Search

Recent comments

- success....

2 hours 20 min ago - seriously....

5 hours 4 min ago - monsters.....

5 hours 11 min ago - people for the people....

5 hours 47 min ago - abusing kids.....

7 hours 20 min ago - brainwashed tim....

11 hours 40 min ago - embezzlers.....

11 hours 47 min ago - epstein connect....

11 hours 58 min ago - 腐敗....

12 hours 17 min ago - multicultural....

12 hours 24 min ago

Democracy Links

Member's Off-site Blogs

biden's heroes: sergeant shultz was doing everything he could to help the americans....

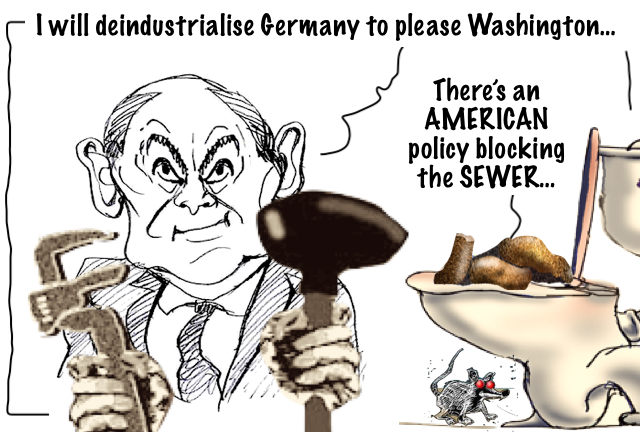

According to the good professor Richard Wolff, in the German law system, German industries have the right to sue the German government for bad policies that affect their performance. This is why Siemens and others such as WW, are demanding massive COMPENSATION (billions of Euros) for the impact that sanctions on Russia have had on their business, as well as the destruction of the Nord Sea pipelines.

By Gus Leonisky, Esq

Actually, apparently only three of the pipelines were destroyed by the Americans, but should the last one be used by Germany to get cheap gas from Russia, the Americans would fall on Germany like a couple of tonnes of old St Peters bricks…

Meanwhile, it appears that the sanctions on Russia have forced Russia to improve its industrialisation, improving its financial prospect and making three times more bombs (tanks, planes, ships, tubes) than all the Western countries can manage, while the West — mostly Europe — is de-industrialising to please the Yankees.

So the Europeans are getting hammered…. Until Europe de-couple from America, they will carry on to be hammered. But nothing will happen to de-Americanise Europe as long as the American trained bobbingkers such as Von de Leyen, Michel, Macron, Borrell, Scholz, or even Maroni hold the reins to the half-dead nag Europe is presently.

And the boffins in Washington are laughing at the EU, while preparing to destroy the rest of the world (and themselves too), something that Putin and Xi are trying to prevent. We should be so lucky….

Meanwhile, as Neil deGrasse Tyson said on his program: we’re F••ked. Global warming which in 2023 was demonstrated as the “warmest year on record, BY A HUGE MARGIN, Gus had been predicting this eventuality (we’re f**ked) since (actually before that) the inception of this little website, you're reading at this instant…

Ah yes, as predicted last year by Gus, Sydney is suffering from a WET El Nino…. that some people call a return of “La Nina”…

De-industrialisation may be de rigeur to save the planet form warming beyond our acceptable comfort… but there always will be some smart arses (LET ME GUESS: THE AMERICANS) who will re-industrialise at the expense of others and throw the necessary process of individual basket-weaving and bicycling out of whack!

Meanwhile, as Yuckraine is being whacked slowly, like a frog being incrementally boiled, we should tell Valery Zaluzhny to sack Zelensky today (tada) and make a deal with Russia...

MAKE A DEAL PRONTO BEFORE THE SHIT HITS THE FAN:

NO NATO IN "UKRAINE" (WHAT'S LEFT OF IT)

THE DONBASS REPUBLICS ARE NOW BACK IN THE RUSSIAN FOLD — AS THEY USED TO BE PRIOR 1922. THE RUSSIANS WON'T ABANDON THESE AGAIN.

CRIMEA IS RUSSIAN — AS IT USED TO BE PRIOR 1954

A MEMORANDUM OF NON-AGGRESSION BETWEEN RUSSIA AND THE USA.

EASY.

THE WEST KNOWS IT.

FREE JULIAN ASSANGE NOW....

- By Gus Leonisky at 2 Feb 2024 - 7:38am

- Gus Leonisky's blog

- Login or register to post comments

losing cash....

The German government is preparing to sell part of its 99% stake in the country’s main gas importer Uniper, which was bailed out during the energy crisis of 2022, Bloomberg reported on Wednesday, citing people familiar with the matter.

Uniper, which is reported to have suffered one of the biggest losses in German corporate history of a staggering €40 billion ($43 billion), was brought to the brink of bankruptcy in 2022 due to surging energy prices and the halt in gas flows from Russia, its major supplier. The company was subsequently nationalized in December 2022.

According to the outlet, the German government may offer the stake late this year or in 2025. The deal could happen via a stake sale or a so-called re-IPO, but the government would likely remain a majority shareholder, sources said.

The sale of Uniper’s shares would provide Germany with a much needed influx of money after the country was plunged into a budget crisis triggered by the top court’s decision to block the use of funds left over after the pandemic.

Citing a Uniper representative, the outlet noted that, in approving the bailout that included up to €34.5 billion in state aid to prevent the company from collapsing, the European Commission obliged Germany to reduce its stake to 25% or less by the end of 2028.

READ MORE: Russian gas fueled German industry – UniperBloomberg noted that Germany’s Finance Ministry declined to comment, as did a Uniper spokesperson, who said merely that the company was “in constant dialogue with the German government as our owner.”

Sources said that Berlin’s stake is currently worth around €23.7 billion but that the shares would probably be priced at a discount to the current price.

https://www.rt.com/business/591615-germany-uniper-stake-sale/

READ FROM TOP.

FREE JULIAN ASSANGE NOW.......

231 bases....

Eric Zuesse (blogs at https://theduran.com/author/eric-zuesse/)

Germany, with 231 U.S. military bases on its soil, is a U.S. colony, and therefore hides from its public that the U.S. Government not only had perpetrated the bombing of the Nord Stream pipelines that were supplying Germany with inexpensive energy that German industry and consumers had been relying upon for over a decade so as to be internationally competitive, but both America’s President Biden and his agent Victoria Nuland promised on several occasions to end those pipelines, and the great American investigative journalist Seymour Hersh reported that Biden personally oversaw the operation that bombed them. Germany’s media hide the reality that its Government does the bidding of the U.S. Government (which represents America’s billionaires) even when it means destroying the Germany economy.

Here’s an example of this deception of the German public by their media, from today’s ‘news’ in Germany (autotranslated by Google):

https://www.bild.de/politik/inland/politik-inland/schwaecht-das-duell-die-afd-das-will-scholz-das-will-merz-86999992.bild.html

https://www-bild-de.translate.goog/politik/inland/politik-inland/schwaecht-das-duell-die-afd-das-will-scholz-das-will-merz-86999992.bild.html?_x_tr_sl=de&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=wapp&_x_tr_hist=true

https://archive.is/ERttB

READ FROM TOP.

FREE JULIAN ASSANGE NOW.....................

unpopular.....

https://www.youtube.com/watch?v=U_yN_zE_FCo&t=143s

Prof. Jeffrey Sachs: America the Bully.READ FROM TOP.

FREE JULIAN ASSANGE NOW.....................

tired?....

Germany’s economy is dying. Here’s why and what happens next

The once mighty growth engine of the EU now seems vulnerable as the threat of deindustrialization looms

Russian Market

German Finance Minister Christian Lindner, injecting some humor at the recent World Economic Forum in Davos, stated that Germany is not the “sick man” of Europe but rather “a tired man,” following the recent years of crisis, in need of a “good cup of coffee.”

However, the economic indicators point to something more than fatigue. Although Germany could be described as merely being in a mild recession – the GDP readings, after all, can hardly be called awful – in reality the economy finds itself in the uneasy place of having no clear prospects for an imminent recovery.

Economic figures paint a darkening pictureInitial estimates suggest a 0.3% decline in GDP in 2023, positioning Germany as the only major industrialized nation in the red. Germany’s national debt saw an increase of about €48 billion, reaching almost €2.6 trillion. While this may appear alarming at first glance, it’s crucial to consider the broader economic context. Germany’s debt-to-GDP ratio, standing at approximately 65%, is relatively favorable compared to many Western countries.

Moreover, Germany has implemented strict limits on deficits, demonstrating a commitment to financial prudence. In light of these measures, there is a counterargument that Germany could potentially consider taking on more debt.

Sentiment among businesses deteriorated further at the beginning of the year, as illustrated by the ifo Business Climate Index in January, which fell to 85.2 points. Both the current situation and expectations for the coming months were evaluated more pessimistically. The ifo Institute has reduced its growth forecast for 2024 to 0.7%, compared to the previously predicted 0.9%. This downgrade is partially attributable to additional cuts in the federal budget, which became necessary due to a ruling by the Federal Constitutional Court that prohibited leftover Covid-stimulus funds from being repurposed.

Deindustrialization in Germany: A growing concernThe German economy is on the brink of a crisis as deindustrialization firmly takes root. Companies, driven by economic considerations, are increasingly relocating their production overseas, posing a significant threat to a nation heavily reliant on industrial output. This trend has immediate and profound consequences that extend beyond the evident impact on industrial sectors. The offshoring of production could entail a surge in layoffs, further aggravating the economic challenges faced by the workforce.

In November 2023, according to preliminary data from the Federal Statistical Office (Destatis), German exports experienced a decline of 5.0% year-on-year, while imports recorded a notable decrease of 12.2%.

While the primary focus is on the industrial landscape, it is crucial to acknowledge the interconnectedness of these shifts. A case in point is the German chemical industry, which finds itself in a deep and prolonged downturn, having lost approximately 23% of its production capacity. Furthermore, leading managers have expressed considerable skepticism about a swift recovery. The challenges are exacerbated by Germany’s struggle with high energy costs, particularly affecting industries engaged in global competition. Despite government attempts to counteract these challenges, such as a billion-dollar electricity price package, success has been limited.

Meanwhile, according to a report by Deloitte, an alarming two out of three German companies have partially relocated their operations abroad due to the country’s ongoing energy crisis. This trend is particularly pronounced in critical sectors, such as mechanical engineering, industrial goods, and automotive industries, where 69% of companies have relocated their operations to a moderate or large extent.

Key findings from the Deloitte report shed light on the reasons behind this significant shift. Most businesses attribute their decisions to move operations overseas to the combination of high energy prices and inflation. Notably, companies in these industries are planning to relocate not only low-skilled component production but also, to a lesser extent, high-skilled production processes.

Germany’s attempts to shift toward green energy agenda have also contributed to the rise in electricity prices, further aggravating the situation. Deloitte partner Florian Ploner warns of widespread deindustrialization occurring on a significant scale, with the potential for more companies to follow suit if electricity prices remain high. The bleak outlook for Germany is compounded by skepticism among companies about the government’s ability to address their concerns. Despite companies saying that increased subsidies and reduced bureaucracy would encourage them to stay, there is little confidence that the current government will take the necessary actions to prevent further departures.

Contrasting trajectories: US thrives while Germany struggles amid sanctions impactAs 2024 unfolds, a striking disparity in the economic trajectories of the US and Germany becomes evident. While the US has been surpassing expectations, Germany, entangled in the repercussions of Russian sanctions, faces a precarious descent into recession.

The resilience of the US economy is evident in the final quarter of 2023, which saw a growth rate of 3.3%, a performance that surpassed economists’ projections. Notably, inflation in the US has receded from its peak of 9% in June 2022 to a more manageable 3.4%.

In stark contrast, Germany stands at a critical crossroads. The situation is further complicated by warnings of a politically motivated shift, particularly towards green energy, posing additional hurdles for major companies and casting a shadow over the nation’s economic landscape. The reluctance of the German government to acknowledge the true costs of its industry, coupled with the decision to abandon Russian gas, appears to be a misstep that has inadvertently weakened its economic standing.

The reality now unfolds: the US economy emerges stronger, while Germany, adhering to the Washington agenda and bearing the brunt of Russia sanctions, faces the consequences of an erroneous course.

A significant aspect of Germany’s predicament lies in its steadfast alignment with the Washington agenda and the consequential impact of Russia sanctions. The sanctions have placed a considerable burden on Germany’s economic machinery while serving no national interest. Industries, especially those with strong ties to Russian markets, find themselves grappling with disrupted supply chains, reduced exports, and heightened uncertainty.

This alignment with Washington has exposed Germany to economic vulnerabilities that will not be easy to overcome. Recessions come and go, but what Germany is confronting is deeper than a mere downturn: the underpinnings of its prosperity have been ripped out, while there is no quick fix to restructure the economy.

https://www.rt.com/business/591580-germany-economy-shrinks/

READ FROM TOP.

FREE JULIAN ASSANGE NOW.....................