Search

Recent comments

- in voltaire's country....

11 hours 1 min ago - hypocrites....

21 hours 25 min ago - evil's will....

21 hours 30 min ago - "indispensable"....

21 hours 53 min ago - grandeur....

22 hours 38 min ago - defying david's....

1 day 1 hour ago - no free speech....

1 day 15 hours ago - second rate.....

1 day 15 hours ago - deal....

1 day 16 hours ago - deliberate murder.....

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

shadow dancers .....

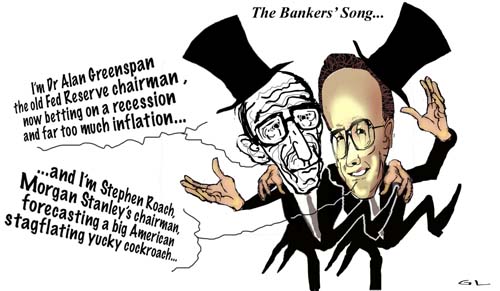

Greenspan predicts recession in US

As the credit crisis continues to bite around the world, two eminent economists have predicted the United States will most likely fall into a recession next year.

The former chairman of the US Federal Reserve, Dr Alan Greenspan, says a recession is a 50 per cent chance while the chairman of the global investment bank Morgan Stanley, Stephen Roach, is tipping an even greater risk.- By Gus Leonisky at 17 Dec 2007 - 10:17pm

- Gus Leonisky's blog

- Login or register to post comments

Greenspan was asleep at the wheel

from the NYT

WASHINGTON — Until the boom in subprime mortgages turned into a national nightmare this summer, the few people who tried to warn federal banking officials might as well have been talking to themselves.

Edward M. Gramlich, a Federal Reserve governor who died in September, warned nearly seven years ago that a fast-growing new breed of lenders was luring many people into risky mortgages they could not afford.

But when Mr. Gramlich privately urged Fed examiners to investigate mortgage lenders affiliated with national banks, he was rebuffed by Alan Greenspan, the Fed chairman.

In 2001, a senior Treasury official, Sheila C. Bair, tried to persuade subprime lenders to adopt a code of “best practices” and to let outside monitors verify their compliance. None of the lenders would agree to the monitors, and many rejected the code itself. Even those who did adopt those practices, Ms. Bair recalled recently, soon let them slip.

--------------

Gus: shonky-tshonk shonky-tshonk shonky-tshonk shonky-tshonk....The engine of "free" market and con-artistry was going at full bore in the US... and the regulators, seeing a pile of cash on the move, kept smiling despite not knowing whether it was coming or going...

We've been lucky in this country that not everyone has been about making a buck despite whatever greedy feelings were thrown at us by the Howard years...

less than sub-prime .....

Losses arising from America’s housing recession could triple over the next few years and they represent the greatest threat to growth in the United States, one of the world’s leading economists has told The Times.

Robert Shiller, Professor of Economics at Yale University, predicted that there was a very real possibility that the US would be plunged into a Japan-style slump, with house prices declining for years.

Professor Shiller, co-founder of the respected S&P Case/Shiller house-price index, said: “American real estate values have already lost around $1 trillion [£503 billion]. That could easily increase threefold over the next few years.

This is a much bigger issue than sub-prime. We are talking trillions of dollars’ worth of losses.” He said that US futures markets had priced in further declines in house prices in the short term, with contracts on the S&P Shiller index pointing to decreases of up to 14 per cent.

“Over the next five years, the futures contracts are pointing to losses of around 35 per cent in some areas, such as Florida, California and Las Vegas. There is a good chance that this housing recession will go on for years,” he said.

Top economist Says America Could Plunge Into Recession

are we there yet?

US recession still possible: Alan Greenspan

A recession in the United States remains a probability, former Federal Reserve chairman Alan Greenspan said in an interview published today.

Speaking to the Financial Times from Washington, Mr Greenspan said he believed "there is a greater than 50 per cent probability of recession".

He noted, however, that "that probability has receded a little".

The likelihood of a severe recession had "come down markedly", he added, but he said it was too soon to tell whether the worst was already over.

According to the Financial Times, Mr Greenspan estimated that house prices in the United States would drop by a further 10 per cent from their levels in February, which comes to a 25 per cent drop from their peak

--------------

Gus: More than anybody else, Mr Greenspan should know... He was probably the architect-in-chief of the market over-confidence, of the Sub-prime "laisser-faire" and, on top of that, he was content to let Junior spend as if there was no tomorrow, on his little wars... All of this happened during his watch. Of course all these discreet and not so discreet excesses have all lead to the economic mess today. His successor has not mastered the art of the convoluted phrase that says nothing but inspire confidence nonetheless... Thus when Greenspan spoke of sweet nothings, the market used to have an orgasm... When Bernanke speaks, it's usually to warn about some venereal disease in the economy, which he has to treat by opening the floodgates of the deficit... Penicillin may cure the symptoms but it does nothing for the bad behaviour of the market prostituting itself to the highest bidder...

Rule book

With Bold Steps, Fed Chief Quiets Some Criticism

By STEVEN R. WEISMAN

Published: May 28, 2008

WASHINGTON — Over a frantic weekend in mid-March, Ben S. Bernanke rewrote the rule book as chairman of the Federal Reserve. Like a military commander applying overwhelming force, he took steps then and over the next two months that some at the central bank are now calling the Bernanke Doctrine.

Today, Mr. Bernanke appears to have quieted many critics, especially on Wall Street, who earlier said he was overly academic and slow to react to market conditions.

But at the same time, new criticisms have surfaced that Mr. Bernanke has fanned inflation and contributed to the decline of the dollar by aggressively cutting interest rates. Some say he has put at risk billions in public funds by accepting devalued assets like mortgages and auto loans as collateral for loans to financial institutions. And by thrusting the Fed into new realms of intervention and regulation, he has raised questions about whether he is threatening the Fed’s independence.

-------------

Gus: read blog above and see toon at top...

gold, gold, gold...

However, the prospect of Lehman's failing to find a saviour and serious funding shortfalls at rival investment banks and mortgage lenders such as Washington Mutual spooked the markets and prompted further falls.

Gerard Burg, an analyst at National Australia Bank, said: "Gold's price response today looks like safe-haven behaviour. The Lehman story is dominating markets, while bullion is probably getting a bit of a lift from the dollar.

"But the longer-term is still bearish. In relative terms gold has been pretty soft as the dollar strengthened. Also Indian demand looks comparatively weak and the gold market can't live without India."

---------------

Former Federal Reserve Chairman Alan Greenspan offered a woeful outlook of America's economic situation on Sunday, saying the crisis with the country's financial institutions was as dire as he had ever seen in his long career, and predicting that one or more of those institutions would likely collapse in the near future.

"Oh, by far," Greenspan said, when asked if the situation was the worst he had seen in his career. "There's no question that this is in the process of outstripping anything I've seen and it still is not resolved and still has a way to go and, indeed, it will continue to be a corrosive force until the price of homes in the United States stabilizes. That will induce a series of events around the globe which will stabilize the system."

0,000,000,000,000,000,000.00

See toon at top...

"people got too greedy" Greespan...

Taking Hard New Look at a Greenspan Legacy

By PETER S. GOODMAN“Not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient.” — Alan Greenspan in 2004

George Soros, the prominent financier, avoids using the financial contracts known as derivatives “because we don’t really understand how they work.” Felix G. Rohatyn, the investment banker who saved New York from financial catastrophe in the 1970s, described derivatives as potential “hydrogen bombs.”

And Warren E. Buffett presciently observed five years ago that derivatives were “financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.”

One prominent financial figure, however, has long thought otherwise. And his views held the greatest sway in debates about the regulation and use of derivatives — exotic contracts that promised to protect investors from losses, thereby stimulating riskier practices that led to the financial crisis. For more than a decade, the former Federal Reserve Chairman Alan Greenspan has fiercely objected whenever derivatives have come under scrutiny in Congress or on Wall Street. “What we have found over the years in the marketplace is that derivatives have been an extraordinarily useful vehicle to transfer risk from those who shouldn’t be taking it to those who are willing to and are capable of doing so,” Mr. Greenspan told the Senate Banking Committee in 2003. “We think it would be a mistake” to more deeply regulate the contracts, he added.

Today, with the world caught in an economic tempest that Mr. Greenspan recently described as “the type of wrenching financial crisis that comes along only once in a century,” his faith in derivatives remains unshaken.

The problem is not that the contracts failed, he says. Rather, the people using them got greedy.

_________________

Thanks for your wise silly words, Mr Greenspan... You would not have any clue. If people can become "too greedy" on a system, the system is crook.

REGULATIONS are needed. see toon at top.

deregulate snake oil... it's good for you...

The man who brought us the global financial crisis, Alan Greenspan, has spoken out on how to fix the system. Of all the advice he might give, he has given the most unexpected. In essence, he has said: "Don't even try."

In one of the most remarkable statements of our time, the former chairman of the US Federal Reserve has argued that it is inherently impossible to usefully regulate a modern financial system, telling us to relax because "the global invisible hand" of the free market has created a stable economy over the longer run.

Greenspan went further. In an opinion piece in London's Financial Times, he suggested that an ever-growing and unmanageably complex financial system might even be "a necessary condition of growth"

Incredulous, the US congressman who has led the regulatory reform effort, Barney Frank, responded that while many had suggested ways of improving regulations, "until last week no one had seriously suggested that we should have done nothing in response to the financial crisis".

Frank reminded Greenspan of the cost of his failures: "His rosy view overlooks a monumental crisis that threatened the foundations of the American economy, led to soaring unemployment, a continuing foreclosure crisis and weakened economies in the US and Europe."

It is breathtaking audacity that the chief arsonist should scold the fire brigade, saying: "Put away your hoses and enjoy the fire".

http://www.smh.com.au/opinion/politics/uncle-sam-heading-closer-to-a-fresh-financial-meltdown-20110404-1cyil.html

see toon at top..