Search

Democracy Links

Member's Off-site Blogs

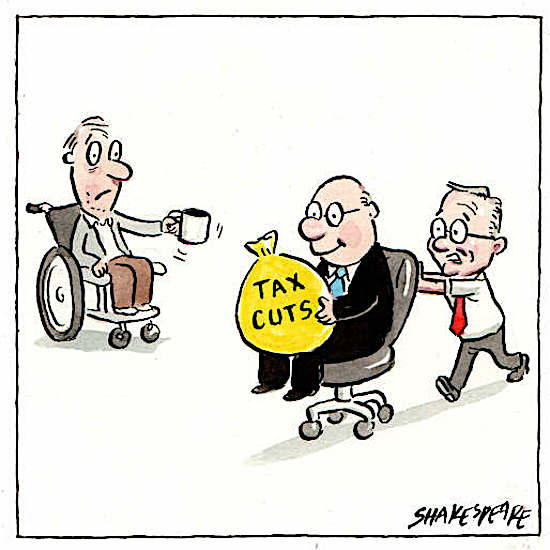

saving election promises….

The editorial (“The RBA says it out loud: Raise taxes to fix the budget”, September 19) highlights the dilemma facing the Albanese government over the promised stage three personal income tax cuts while the Reserve Bank says that taxes should be raised. But most fair-minded Australians would agree that, whatever the situation when the original promise was made, the difficult circumstances of our current economic reality demand the tax cuts be dumped, especially when they will favour the already wealthy. Albanese can be forgiven for breaking an election promise for the benefit of the people as a whole.

Rob Phillips, North Epping

The prime minister would gain respect and possibly votes from most thoughtful and concerned Australians if his government makes the hard decision to stop the stage three tax cuts. He could be forgiven by most voters for breaking his promise in order to save the country overwhelming debt in the future.

Joy Paterson, Mount Annan

Perhaps Peter Dutton could break the impasse, and excel himself, by endorsing the dropping of the misguided tax cuts for wealthy people, legislated by his party.

Stein Boddington, St Claire

Some years ago, in his only policy with which I agreed, my namesake, Queensland premier Campbell Newman, asked voters to nominate not only which areas they wanted to spend revenue on, but also where they wanted revenue to come from. The choices were bigger deficits and more borrowing, selling state assets and infrastructure, or raising taxes. People overwhelmingly said they wanted to pay more income tax and, in sadly typical fashion, the results were never spoken of again. It seems that people are decent given half a chance. Higher taxes are the only responsible way to get out of a budget hole and income tax is the fairest and most progressive way to do it. With effective brackets, the rich pay more of their income than the struggling, who should pay little or none since they bear the brunt of economic pain. I, for one, am happy to pay more income tax.

Campbell Newman, Ashmore (Qld)

It’s a no-brainer that we need higher taxes to fund what we need: decent wages for teachers, nurses, aged care and childcare workers, a living wage for the unemployed or disabled, to name just a few (Letters, September 19). This could be done by properly taxing major corporations, closing tax loops and not funding the promised tax cuts. While raising the GST would hurt the already poor, the health system could be improved greatly by increasing the Medicare levy – a much fairer way to tax people.

Margaret Grove, Abbotsford

Your correspondent notes that “the government has to earn more and spend less”. One difficulty in “earning more” is that those taxpayers who earn heaps can reduce the tax they should pay by various means (some legitimate, some not). I recall one car salesman of yesteryear proudly proclaiming that he paid only 2 per cent tax. It’s a pity he didn’t see that part of belonging to society is to help those less fortunate than himself; contrariwise, his view of society was “me, Me, ME”.

David Gordon, Cranebrook

READ MORE:

FREE JULIAN ASSANGE NOW........

(LUCKY THE ROYALS ARE NOT DEMANDING RENT FOR HIM TO BE INCARCERATED AT THE KING'S PLEASURE....)

- By Gus Leonisky at 20 Sep 2022 - 8:49am

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

11 hours 12 min ago

12 hours 23 min ago

12 hours 48 min ago

13 hours 19 min ago

13 hours 23 min ago

17 hours 44 min ago

20 hours 20 min ago

20 hours 31 min ago

1 day 7 hours ago

1 day 8 hours ago