administration has long sought to weaken Russia’s position in global energy markets. Any opportunity to sideline Moscow is seen in Washington not only as an economic achievement but also as a tool of geopolitical leverage.

However, the real question is whether China truly needs such a partner. Despite its rhetoric about “energy diversification,” Beijing prefers to work with suppliers who do not use energy as a political weapon. Russia, by contrast, offers long-term contracts with flexible pricing and predictable policy.

Limits of American StabilityThe United States, even if willing, cannot provide such stability. Every change of administration in Washington—Republican or Democrat—can shift the country’s energy policy.

Moreover, the US energy sector is heavily influenced by domestic politics: environmental restrictions, tax fluctuations, and pressure from the “green” lobby all directly affect production and export volumes.

Focus on Alaska and Political OpticsWright paid special attention to Alaska, calling the region “a place of enormous potential” for increasing oil production. President Donald Trump agreed, saying that China was reportedly interested in purchasing raw materials from Alaska.

In reality, however, oil production in Alaska has been declining for several years due to high extraction costs and logistical challenges. The region is one of the most expensive in the world to develop, and in a highly competitive market—where prices often hover near break-even levels—hopes for major Alaskan exports seem more symbolic than practical.

China’s Pragmatic StrategyIn recent years, China has pursued a pragmatic policy of diversifying energy supplies without relying on a single partner. Besides Russia, major suppliers include Saudi Arabia, Iran, and several African nations. Unlike their American counterparts, these countries are often willing to make price and contract concessions to secure access to the vast Chinese market.

Furthermore, energy cooperation with Russia holds not only economic but also political significance for Beijing. Joint infrastructure projects—such as the Power of Siberia gas pipeline—strengthen long-term ties and reduce both countries’ dependence on Western markets. Replacing such cooperation with unstable US supplies appears highly improbable.

Conclusion: More Rhetoric Than RealityThus, Secretary Wright’s statement should be viewed more as rhetorical bravado—a demonstration of American energy might and Washington’s desire to dominate the global hydrocarbon market.

In practice, however, the picture is far more complex. US production is constrained by domestic politics, Asian logistics are difficult, and geopolitical risks remain high. Washington can proclaim its readiness to replace Moscow as much as it likes—but in the world of energy, words alone are never enough.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!

https://english.pravda.ru/world/164690-us-energy-china-russia-market/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

aussie supplied....

https://www.youtube.com/watch?v=9wBbcObcfxw

Australia sells China critical minerals vital for Beijing's weapon programs | ABC NEWSAn ABC investigation has uncovered that Australia is selling China critical minerals crucial to Beijing’s military build-up, despite the Albanese government openly declaring support for Washington's bid to break China's domination in the critical minerals sector.

One of these minerals is zirconium (Zr), an essential ingredient used in protective coating for hypersonic missiles, submarines and aircraft carriers and nuclear propulsion and fuel systems.

A research paper by the Chinese People’s Liberation Army has highlighted China's vulnerability to a zirconium shortage, but Australia is still exporting the mineral sand to Chinese buyers while spending billions of dollars on countering Chinese military expansion.

AUSSIELAND IS NOT THE ONLY PLACE IN THE WORLD WHERE CHINA CAN FIND ZIRCONIUM... THAT AUSTRALIA SUPPLIES THE MINERAL SANDS IS A BUSINESS ARRANGEMENT THAT IF MY MEMORY IS CORRECT HAS BEEN IN PLACE FOR A LONG TIME... SHOULD AUSTRALIA RESTRICT THE EXPORT OF THE MINERAL ORE, CHINA WOULD FIND IT SOMEWHERE ELSE, PROBABLY AT A CHEAPER PRICE....

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

GUSNOTE: ZIRCONIUM IS NOT A RARE EARTH METAL......