Search

Recent comments

- loser....

1 hour 27 min ago - relatively....

1 hour 49 min ago - eternally....

1 hour 54 min ago - success....

12 hours 23 min ago - seriously....

15 hours 7 min ago - monsters.....

15 hours 14 min ago - people for the people....

15 hours 50 min ago - abusing kids.....

17 hours 23 min ago - brainwashed tim....

21 hours 43 min ago - embezzlers.....

21 hours 50 min ago

Democracy Links

Member's Off-site Blogs

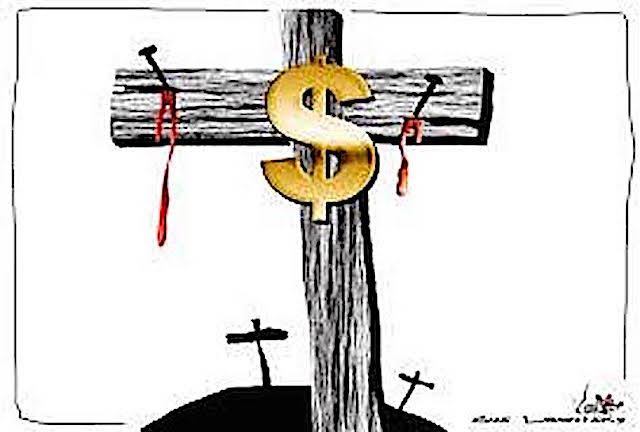

good dollar bad...

Suddenly, financial markets have become highly volatile, with the escalation of Middle East hostilities and last week’s increased US inflation reading generating tension and uncertainty.

The US dollar is surging and creating dilemmas for central bankers elsewhere.

GUSNOTE: THIS IS NOT SUDDEN... THE WRITING WAS ON THE WALL FOR A WHILE....

Oil prices, already above $US90 a barrel, could go higher and add to the challenges faced by economic managers, depending on how Israel responds to the weekend barrage of drones and missiles.

Gold prices are at record levels despite the strength of the US dollar.

The US CPI numbers, which saw the inflation rate edging up, sent shockwaves through markets.

The stock market fell almost 1.5 per cent and US bond yields spiked significantly – both 2-year and 10-year yields ended the week 16 basis points higher.

The US dollar jumped nearly two per cent against the basket of its major trading partners’ currencies

The Australian dollar was down more than one and a half US cents, dropping from US66.29 cents to US64.75 cents after the CPI’s release was interpreted as ruling out any near-term cut to US interest rates.

Where, at the start of the year, markets had factored in as many as six rate reductions by the Federal Reserve Board this year, now the most optimistic case is that there might be two. Some economists are ruling out any increase while Larry Summers, the former US Treasury secretary, says there might even be a rate rise.

It appears the impact of the Biden administration’s very loose fiscal policies in negating the effects of the Fed’s tight monetary policies and keeping US inflation rates at levels the Fed is uncomfortable with might have been underestimated.

The “high for longer” scenario that has now taken hold, and the US bond market’s response to the inflation data, means that the interest rate differentials between the US and other major – and minor – economies are widening.

Japan’s yen is now at a 34-year low against the dollar, the euro (which was already falling against the dollar) has depreciated further, by a fraction less than 2 per cent, since last Wednesday’s inflation data release.

China’s yuan has been edging down against the dollar all year, even though it is a “managed” currency. Emerging market currencies are under similar pressures – Indonesia had already been buying rupiahs and selling dollars to try to put a floor under its currency.

For central banks and economic policymakers whose economies are experiencing low growth and declining inflation, the dwindling prospect of lower US interest rates is a threatening complication.

The European Central Bank, for instance, has conditioned its markets to expect several rate cuts this year.

With the interest rate differentials already wide – the yields on 2 and 10-year German bunds are already more than 2 percentage points lower than those on their US counterparts – further divergence could spark capital flight from Europe as investors pursue the higher returns available in the US.

The Japanese, amid widespread speculation that the Bank of Japan will intervene to put a floor under the yen, face a similar dilemma.

In an economy that has experienced decades of deflation, the emergence of modest inflation (it was running at 2.8 per cent in February) was welcomed.

it's time for being earnest.....

SEE ALSO :

incoming financial bloodbath...- By Gus Leonisky at 15 Apr 2024 - 1:02pm

- Gus Leonisky's blog

- Login or register to post comments

hormuz.....

https://www.youtube.com/watch?v=ykpxKcr8MCk

BREAKING POINT: The CRISIS in Middle East will Crash Global Crude Oil Market in Strait of HormuzREAD FROM TOP

FREE JULIAN ASSANGE NOW....

sad to watch....

https://www.youtube.com/watch?v=9MGEtd5mNVI

Yellen Visit to China BACKFIRES. Exposes US Trade Weakness | Lena PetrovaREAD FROM TOP

FREE JULIAN ASSANGE NOW....

ballooningomics....

The International Monetary Fund (IMF) has raised concerns about overspending by the US government, warning it has been reigniting inflation risks and undermining financial stability around the world.

The US federal budget deficit jumped from $1.4 trillion in fiscal 2022 to $1.7 trillion last year, according to the latest World Economic Outlook, issued by the IMF on Tuesday.

“The exceptional recent performance of the United States is certainly impressive and a major driver of global growth,” the IMF said. However, the report explained that this “reflects strong demand factors as well, including a fiscal stance that is out of line with long-term fiscal sustainability.”

The ballooning US national debt, which exceeded $34 trillion in December, and the fiscal deficit threatened to exacerbate sky-high levels of inflation while posing a long-term risk to the global economy, according to the report.

“Something will have to give,” the IMF warned.

The US exceeded its debt ceiling, which was legally set at $31.4 trillion, in January 2023. After months of warnings of an imminent and economically disastrous default from the US Treasury, President Joe Biden in June 2023 signed a bipartisan debt bill that suspended the cap until January 2025. This effectively allowed the government to keep borrowing without limits through next year. Debt spiked to $32 trillion less than two weeks after the bill was approved, and has been piling up ever since.

The debt held by the public could surge by $19 trillion over the next decade to surpass the $54 trillion mark, owing to the mounting costs of an aging population and higher interest expenses, according to recent projections by the Congressional Budget Office (CBO).

Since entering office, Biden has spent trillions on Covid relief as well as on infrastructure. The US has also spent billions on aid for Ukraine. The Biden administration, however, has been insisting that tax cuts signed into law by then-President Donald Trump were to blame for the ballooning national debt.

Last month, Biden unveiled a $7.3-trillion budget plan for 2025 which would push US debt over 100% of GDP, as he laid out a fiscal agenda that boosts spending but plans to save $3 trillion through higher taxes over ten years.

Republicans in the House of Representatives have described the proposed budget as a “roadmap to accelerate America’s decline,” accusing the Biden administration of “reckless spending” and of engaging in a “runaway spending spree” that disregards fiscal responsibility.

https://www.rt.com/business/596061-imf-us-rising-debt/

READ FROM TOP

FREE JULIAN ASSANGE NOW....