Search

Recent comments

- relatively....

6 min 41 sec ago - eternally....

12 min 1 sec ago - success....

10 hours 40 min ago - seriously....

13 hours 24 min ago - monsters.....

13 hours 31 min ago - people for the people....

14 hours 8 min ago - abusing kids.....

15 hours 41 min ago - brainwashed tim....

20 hours 1 min ago - embezzlers.....

20 hours 7 min ago - epstein connect....

20 hours 18 min ago

Democracy Links

Member's Off-site Blogs

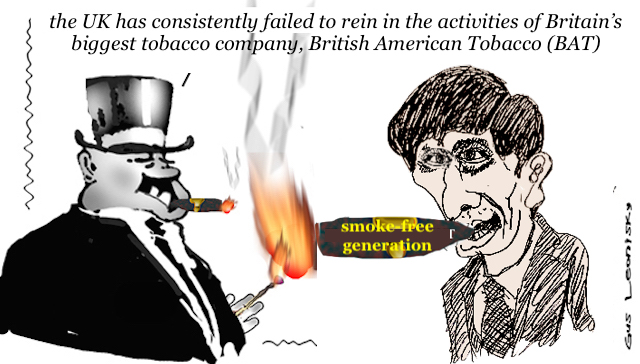

resolutions going up in smoke....

At last year’s Conservative party conference, prime minister Rishi Sunak declared the UK government planned to increase, year by year, the legal age of smoking to achieve a “smoke-free generation”.

The announcement gave the impression the prime minister was taking on Big Tobacco.

However, the UK has consistently failed to rein in the activities of Britain’s biggest tobacco company, British American Tobacco (BAT), which predominantly operates overseas.

BAT is a blue-chip company, one of the few genuinely transnational British businesses. Operating in some 180 countries, BAT says it is “one of the world’s most international businesses”.

Although it claims to be developing a new brand of “safer” non-tobacco products, last year, BAT sold over 600bn cigarettes with brands such as Dunhill, Kent, Lucky Strike, Pall Mall, and Rothmans.

Tobacco kills more than eight million people each year, and up to half the long-term users die from the addictive product. However, BAT has also been accused of other nefarious activities stretching back decades.

In 2000, the Guardian, working with the International Consortium of Investigative Journalists, reported that BAT “condoned tax evasion and exploited the smuggling of billions of cigarettes in a global effort to boost sales and lure generations of new smokers”.

At the time, Conservative grandee Kenneth Clarke, then deputy chair of BAT, “admitted” the company was supplying cigarettes “knowing they are likely to end up on the black market”.

Such was the political outcry about the smuggling scandal that the Department of Trade and Industry ordered an inquiry into BAT. Twenty years later, this report remains wrapped in secrecy, despite attempts to gain access via Freedom of Information laws.

What are successive governments trying to hide?

https://www.declassifieduk.org/what-is-the-government-trying-to-hide-about-b-a-t/

SIMPLE... OR ACTUALLY A QUITE COMPLICATED SWINDLE... THIS FROM "HOT MONEY" (2004 EDITION) BY R T NAYLOR...:

The Smoke Ring

The pool of hot money that reduced debtor countries (except the United States, which prints the world currency) to public penury while it permitted obscene accumulation of private wealth has two distinct components.

The first is of legal (roughly speaking) origin, although much of it is subsequently rendered illegal by tax evasion and capital flight. Apart from the occasional titillating tale about a bread riot in some miserable shantytown, or the odd scandal when a big financial institution gets caught counting stacks of $100 bills on behalf of the military overseer of an arid backwater that happens to sit atop a sea of oil, this part attracts remarkably little attention.

The second portion is explicitly criminal, and therefore much sexier, particularly given the sums supposedly involved. Thus, experts insist, the world drug trade generates an annual cash flow of at least $500 billion per year. The result is to shift attention away from the profound malaise in the operating principles of modern financial capitalism, which require far-reaching structural transformations to truly address, and to turn the problem into one of simple crime control.

This has several advantages. It precludes the need to ask potentially awkward questions about the actual sources of the money. As well, by treating the spread of drug-crop cultivation as a symptom not of economic distress and social disorder but of the machinations of greedy bad guys, it provides a pretext to project American military power into distant lands. Meanwhile the search for drug money at home and abroad gives police and intelligence agencies carte blanche to pry and spy for quite unrelated reasons. Of course, drug trafficking can impose important social costs in its own right, and drug money raises important moral issues, not least that it violates the very worthy principle that people ought not to profit from crimes. Nonetheless, while the United States bludgeons its way around the globe on highly publicized chases for drug dollars, it quietly rolls out the welcome mat at home for foreign tax evaders and flight capitalists. Yet fiscal crime obviously does far more damage to the social fabric of most poor countries than laundering drug money could possibly do to that of the rich. Furthermore, to treat the drug issue as fundamentally a police matter is just plain dumb. Consider, for example, what would have happened if police in North America had been successful in ending sales of Jamaican ganga (marijuana). On the surface they would have solved a serious crime problem - anyone who has watched Reefer Madness knows only too well how toking the demon weed turns life-insurance salesmen into serial killers, nuns into nymphomaniacs, and social workers into child molesters. But the story would not stop there. Deprived of a market, large numbers of Jamaican gang farmers, many of them refugees from the previous collapses of bauxite and sugar, would have been driven out of business. They might have moved en masse into the city slums, swelling an already big problem of urban crime that threatened the country's social stability and its tourism, by far the most important source of legal foreign exchange. They would also have emigrated abroad in increasing numbers to swell the manpower of the exiled 'posses' who would compensate for loss of ganga profit by putting more energy into 'crack' and extortion. Meanwhile, back in Jamaica, banks drained of liquidity might have been forced to cut loans to legitimate businesses, and the country's exchange reserves might have been depleted enough for it to drastically reduce imports of capital equipment necessary for economic growth.

Consequently, loans extended to Jamaica by both international banks and development agencies might have gone unserviced, while exports from other countries to Jamaica could have been slashed because of shortages of foreign exchange. Fortunately that bleak scenario has not, and likely will not, come to pass. For even as Jamaican governments make a show of sending in the police to stamp out the traffickers (who are better armed than the police and can buy off anyone they cannot scare off), they tell local bankers not to look too closely at the origins of the bags of dollars that come their way. And few will give up the use of the ganga gangs to terrorize the opposition during elections, particularly since they can always point to the role allegedly played by the CIA in creating those gangs to destabilize previous governments.

While drug money certainly flows through the global machinery of peekaboo finance, it is far from a dominant factor even within the category of funds from explicitly illegal sources. More important are two other sources. One is the proceeds of various forms of financial fraud, orchestrated not in the torrid rainforests of the Andes but in the concrete jungles of New York. Even the most successful drug entrepreneur must cock an envious eye at the skill and scale with which the architects of an Enron or Parmalat worked, and wonder why a crooked drug lord is prosecuted with so much more zeal than a crooked press lord.

The second major criminal source is the money generated by illegal dealings in legal substances. These too accrue not to gun-toting cocaine barons but to golf-club brandishing corporate executives. Thus, the so-called Medellin Cartel, which reputedly controlled billions of dollars annually in cocaine sales, is really a figment of the drug-enhanced imaginations of law enforcement.

On the other hand, the Virginia Cartel, made up of five big Anglo-American tobacco companies who have for decades orchestrated the worldwide smuggling of cigarettes, is all too real. In the year 2000, the world as a whole exported over a trillion cigarettes. That same year the entire world imported about 650 billion cigarettes.

In other words, about one cigarette in every three of those that entered world trade circuits went up in smoke. The reasons are simple: exports are almost always tax free and therefore accurately reported; imports are almost always taxed and therefore prime targets for smuggling. This is not new. For hundreds of years governments have imposed heavy sin taxes on tobacco products, and tobacco has always been at or near the top of the smugglers’ unwritten freight manifests. However, since World War II, cigarette smuggling has not only dramatically accelerated (partly because war is so remarkable a device for marketing brand names) but become increasingly concentrated on the 'blonde' brands produced by the Virginia Cartel.

Across the world the story is the same. The big tobacco companies ship en masse to what are euphemistically called ‘free-trade' centers and sell the cigarettes, often on credit, to wholesalers.

They, in turn, hire or sell to career smugglers who move the merchandise into the target country, along with loads of whiskey, weapons, and electronics. Since any sensible smuggler wants a two-way flow of cargo, on the return leg their boats or planes carry everything from cocaine to illegal immigrants.? Starting in South America, this pattern was later repeated in South East Asia and Eastern Europe.

Thus, it was not just by happenstance that the richest underworld entrepreneur in Colombia was known not as Don Perica (Andean slang for cocaine, among other less polite meanings) but as the Marlboro Man. He was so proud of his vocation that, when extradited to the United States, he insisted on leaving his Colombian jail cell decked out in a Marlboro uniform - a sweat-suit with a big Marlboro logo on the back.?

But even taking the proceeds of trafficking in everything from kiddy porn to counterfeit Rolex watches and adding to it the ill-gotten gains from financial crime, the portion of hot money of explicitly criminal origin washing through the world financial system is dwarfed by that from legal (though not nessessarily legitimate) sources...

it's time for being earnest.....

- By Gus Leonisky at 5 Apr 2024 - 7:48pm

- Gus Leonisky's blog

- Login or register to post comments

contra affair....

The Iran-Contra Affairs of the 1980s stemmed from the Reagan Administration's foreign policies toward two seemingly unrelated countries, Nicaragua and Iran. The Administration believed that changes to these countries that occurred in the 1970s threatened U.S. national interests.

In Nicaragua, a socialist movement (the Sandinistas) seized power through a revolution in 1979. The Administration, fearful of the potential spread of socialism throughout Latin America, eventually backed paramilitaries (the contras) who sought to overthrow this revolutionary regime. In the section on Nicaragua, you will find a brief background of U.S. policy toward the region since the 19th Century; information on the history, composition, ideologies, and policies of the Sandinistas and contras; and a detailed description of the actions the United States took in Nicaragua from 1979 until the Iran-Contra Affairs. You will also find a brief description of Nicaragua since the affairs.

In 1979, power also changed hands in Iran when a radical Islamic movement overthrew the U.S.-backed government. Because the revolutionary government was unfriendly toward the United States and potentially allied with the Soviet Union, the Administration tried to bolster moderate elements within Iran, a policy that became more complicated when Iranian-backed Lebanese terrorist groups seized American hostages. In the Iran section, you will find a history of U.S. foreign policy toward Iran, as well as a history of Iran's domestic politics. Additionally, you will find a detailed section on the Reagan Administration's policies toward Iran with regard to both the regime and U.S. hostages.

READ MORE:

https://www.brown.edu/Research/Understanding_the_Iran_Contra_Affair/iran-contra-affairs.php

READ FROM TOP.

it's time for being earnest.....