Search

Recent comments

- success....

8 hours 16 min ago - seriously....

11 hours 11 sec ago - monsters.....

11 hours 7 min ago - people for the people....

11 hours 44 min ago - abusing kids.....

13 hours 17 min ago - brainwashed tim....

17 hours 36 min ago - embezzlers.....

17 hours 43 min ago - epstein connect....

17 hours 54 min ago - 腐敗....

18 hours 13 min ago - multicultural....

18 hours 20 min ago

Democracy Links

Member's Off-site Blogs

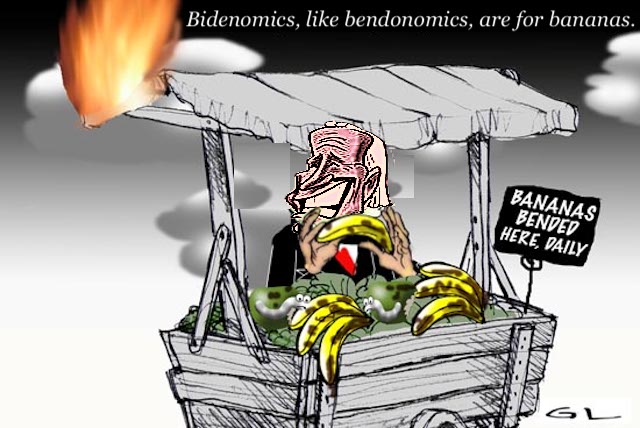

the fraud of fiat moneys in a print cash-as-you-can economy of thieves......

Global Economy Collapse: Banking Crisis Is Only Just Getting Started - Brian Rose & James Rickards

https://www.youtube.com/watch?v=2-zyrQwiQF0

MEANWHILE: AFTERWORD...

Nearly two decades have passed [GUS: 2004 EDITION AFTERWORD] since Hot Money first appeared in print [1983 EDITION]. Since then much has happened, yet little has changed, except perhaps for the worse [THINGS HAVE GOTTEN FAR WORSE SINCE 2004]. To do even partial justice to the panorama of sleaze that has formed the core of recent world financial history would require a small encyclopedia - maybe not so small. However, most of that history consists of variations, grand and petty, on a few larcenous themes already developed in the original text. Those themes were fourfold.

First, the world was awash in hot and homeless money. Although most was of (more or less) legitimate origin, there was a hefty chunk from capital flight and tax evasion along with a hearty sprinkling of proceeds from black marketeering and financial fraud.

Second, these funds got washed by obliging banks through a network of secret accounts in financial havens. Set up principally to cater to American transnational corporations and international banks who were ducking taxes and dodging regulations with us government approval, these havens were also open for business to the world's drug smugglers and gun runners, spies and embargo busters, alimony dodgers and bankruptcy-fraud artists.

Third, the money magically re-materialized, often in the name of shell companies or offshore trusts, in things like Miami condos, portfolios of blue-chip stocks - and, not least, us treasury bills, where it played a major role in making possible the double-deficit strategy on which America's ability to project economic, political, and military power so heavily relied.

Fourth, once debtor countries were forced by creditor pressure to submit to 'restructuring' deals that ultimately made the problem worse, along with programs of radical 'liberalization' and privatization, some of the itinerant money was tempted to return home in deep-discount purchases of the 'restructured' debt of the countries from whence it fled or in the bargain-basement acquisition of formerly public assets that those same debtor countries had been forced to put on the auction block. The conclusion was that the so-called Third World debt crisis was a giant extortion and money-laundering scheme run by and on behalf of major international banks, and that there existed alternative strategies to deal with the problem which were more consistent with economic justice, not to mention common sense. Those were the claims of the original book. They still hold true, with some minor qualification.

Granted, the waves of capital flight that drained the foreign-exchange reserves and wrecked the fiscal base of debtor countries in the 1980s and precipitated Latin America's 'lost decade' abated at the end of that decade and the beginning of the next. But that was only because in some victim countries there seemed little left to steal, while in others the surrender had been so total that no ruminative local speculator could find the Astroturf of Miami nearly as green as the lush pastures available right at home.

However, that was only a respite. During this period of 'stabilization,' new teams of IMF-approved technocrats assumed power and abandoned most pretense to social policy, except perhaps an increase in police-force budgets. Financiers speculated happily in the debased debt of what some still laughingly called ‘developing countries,' and local vulture capitalists with their foreign partners looted the public patrimony. Soon the twin specters of rampant capital flight and escalating international debt came roaring back - across parts of Asia, through Latin America, even in newly Much of this was due to the magic of compound interest. Debt reschedulings were really con iobs. Debtor-country governments made a show of defiance by publicly insisting that they would not repudiation. Meanwhile they were quietly negotiating to build back interest into the capital sum so that interest payments would be all the heavier in, and stretch longer into, the future. In 1973, the time of the so-called oil crisis, total developing-country borrowings stood at about $100 billion. Then came both heavy borrowings and soaring interest rates. By the end of the 1990s, despite some hefty repayments (when and if debtors were able), their total debt had compounded to at least $1.5 trillion, perhaps much, much more.

GUS: THINGS HAVE GOTTEN FAR WORSE SINCE 2004, WHEN THIS WAS WRITTEN...

it's time for being earnest.....

- By Gus Leonisky at 2 Apr 2024 - 9:41am

- Gus Leonisky's blog

- Login or register to post comments

theft.....

Followers of the Austrian school of economics know that the term inflation refers to increasing the quantity of money or money substitutes. The result being a rise in the price of goods and services or a fall in the value of money. But, in the modern era, this rise in prices is called inflation and as Ludwig von Mises wrote, “This semantic innovation is by no means harmless.” The semantic change has people looking everywhere but where they should to blame for higher prices.

Bloomberg’s Enda Curran writes, “A prolonged period of elevated inflation has left consumers cranky and eager to cast blame.” With the term inflation evidently getting tiresome, Curren lists some new price increase buzzwords and phrases.

“Shrinkflation” This is the President’s favorite. He even mentioned it in his State of the Union speech. The White House posted on X, “President Biden is calling on companies to put a stop to shrinkflation.” In other words, put more cookies back in the bag or make Snickers bars the same size they used to be. Even Sesame Street’s Cookie Monster has complained his cookies were getting smaller.

“Drip Pricing” These are fees which are added for your luggage when you fly or resort fees added on to your hotel bill. Processing and service fees were called junk fees by President Biden in last year’s State of the Union speech and he vowed to fight “those hidden surcharges too many companies use to make you pay more.” As if the hotel clerk puts a gun to your head at checkout time.

“Greedflation” Ms. Curren says “It’s a modern take on profiteering — “‘making an unreasonable profit on the sale of essential goods especially during times of emergency.’” Of course, price is how goods are distributed during a shortage or any other time as opposed to, as the Economist magazine wrote,” something worse, such as rationing or queues.”

“Excuseflation” This one sounds a lot like the above-mentioned “greedflation.” Curren cites a paper by UBS AG chief global economist Paul Donovan, who claims developed economies are in a period “when some companies spin a story that convinces customers that price increases are ‘fair,’ when in fact they disguise profit margin expansion.” A baker in Chicago said on an Bloomberg Odd Lots podcast that global news events allow him to raise prices “without getting a whole bunch of complaining from the customers.”

“Sellers’ Inflation” This term is credited to Isabella Weber, an assistant professor of economics at the University of Massachusetts who claims large corporations have market power and “have used supply problems as an opportunity to increase prices and scoop windfall profits.” Her solution is price controls, which would lead to long lines and rationing.

“Disinflation” Prices are rising but at a lower rate of change.

Immaculate disinflation. Curren says this is the “optimistic notion” that Jerome Powell and the economists at the Eccles Building can bring prices under control without putting a bunch of people out of work. The Federal Reserve can either create money fast or create money slow. That’s all it has. Jerome Powell is not the economy’s Geppetto.

Murray Rothbard explained where inflation comes from everywhere and always:

The fault of inflation is not in business “monopoly,” or in union agitation, or in the hunches of speculators, or in the “greediness” of consumers; the fault is in the legalized counterfeiting operations of the government itself. For the government is the only institution in society with the power to counterfeit — to create new money. So long as it continues to use that power, we will continue to suffer from inflation, even unto a runaway inflation that will utterly destroy the currency.

Inflation, or whatever you want to call it, is nothing more than government taxation in stealth form. Only the government can conjure up new money from nothing, using it to bid away resources from private individuals.

https://mises.org/mises-wire/price-inflation-comes-government-not-excuseflation-or-greedflation

READ FROM TOP.

READ "HOT MONEY".

it's time for being earnest.....

exchange values...

The gold price has risen to a series of new all-time highs of late, a development that has received only cursory attention in the mainstream financial media. But as is the case with so much else these days, there is much more going on than meets the eye. In fact, the rise in the dollar price of gold is almost the least interesting aspect to this story.

For thousands of years, gold was the ultimate store of value and was synonymous with the concept of ‘money’. Trade was often settled either in gold itself or in bank notes backed by gold and directly exchangeable for it. Currencies backed by nothing but government decree – called 'fiat' currencies – have tended to eventually fail.

However, in 1971, gold found itself cast out of this ancient role when the US unilaterally suspended dollar convertibility into gold as enshrined in the Bretton Woods agreement that established the framework for the post-war economy. Shortly thereafter, in an act that medieval alchemists only dreamed of, gold was created out of thin air in the form of futures contracts, meaning bullion could be bought and sold without any metal changing hands – or even existing.

Besides the obvious ramification of all of this – the removal of gold backing to the dollar and thus implicitly to nearly all currencies – there are two important features of how the gold market has subsequently functioned: first, gold has essentially been reduced to trading like any other cyclical financial asset; second, the price of gold has largely been determined by Western institutional investors.

Both of these longstanding trends are now breaking down. As we will see, the importance of this development is hard to overstate. But let’s begin with a very quick examination of how gold went from being the ultimate source of value to just another ticker moving in predictable patterns in the constellation of financial instruments.

How paper replaced metalThe collapse of Bretton Woods in the late ‘60s and early ‘70s – culminating in the gold window being shut in 1971 – was a messy period of transition, uncertainty, and instability. The dollar devalued and a fixed-rate system was negotiated and soon thereafter abandoned. But what was clear was that the US was steering the world away from gold and toward a dollar standard.

Jelle Zijlstra, president of the Dutch central bank, chairman of the Bank of International Settlements from 1967 until 1981, and a prominent figure at the time, recalled in his memoirs how “gold disappeared as the anchor of monetary stability” and that “the road… through endless vicissitudes to a new dollar hegemony was paved with many conferences, with faithful, shrewd, and sometimes misleading stories, with idealistic visions of the future and impressive professorial speeches.” But, he concluded, the ultimate political reality was that the “Americans supported or fought any change, depending on whether they saw the dollar’s position strengthened or threatened.”

Nevertheless, gold was lurking in the shadows like a deposed but still-living monarch and thus represented an implicit guard against the abuse of what had become fiat currencies. If nothing else, as dollars continued to be printed, the price of gold would surge and signal a debasement of the greenback. And this is more or less what happened in the 1970s after the gold window was shuttered. After breaking the $35 per-ounce peg in 1971, gold rocketed all the way up to $850 by 1980.

So the US government had a strong interest in managing the perception of the dollar through gold. Most importantly, it didn’t want to see gold recreate a pseudo reserve currency by strengthening substantially. Legendary Fed chairman Paul Volcker once said “gold is my enemy.” And indeed it traditionally had been the enemy of central banks: it forced them to tighten rates when they didn’t want to and imposed on them a certain discipline.

This framework helps make sense of the rise of the unallocated – i.e. ‘paper’ – gold market in the 1980s and the countless gold derivatives that emerged. This actually started in 1974 with the launch of gold futures trading but exploded in the next decade. What happened is that bullion banks began selling paper claims on gold for which there was no actual gold attached. And buyers were not actually required to pay upfront but could simply leave a cash margin.

READ MORE:

https://www.rt.com/business/595122-west-losing-gold-east/

READ FROM TOP.

READ "HOT MONEY".

it's time for being earnest.....

job, job, jobs....

https://www.youtube.com/watch?v=ctk2bZ3Z8uU

BREAKING: Shocking U.S. Labor Report with 303,000 Jobs Added Is NOT What You ThinkREAD FROM TOP.

READ "HOT MONEY".

it's time for being earnest.....

attack on workers....

https://www.youtube.com/watch?v=zfgKTZHcHQM

Billionaires are pillaging America. How do we fight back? | The Chris Hedges ReportREAD FROM TOP

FREE JULIAN ASSANGE NOW....