Search

Recent comments

- 2019 clean up before the storm....

2 hours 10 min ago - to death....

2 hours 49 min ago - noise....

2 hours 56 min ago - loser....

5 hours 36 min ago - relatively....

5 hours 58 min ago - eternally....

6 hours 4 min ago - success....

16 hours 32 min ago - seriously....

19 hours 16 min ago - monsters.....

19 hours 23 min ago - people for the people....

20 hours 18 sec ago

Democracy Links

Member's Off-site Blogs

equality, respect and mutual benefit......

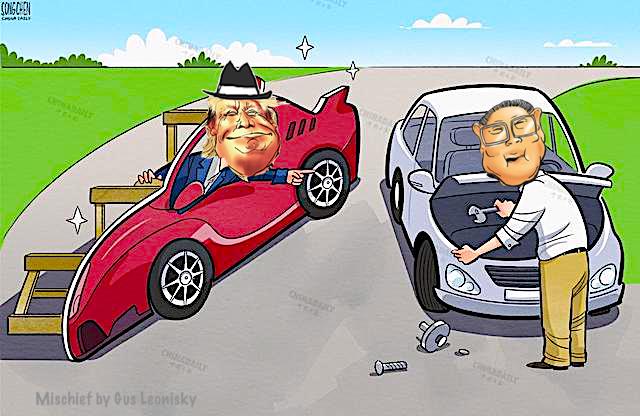

The Trump administration said on Tuesday that the 145 percent tariffs imposed on Chinese imports will eventually "come down substantially" while expressing optimism about future talks to reach a US-China trade deal, US media reported.

US says tariffs on China will drop ‘substantially’; expert warns Washington faces difficulties in achieving initial goals as bullying unsustainable

By Ma Jingjing

The US government's seemingly softening tone indicates that it is encountering huge difficulties in achieving its initial goals when announcing steep "reciprocal tariffs," which have resulted in US domestic financial market fluctuations and potential recessions, a Chinese expert said. The expert stressed that the US tariff bullying is unsustainable and will inevitably harm US economy.

"145% is very high, and it won't be that high," US President Donald Trump told reporters in the Oval Office on Tuesday, USA Today reported.

"No, it won't be anywhere near that high. It'll come down substantially. But it won't be zero ‒ used to be zero," the US President said. "We're going to be very nice, they're going to be very nice, and we'll see what happens," he said, according to the report.

"The US seemingly softening tone underscores that the US tariff policy has shown a significant discrepancy between its actual outcomes and its initial goals," Bao Jianyun, dean and professor of the Department of International Politics, School of International studies at Renmin University of China, told the Global Times on Wednesday.

US stock and bond market fluctuations, along with growing domestic opposition from companies, economists and consumers, also add pressure on the US government to soften its hard stance on its steep tariffs, Bao said.

Treasury Secretary Scott Bessent said earlier on Tuesday in a closed-door speech that the ongoing tariffs showdown against China is unsustainable and he expects a "de-escalation" in the trade war between the world's two largest economies, the Associated Press (AP) reported.

"Neither side thinks the status quo is sustainable," it said, citing a transcript of the meeting.

US White House press secretary Karoline Leavitt told reporters on Tuesday "The president and the administration are setting the stage for a deal... the ball is moving in the right direction," The Hill reported.

US stocks rallied Tuesday on hopes that US-China trade tensions could ease soon, as investors recovered from the steep declines suffered in the previous session, CNBC reported. The Dow Jones Industrial Average rose 1,016.57 points, or 2.66 percent, to close at 39,186.98. The S&P 500 gained 2.51 percent and settled at 5,287.76, while the Nasdaq Composite rose 2.71 percent to end at 16,300.42, per the media outlet.

The latest response of the Trump administration is within expectations, indicating that it is beginning to realize that its tariffs cannot only hurt others without also harming the US itself, Lü Xiang, an expert on US studies and a research fellow at the Chinese Academy of Social Sciences, told the Global Times on Wednesday. "But we should not be too optimistic," Lü noted.

Two Nobel laureates in economics - Vernon Smith and James Heckman, along with other economists and scholars, have initiated an Anti-Tariff declaration on the website anti-tariff.org, encouraging more people to sign up and jointly reject the tariffs, according to media reports.

"The current administration's tariffs are motivated by a mistaken understanding of the economic conditions faced by ordinary Americans. We anticipate that American workers will incur the brunt of these misguided policies in the form of increased prices and the risk of a self-inflicted recession," read the statement.

"Despite the US seemingly softening tone, we should be cautious that it's only technical strategy adjustment in the context of new global trade trends, while the US goal of containing and suppressing China will not change," Bao said, noting that the US has reduced its credibility with back-and-forth on tariffs.

He said the US should show sincerity if it wants to resolve trade issue through talk, for example, by removing the high tariffs on China imports, while stressing that China must maintain strategic focus.

Chinese Foreign Ministry Spokesperson Lin Jian said on April 16 that the tariff war was started by the US. China has taken necessary countermeasures in order to defend its legitimate rights and interests and international fairness and justice. This is fully justified and lawful. China's position has been very clear. Tariff and trade wars have no winners. China does not want to fight these wars but is not scared of them. If the US truly wants to resolve the issue through dialogue and negotiation, it should stop using maximum pressure, stop threats and blackmail and seek dialogue with China on the basis of equality, respect and mutual benefit.

https://www.globaltimes.cn/page/202504/1332679.shtml

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 23 Apr 2025 - 8:53pm

- Gus Leonisky's blog

- Login or register to post comments

tariff wars....

China's Tariff Smackdown

Interview with Hua Bin

MIKE WHITNEY AND HUA BIN

Question 1—What are Trump’s tariffs on China supposed to achieve, and will they succeed?

Hua Bin— I don’t think Trump has a clear idea himself because many of the supposed goals are contradictory and historically he is a shoot-from-the-hip type guy – no deep thinking, always swinging, and never ashamed of his own blatant lies.

That said, he has referred to several objectives:

In Trump’s mind, numbers 2, 3 and 4 are all linked to China. China is the main perpetrator of manufacturing job-loss in the US. So, reindustrialization is largely about bringing jobs back from China. Imposing trade sanctions on China—even a full embargo—has long been in the cards as part of the decoupling of the two economies and preparation for an eventual military conflict. In fact, both sides want to reduce or eliminate dependencies on each other, although Trump is much less patient and strategic.

Lastly, I have no doubt that the concessions Trump wants from other trading partners are aimed at reducing their economic ties with China. The goal is to isolate China economically. (as explicitly articulated by Bessent and Lutnick.) This is essentially what the West did to Russia after the Ukraine war broke out, but Trump is ready to push the schedule ahead on China in the absence of a more credible pretext.

Trump may think he is playing 3D chess, but his plan has not been well-thought out, which is obvious now that China has refused to back down. After stocks, bonds and the Dollar went into free fall, he panicked and rolled back part of his program, which is a clear sign of poor preparation and faulty assumptions. Of course, he didn’t hesitate to help his family and friends profit from the market turmoil through insider trading (similar to the way Hunter Biden used his father’s influence for self-enrichment).

Other indications that his tariff strategy is half-baked, include the laughable math behind the “reciprocal” tariff calculation and the many contradictions of what he was trying to accomplish. For example, why did he choose to humiliate the trading partners who came to negotiate (Trump says, “Kiss my ass”)? If he was serious about enlisting their help to embargo China, how did he expect them to do that without inputs from the largest manufacturing power in the world (China) who controls many of the critical supply chains?

Personally, I would have fired anyone who presented me with such a poorly thought-out business plan. But the US is now a state that is ruled by one man alone, so there’s no accountability and Trump can do whatever he wants.

China Foreign Minister Wang Yi: “We will uphold the basic rules of free trade. We will not bow to power politics or bullying. “video (2 minutes)

Question 2—Which country will be hurt more by the tariffs: US or China?

Hua Bin—As China has repeatedly said, there are no winners in a trade war. But in the absence of a negotiated settlement, China will likely suffer more short-term pain from loss of the US consumer market. This is going to impact GDP and employment. Clearly, the country needs to stimulate more domestic consumption, which is now more urgent than ever. It also needs to redirect some trade to other countries. There could be deflationary pressures domestically, but China has plenty of ways to fiscally stimulate consumption to mitigate the impact, especially since the state controls the flow of credit via state-owned banks. Longer term, the current trade war will likely pave the way for a complete decoupling between the world’s two economic superpowers. (similar to the separation between Russia and the West.)

On the US side, the short-term impact means the loss of the Chinese market for its agricultural and energy products (which represent 70% of Chinese imports from the US). Inflation is inevitable. There will be shortages of certain goods for consumers, businesses, and for many US manufacturers that rely on imported parts, components and critical minerals from China for their production. (such as machine tools, rare earth, battery, and active pharmaceutical ingredients.) The main thing to remember is that China sits at the very top of the global supply chain whereas, the US is at the bottom. So, any disruptions to the supply chain will cascade downward amplifying the damage to the US economy.

Given China’s pole position in many high-tech manufacturing supply chains, these impacts are likely to become long term problems. US businesses will need to invest more in CAPEX to strengthen domestic supply chains, factories, and skilled labor, etc, at a cost of hundreds of billions of dollars. Unfortunately, these new American industries will face stiff competition in international markets and are unlikely to be profitable for quite some time. Also, there aren’t many corporate executives who will want to invest the capital required to reindustrialize without explicit assurances from the government that their investment will be protected. (Trump’s flip-flop on these matters is certainly no help.)

In my opinion, the US will find the transition (back to a “country that produces things”) extremely painful and, perhaps, impossible. I suspect that’s why China is taking a hard line and made it clear that it will fight to the end if the US insists on imposing an unfair deal. In short, Trump has no cards vis-a-vis China.

Question 3– In your opinion, should Trump seek greater economic integration with China or continue along the current path of economic isolation, sanctions and conflict?

Hua Bin—There’s no doubt that economic cooperation is mutually beneficial and, frankly, the US could use China’s help to reindustrialize if that is the real goal. And the two economies are complimentary in many ways. The US actually runs a multi-billion surplus with China in services although the Trump regime chose to focus entirely on the trading of merchandise where it runs a structural deficit with most of the world. (Note—In 2024, the U.S. trade deficit with China was approximately $295 billion for goods alone, according to the U.S. Census Bureau. When including both goods and services, the deficit was around $263 billion, as reported by the Bureau of Economic Analysis.) The US exports far more tech, IP, financial services, business services, education, and tourism to China than the other way around. The two economies have many synergies. However, given the current US political consensus to treat China as the new bogeyman, any compromise is highly unlikely. And, even if a deal is struck, I don’t think there’s enough trust on either side to sustain an agreement for very long.

So, an economic and trade divorce is a high-probability outcome, if not immediately, then in the next 3 to 5 years. The world is likely to bifurcate into two camps with most nations trying to find a balance between China and the US.

In the long run, I believe that China has the more dynamic of the two economies and will emerge from the current trade war triumphant. In contrast, the US will find it much harder to muddle through while trying to manage plunging markets, a steadily weakening currency, and an ocean of red ink. Of course, the worst option for the United States would be a direct military confrontation with China. As I have explained in earlier articles, the US would undoubtedly lose a war with China which would greatly accelerate the pace of America’s decline. If that were to happen, the post-war international order would be kaput.

https://www.unz.com/mwhitney/chinas-tariff-smackdown/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.