Search

Recent comments

- success....

47 min 40 sec ago - seriously....

3 hours 31 min ago - monsters.....

3 hours 38 min ago - people for the people....

4 hours 15 min ago - abusing kids.....

5 hours 48 min ago - brainwashed tim....

10 hours 8 min ago - embezzlers.....

10 hours 14 min ago - epstein connect....

10 hours 25 min ago - 腐敗....

10 hours 44 min ago - multicultural....

10 hours 51 min ago

Democracy Links

Member's Off-site Blogs

the widely predicted global recession has yet to occur.....

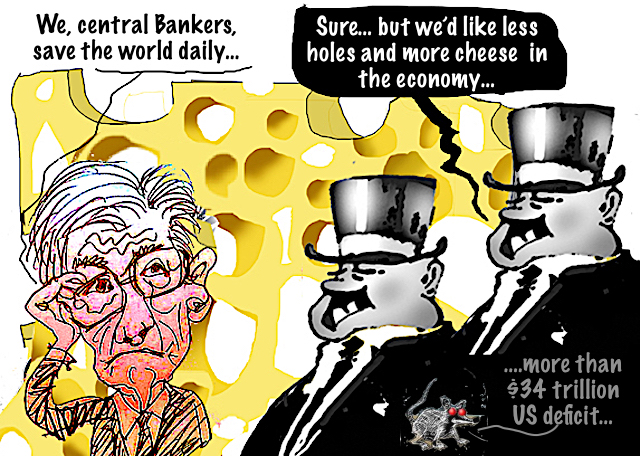

To hear it from bulls, the newborn year already belongs to central banks. Reviled not long ago for letting prices surge, Federal Reserve Chair Jerome Powell and his peers have been anointed by traders as saviours of the world. Those clapping the loudest probably don’t know how right they are.

The widely predicted global recession has yet to occur, inflation is coming down quickly, and interest rate cuts are projected. As welcome as this development is, don’t imagine for a second that the lords of finance are going into repose. It’s never mission accomplished. Central banks will occupy an ever-more important position in the economic and security life of nations, if history is any guide.

SEE ALSO: https://www.youtube.com/watch?v=zrTgTd6hJHM

FREE JULIAN ASSANGE NOW......................

- By Gus Leonisky at 4 Jan 2024 - 7:13pm

- Gus Leonisky's blog

- Login or register to post comments

false flags.....

https://www.youtube.com/watch?v=GqNWKJENDLY

Col. Douglas Macgregor: Wrongheaded US Military Priorities.READ FROM TOP.

FREE JULIAN ASSANGE NOW....................

shrinkflation......

French supermarket Carrefour is telling shoppers that it will no longer sell PepsiCo products such as carbonated soda drinks Pepsi and 7up and Lay’s chips products because they’ve become too expensive, Reuters has reported.

According to the outlet, a spokesperson for France’s second biggest grocery has chain confirmed that it will place a note on shelves that have displayed PepsiCo goods which reads “We are no longer selling this brand due to unacceptable price increases.” It is unclear whether PepsiCo products already on Carrefour shelves will be withdrawn, the report added.

In October, PepsiCo warned of “modest” price hikes in the new year amid steady demand. The US snacking and beverage giant has raised prices for seven consecutive quarters, hiking them by double digits in the July-September period last year. The company also reduced package sizes of some of its products claiming the aim was “to meet consumer demand for convenience and portion control.”

(WHEN FRENCH WOMEN GO TO THE GYM AS THEY BECOME TOO FAT, YOU KNOW THAT THEY NEED "PORTION CONTROL" AND GO BACK TO FRENCH DIET OF CREAM AND ESCARGOTS — RATHER THAN AMERICAN HAMBURGERS....)

Last year, amid high consumer inflation, grocery retailers in several EU countries challenged global food giants over prices. Carrefour started a “shrinkflation”campaign in September, sticking warnings on goods that have shrunk in size but cost more.

Negotiations are underway in France between food manufacturers and retailers, with the latter demanding price cuts, as they say prices for raw materials and energy have recently come down. Food industry representatives argue that production costs remain high and that manufacturers have absorbed significant inflationary shocks.

https://www.rt.com/business/590114-carrefour-france-drops-pepsico-products/

READ FROM TOP.

FREE JULIAN ASSANGE NOW.............

sugar high....

JPMorgan Chase CEO Jamie Dimon issued a stark warning to Wall Street on Wednesday: Inflation could rise further and recession is not off the table.

“A lot of things out there are dangerous and inflationary. Be prepared,” he said at the 2023 New York Times DealBook Summit in New York. “Interest rates may go up and that might lead to recession.”

Governments across the globe need more money, he said, to fund the green economy, remilitarize and to address energy crises — and that will all be inflationary.

“I’m cautious about the economy,” he said. The labor market in the United States has been resilient, but “inflation is hurting people.”

Stimulus money handed out during Covid shutdowns and quantitative easing by the Federal Reserve had injected “drugs directly into our system” and caused an economic “sugar high,” said Dimon. But that’s fading. “I think quantitative easing and tightening and these geopolitical issues can bite,” he said.

In previous interviews, Dimon has said that the Fed may be far from finished with its aggressive regimen of interest rate hikes in the fight against elevated inflation, and that it’s possible the central bank will continue hiking rates by another 1.5 percentage points, to 7%.

Geopolitical woesDimon stressed that this may be the most dangerous time the world has seen in decades and that the wars in Ukraine, Israel and Gaza could have far-reaching impacts on energy and food supply, trade and geopolitical relationships. It could even, he said, lead to “nuclear blackmail.”

Mankind faces huge risks, he said. One is obviously war in Eastern Europe and the Middle East. But beyond that, Dimon is worried about nuclear proliferation, climate change and the risk of another pandemic.

The United States, he said, needs to make sure it has “the best military in the world, bar none.” It’s an expensive task, he said, but the stakes are high, “This is about keeping the Western world together,” he said at the DealBook Summit. “We need American leadership to make sure this all stays together. I don’t want a book written in 50 years about how the West lost.”

Business in ChinaJPMorgan Chase does business with TikTok’s parent company ByteDance and is partially underwriting the planned IPO of Chinese fast-fashion company Shein, according to a recent report from Reuters.

Dimon said on Wednesday that he’ll follow the lead of the US government when it comes to doing business in China but that he believes companies like Shein do not present a threat to US national security.

While some US lawmakers have said that TikTok is a national security threat, Dimon countered that JPMorgan Chase does due diligence on all of its clients.

https://edition.cnn.com/2023/11/29/investing/jamie-dimon-recession-jpmorgan-economy/index.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW.............