Search

Recent comments

- arseholic....

2 hours 54 min ago - cruelty....

4 hours 11 min ago - japan's gas....

4 hours 51 min ago - peacemonger....

5 hours 48 min ago - see also:

14 hours 49 min ago - calculus....

15 hours 3 min ago - UNAC/UHCP...

19 hours 44 min ago - crafty lingo....

21 hours 8 min ago - off food....

21 hours 17 min ago - lies of empire...

22 hours 16 min ago

Democracy Links

Member's Off-site Blogs

economic voodoo........

The global economic outlook is deteriorating due to inflation-fighting efforts by central banks, the war between Russia and Ukraine, and China’s prioritization of political control over economic growth. A global recession is likely, with at least slower economic growth virtually certain.

People who have followed my work for years often say that I’m an optimist, and usually I am. Right now, though, the weight of evidence points to a slowing world economy.

Senior ContributorI Connect The Dots Between The Economy ... And Business!Sep 23, 2022

Just as the Federal Reserve has hiked interest rates in the U.S., many central banks around the world are tightening monetary policy. The Council on Foreign Relations publishes a Global Monetary Policy Tracker which, as of August 2022, shows tightening among most of the 54 central banks that they track.

Specifically, the European Central Bank has increased its policy rate and signaled more increases are likely in the coming months. So have the Bank of England and the Bank of Canada. Other tightening countries include Australia, India, and many in Latin America. The only major countries easing monetary policy are Russia and China. The global tightening is likely to slow economic growth around the world and lead to recession in some countries.

READ MORE:

A key source of uncertainty for the domestic growth outlook relates to the competing forces affecting household spending. Household incomes have been sustained by strong labour demand, which has supported employment and hours worked; this strong labour demand will ultimately lead to stronger wages growth. Household balance sheets are in generally good shape, underpinned by a high level of savings in recent years. However, high inflation and rising interest rates are raising the cost of living and will weigh on households’ income and spending in real terms. Household consumption will also be dampened by wealth effects as housing and other asset prices continue to weaken. Other important sources of uncertainty include the outlook for global growth and the possible knock-on effects of a sharper-than-expected downturn in a major economy.

READ MORE:

https://www.rba.gov.au/publications/smp/2022/nov/economic-outlook.html

SEE ALSO:

FREE JULIAN ASSANGE NOW..............

- By Gus Leonisky at 24 Nov 2022 - 7:22am

- Gus Leonisky's blog

- Login or register to post comments

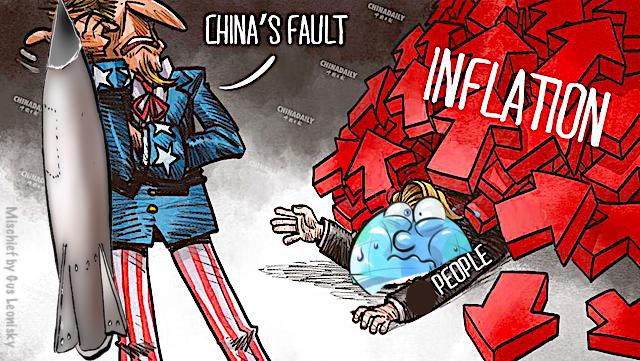

a economic cartoon....

READ FROM TOP.

FREE JULIAN ASSANGE NOW..................