Search

Recent comments

- making sense....

26 min 31 sec ago - balls....

29 min 44 sec ago - university semites....

1 hour 17 min ago - by the balls....

1 hour 31 min ago - furphy....

6 hours 46 min ago - nothing new....

7 hours 19 min ago - blood brothers....

8 hours 16 min ago - germanic merde....

8 hours 20 min ago - englishit....

10 hours 3 min ago - kurdylord....

10 hours 14 min ago

Democracy Links

Member's Off-site Blogs

er, sorry .....

Fed Chief Warns of Worse Times in the Economy

Ben S. Bernanke, chairman of the Federal Reserve, told Congress on Thursday that the economy was going to get worse before it got better, a message that received a chilly reception from both Wall Street and politicians.

On a day when stock prices swung wildly, the dollar hit another new low against the euro and further signs emerged from retailers that consumers are growing more cautious about spending, Mr. Bernanke warned that the economy was about to “slow noticeably” as the housing market continues to spiral downward and financial institutions tighten up on lending.

But in a disappointment to investors, Mr. Bernanke offered no signal that the central bank might soften the blow by lowering interest rates for a third time this year at its next policy meeting on Dec. 11.- By Gus Leonisky at 11 Nov 2007 - 7:23am

- Gus Leonisky's blog

- Login or register to post comments

all that aspirational prosperity .....

The US addicted to debt - and the country and millions of its citizens are at the brink of bankruptcy.

Money for nothing.

Own a home for no money down.

Do not pay for your appliances until 2012.

This is the new American Dream, and for the last few years, millions have been giddily living it. Dead is the old version, the one historian James Truslow Adams introduced to the world as "that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement."

Such Puritan ideals - to work hard, to save for a better life - didn't die from the natural causes of age and obsolescence. We killed them, willfully and purposefully, to create a new gilded age.

As a society, we told ourselves we could all get rich, put our feet up on the decks of our new vacation homes, and let our money work for us. Earning is for the unenlightened.

Equity is the new golden calf.

Sadly, this is a hollow dream.

Yes, luxury homes have been hitting new gargantuan heights. Ferrari sales have never been better. But much of the ever-expanding wealth is an illusory façade masking a teetering tower of debt - the greatest the world has seen. It will collapse, in a disaster of our own making.

Pay It Off Later: Debt Is The New American Dream

money gone bad...

The scale of the losses that will hit Wall Street banks could approach half a trillion dollars as large numbers of sub-prime home loans go bad.

And the carnage in the financial markets could cause a credit squeeze that will dampen economic growth for years to come.

----------

Gus: half a trillion dollars?... as much as the entire Australian deficit...

Meanwhile, at the biggest casino in the world...

House prices are crumbling on both sides of the Atlantic, growing numbers of homeowners face repossession, financial markets are yo-yoing and the UK saw its first run on a bank in living memory. But for three audacious New York traders it all added up to a $4bn (£2bn) profit opportunity and the biggest jackpot in the history of Wall Street.

The young guns at the investment bank Goldman Sachs – none of them over 40 years old – were unmasked yesterday, prompting a wave of adulation and envy among their colleagues, and another bout of handwringing about Wall Street's ability to make multibillion-dollar profits even as millions of ordinary people face losing their homes.

Dan Sparks and two underlings, Josh Birnbaum and Michael "Swenny" Swenson, placed what were in effect giant bets against the US mortgage market at the start of the year and watched their winnings tick higher and higher as the rising numbers of mortgage defaults spiralled into a worldwide financial crisis. Throughout the year, they battled with more cautious bosses who feared the bets were too big and too dangerous, but in part because of their success Goldman Sachs will post record profits next week. In doing so, the firm will stand alone on Wall Street, where rivals have suffered huge losses from the credit market meltdown.

The trio themselves are in line for bonuses of about $10m apiece from a record bonus pool at Goldman of about $19bn. "They are very embarrassed that their names have come out," said a company source. "Until now, nobody had heard of them, including most of the people on the floor where they work."

-----------------

Gus: one would tempted to applaud the feat, but, in fact, the money has to come from somewhere... Most likely a few mums and dads out there (and possibly the Fed Bank) via a succession of hedge funds and shelves stuff — have lost a bit of their savings (or some of the interests cuts meant to help the struggling in the case of the Bank) might help the bank Goldman Sachs salt its own mine...

The fact that one is allowed to bet on financial markets is "ugly"... Although anyone with a brain and a nose to the ground would have had to know that the bubble of the "subprime" market was going to burst...

greed swallowed by greed

It is estimated that ultimately losses suffered by financial institutions could be between $220bn and $450bn, as the $1 trillion in sub-prime mortgage bonds is revalued.

Gus: Holy mackerels... I know it's "only money" but it's a lot of it!!... Not good for the system to bleed so much, after having been on shonky subprime steroids... Ah, I see our Malcolm has decided to inform the Rudd that he should talk to the big banks' CEO — as if our Rudd did not know that... and as if our Rudd did not know the "big bank" were over-salting their chips — instead of talking to the Reserve Bank of Australia honchos...

But that's the nature of the capitalist credit beast, my dear Malcolm... Banks "have to" make at least 15 per cent profit increase every year to satisfy their greedy shareholders... and their profits is mostly made by collecting OUR cash, once we've bought our overvalued roof with THEIR money... A bit of blood sucking at their leisure and at the rate they think we can afford without us being pushed to chose another financial institution to great trauma of banking fiddleshift. And knowing what they know, they know the other banks are in the same poo as they are... They win, we loose...

Malcolm would know there's buckley's we can do except ask the banks to be "lenient" unless "we" put more regulations in place, etc... sure. Rudd knows that too... But then the system is stuffed as a "free" market... which it is anyway. But the illusions, Malcolm... the illusions...

sausages

By ROGER LOWENSTEIN

Ben Bernanke’s first exposure to monetary policy was reading the works of Milton Friedman, the Nobel laureate. That was 30 years ago, when Bernanke was a graduate student at M.I.T., and he has been studying central banking ever since. By the time President Bush nominated him to run the Federal Reserve, at the end of 2005, Bernanke knew more about central banking than any economist alive. On virtually every topic of significance — how to prevent deflationary panics, for instance, or to gauge the effect of Fed moves on stock-market prices — Bernanke wrote one of the seminal papers. He championed ideas for improving communications between the Fed — whose previous chairman, Alan Greenspan, spoke in riddles — and the public, believing that clearer guidance about the Fed’s aims would help the economy run more smoothly. And having devoted much of his career to studying the causes of the Great Depression, Bernanke was the academic expert on how to prevent financial crises from spinning out of control and threatening the general economy. One line from his “Essays on the Great Depression” sounds especially prescient today: “To the extent that bank panics interfere with normal flows of credit, they may affect the performance of the real economy.”

Bernanke, who came to the job with a refreshing humility — a desire to be less an oracle like Greenspan than a plain-speaking technocrat —faces exactly this sort of crisis now.

----------------

Gus: Hello? Anyone there? If economist start to tell the truth about the value of things, we're in for a very rough ride, aren't we???. It's like believing the world was created in seven days when it came to be — within a nanosecond plus some fascinating evolutive changes after something blew up about 16 billion years ago... who knows... That's why Greenspan was arcane about the value of trust in the illusions of sacred money flow... What Greenspan was good at was to inspire confidence in intangibility and ephemerals without saying anything that would rock the flimsy foundations of a sand castle on a sand dune. Of course this led to the subprime crisis that's hitting the stratosphere, but really its only a third of a trillion dollar that has evaporated from our banking pockets... Some would even say that a lot of pass-the-loan-sharks made a lot of money out of it, encouraged by the banks to fleece the poor, but eventually they fleeced too much... That's the problem... Fleece as much as you like but don't kill the goose. Greedy bums killed the goose but these greedy bastards are all in the Bahamas enjoying luxury holidays that we're paying for at hundred times the price of gold dust...

But now, the economist Mr Bernanke wants to talk the economy as it is... Brother!!... Knowing how the sausages are made will turn us off sausages won't it?... Too much sawdust in them from day one. Refreshing humility? Not a good look in an industry based on making people believe stuff that's really not believable. The more you try to explain how the economic con works, the more one appears like the failed salesman in "the assassination of Richard Nixon" movie... He did not get the loans and it wasn't pretty.

The Jack Thompson boss character got the illusions fine-tuned to perfection...

tem-po-ra-ri-ly...

Something's wrong with the system... er. I mean...

I believe that banks are happier to post huge losses rather than show a reduced profit. Tem-po-ra-ri-ly...

I will explain what I smell: A dead rat. An overflowing dunny drain. "Thou odoriferous stench!" as Shakespeare is quoted in the Sydney Morning Herald in regard to sledging, on the SIT back page.

Should banks post a reduced profit, they would get hammered by "their" shareholders. Their CEOs and their lackeys of capital executions (the execs) would have to resign and move on to better pastures or, shock horror, take pay cuts and forgo of their privilegious bonuses. Not on your Nelly. Competition would hammer them too... Other banks would come and try to pinch their territorial blankets from under their fleeting footsies.

Thus when banks dive, they tend to dive together, because they lend money to each other, making sure they are somewhat enchained together. Cartel? Anti-trust regulation would stop that forthwith but then comes a lot of smart schemes of on-selling stuff in the shape of wedges, hedges and other ledges that at the end of the line, don't mean a thing more than a roulette table at a Las Vegas casino. Competition? Sure, they compete... To me they look like male athletes on steroid since they were born and bitchily bonding like some randy gay men at a circular conga line convention... I may be wrong. And my apologies to the gay community. Many of my friends are gay and lovely people... but I could not think of any other image to transmit my impression of the banking system...

Who knows.

Whoever came up with the subprime loans idea should be flogged, quartered, water-boarded... nailed to a cross just for fun. Our fun. But oh no... Whoever in the public governing arena allowed this to develop should suffer the same fate. Sure, there might have been a bit of genuine trying to help the "poor" get a roof over their heads at the beginning — but the way greed was written into the loans, I think not.

No brainer... At one stage or another of the "scam", banks would have had to know that people were not going to be able to repay the loan as it ballooned with discretionary interest and fuzzy infectious charges... Sure, the people can be thrown out to the street and their asset on-sold to another mug... But how many goose can you cook before there is none left in the yard? One or two goose and one can make a tidy profit on the misery of the "poor". Now say, if 10 million people (still small potatoes) are caught in the scheme, each owing about $2.500 a month on their mortgage but can't pay a dime, one ends up with a black hole of 25 billion a month in the banks ledgers. OOPS across the board... The banks can go blue in the face, and "repossess" but one knows that the value of things lie in the want of other people and if no-one wants to buy the "repossession". this repossession is "worthless", especially on the short-term... No liquidity, plenty of crumbling assets... Not a good look.

But in theory and in the early stages there was huge money to be made... see on an initial loan organised by brokers who took a big payola to set up the shonky loans, the returns were low but with huge potential when the interest rates were turned up — turned up at will, passed a certain short period of time... But as protection and for a quick buck, this magic pudding potential was on-sold to another bank which may have paid with non-existent moneys or marked down a debt from the first bank who had written the lending to the subprime borrower. But the second bank not knowing the real potential risk in the magic pudding would insure it with another bank which in turn would insure the insurance with another bank — all doing the merry-go-round to the first bank that wrote the doosy subprime lending. By then the money trail is very fuzzy, has been wedged, hedged and ledged beyond anyone responsibility... And everyone along the way MADE MONEY... Far more more money than the original values of the loans. That's the name of the game.

Sure, the subprime loans could be rewritten to lower the repayments and in some cases this has been done... But be real, this would mean that banks would end up with quite "reduced" profits and would be hammered for that (see beginning of this story)... And by the time the original contracts end up in tonnages of bundles of paper in other banks, who's going to fossick and review each subprime case on its merit? Anthropologists? Banks are not "charitable" organisation either. Changing the terms of a contract to help borrowers is not in their manuals — unless these borrowers are rich and influential... or done to increase profits to the bank. Thus banks prefer to "loose" money rather than find ways to "make a bit less". Anyway, interest rates can be turned up "across the board", just enough as not to make other financial institution steal your market and bob's your uncle...

When banks post losses, these losses are huge. and across the board. In this case "the system is to be blamed", not the banks. Magic... And not only that, the "system" via Central Bank has to fork out lots more cash to arrest the turmoil — fork out more cash via the banks which take their cut on the way to "you", indirectly "managing their losses into profits". But you rarely see the colour of the money... It is mopped up by institutions, price rises and other clever schemes that lines the pockets of execs...

Tax cuts as an incentive? Sure. But the beneficiary of tax cuts are usually those who do not need the cuts. Those rich people whose pockets are already massively bulging with packets of banknotes while we, the louses on social benefits or underpaid at the coal-face usually take a cut in our measly benefits "as the country cannot afford to pay for lazy bums"...: "there is a potential recession, you know, and everyone needs to do their bit..."

Dead rat.

Bernanke should make the banks pay with real sweat but that's a pie in the sky, isn't it? The banks would take revenge on us...

Easier to print banknotes... Dig a deficit deeper... Give the illusion the poor are looked after by making sure "the system does not collapse"... Temporarily mind you... That's the key word, that's the magic BS word... Tem-po-ra-r-ily... Ugly.

Ah, where is Newton [scientist extraordinaire and chaser of counterfeiters, of the seventeenth century] when we need him to put the profiteering thieves in their place...????

Banks? Loosing money???

black mood...

Fed Chief’s Reassurance Fails to Halt Stock Plunge

Despite the rising prospect of a fiscal pump-priming effort from Washington, investors on Wall Street remained in a black mood as new data showed that the housing debacle was getting worse and beginning to bring down the rest of the economy.

The Dow Jones industrial average turned down on Thursday even as the Fed chairman, Ben S. Bernanke, began to deliver his widely anticipated testimony to the House Budget Committee. By the end of the day, the Dow had plunged 307 points; the fall since Jan. 1 is now 9.2 percent. Wall Street started the day with Merrill Lynch reporting that it lost $9.8 billion in the fourth quarter of 2007, mainly because of booking $15 billion in losses tied to soured home mortgages.

Adding to the pessimism, which drowned out the reassurances by Mr. Bernanke that a recession could be averted, were reports that manufacturing activity could be slowing even more than analysts had expected, and that housing starts dropped 14 percent last month and reached their lowest level in 16 years.

avoiding the R word...

WASHINGTON — President Bush called on Friday for about $145 billion worth of tax rebates for American families and incentives for businesses to provide “a shot in the arm to keep a fundamentally strong economy healthy” and avert a slide into recession.

The president said the package “must be big enough to make a difference” in an economy as large as that of the United States, meaning it should be worth about 1 percent of the gross domestic product, putting it at $140 billion to $150 billion, Treasury Secretary Henry M. Paulson Jr. said later.

“This growth package must be temporary and take effect right away,” Mr. Bush said. The president said Mr. Paulson would work with Congressional leaders to get a bipartisan relief package ready as soon as possible.

----------------------

Gus: according to the law of bonuses for the big boys, about "ten" (twenty in real terms) per cent of this money will vanish in "management fees", 50 per cent will go to the "wrong people" (those who don't need it), 25 per cent will evaporate in price hikes, three per cent will go towards the pocket of the shonks who devised the subprime wonky loans, fifteen per cent will be absorbed within a week by a further weakening dollar and the rest will dilute down to an extra BigMeal a day at the local fast food outlet for the next three weeks for each adult (200 million in the USA), compounding the US huge obesity problem. But the R word will appear to stay away for another month... tem-po-ra-ri-ly... Did I spend 120 per cent out of all this?

... And the banks will be laughing all the way to the banks...

Fantastic. Like trying to fight cancer with sugar pills. One never knows, it might work.

And by the way, Mr President the word "fundamentals" does not refer to the cheeks on which you sit in a chair, although it could, since comfort is the purpose. Letting you know just in case...

distorted foods...

Mr. Pollan agreed to take some time this week to answer a few questions from the Well blog.

In this book, you talk about “nutritionism,” the tendency of scientists and nutrition experts to view food as just a sum of its nutrient parts. What’s wrong with that thinking?

Two things go wrong with nutritionism. Whatever tentative scientific information is developed, it gets very quickly distorted by the food marketers and manufacturers. They will take partial information about antioxidants, and they are suddenly telling you if you eat almonds you are going to live forever. There is a distortion of what are hypotheses of science. We’re guilty of this too. We take sketchy science, and we write headlines.

One of the things that surprised me is how poor the data is that is underlying many of these big dietary trials. If you try to fill out a food frequency questionnaire, you realize very quickly this is not good data. I was as honest as I could be and tried to remember what I’d eaten, and it claimed I was only eating 1,200 calories a day. Clearly, I was forgetting at least 1,000 calories. We know people underreport by about 30 percent. We don’t know the first thing about nutrition, which is, “What are people actually eating?” It’s hard to build good science on top of that.

read more at the well blog.

too fat to let it die on top of you...

At the heart of the Obama crackdown is the role of the US Federal Reserve. The legislation unveiled earlier this week suggests that the central bank would supervise only the biggest banks, those described as "too big to fail."

But the Federal Reserve chairman Ben Bernanke says he wants to have control over Main Street as well as Wall Street.

However, Ben Bernanke has faced a grilling in front of Congress, and was constantly reminded that the US Federal Reserve failed to see the global financial meltdown coming.

"There's been a massive failure on the part of the Fed in my opinion," said one member of the powerful House Financial Services Committee in Washington.

"I don't understand why a regulator can't take a look at a product and say this is so bad, this is so predatory that it shouldn't be on the market, and we're not going to allow it to be on the market," commented another.

"I think we would have had a much better outcome if we would have had people that were doing the job that they were already supposed to be doing," opined a third.

The world's most powerful central banker was making no excuses.

"We need to change our culture, our structure and our instructions to examiners and so on to make sure that we do a better job next time," Ben Bernanke acknowledged.

"So everyone has to do a better job. We are working to do a better job."

However, Democrat Gary Ackerman was not giving up on the Fed's flat-footed record in forecasting the global financial crisis.

"How do you miss it and how would have you done it different? Because if you're not going to do it different, then we're moving down the wrong direction here," he said.

"Well that's the $64 billion question you just asked," responded the Fed chairman.

-------------------------

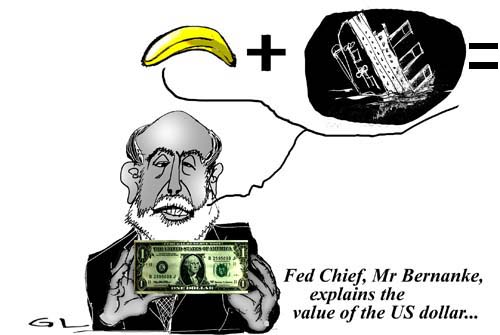

a banana plus a Titanic equals a dollar... see toon at top.