Search

Recent comments

- cow bells....

13 hours 5 min ago - exiled....

18 hours 7 min ago - whitewashing a turd....

19 hours 6 min ago - send him back....

20 hours 36 min ago - the original...

22 hours 25 min ago - NZ leaks....

1 day 8 hours ago - help?....

1 day 9 hours ago - maps....

1 day 9 hours ago - bastards...

1 day 15 hours ago - narcissist.....

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

specialised banking centres for your inconvenience.....

enough is enough — bring him home......

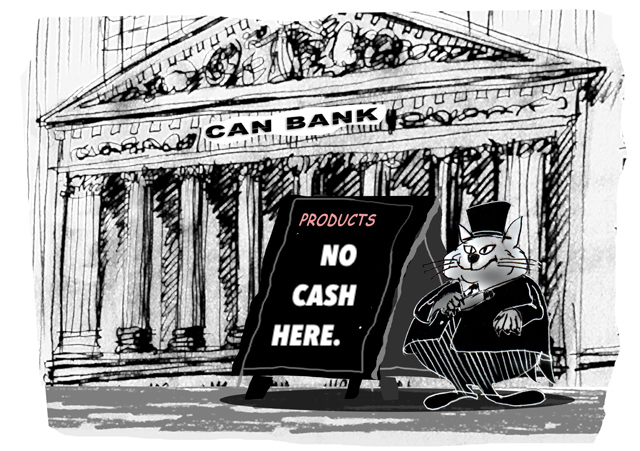

In many branches across Australia, Commonwealth Bank has decided to abolish cash withdrawals and deposits. These branches of CommBank have therefore become “ cashless ”. Earlier this year, ANZ ( Australia and New Zealand Banking Group ) said it had also phased out cash.

Withdrawing money is getting harder and harder in AustraliaCommonwealth Bank has opened a number of 'cashless' branches with customers who can no longer access their money in cash. Cash over the counter transactions are not available at these branches, including Commonwealth Bank Place which is located in central Sydney. Same situation in Brisbane and Melbourne. These cashless branches are called “specialized centers”.

Deposits and withdrawals can still be made through on-site ATMs, but for those who don't have their bank card handy, things get much more difficult. " Card-free cash " withdrawals of up to $500 per day using the CommBank app are available, but for those who need more funds or don't have their phone with them, their cash is not accessible.

In March, another banking group did the same: the Australia and New Zealand Banking Group announced that it was cutting some of its services and that some branches would no longer have cash. He did not, at the time, reveal which branches would be affected, but insisted it would be only a “small number”.

This dominance of digital banking raises concerns that society has become too dependent on potentially vulnerable systemsIn a statement, ANZ said it was standing by its 'cashless' decision and clarified which branches are affected: " Some ANZ branches no longer handle cash over the counter, but continue to have cash available via our on-site smart ATMs ”.

The dominance of digital banking raises fears that society has become too dependent on potentially vulnerable systems. Indeed, Commonwealth Bank customers were crippled after the bank's app crashed earlier this month, preventing them from accessing their accounts, transferring funds online or using their cards to make purchases.

The outage sparked a barrage of angry calls and social media posts from worried customers who wanted to know why they couldn't use the bank's services, including some ATMs. In conclusion, experts argued that the troubling episode of Commonwealth banking is a glimpse into what can go wrong when people rely too much on online banking instead of keeping cash on hand. Ancient.

Cybersecurity expert Ben Britton, who works as an information security officer, told Daily Mail Australia that events like these have exposed the vulnerabilities of overreliance on digital payments: " If there's no internet, there's no transactions, there's no access to your money ," he said.

“ But if you have your money in your hand or in your pocket, there may be no electricity and you can still make payments to people. The huge weakness of the system is that it depends on the internet, internet security and individual device security. While no one can remotely access the cash in your pocket ”.

All-digital enables greater control of society by banks and governmentsBen Britton also points to the exponential possibilities for cybercrime. According to him, many criminals have stopped selling drugs, turning instead to online fraud because it is much more profitable and they are much less likely to be caught, as online transactions have opened up new frontiers for criminals. in terms of how many people they can target and huge amounts of money they can steal:

“ If you look at a cybercriminal organization or individuals who are cybercriminals who want to steal from a large number of people, they can steal millions of dollars from tens of thousands of people in a day. It would not be possible to go and do that in the street, depriving citizens of their cash. The old system, physical coins and cash, has worked for thousands of years. It definitely has its issues, but we know what they are but if you look at the digital world, there are so many unknown issues that we haven't even encountered yet ”.

Another disadvantage of a cashless society is the lack of privacy. Every time you pay for something digitally, it leaves a digital footprint, which can be monitored by banks, and governments.

This is why, despite these dangers of all digital, there is a political will on the part of the globalists to make cash disappear, which will facilitate the control society desired by the tenants of Davos.

- By Gus Leonisky at 27 Jul 2023 - 7:35am

- Gus Leonisky's blog

- Login or register to post comments

shrinking cash....

YOUR MONEY IS SHRINKING BECAUSE OF THE OLD FARTS IN WASHINGTON....

https://www.youtube.com/watch?v=rgQ2nO72PWk

Richard Wolff on How Russia Defeated the EU and US Sanctions RegimeEconomist Richard Wolff exposes how the neocon foreign policy establishment in the US and its allies have lost the economic war that they brought upon Russia.

READ FROM TOP.

enough is enough — bring him home......

families business.....

By Neenah Payne

The July 27 article by Dr. Joseph Mercola “Chase Shuts Down Bank Accounts of Mercola and Key Employees” (now in his paid Substack) reported:

July 13, 2023, JP Morgan Chase Bank suddenly informed me they are closing all of my business accounts, both banking and investment accounts, along with the personal accounts of my CEO, my CFO and their respective spouses and children. No reason for the decision was given, other than there was “unexpected activity” on an unspecified account. The oldest of these accounts has been active for 18 years….

My CFO, Amalia Legaspi, whose Chase accounts — including a joint account with her husband — were closed along with mine, is now struggling to figure out how to pay for her husband’s health care in the Philippines. He’s bedridden with dementia and is wholly dependent on her financial support, and she’s not allowed to open another bank account in his name.

Legaspi’s son’s account — which he’s using to pay for college expenses — was also cancelled. My CEO, Steven Rye, believes his and his wife’s accounts were shut down because of my opinions on COVID-19. He told Florida’s Voice: “I believe they cancelled all of the accounts because of Dr. Mercola’s (our employer) opinions. He has carried a contradictory view throughout the COVID narrative and co-authored the best-selling book The Truth About COVID-19, which exposed the likelihood that this virus was engineered in a laboratory funded by the NIH.”

In May 2023, Florida Gov. Ron DeSantis signed legislation specifically prohibiting financial institutions from denying or canceling services based on political or religious beliefs.

Apparently, Chase Bank is bowing to some other “authority,” and perhaps they refuse to cite a specific reason for the cancellation, “for legal reasons,” is because they know they’re acting unlawfully.

Generational Punishment for Wrongthink

On top of closing the accounts of Rye and his wife, Rye also was told his young children will not be able to open accounts with Chase Bank. “It’s just hard to believe that your family, your wife, your kids can’t have a bank account because of the opinions of your employer and they’ve never done anything wrong. We all have completely clear records,” Rye told Florida’s Voice.

In a voicemail reply, a Chase Bank representative told Rye the reason for closing his personal accounts and that of his wife could not be disclosed “for legal reasons.” He was, however, told he could submit paperwork to have their accounts reconsidered. “We are going to try because you’re a good client of our institution,” the representative said.

While a common suggestion is to “just go with a small bank,” this is not an ideal solution for many companies, as small banks are getting destroyed and won’t get bailouts. Even if a small local bank is FDIC insured, that only covers up to $250,000.00 of total deposits between all accounts. That amount would not cover a single payroll. As an online business, you also have requirements for payment gateways and merchant accounts — and cryptocurrency does not have the infrastructure or general acceptance to support most businesses.

Chase Bank Holds Moral Low Ground

Mercola Market has more than 150 employees and thousands of vendors that farm, process, manufacture, distribute and manage the logistics of our business. Will the banks go after all of our employees? Will they start closing the accounts of our contractors? Will they go after our customers?

Again, this is the social credit system in action. Just imagine how easy it will be to control people’s expressions and actions once all currency is digital, centrally controlled and mandated. This could happen to anyone. My CFO and CEO are not me. They’re not directly engaged in the dissemination of my views, and their spouses and children most certainly have nothing to do with my business or my views. Yet they’re being “punished” too, merely because they’re related to people who work for me.

Imagine being retaliated against for something your neighbor, your employer, a friend or some distant relative has said or done. That’s our future, unless we all refuse to play along. It’s crucial to reject CBDCs and to do everything in your power to not enter into that system. The life and freedom of your children and grandchildren depend on it. Your actions today will shape the future of your descendants, perhaps in perpetuity.

In closing, let me remind you that if Chase Bank is trying to stand on some moral high ground, they can’t. While they may think they’re doing the world a favor by debanking socalled “anti-vaxxers,” they had no problem aiding and abetting child sex trafficking efforts by the likes of Jeffrey Epstein. They didn’t cut ties with that notorious pedophile until a few months before his death.

Dr. Mercola’s July 15 Article on The RockefellersSo, Dr. Mercola and his staff seem to have concluded that Chase banned all their accounts because of Dr. Mercola’s position on the official COVID 19 policies. A Google search returns many articles on Chase’s ban of Dr. Mercola which all assume Chase banned Dr. Mercola because of his stance on COVID.

However, Dr. Mercola has been publishing his position on COVID for three years. So, what caused Chase’s sudden ban? Did Chase (owned by the Rockefeller family) ban Dr. Mercola on July 13 because it knew he planned to publish The Greatest History Never Told on July 15? The article discusses the link between the Rockefeller family and the plan to control the world. If so, that suggests either there is a mole in Dr. Mercola’s organization who alerted the Rockefellers or someone who is in touch with the Rockefellers has other access to Dr. Mercola’s plans for upcoming articles.

That article now in his paid Substack was reprinted by permission of Dr. Mercola. It links to the video The Greatest History Never Told. In the video, Ivor Cummins, a biochemical engineer with a background in medical device engineering and leading teams in complex problem-solving, interviewed Jacob Nordangard, a Swedish researcher and author who has a Ph.D. in technology and social change, a Master of Social Science in geography, and a Master of Social Science in culture and media production.

The article provides the following summary:

Ivor Cummins interviews Jacob Nordangard, a Swedish researcher and author, about The Great Reset and plans for a totalitarian future. The interview takes you on a journey from the late 19th century to present day, laying out the nefarious path of how we ended up in the place we are today, on the verge of takeover by a corrupted few.

Nordangard is the author of Rockefeller: Controlling the Game, a book that explores how this prominent family funded and shaped key aspects of society, from environmental and climate research to education, medicine, politics and agriculture, all using propaganda techniques.

The Rockefellers’ goal was a transformation of the world’s economy, culture, and governments into a new world order — with the Rockefellers and their select cronies at the helm. Much of the new world order’s plans are based on crisis management, and the idea that a great crisis will occur that will lead to the great transition, where globalists will swoop in to save the day, transforming society into the promised paradise — which actually takes away sovereignty.

Global Fear Narrative Is Designed To Create ObedienceThe article explains how John D. Rockefeller, the world’s richest man in the early 20th century, created a plan to control every aspect of global society. Rockefeller used the wealth he made in oil to take over medicine to force out naturopathic approaches. That allowed him to force medicine to be based on oil-derived drugs to treat symptoms to further enrich his family.

The Rockefellers created the United Nations which led to the World Health Organization. Their protégé Henry Kissinger tutored Klaus Schwab, founder of the World Economic Forum who is advocating The Great Reset and The Fourth Industrial Revolution. The Rockefellers drove The Green Revolution. The goal is global control by a tiny unelected cabal. Various crises are created to instill mass fear and encourage unquestioning obedience and compliance. Excerpts of the article are copied below.

The Rockefellers’ rise to power

In the late 19th century, John D. Rockefeller became the richest man in the world. He started Standard Oil Corporation in 1870, which soon came under fire. In 1911, Standard Oil was ruled an unreasonable monopoly and split into 34 companies, which became Exxon, Mobil, Chevron, Amoco, Marathon and others.

To improve his image and exert more world control, Rockefeller got into philanthropy, allowing him to avoid taxation and put money into society in ways that would benefit his businesses. Rockefeller founded the University of Chicago and the Rockefeller Institute for Medical Research, allowing him to set the research agenda to further their own interests.

Then, in 1913, John D. Rockefeller set up the Rockefeller Foundation….

The Foundation, in partnership with Andrew Carnegie and educator Abraham Flexner, then set out to centralize U.S. medical schooling, orienting it to the “germ theory” of disease, which states that germs are solely responsible for disease and necessitate the use of pharmaceuticals to target said germs.

With that narrative in hand, Rockefeller financed the campaign to consolidate mainstream medicine, adopt the philosophies of the growing pharmaceutical industry and shutter its competition. Rockefeller’s crusade caused the closure of more than half of U.S. medical schools, fostered public and press scorn for homeopathy, osteopathy, chiropractic, nutritional, holistic, functional, integrative and natural medicines, and led to the incarceration of many practicing physicians.

What many don’t realize, however, is that the Rockefeller Foundation was the precursor to the World Health Organization and also played an important role in the transition of the League of Nations to the United Nations….Here again you’ll notice a connection to modern-day Bill Gates, who tried to monopolize the early computer market with his software company Microsoft. Using PR and philanthropy, he was able to change his ruthless corporate image to one of a generous philanthropist. But, like Rockefeller, Gates uses his donations to grow his own wealth, as the money spent on “charity” ultimately ends up benefiting his own investments and/or business interests.

Creating problems of global scale

In order to establish a new world order, there needs to be problems that are global in scope. The Rockefellers contacted influential people to discuss what problems would apply, settling on science as a buzzword, with global health and pandemics, along with oceanography and meteorology, as areas in need of management. “They’re perfect to make a global fear narrative,” Cummins says….

In the 1950s, the Rockefellers picked up Henry Kissinger, who mentored Klaus Schwab, World Economic Forum cofounder and chairman. Kissinger recruited Schwab at a Harvard international seminar, which was funded by the U.S. CIA. The Rockefellers and early WEF affiliations can also be tied back to the Club of Rome, a think tank that aligned with neo-Malthusianism — the idea that an overly large population would decimate resources — and was intending to implement a global depopulation agenda. Then, in 1972, a United Nations meeting about climate change was held to come up with a plan to manage the planet in a sustainable manner. This led to the creation of Agenda 21 (Agenda for the 21st Century) — the inventory and control plan for all land, water, minerals, plants, animals, construction, means of production, food, energy, information, education and all human beings in the world….

The Great Transition

Much of the new world order’s plans are based on crisis management, and the idea that a great crisis will occur that will lead to the great transition, where globalists will swoop in to save the day, transforming society into the promised paradise. The idea of the great transition came about in 2002, as the 2000s were deemed crucial years in pushing Agenda 21 forward. But the COVID-19 pandemic ultimately served this purpose.

Cummins explains: “It [the pandemic] truly was a trigger. It created horrific dystopia mandates. Anti-science became the new science. Every single thing in COVID was antiscientific. Essentially, in the end, we know that, but it was a trigger for a massive splurge of all of their climate strategies, transgender society atomization strategies have exploded and there’s also a massive change in immigration … We don’t want to get into immigration in this discussion but it has been many times identified as a way of breaking down nationalism … the United Nations … made it clear we need to destroy national, we need to destroy sovereign nations …”

Meanwhile, WEF introduced stakeholder capitalism and its young global leaders program, along with the idea of managing problems using public-private partnerships. WEF’s “Young Global Leaders” program, which is essentially a five-year indoctrination into their principles, with a goal of creating world leaders who don’t answer to their people but to their bosses at WEF. Graduates include Canadian Prime Minister Justin Trudeau, France’s President Emmanuel Macron, Alicia Garza, who cofounded the Black Lives Matter movement, and even actor Leonardo DiCaprio. WEF’s annual “Global Risks Reports” started in 2004 to outline the most severe risks we may face in coming years. They then put together working groups, composed mostly of multinational corporations, work on the big agenda.

In 2019, WEF entered into a strategic alliance with the United Nations, which called for the UN to “use public-private partnerships as the model for nearly all policies that it implements, most specifically the implementation of the 17 sustainable development goals, sometimes referred to as Agenda 2030.” Agenda 2030 is composed of 17 sustainable development goals with 169 specific targets to be imposed across the globe.

The Great Reset Is Launched

Soon after the COVID-19 pandemic began, global leaders and WEF began calling for The Great Reset. For instance, in June 2020, King Charles, then the Prince of Wales, announced he was launching a “new global initiative, The Great Reset,” along with WEF and His Royal Highness’ Sustainable Markets Initiative. A tweet from Clarence House stated: 16 17 18 19 20 “#TheGreatReset initiative is designed to ensure businesses and communities ‘build back better’ by putting sustainable business practices at the heart of their operations as they begin to recover from the coronavirus pandemic.”

Embedded in this future world order will be widespread digitization, data collection and digital IDs intended to track and trace the global population. The United Nation’s Summit of the Future is scheduled for 2024, honing in on “the triple planetary crisis,” the COVID19 pandemic and the Ukraine war to instill fear and propel their agenda forward.

Described as a “once-in-a-generation opportunity to enhance cooperation on critical challenges and address gaps in global governance, reaffirm existing commitments including to the Sustainable Development Goals (SDGs) and the United Nations Charter, and move towards a reinvigorated multilateral system that is better positioned to positively impact people’s lives,” — this is but one more checkmark toward reaching the new world order the Rockefeller’s first dreamed up so many years ago. In order to survive in this brutal climate, a new societal contract will be necessary, they’ll say — one in which we all become citizens of the world.

As Cummins says: “So, the citizens that were sovereign and national, we had all this beautiful diversity around the world and people traveled between all cultures. We now are all responsible as some kind of global pawns to help commit, to fix the made-up nonsense crises that they’ve created. And a big part of the plan will involve readying for the next crisis — and obeying their orders on how to react when it occurs. They’ll put emergency platforms into place under the promise that they’ll dissolve once the crisis is solved. But if the crisis never ends, neither will their new authoritarian regime.”

Nordangard adds, “It’s a very big part of this, so everyone should be prepared for a crisis, and they will also have protocols that tell them what to do when the crisis hits … everybody has to obey.” For more details and documentation of this important history lesson that’s rarely told, be sure to pick up a copy of Nordangard’s book, Rockefeller: Controlling the Game.

Jacob Nordangard is the author of the 2022 book Rockefeller: Controlling the Game, which explores how that family funded and shaped key aspects of society, from environmental and climate research to education, medicine, politics and agriculture, all using propaganda techniques

The Rockefellers’ goal was a transformation of the world’s economy, culture and governments into a new world order — with the Rockefellers and their select cronies at the helm. Much of the new world order’s plans are based on crisis management, and the idea that a great crisis will occur that will lead to the great transition, where globalists will swoop in to save the day, transforming society into the promised paradise — which actually takes away sovereignty.

Dr. Mercola points out that Cummins and Nordangard fail to explain the connection between Rockefellers and the powerful British family, the Rothschilds.

Book Description

This is a thrilling and paradoxical story of how the family that made the world dependent on oil has funded environmental and climate research since the 1950s, helped shape climate policy since the 1980s, and supported climate activism since the 1990s.

The Rockefeller family’s long-standing battle against climate change contains elements of sophisticated propaganda techniques, futurism, and New Age philosophy, aiming at a complete transformation of the whole earth system, including economy, ecology, culture, and humanity itself. The Rockefeller Foundation’s stated mission to “promote the well-being of humanity throughout the world” has a dark flipside.

This book introduces the Rockefeller family’s most influential members, businesses, philanthropies and associates, and highlights their unprecedented influence over areas such as education, medicine, agriculture, art, architecture, population control, and geopolitics.

Dr. Mercola’s 7/16/23 email “Rise Against the Cabal: Can We Crush This Untouchable Empire?” links to his article below which is now on his paid Substack. The article includes the video below in which Dr. Meryl Nass explains the Rockefellers’ connection to the global health coup starting about 30 minutes. The article begins:

Launch of a New Doorway to Freedom

“The moment of reckoning has arrived. Dark forces, shrouded in a cloak of goodwill, plot to seize the reins of our existence. It’s our turn to rise, decipher their sinister plans and erect an unyielding barricade against their march.”

The summary of the article explains:

The World Health Organization is laying the foundation to take control over all aspects of everyone’s lives, across the world, under the auspice of “biosecurity”. A new organization called Door to Freedom is being set up as a one-stop shop where everyone can learn what the plan is and what we can do to stop it. Door to Freedom also hopes to align freedom organizations around the world to act in concert to get the word out more widely

The global cabal that is trying to seize control over the world have access to loads of capital, but they’re also using our tax dollars. The U.S. government has spent some $5 trillion on the pandemic response. Much of that money went to bribe media, hospitals, influencers, churches, medical groups and other social organizations to push the official narrative

Current laws give immunity to a lot of bad actors, including the Federal Reserve, the Bank of International Settlements, everybody who works for the WHO and the UN, federal government employees as well as many private organizations. Vaccines and their manufacturers are also indemnified. We need to pass new laws that eliminate all of these indemnifications, so that we can retroactively take them to court for the crimes they’ve committed.

Chase Bank: The RockefellersA Google search shows the many connections between the Rockefellers and Chase Bank.

Wikipedia says:

The Rockefeller family is an American industrial, political, and banking family that owns one of the world’s largest fortunes. The fortune was made in the American petroleum industry during the late 19th and early 20th centuries by brothers John D. Rockefeller and William A. Rockefeller Jr., primarily through Standard Oil (the predecessor of ExxonMobil and Chevron Corporation). The family had a long association with, and control of, Chase Manhattan Bank. By 1977, the Rockefellers were considered one of the most powerful families in American history….

Much of the wealth has been locked up in the family trust of 1934 (which holds the bulk of the fortune and matures on the death of the fourth generation) and the trust of 1952, both administered by Chase Bank, the corporate successor to Chase Manhattan Bank. These trusts have consisted of shares in the successor companies to Standard Oil and other diversified investments, as well as the family’s considerable real estate holdings. They are administered by a trust committee that oversees the fortune.

Management of this fortune today also rests with professional money managers who oversee the principal holding company, Rockefeller Financial Services, which controls all the family’s investments, now that Rockefeller Center is no longer owned by the family. The present chairman is David Rockefeller Jr.

The Family That Preys Together reports:

Although international banking is probably the Rockefellers’ most important business, Standard Oil remains the keystone in the arch of the Rockefeller Empire. The family is still better known to the public for its oil properties than for its bank shares…. Not only grown but also prospered-so much so that last month it reported the largest annual profit ever earned by any industrial company: $2.4 billion after taxes….

In addition, there are shares held in trust by the Rockefeller banks, insurance companies, universities and other groups whose boards of directors and trustees are interlocked with the Rockefellers. And yet, incredibly, oil is not even the Rockefellers’ biggest business. That honor is reserved for international banking. The Rockefeller family banks are the First National City Bank and the Chase Manhattan Bank. The Chase Manhattan is the third largest banking establishment in the world; and while only number three, it is by far the most influential….

Chase Manhattan was created by the union of the Rockefeller-owned Chase Bank with the Kuhn, Loeb controlled Manhattan Bank. The marriage has been a huge success for both families; in 1971 Chase Manhattan claimed $36 billion in assets. This is impressive enough, but the New York Times has pointed out that it is not the whole story:

“. . a major portion of their [Chase Manhattan’s] business carried on through affiliated banks overseas is not consolidated on the balance sheet.”

Time also emphasizes the immense power of the Chase Manhattan, noting that

“The Chase has 28 foreign branches of its own, but more important, it has a globe encircling string of 50,000 correspondent banking offices.”

Fifty thousand correspondent banks around the world! if each correspondent bank were worth only a paltry $10 million, it would give Chase potential world wide clout of five hundred billion dollars! Such a figure is simply incomprehensible. Unfortunately, it is probably, conservative estimate of Chase’s power and influence.

Such financial clout would give the Rockefellers the ability to create an international monetary crisis over night. Could it be that it is they who have been yo-yoing the price of gold, dollars and foreign currencies during the past few years—creating panics for most investors, but profits for themselves?

Every time an international monetary storm blows up hundreds of millions of dollars flow into European banks. When the storm subsides, those who were “in the know” at the beginning have made enormous sums of money, That the Rockefellers have been very profitably involved through the Chase Manhattan Bank and its overseas facilities, seems more than reasonable.

By almost any standard, Chase Manhattan has become virtually a sovereign state. Except it has more money, than most. It even employs a full-time envoy to the United Nations.

As just one illuminating statistic, during 1973 Chase board chairman David Rockefeller met with 27 heads of state, including the rulers of Russia and Red China, plus scores of lesser dignitaries. Not even Henry Kissinger, he of the shuttle diplomacy and much-publicized state dinners, can match Rockefeller’s influence with the men at the top.

Chase Manhattan’s annual reports contain much information detailing the worldwide expansion of the bank. It has gone international on the grand scale. And it shows no signs of slowing down. In fact, Chase Manhattan is the undisputed world heavyweight champion when it comes to international banking.

During the Senate hearing on Nelson’s confirmation, he claimed, “I do not own any shares in the Chase Manhattan Bank.” However, he neglected to mention that his family owns 623,000 shares, or 2.54 percent of the Chase Manhattan stock. And he also conveniently overlooked the fact that the Rockefeller Brothers Fund owns another 148,000 Chase shares and Rockefeller University holds 81,296.

Myer Kutz tells us in the New York Times of April 28, 1974:

“The Rockefellers and Rockefeller institutions own a major, essentially controlling interest, estimated at more than 4 percent, in The Chase Manhattan Bank.”

The Chase Annual Reports 1974 reports that the total assets of The Chase Manhattan Corporation stood at $42,532,003,302. That’s over forty-two billion dollars. From this, reports Chase, they had a net income of $180,801,382 for the year 1974 That’s over $180 million profit in just one year—or $3.5 million in profit a week—of which the Rockefeller family pockets over four percent, or roughly 7.2 million dollars. That’s not bad, considering Chase is mainly a device for holding and boosting many of the family’s other financial interests.

Once again we must note that actual ownership by the family in Chase Manhattan may be much greater than is admitted. Professor James Knowles in his highly detailed study, The Rockefeller Financial Group states: It is impossible to establish conclusively that the wealthy families represented on the boards of the banks in the Rockefeller Group own a controlling share of the stock. The ownership of large banks is a carefully guarded secret. Even when banks are required to disclose their largest stockholders, as was the case in the 1962 Patman investigation of chain banking, they have used what are called “street names” in referring to stockholding in trust.

The Federal Reserve Cartel: The Eight Families reports:

The Four Horsemen of Banking (Bank of America, JP Morgan Chase, Citigroup, and Wells Fargo) own the Four Horsemen of Oil (Exxon Mobil, Royal Dutch/Shell, BP, and Chevron Texaco); in tandem with Deutsche Bank, BNP, Barclays, and other European old money behemoths.

But their monopoly over the global economy does not end at the edge of the oil patch. According to company 10K filings to the SEC, the Four Horsemen of Banking are among the top ten stock holders of virtually every Fortune 500 corporation. So, who then are the stockholders in these money center banks? This information is guarded much more closely. My queries to bank regulatory agencies regarding stock ownership in the top 25 US bank holding companies were given Freedom of Information Act status, before being denied on “national security” grounds. This is rather ironic, since many of the bank’s stockholders reside in Europe.

The bankers that define the decades: David Rockefeller Chase Manhattan The first global banker from the 1970s is a 6/20/19 article which says. “For access to our content, please go to Order reprints and PDFs | Euromoney” where you have to fill out a form and wait for a response for access to the article.

J P Morgan Chase & Co.: History of Our Firm says:

The firm is built on the foundation of more than 1,200 predecessor institutions that have come together through the years to form today’s company.

We trace our roots to 1799 in New York City, and our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First National Bank of Chicago, National Bank of Detroit, The Bear Stearns Companies Inc., Robert Fleming Holdings, Cazenove Group and the business acquired in the Washington Mutual transaction. Each of these firms, in its time, was closely tied to innovations in finance and the growth of the U.S. and global economies.

The 5/30/12 article Rockefellers and Rothschilds Unite discusses the collaboration between the two banking families.

READ MORE:

https://www.activistpost.com/2023/07/is-this-why-chase-banned-dr-joseph-mercola.html

READ FROM TOP.

enough is enough — bring him home......

crackdown.....

“Eye-watering”, “fines jump 10,000% in huge crackdown”! The Big 4 crackdown has arrived in the most cracking down fashion. But what is it really? Michael West reports.

Just one day ahead of a Four Corners exposé on the Big Four – something the ABC could have done eight years ago when the story was plonked in front of them by yours truly – the government has announced a crackdown. Make that a trumpets, lights, red-letter CRACKDOWN!!!

Crackdowns have played a crucial role in government media relations for decades now; to such an extent in fact that, back in the day, we banned the use of the very word crackdown in press coverage at Fairfax because some regulator or other would issue a crackdown media release, the journalists would faithfully unfurl crackdown stories and that was often the last we heard of it.

They moved fleetingly to “clamp-downs”, which we quickly proscribed as well. But they’re back!

When it comes to crackdowns, there is a deep schism between image and substance, between rhetoric and reality. And this one will be no different because it utterly fails to address the roots of the problem.

What did they miss?Did they ban political donations by the Big 4 – PwC, Deloitte, KPMG and EY? No. Did they compel them to register as lobbyists? No. Did they impose gaol sentences for fraud? No. Did they impose criminal penalties? No, only civil. Did they stop the procuring of government work while the Big 4 work against the interest of governments for their multinational clients? No. Did they move to bust them up to address the ultimate issue, conflicts of interest? No.

What did they do about tax secrecy, transparency? They say they’ll do something. That remains to be seen.

To be fair to Treasurer Jim Chalmers and co, they have moved decisively and loudly to respond to the debacle which is PwC and dodgy consultants. Dropping their crackdown news yesterday evening it got full-court press today, and this action will arrest decline for a while:

“Tax fines jump 10,000% in huge crackdown,” roared News.com.au and the News Corp tabloids. “Eye-watering”, it was, they said. SMH, Age, The Guardian, AFR – they all ran their big crackdown stories. Meanwhile, another day, another scandal. Besides its crackdown yarn, The Australian carried “KPMG ‘billed Defence for hours not worked”:

“Whistleblowers allege KPMG over-billed and incorrectly charged Defence, reportedly wasting ‘significant’ public funds on contracts that were extended with ‘little or no scrutiny’. SUBSCRIBE to read the full story.”

Conflicts of interest remain, system change requiredBut what is it really?

“The Albanese Government will oversee the biggest crackdown on tax adviser misconduct in Australian history,” ran the official announcement. “The PwC scandal exposed severe shortcomings in our regulatory frameworks that were largely ignored by the Coalition, and today we’re taking significant steps to clean up the mess.”

“We’re cracking down on misconduct to rebuild people’s faith in the systems and structures that keep our tax system and capital markets strong. We’re also cracking down on the scourge of multinational tax avoidance and making sure multinationals pay their fair share of tax in Australia.”

That’s the top of the multi-ministry press release. Peeling back the rhetoric, there are a series of reviews coming from Treasury, Finance and the AG’s department, none of which foreshadows action over the ultimate issue: conflicts of interest between audit, tax and consulting divisions of the Big 4 – that is, these gargantuan and dazzlingly profitable firms being both poachers and gamekeepers, both refs and players.

How can you give governments advice on cracking down on corporate tax avoidance while you are giving advice to multinational corporations on how to dodge that very tax? How can you audit their financial accounts as “true and fair” while advising these clients on aggressive tax avoidance strategies?

“Dodgy firms and advisers facing huge fines following government crackdown on tax adviser misconduct,” was the headline from the ABC: “That’s a 100-fold (or 10,000 per cent) increase from the current penalty of $7.8m.”

And so the Big 4 and their multitude of advisers will now respond by lobbying to protect their patch, consulting to every consulting review, earnestly co-operating while diminishing the potency of any threat to their revenues.

There are modest legislative measures:

Good to see a criminal referral. PwC busted for flogging state secrets on how to avoid tax to its multinational clients while advising Treasury on how to crack down on the very same abuses, is high treason but also, arguably, comfortably defensible if the Commonwealth DPP were ever to lay charges.

The TPB measures are good, but “action” on procurement frameworks in the wake of what is likely to be a Switkowski whitewash is likely to fall into the “all talk and no action” basket.

So debilitated, so gutted is government by outsourcing to consultants, they can barely wipe their bottoms without sign-off and “independent expert” advice from the Big 4. Will this change?

There will be more restraint now. Greater vigilance. That is positive. And to be fair to the politicians, the Parliamentary inquiry into consultants and the PwC scandal was robust and covered the vital issues of secrecy, conflicts of interest and rubber-stamping.

Yet, unless the underlying issues of conflicts of interest are addressed, systemic change that is, busting up the Big 4 along audit, tax and consulting lines, this crackdown will go down in history as just another crackdown.

This was the first story we published, now 8 years old, as an independent media operation. The message remains the same.

https://michaelwest.com.au/crackdown-better-watch-out-you-big-4-well-wave-a-stern-finger-at-yers/

READ FROM TOP.

enough is enough — bring him home......