Search

Recent comments

- cow bells....

10 hours 27 min ago - exiled....

15 hours 29 min ago - whitewashing a turd....

16 hours 28 min ago - send him back....

17 hours 58 min ago - the original...

19 hours 46 min ago - NZ leaks....

1 day 5 hours ago - help?....

1 day 6 hours ago - maps....

1 day 6 hours ago - bastards...

1 day 13 hours ago - narcissist.....

1 day 14 hours ago

Democracy Links

Member's Off-site Blogs

we have no idea what the mises is talking about.......

The real drama of default in global markets has not been the federal debt ceiling negotiations in Washington but the write-off by inflation. The issue of whether it turns out that the US Treasury for a few weeks has been slow in servicing its debts—with all delays subsequently rectified—is a sideshow. We could regard this as camouflage for the ongoing real write-off operation. In this, countries led by the US, where a great inflation emerged during the pandemic and Ukraine war, have achieved big reductions in the real value of their debts.

The governments have also gained from a reduction in the total nominal market value of their fixed-rate debts due to the rise in interest rates.

Those gains do not show up directly in national accounts. Rather, they are opportunity cost savings. Governments will not have to pay the prevailing higher level of interest rates on that part of their debts which are in fixed-rate form until far-off maturity dates. The savings for government show up in investor wealth statements and balance sheets in so far that they are based on present market values rather than fictitious historic cost. As long as the losses are on government bonds held by the central bank, there is no benefit to big government—it is all a wash in consolidated accounting across the public sector as a whole.

This real write-off by inflation occurred without any of the political wrangling feted by interminable commentary in the financial media. A dance of high inflation stakes has occurred, featuring the central bankers, politicians, and their cronies. The first and biggest dance was when the Fed stuck to its zero interest and quantitative easing policies through the first two years of the pandemic (2020–21), citing with great confidence its central scenario of transitory inflation. The Fed was silent or dismissive about alternative possible scenarios. Chief Jerome Powell told us with great aplomb that the Fed was not even thinking about when the discussion should begin on lifting interest rates from zero.

Incredibly, at least in hindsight, the Fed announced its new framework of “flexible inflation targeting” in August 2020, already well into the germination period for the great pandemic inflation. The idea was that higher inflation for sometime in the future was welcome to “make up” for the long years of inflation less than the 2 percent target during the 2010s. Big government, in all its branches and alongside powerful outside interests—including the private equity barons, who would benefit from a reduction in the real value of their debts in a shock outbreak of high inflation—happily tolerated the complacency.

The same choreography has played out in the high-inflation countries of Europe including the United Kingdom, Italy, France, and Spain. Yes, there was some resistance within the European Central Bank (ECB) from Germany and Holland, but mooting this was a general concern in its policy board to avoid a return of European debt crisis. Remember that as late as July 2021 the ECB rolled out its new monetary framework of quasi-flexible inflation targeting, a year later than the Fed, albeit in a greener and less explicit form. The message was that the ECB would be more tolerant of inflation overshoots than undershoots as it was harder to get inflation up than down!

Japan and Switzerland have been outliers in the dance of default by inflation. There has not been a real write-off in Japan or Switzerland on anything like the scale of the high-inflation countries. Over the four-year period of 2020–23, the estimated fall in purchasing power of the domestic money has been around 17 percent in the US, 20 percent in Italy, and 5 percent in Switzerland and Japan.

In Switzerland, a low public debt to gross domestic product ratio (around 40 percent) means that big government would not join an inflation dance with the central bank. In Japan, it’s quite the opposite. Japan’s crushingly high public sector means there is visible danger of the government and the National Diet joining the Bank of Japan in a dance. The musical theme would be high optimism about future inflation despite continuing very low interest rates. The collapse of the yen against the Swiss franc reflects the specter of eventual real default by inflation in Japan. The yen/Swiss franc exchange rate has soared from 112 on the eve of the pandemic to 153 now.

Japan’s real debt write-off is small so far. High consumer price index inflation did not emerge in the second half of 2021 and early 2022 because household and business spending in the US, eurozone, and United Kingdom remained remarkably cautious. But that restraint could be fading now during a powerful rise in the Tokyo stock market alongside a crescendo of foreign optimism (the so-called Buffett boom) and the super cheap yen. So, the future of inflation in Japan might well be very different from 2021–22.

The low inflation then, however, helps to explain the so far stubbornly bad time profile of Japan’s gross general government debt to gross domestic product—rising from 238 percent in 2019 to 259 in 2020 and to 261 in 2022, eventually falling this year according to the International Monetary Fund to 258 as consumer price index inflation rises (3.2 percent year-over-year in May and long-term interest rates at below 0.5 percent). By contrast, the same ratio in the US rose from 109 in 2019 to 134 in 2020, falling back to 122 this year despite a general government deficit running now at 5–6 percent of gross domestic product. In Italy, the same ratio was at 134 percent on the eve of the pandemic, rising to 155 in 2020, and falling to an estimated 140 percent this year.

READ MORE:

https://mises.org/wire/default-inflation-real-drama-global-debt-market

FREE JULIAN ASSANGE NOW...............

- By Gus Leonisky at 14 Jun 2023 - 5:49am

- Gus Leonisky's blog

- Login or register to post comments

the real drama.......

***THE WORD OF MOUTH INTERNATIONAL BESTSELLER NOW UPDATED WITH 15 EXPLOSIVE NEW CHAPTERS***

False economics. Threats, bribes, extortion. Debt, deception, coups, assassinations and unbridled military power. These are the tools used by the 'corporatocracy' - a vast network of corporations, banks, colluding governments and rich and powerful individuals - to ensure that they retain and expand their wealth and influence, growing richer and richer as the poor become poorer.

In his original, post 9/11 book, John Perkins revealed how he was recruited as an economic hit man in the 1970s, and exposed the corrupt methods American corporations use to spread their influence in the developing world, cheating countries out of trillions of dollars. In this new, extensively updated edition he lays bare the latest, terrifying evolution of the economic hit man, and how the system has become even more entrenched and powerful than ever before.

In New Confessions of an Economic Hit Man, John Perkins provides fresh and chilling evidence of how the corporatocracy has grown its influence to every corner of the globe, making us all unwitting slaves to their regime. But he also provides advice on how we can end our unconscious support of the system and its self-serving, lethal economy.

------------------------------------------------------------------------------------------------------

"Perkins has, once again, made a substantial contribution to a world that needs whistle-blowers to open its eyes to the true sources of political, social, and economic power" - Yanis Varoufakis

READ MORE:

FREE JULIAN ASSANGE NOW.................

in the woods....

Attempts to control inflation at the expense of growth could be driving the US towards stagflation. Dr Linwood Tauheed, associate professor of economics at the University of Missouri Kansas City and former president of the National Economics Association, argues that the government must intervene to revive the country's fortunes.

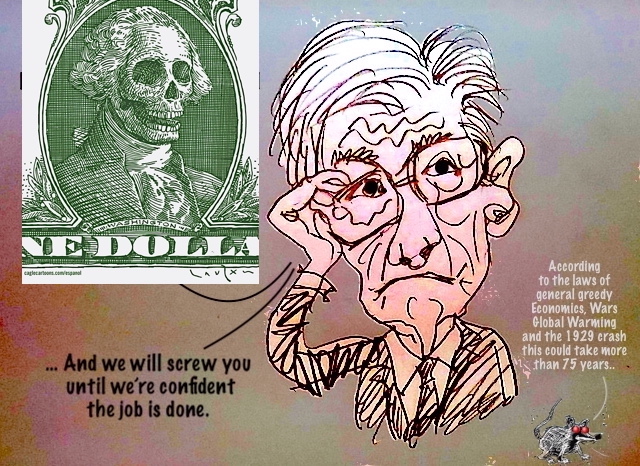

The US Federal Reserve cannot fix America's economic problems by tinkering with its only tool of interest rates, an economist argues.

Federal Reserve Chairman Jerome Powell is torn between conflicting pressures to control inflation and get the economy growing again following the COVID-19 lockdown and the energy crisis caused by sanctions on Russia.

Economist Dr Linwood Tauheed told Sputnik that it was not exactly a case of the chickens coming home to roost for Powell.

"I think the chickens don't want to come home this time. I think they want to continue on their path away from home, because home is quite messy."

The academic pointed out that Powell's policy for beating inflation was to send the economy into a nosedive and sacrifice millions of jobs.

"Jerome Powell has indicated in a very upfront manner that he was going to increase interest rates until there was a change in the labor market. Now, what that meant was an increase in unemployment," Tauheed said.

"He also made it very clear that increase in unemployment would cause a decrease in workers wanting to actually have their pay increased. That is when unemployment rate goes up, people don't worry about how much they get paid. They just worry about having a job," the economist stressed. "He set that out as his goal to discipline labor to the advantage of the business environment.”

READ MORE:

https://sputnikglobe.com/20230613/federal-reserve-boss-faces-dilemma-with-us-economy-not-out-of-the-woods-1111118386.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW............@#!