Search

Recent comments

- cow bells....

9 hours 8 min ago - exiled....

14 hours 10 min ago - whitewashing a turd....

15 hours 9 min ago - send him back....

16 hours 39 min ago - the original...

18 hours 28 min ago - NZ leaks....

1 day 4 hours ago - help?....

1 day 5 hours ago - maps....

1 day 5 hours ago - bastards...

1 day 11 hours ago - narcissist.....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

of money.........

What makes us who we are? I mean how, why and what we think of, during the day?

Work? TikTok? Politics? Woke? Sex? Local bands? Pubs? Rent? Housing? Price of food? Amusements? Entertainment? History? guns? Classical music? Friends? Accomplishments? Future? Past? Sickness? Clothes? Hope? Family? Religion? Shopping? Language? What drives the bird from A to B? Drinks? Peanuts? Car maintenance? Fashion? Bills to pay? Cooking? Not sleeping enough? Getting old? The news? Sport? Money? Money? Money….

We’re all different, yet our modern philosophical package is set by many habits that are mostly ruled by our relationship with money. With money, we can buy a loaf of bread or a company worth $40 billion.

Out of all activities, for most people, politics would rate around one per cent of their interests on a good day. Even when we could be threatened with 50/50 per cent nuclear war, they could reach up to five per cent of concerns amongst their interests — though a few people might be alarmed and react with high levels of political activism. In general, the majority of people tend to delegate the dull duty of decision making to politicians, who more often than not are a bunch of psychopaths, self-bred for the purpose. It is hard to motivate people at a civic level. 100,000 people at a grand final. 153 bods on a good day at a socialist forum.... Activism can lead to becoming rich bastards (no heart) or becoming revolutionaries (no brains). Or we can relatively understand the processes of nature.

Or we can play the field without care.

One of the most important event in the “recent” past was the treaty referred to as the “Peace of Utrecht”.

In light of the current events in Ukraine, looking at this moment in time of “who owns what and who controls who” might not go astray. As well the recent fake theatre about the US debt ceiling is a reminder that this is not a new fiddle of finance.

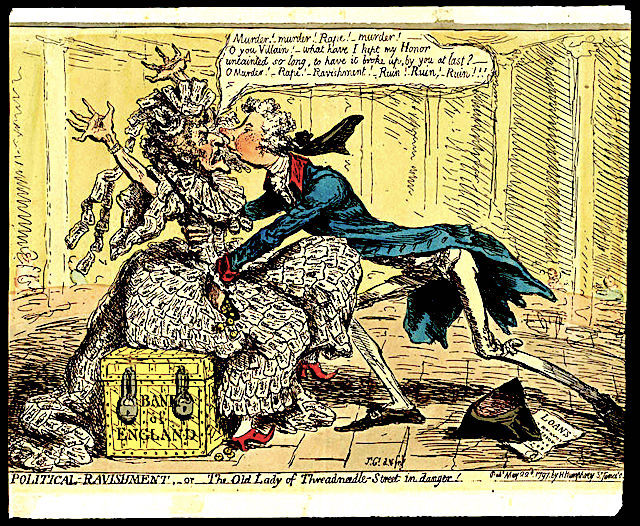

Here at top we have a James Gillray cartoon lampooning Prime Minister William Pitt's financial policies. Pitt's Bank Restriction Act was enacted in May 1797 in the feverish atmosphere caused by naval mutinies, runs on banks in the north-east of England and threats of invasion from the French.

Passage of the Act released the government from the fear of mass redemption of banknotes into gold, so much so that, by 1814, at the end of the Napoleonic Wars, the banknotes in circulation had a face value of £28.4 million but were backed by only £2.2 million of gold.

After the passing of the Act, the Irish playwright and Member of Parliament, Richard Brinsley Sheridan, publicly bemoaned the way in which the Bank of England had fallen under the influence of William Pitt by describing the institution as: “An elderly lady in the City, of great credit and long standing who had unfortunately fallen into bad company.”

This in turn led to James Gillray’s cartoon above entitled Political-Ravishment, or the Old Lady of Threadneedle Street in Danger! It depicts Pitt seducing the Bank of England, an old lady attired in a dress made of £1 notes. The ‘Old Lady’ is a harridan, and seated on an iron-studded treasure-chest inscribed ‘Bank of England’, fastened by two heavy padlocks. She shrieks and throws up her arms at Pitt’s advances as he takes a long stride towards her, with his right hand round her waist and his left dipping into a pocket and taking out [gold] Guineas. This cartoon is the origin of the Bank’s nickname of ‘The Old Lady of Threadneedle Street’.…

These day, we have a couple of old folks, Biden and McCarthy making a deal to rob the nation and other countries by raising the US National Debt, beyond what America can pay back (which the US never had the intention to pay back anyway). It's a trick of (de)valuation....

So, BACK TO THE NEED for PEACE: This was geopolitics before the term was defined — and when the powers were still in the hands of kings and queens, some of these at the mercy of recalcitrant parliament. Say Cromwell et all…

Oliver Cromwell (25 April 1599 – 3 September 1658) was an English statesman, politician, and soldier, widely regarded as one of the most important figures in the history of the British Isles. He came to prominence during the 1639 to 1653 Wars of the Three Kingdoms, initially as a senior commander in the Parliamentarian army and latterly as a politician. A leading advocate of the execution of Charles I in January 1649, which led to the establishment of The Protectorate, he ruled as Lord Protector from December 1653 until his death in September 1658. Cromwell remains a controversial figure due to his use of the army to acquire political power, and the brutality of his 1649 campaign in Ireland.[2]

A bit more than 50 years later, the Peace of Utrecht was a series of peace treaties signed by the belligerents in the War of the Spanish Succession, in the Dutch city of Utrecht, between April 1713 and February 1715. The war had involved three contenders for the vacant throne of Spain, and bothered much of Europe for over a decade. The main action saw France as the defender of Spain against a multinational coalition. The war was very expensive and bloody and finally stalemated. Essentially, the treaties allowed Philip V (grandson of King Louis XIV of France) to keep the Spanish throne in return for permanently renouncing his claim to the French throne, along with other necessary guarantees that would ensure that France and Spain should not merge, thus preserving the balance of power in Europe.[1] Gosh....

Sitting on thrones was more than symbolic or godly. It involved making a lot of cash.

The treaties between several European states, including Spain, Great Britain, France, Portugal, Savoy and the Dutch Republic, helped end the war. The treaties were concluded between the representatives of Louis XIV of France and of his grandson Philip on one hand, and representatives of Queen Anne of Great Britain, King Victor Amadeus II of Sardinia, King John V of Portugal and the United Provinces of the Netherlands on the other.

See also Willem III.

William III (William Henry; Dutch: Willem Hendrik; 4 November 1650 – 8 March 1702),[b] also widely known as William of Orange, was the sovereign Prince of Orange from birth, Stadtholder of Holland, Zeeland, Utrecht, Guelders, and Overijssel in the Dutch Republic from the 1670s, and King of England, Ireland, and Scotland from 1689 until his death in 1702.

As King of Scotland, he is known as William II.[1] He is sometimes informally known as "King Billy" in Ireland and Scotland.[2] His victory at the Battle of the Boyne in 1690 is commemorated by Unionists, who display orange colours in his honour. He ruled Britain alongside his wife and cousin, Queen Mary II, and popular histories usually refer to their reign as that of "William and Mary”.

By 1713, though the king of France ensured the Spanish crown for his dynasty, the treaties marked the end of French ambitions of hegemony in Europe expressed in the continuous wars of Louis XIV, and paved the way to the European system based on the balance of power.[2] The Spanish Bourbon dynasty still reigns over Spain, whilst the French branch of the House of Bourbon has long since been dethroned. GUSNOTE: Wars was a way to eliminate unemployment and rob somebody else — and raise taxes on the bourgeoisie that "was part of the protection/protected racket" of the king....

British historian G. M. Trevelyan argued that:

That Treaty, which ushered in the stable and characteristic period of Eighteenth-Century civilization, marked the end of danger to Europe from the old French monarchy, and it marked a change of no less significance to the world at large, – the maritime, commercial and financial supremacy of Great Britain.[3]

"BRITANNIA RULES THE WAVES"...

——————

There was a few sour notes though.

In a major victory, the British government emerged from the treaty with the Asiento de Negros, which was the monopoly contract granted by the Spanish government to other European nations to supply slaves to Spain's colonies in the Americas. The Spanish Empire rarely engaged in the transatlantic slave trade itself, preferring to outsource this to foreign merchants. THE SPANISH PREFERRED TO TRANSPORT GOLD FROM SOUTH AMERICA.... France had previously held the Asiento de Negros, allowing French slave traders to supply 5,000 slaves to the Spanish Empire each year; After the British government gained access to the Asiento de Negros, the economic prominence held by Dutch Sephardic Jewish slaveowners began to fade, while the South Sea Company was established in hopes of gaining exclusive access to the official contract. The British government sought to reduce its debt by increasing the volume of trade it had with Spain; following the passage of the treaty, the British government gained a thirty-year lease to the Asiento de Negros.[13][14][15][16][17][18]

This seemed to be a win-win situation for England, yet someone screwed-up. The private/public partnership called The South Seas Company did not work well. WHY?

It became the world’s first large financial crash, the world’s first Ponzi scheme. It became speculation mania and a disastrous example of what can happen when people fall prey to ‘group think’. We’d seen this with the Tulip Mania beforehand. The South Sea Bubble was a catastrophic financial crash and some of the greatest thinkers at the time succumbed to it, including Isaac Newton. Estimates vary but Newton reportedly lost as much as £40 million of today’s money in the scheme. But what actually happened?

The South Sea Company was founded in 1711 by an Act of Parliament. It was a public and private stock partnership that was designed to consolidate, control and reduce the national debt and to help Britain increase its trade and profits in the Americas — like the East India Company was doing in the East….

In 1713 it was granted a trading monopoly in the region. Part of this was the asiento, which allowed for the trading of African slaves to the Spanish and Portuguese Empires — a business proved immensely profitable in the previous century. There was huge public confidence in the South Sea Company, as many expected slave transport to increase dramatically, as the War of the Spanish Succession had come to an end. Trade could begin in earnest. It didn’t quite work out however…

The South Sea Company began by offering those who bought stocks a big 6% interest. Yet, after the Treaty of Utrecht, the expected trade increase did not happen. In fact, Spain only allowed Britain a limited amount of trade and even took a percentage of the British profits. Spain also taxed the importation of slaves and put strict limits on the numbers of ships Britain could send for ‘general trade’, which ended up being a single ship per year. This did not generate anywhere near to the profit that the South Sea Company needed to sustain. The Brits we loosing money....

International politics played a huge role here. How come the Spaniards were allowed to somehow “blackmail” England with restriction on trade? Here we can only speculate… Revenge?

The Spanish Armada (a.k.a. the Invincible Armada or the Enterprise of England, Spanish: Grande y Felicísima Armada, lit. 'Great and Most Fortunate Navy') was a Spanish fleet that sailed from Lisbon in late May 1588, commanded by the Duke of Medina Sidonia, an aristocrat without previous naval experience appointed by Philip II of Spain. His orders were to sail up the English Channel, link up with the Duke of Parma in Flanders, and escort an invasion force that would land in England and overthrow Elizabeth I. Its purpose was to reinstate Catholicism in England, end support for the Dutch Republic, and prevent attacks by English and Dutch privateers against Spanish interests in the Americas.

The Spanish were opposed by an English fleet based in Plymouth. Faster and more manoeuvrable than the larger Spanish galleons, they were able to attack the Armada as it sailed up the Channel. Several subordinates advised Medina Sidonia to anchor in The Solent and occupy the Isle of Wight, but he refused to deviate from his instructions to link up with Parma. Although the Armada reached Calais largely intact, while awaiting communication from Parma, it was attacked at night by English fire ships and forced to scatter.

The Armada suffered further losses in the ensuing Battle of Gravelines, and was in danger of running aground on the Dutch coast when the wind changed, allowing it to escape into the North Sea. Pursued by the English, the Spanish ships returned home via Scotland and Ireland. Up to 24 ships were wrecked along the way before the rest managed to get home.

Memory (revenge) is a cold dish… From 1588 to 1711 lays barely 123 years of bickering that eventually needed the Peace of Utrecht to arrest the simmering damage since then. Could the British go to war again, against the Spanish to collect their dues from the Utrecht treaties?

This would have most likely united the Europeans against the English, who weary of historical bets, would have known the odds were against them.

However, King George himself took governorship of the South Seas Company in 1718. This inflated the stock as nothing instils confidence quite like the endorsement of the ruling monarch. Soon, stocks were returning one hundred percent interest. But the bubble began to blow out, as the company itself was not making anywhere near the profits it had promised.

So the English coped with the semi-demise of the South Seas Company which in order to survive in this environment had become a Ponzi scheme, in which all the late investors lost their fortunes — including Isaac Newton — though "Early" investors managed to make good cash….

Speculation again….

Isaac Newton was in charge of the English Mint, as well as controlling the repayment with interest of the borrowings from the English Crown in other countries — and the trade payment exchanges. I could be wrong, but my memory tells me that Newton, a mathematician extraordinaire, was fiddling the “repayments” exchange rates by artificially manipulating the price of gold and silver — to the benefit of the English Crown. Who advised Newton to invest in the South Sea Company? A Spanish spy, under supervision of the Spanish King, via one of Newton’s friend?…

The interest in Newton's activities in the South Sea Bubble is surely due primarily to his fame as one of the greatest scientists in the world. It is also very likely magnified by the fact that he was not an other-worldly researcher ignorant of finance. Aside from the effort he put into alchemy and theology as well as into astronomy, physics and mathematics, he was an accomplished administrator, technologist and engineer.

As first Warden and then Master of the Royal Mint, his efficiency improvements were crucial to the success of the great recoinage of the 1690s and later operations.1 His broad range of skills is illustrated also by work at the Mint as a detective, in pursuit of counterfeiters.2

Newton was a member of the British governing elite. He took part in the debates over the major changes in monetary policy that were carried out in that period, one effect of which was to initiate the move from silver to gold as the standard, a move that was later followed by most of the world. His influence there is not clear, though, and generally, he did not contribute any striking insights into monetary or general economic thinking.3 Aside from the great scientific reputation he enjoyed during his life, he was paid well for his duties at the Mint.

In spite of any losses in the South Sea Bubble, Newton died a very rich person. Before the South Sea mania, he was already a shrewd and successful investor. That a person of such ability, knowledge and connections could lose his head in a mania is therefore frequently cited as an example of the difficulty of recognising “bubbles”.

https://royalsocietypublishing.org/doi/10.1098/rsnr.2018.0018

MEANWHILE TOWARDS THE EAST:

The East India Company (EIC)[a] was an English, and later British, joint-stock company founded in 1600 and dissolved in 1874.[4] It was formed to trade in the Indian Ocean region, initially with the East Indies (the Indian subcontinent and Southeast Asia), and later with East Asia. The company seized control of large parts of the Indian subcontinent and colonised parts of Southeast Asia and Hong Kong. At its peak, the company was the largest corporation in the world by various measures. The EIC had its own armed forces in the form of the company's three Presidency armies, totalling about 260,000 soldiers, twice the size of the British army at the time.[5][6] The operations of the company had a profound effect on the global balance of trade, almost single-handedly[7] reversing the trend of eastward drain of Western bullion, seen since Roman times.[8]

Originally chartered as the "Governor and Company of Merchants of London Trading into the East-Indies",[9][10] the company rose to account for half of the world's trade during the mid-1700s and early 1800s,[11] particularly in basic commodities including cotton, silk, indigo dye, sugar, salt, spices, saltpetre, tea, and opium. The company also ruled the beginnings of the British Empire in India.[11][12]

The company eventually came to rule large areas of India, exercising military power and assuming administrative functions. Company rule in India effectively began in 1757 after the Battle of Plassey and lasted until 1858. Following the Indian Rebellion of 1857, the Government of India Act 1858 led to the British Crown assuming direct control of India in the form of the new British Raj.

CONCLUSION:

Better luck with spices than with the slave trade, which came to a halt, after many failed attempts... In 1807, the slave trade in the British Empire was abolished. However, slaves in the colonies (excluding areas ruled by the East India Company) were not freed until 1838 – and ABOLISHED only after slave-owners, rather than the slaves themselves, received compensation.

In 1787, campaigners against slavery such as Thomas Clarkson and Granville Sharp founded the Society for the Abolition of the Slave Trade, believing that ending the trade was the first step towards eradicating slavery completely. They raised awareness about conditions (including with publications from former slaves such as Olaudah Equiano), boycotted slave-produced goods and petitioned Parliament.

In Parliament, the campaign was led by William Wilberforce.

So, nearly back to where we started… Are we too comfortable and too distracted to see the dirty dynamics of todays political landscape? OR DO WE STILL DREAM OF WOKISH DEMOCRACY — which is used as an amusing distraction of the "people" by the rich who control the loot — and we own less and less?

What makes us who we are? How, why and what we think of, during the day?

Work? TikTok? Politics? Woke? Sex? Local bands? Pubs? Rent? Housing? Price of food? Amusements? Entertainment? History? Classical music? War? Friends? Accomplishments? Future? Past? Sickness? Clothes? Hope? Family? Religion? Shopping? Language? What drives the bird from A to B? Drinks? Peanuts? Car maintenance? Fashion? Bills to pay? Cooking? Not sleeping enough? Getting old? The news? Sport? Money? Money? Money…. until something is going to go south....

GUS LEONISKY

CARTOONIST SINCE 1951

RABID ATHEIST AND LUNATIC.

FREE JULIAN ASSANGE NOW.............

- By Gus Leonisky at 5 Jun 2023 - 5:48am

- Gus Leonisky's blog

- Login or register to post comments

bubble trouble.....

A cycle of boom and bust will return this year and a wave of corporate debt defaults is imminent, particularly in the US and Europe, Deutsche Bank has warned.

According to the bank’s annual study released on Wednesday, defaults by companies will become more commonplace compared with the last 20 years.

Deutsche expects default rates to peak in the fourth quarter of 2024. The bank projected peak default rates to reach 9% for US high-yield debt, 11.3% for US loans, 4.4% for European high-yield bonds, and 7.3% for European loans.

The estimated US loan peak default rate is a near all-time high, compared to a peak of 12% during the 2007-2008 global financial crisis and 7.7% during the dot-com bubble in the late 1990s, the study showed.

“Our cycle indicators signal a default wave is imminent,” Deutsche economists wrote. “The tightest Fed and ECB policy in 15 years is colliding with high leverage built upon stretched margins. And tactically, our US credit cycle gauge is producing its highest non-pandemic warning signal to investors, since before the GFC [Global Financial Crisis].”

Strategists noted that the magnitude and length of the cycle could come as a surprise. “Although our forecasts just presume a return of the Boom Bust cycle, not a GFC-style shock,” they added.

READ MORE: Data reveals Germany has entered recessionAggressive interest rate hikes by central banks, including the US Federal Reserve and the European Central Bank as they continue to fight runaway inflation, have raised global recession risks, Deutsche warned. The EU’s largest economy, Germany, has already entered recession.

“We suspect the next recession will be the first since the US tech bubble to inflict more pain on credit markets than the real economy,” experts cautioned. “Corporate leverage is elevated. And global credit markets derive more of their revenue from manufacturing and the sale of physical goods than the real economy at large,” they concluded.

READ MORE:

https://www.rt.com/business/577275-recession-defaults-us-eu-deutsche/

REAd from top.

FREE JULIAN ASSANGE NNOWWWWWWW