Search

Recent comments

- naked.....

1 hour 38 min ago - darkness....

2 hours 38 sec ago - 2019 clean up before the storm....

7 hours 20 min ago - to death....

7 hours 59 min ago - noise....

8 hours 6 min ago - loser....

10 hours 46 min ago - relatively....

11 hours 9 min ago - eternally....

11 hours 14 min ago - success....

21 hours 43 min ago - seriously....

1 day 26 min ago

Democracy Links

Member's Off-site Blogs

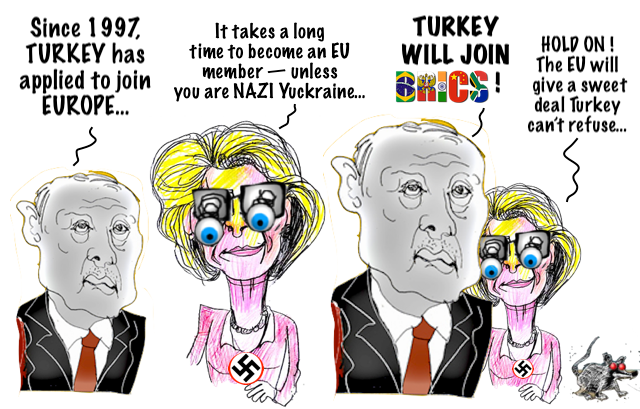

no strings attached — why turkey wants to join BRICS.....................

The secret to the success of BRICS is not what it is, but what it’s not

The group is the antidote to a declining hegemon pursuing its own interests without regard for problems that require system-level solutions

By Henry Johnston, a Moscow-based RT editor who worked in finance for over a decade

BRICS is on the move. It already expanded at the beginning of this year, while no fewer than 40 countries have expressed interest in joining. Russian Federation Council Chairwoman Valentina Matvienko recently claimed that 24 countries are in line to actually become members.

But successful blocs comprising such a diverse assortment of nations are exceedingly rare. What could possibly compel countries so culturally, geographically, and politically disparate to band together?

Here we can offer the standard line about how BRICS does not seek to corral members into line around a narrow set of interests. Nor does it impose ideological purity tests, or insist upon a certain political makeup. It respects sovereignty. It offers a vehicle for nations left on the margins of Western-controlled institutions to have a stronger voice. This is all true but it has been said many times.

Let’s instead go for a more provocative question: what is so attractive about a group that has very few actual accomplishments to its name? It is in fact this relative lack of achievement that many naysayers have latched on to in dismissing the whole enterprise.

To find a good example of this point of view, look no further than the man who coined the acronym in the first place, former Goldman Sachs analyst Jim O’Neill. Ahead of the group’s summit in South Africa last year, O’Neill told the Financial Times that BRICS had “never achieved anything since they first started meeting” and that beyond “powerful symbolism” he wasn’t sure what its members were even hoping to achieve.

And indeed, one will notice that the group’s muscle is often expressed merely in the raw economic or human potential of its members – such-and-such a percentage of global GDP, or population, or oil production, or the number of members (current members are Brazil, Russia, India, China, South Africa, the United Arab Emirates, Egypt, Iran, and Ethiopia). More seldom heard is what the group has actually done.

Of the concrete achievements of the bloc, perhaps the most notable is the founding of a development bank that aims to rival the World Bank. The New Development Bank (NDB) was begun in 2015 with its headquarters in Shanghai, and was seeded with $50 billion to fund infrastructure and sustainability projects. Around the same time, a BRICS monetary fund called the Contingent Reserve Arrangement (CRA) – an alternative to the IMF – was created. These are institutions born out of years of frustration at the failure to reform their US-dominated counterparts.

However, they have not entirely lived up to their hype. Brazilian economist Paulo Nogueira Batista, who represented his country at the IMF from 2007 to 2015 and then was vice-president of the NDB from 2015 to 2017, prepared a paper for the Valdai Club meeting in Sochi, Russia in 2023 in which he painted a sober picture of the impact these institutions have had.

“When we started out with the CRA and the NDB, there was considerable concern with what the BRICS were doing in this area in Washington, DC., in the IMF and World Bank. I can testify to that because I lived there at the time, as executive director for Brazil and other countries in the board of the IMF. As time went by, however, people in Washington relaxed, sensing perhaps that we were going nowhere with the CRA and the NDB.”

The NDB has approved only $33 billion worth of projects in its entire history; the World Bank committed $128 billion in 2023 alone. Of the projects approved by the BRICS lender, roughly two-thirds have been in dollars, according to an investor presentation cited by Reuters. Perhaps surprisingly to some who expect BRICS to offer an immediate and brazen challenge to the West, the NDB has even respectedWestern sanctions on Russia, putting new transactions with Moscow on hold. It is no wonder that in the halls of US-led institutions concern about this upstart rival has subsided.

The other realm in which BRICS has been expected to deliver something tangible is in launching its own currency. But here, unfortunately, a lot of loose talk has set up the group for disappointment. A wave of hype early last year, even in Western establishment outlets, touting a soon-to-be-created BRICS currency as having the potential to “shake the dollar’s dominance,” has given way to skepticism.

It is loose talk because a currency per se is not what is on the agenda. The BRICS nations have no intention of surrendering their national currencies – and therefore much of their sovereignty – in a Eurozone-like experiment. Consumers won’t be taking a wad of brics to the grocery store.

And it is not entirely clear how such an arrangement would even work, particularly given that nearly all BRICS countries run current account surpluses. This is a complicated topic best left for another day, but suffice it to say that a certain amount of restructuring of the BRICS economies would be needed for such a plan to be viable. In any case, India has flat-out rejected the idea of a BRICS currency.

What is much more likely to happen is a means of settlement will be developed among central banks for imbalances between surplus and deficit countries. It will be something of a neutral reserve asset, perhaps akin to the bancor system proposed by John Maynard Keynes at Bretton Woods but dismissed by the Americans. Meanwhile, it certainly bears mentioning that a BRICS alternative to the Western SWIFT financial messaging system seems imminent.

Such developments would, of course, be hugely significant, and would count as a genuine achievement, but this will not happen overnight. At least insofar as a new currency is concerned, this is certainly an area where excessive hype and dramatic proclamations have obscured what is a nuanced and highly technical matter.

Finally, although a handful of BRICS countries have free-trade agreements with each other, there is currently no such agreement covering the entire nine-nation group. Although intra-group trade has been growing at a brisk pace – and more and more of this is settled in local currencies – an initiative floated by China to reach a free-trade deal within the bloc was not supported by the other members. The brief history of BRICS has shown without a doubt that the differences among members are real. Their interests do not always align.

So what we have summarized is a certain gap between what is being trumpeted in some quarters and what has transpired. The purpose of pointing this out is not to denigrate the BRICS project or to side with the naysayers. The aim, rather, is to show that that the exuberant interest in BRICS cannot be attributed to its merits alone.

It is said that animals can sense a tsunami coming and sometimes flee for higher ground. Upon seeing all manner of mammals, reptiles, birds, and insects moving in the same direction, it is of far greater interest to ascertain what is driving them en masse than to fixate on the makeup of the scurrying pack. In the case of BRICS, the analogy holds: it’s more a matter of what they are running ‘from’ than running ‘to’.

What has triggered this flight to safer ground is the unseemly and prying arm of an ever more belligerent Washington. The US has weaponized the financial system it presides over, ever more frequently resorted to unilateral sanctions, expanded the scope for secondary sanctions, and also employs economic blockades, and various forms of coercion – up to and including the sabotage of major energy infrastructure – in order to keep as much of the globe as possible under its thumb.

A US Treasury Department report found a 933% increase in the use of sanctions in the decades since the September 11 attacks – and those figures are through 2021, meaning that the avalanche of restrictions unleashed in the last two years aren’t even captured in the data. In 2023 alone, the US added2,500 persons, comprising 1,621 entities and 879 individuals, to its Specially Designated Nationals and Blocked Persons (SDN) list. The Treasury’s Office of Foreign Assets Control’s list of individuals and entities under sanctions reportedly runs to over 2,000 pages featuring some 12,000 names.

In recent years, America’s global policing has plunged its tentacles into hitherto unthinkable realms. There was a time when sanctions were reserved for countries whose transgressions against the ‘rules-based order’ were of a certain magnitude. This does not justify their use, but most players at least knew where they stood. If before the US responded to real or perceived threats by using what historian Immanuel Wallerstein called a “velvet glove concealing a mailed fist,” the velvet glove has now been cast aside and the mailed fist is roaming the world in paroxysms of anxious rage. Examples are many.

In its desperate effort to suffocate Russia’s defense industry, late last year the Treasury was authorized to sanction any financial institution seen as helping Moscow’s military industrial base. NATO ally Türkiye has been warned that its banks could be targeted for facilitating trade in dual-use goods with Russia. The UAE got a similar lecture. China is, of course, in the crosshairs. Prior to taking matters into its own hands, the US slapped sanctions on the undesirable Nord Stream pipeline, over the feeble objections of staunch ally Germany.

Some of the recent measures can be seen as nothing less than outrageous meddling in the affairs of others. Uganda’s ‘sodomy law’ passed last year compelled the US to reevaluate “all aspects” of its engagement with the country. Officials have indicated that they will even review Uganda’s eligibility for duty-free access to the US for hundreds of goods, a move that would further impair the African country’s already fledgling economy.

Georgia’s law mandating that NGOs funded from abroad register as such and submit to tighter regulations was passed by a legitimate legislature in accordance with democratic procedure. Yet it elicited a virulent reaction from the US and its subservient European allies (and, yes, sanctions are in the works). The EU has even gone so far as to suspend Georgia’s accession process – a position that the US clearly endorses.

Such is life under the frenzied tyranny of the Office of Foreign Assets Control, a once-obscure Treasury department that now bestrides the globe like a colossus. South China Morning Post columnist Alex Lo remarked that the weaponized dollar hangs over many developing countries “like the sword of Damocles”and that BRICS offers an “escape route.” Lo sees this as the main attraction of the group.

Indeed this is the case, but what is transpiring should be seen in a far greater context than just a weaponized currency. Italian economist and historian Giovanni Arrighi, whose work I discussed at length in a previous article, wrote that “declining hegemonic states are faced with the Sisyphean task of containing forces that keep rolling forth with ever renewed strength. Sooner or later, even a small disturbance can tilt the balance in favor of the forces that wittingly or unwittingly are undermining the already precarious stability of existing structures.”

It was inevitable that the shift in economic power away from the West and toward the rising powers of the Global South would lead to those countries having greater influence in global affairs. And perhaps it was inevitable that the US would embark on the Sisyphean task of containing their rise.

The fear of even a small disturbance goes some way toward explaining what appears as a brittleness and intransigence at the heart of the US’ posture toward the world. The line must be held everywhere, all at once. Underlying this stance is a deep anxiety, a foreboding that if one brick (BRIC?) is out of place, the whole edifice could come crashing down. This, Arrighi tells us, is a typical symptom of the twilight of hegemony.

BRICS thus represents the rest of the world’s response to what Arrighi calls the “final boom” during which a declining power pursues its national interest without regard for the problems that require system-level solutions. It is a state of affairs whereby the US, paradoxically, seeks dominion over the world while making no effort to exercise the type of stewardship of the system that its position would imply. Proper stewardship would entail seeking ways to accommodate as smoothly as possible the changes that are happening anyway. It cannot be the 1950s or even the 1990s forever.

And yet the US exerts an influence both oppressive and absent. It is touchy on all matters related to its hegemony but entirely unresponsive to the actual important issues of the day. This is the under-the-surface magnet pushing disparate nations together under the BRICS banner. It is, as Lo says, “an escape route.” The group represents a new, if still relatively unproven, platform for seeking the exact type of system-level solutions to system-level problems that are not being sought elsewhere. This is a powerful driving force.

It should also be mentioned that the fragmented world that is dawning does not lend itself to the type of rigid and formal institution that thrived in the postwar years. That era has passed. BRICS has wisely refrained from institutionalizing ties through an inflexible policy agenda and a permanent bureaucracy. It seems comfortable with its heterogeneity and loose affiliations.

And this leads to a final thought that is entirely subjective: whatever its limitations and however few its achievements so far, one senses in the rise of BRICS the contours of a great and sweeping change. It is an endeavor with a momentum of its own whose significance will not be measured by tallies on a spreadsheet.

https://www.rt.com/business/601140-brics-accomplishments-countries-join/

In recent years, Turkey's foreign policy has undergone a significant shift, marked by its growing interest in BRICS (Brazil, Russia, India, China, South Africa) and strained relations with the European Union (EU). This blog explores the dynamics behind Turkey's strategic pivot, the EU's response, and the implications for global geopolitics.

SEE MORE: https://thinktankheadquarter.substack.com/p/eu-pressure-on-turkey-to-avoid-brics

- By Gus Leonisky at 30 Jul 2024 - 6:55pm

- Gus Leonisky's blog

- Login or register to post comments

swifty BRICS....

BY Vinod Dsouza

The BRICS alliance seeks to bypass the Western SWIFT system and replace it with its own financial mechanism. The creation of a new financial messaging system similar to SWIFT will allow BRICS to reshape the global trade landscape.

The majority of international transactions today are settled using the SWIFT system, and breaking away from this system allows the nine-member alliance to exert leverage. BRICS can create a new payment system without relying on the US dollar for transactions.

JUST IN: Russia says the creation of a financial system similar to SWIFT will help create a new economic reality for BRICS countries. pic.twitter.com/GV9442G67B

— BRICS News (@BRICSinfo) July 25, 2024Local currencies will be used for trade settlements, ending dependence on the US dollar once and for all. The BRICS payment system, similar to SWIFT, can break the global dominance of the US dollar. Many sectors in the United States will be affected if the BRICS system abandons the dollar for trade.

Russia has confirmed that the BRICS alliance is considering establishing a new payment system similar to SWIFT. The BRICS financial agenda includes a central initiative aimed at establishing a new economic reality that would solve these two major problems.

«Create our own financial messaging system for BRICS countries, similar to SWIFT, leveraging state banks capable of clearing settlements from BRICS country counterparties and the related role of the same bank», specified the vice-president of the Russian Duma, Alexander Babakov.

The ambassador said the creation of an alternative to SWIFT was necessary to advance the BRICS dedollarization agenda.

«This new system must be technically compatible with the existing financial infrastructures of participating countries, including integration with national payment systems, banks and other financial institutions. At the same time, the system must ensure a high level of security and data protection to prevent cyber attacks and unauthorized access to financial information“, he summarized.

source: watchers

https://en.reseauinternational.net/les-brics-annoncent-officiellement-un-systeme-financier-comparable-a-swift/

READ FROM TOP.