Search

Recent comments

- arseholic....

51 min 1 sec ago - cruelty....

2 hours 7 min ago - japan's gas....

2 hours 48 min ago - peacemonger....

3 hours 44 min ago - see also:

12 hours 45 min ago - calculus....

13 hours ago - UNAC/UHCP...

17 hours 40 min ago - crafty lingo....

19 hours 4 min ago - off food....

19 hours 13 min ago - lies of empire...

20 hours 13 min ago

Democracy Links

Member's Off-site Blogs

porkies on the lamb .....

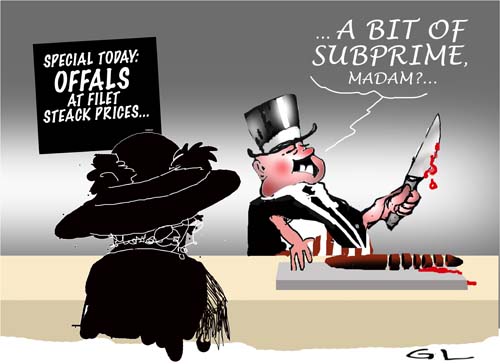

- By Gus Leonisky at 25 Sep 2007 - 6:51am

- Gus Leonisky's blog

- Login or register to post comments

What's a few trillions? a few billions? a few bux? Cents?

"The fiscal gap was developed by Alan J. Auerbach in 1994 as an accounting measure intended to reflect the current long-term budgetary status of the government. CBO's definition is: "The fiscal gap, which is expressed as a percent of GDP, is the size of the immediate and permanent increase in revenues or decrease in outlays, expressed as a percent of GDP, that would be necessary to keep federal debt at or below its current share of GDP" for a future projection period (CBO, 2000)."

The United States has a huge long-term fiscal gap, perhaps with a present value of around $74 trillion [valued at 2002]. By contrast, the explicit national debt of the U.S. is only around $6 trillion [at 2002 — since gone through the roof].

The U.S. may thus be unable to continue meeting its current spending commitments without eventually enacting huge tax increases. The tax cut enacted in 2001 may have increased the fiscal gap by about $13 trillion, but the main cause of the gap is increasing life expectancy, which raises the cost of Social Security and Medicare. While the fiscal gap can in theory be eliminated at the stroke of a pen by simply changing stated policy, in practice this could lead to serious disruption of people's expectations. In addition, the fiscal gap may impair future generations' opportunity to take full advantage of technological advances (such as in treating cancer) that have the potential to make their lives significantly better than ours.

--------------------

Gus: as the US dollar plunges under the strain, Citybank has marked down nearly US$ 6 billions of assets.... and :

---------------

Some Banks in Europe Suffer, Too

By MARK LANDLER and JULIA WERDIGIER

Published: October 2, 2007

FRANKFURT, Oct. 1 — Europe’s biggest bank, UBS, has become the Continent’s biggest casualty of the American mortgage crisis, reporting Monday that it had written down $3.4 billion in the value of mortgage-backed securities and would post a loss in the third quarter.

The financial damage to UBS of Zurich had analysts wondering how so seasoned a lender could fall prey to mortgage troubles.

The write-downs had been expected. But the loss ran deeper than analysts anticipated, and it underscored the extent to which some of Europe’s largest and most prominent financial institutions are exposed to investments that rest on shaky American mortgages.

---------------

Gus: and the stock market rebounds! wow! magic!... that's confidence for you... Damage is under control... or is it? Who knows... as long as the illusion of printing money is worth more than our spirits or the moths in our wallets, all'll be okay...

deregulated beggars need fleas

From George Monbiot

Governments aren't perfect, but it's the libertarians who bleed us dryThe little-known ninth law of thermodynamics states that the more money a group receives from the taxpayer, the more it demands and the more it complains." Thus wrote Matt Ridley in 1994. He was discussing farm subsidies, but the same law applies to his chairmanship of Northern Rock. Before he resigned on Friday, the bank had borrowed £16bn from the government and had refused to rule out asking for more. Ridley and the other bosses blamed everyone but themselves for this disaster.

.....

Ridley, who has a DPhil in zoology, is no stranger to good science, and his explorations of our evolutionary history, which are often fascinating and provoking, are based on papers published in peer-reviewed journals. But whenever a conflict arose between his scientific training and the interests of business, he would discard the science. Ignoring hundreds of scientific papers that came to the opposite conclusion, and drawing instead on material presented by a business lobby group called the Institute of Economic Affairs, he argued that global temperatures have scarcely increased, so we should stop worrying about climate change. He suggested that elephants should be hunted for their ivory, planning laws should be scrapped, recycling should be stopped, bosses should be free to choose whether or not their workers get repetitive strain injury and companies, rather than governments, should be allowed to decide whether or not the food they sell is safe. He raged against taxes, subsidies, bailouts and government regulation. Bureaucracy, he argued, is "a self-seeking flea on the backs of the more productive people of this world ... governments do not run countries, they parasitise them".

Poor people...

Foreclosure wave sweeps America

By Steve Schifferes

BBC economics reporter, Cleveland, Ohio

Thousands of abandoned houses in Cleveland have been vandalized

A wave of foreclosures and evictions is about to sweep the United States in the wake of the sub-prime mortgage lending crisis.

This could destabilise the US housing market and may also lead to further turmoil in financial institutions, who collectively own $1 trillion worth of sub-prime debt.

Cleveland, Ohio, is an industrial city on the banks of Lake Erie in the US "rust belt".

It is the sub-prime capital of the United States. One in ten homes in the city is now vacant, and whole neighbourhoods have been blighted by foreclosed, vandalized and boarded-up homes.

Many of these homes are now owned by the banks and investment pools owning the mortgages, and the company making the most foreclosures in Cleveland is Deutsche Bank Trust, which acts on behalf of such investment pools.

Cleveland is facing a rising crime wave, and the cost of demolishing the vacant houses alone will cost the city $100m of its tax base.

-------------

Gus: ONE TRILLION BUCKS SUBPRIME DEBT????

shonky deals of the centuries

from the NYT

Now that big lenders are originating fewer mortgages, servicing revenues make up a greater percentage of earnings. Because servicers typically keep late fees and certain other charges assessed on delinquent or defaulted loans, “a borrower’s default can present a servicer with an opportunity for additional profit,” Ms. Porter said.

The amounts can be significant. Late fees accounted for 11.5 percent of servicing revenues in 2006 at Ocwen Financial, a big servicing company. At Countrywide, $285 million came from late fees last year, up 20 percent from 2005. Late fees accounted for 7.5 percent of Countrywide’s servicing revenue last year.

But these are not the only charges borrowers face. Others include $145 in something called “demand fees,” $137 in overnight delivery fees, fax fees of $50 and payoff statement charges of $60. Property inspection fees can be levied every month or so, and fees can be imposed every two months to cover assessments of a home’s worth.

“We’re talking about millions and millions of dollars that mortgage servicers are extracting from debtors that I think are totally unlawful and illegal,” said O. Max Gardner III, a lawyer in Shelby, N.C., specializing in consumer bankruptcies. “Somebody files a Chapter 13 bankruptcy, they make all their payments, get their discharge and then three months later, they get a statement from their servicer for $7,000 in fees and charges incurred in bankruptcy but that were never applied for in court and never approved.”

Some fees levied by loan servicers in foreclosure run afoul of state laws. In 2003, for example, a New York appeals court disallowed a $100 payoff statement fee sought by North Fork Bank.

Fees for legal services in foreclosure are also under scrutiny.