Search

Recent comments

- meanwhile....

1 hour 20 min ago - a long day....

3 hours 14 min ago - pressure....

4 hours 2 min ago - peer pressure....

19 hours 21 min ago - strike back....

19 hours 27 min ago - israel paid....

20 hours 29 min ago - on earth....

1 day 59 min ago - distraction....

1 day 2 hours ago - on the brink....

1 day 2 hours ago - witkoff BS....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

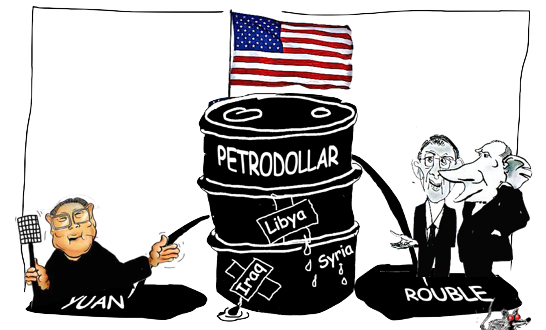

follow the petro-money...

money

money

The “rules-based international order” – as in “our way or the highway” – is unraveling much faster than anyone could have predicted.

The Eurasia Economic Union (EAEU) and China are starting to design a new monetary and financial system bypassing the U.S. dollar, supervised by Sergei Glazyev and intended to compete with the Bretton Woods system.

Saudi Arabia – perpetrator of bombing, famine and genocide in Yemen, weaponized by U.S., UK and EU – is advancing the coming of the petroyuan.

India – third largest importer of oil in the world – is about to sign a mega-contract to buy oil from Russia with a huge discount and using a ruble-rupee mechanism.

Riyadh’s oil exports amount to roughly $170 billion a year. China buys 17% of it, compared to 21% for Japan, 15% for the U.S., 12% for India and roughly 10% for the EU. The U.S. and its vassals – Japan, South Korea, EU – will remain within the petrodollar sphere. India, just like China, may not.

Sanction blowback is on the offense. Even a market/casino capitalism darling such as uber-nerd Credit Suisse strategist Zoltan Poznar, formerly with the NY Fed, IMF and Treasury Dept., has been forced to admit, in an analytical note: “If you think that the West can develop sanctions that will maximize the pain for Russia by minimizing the risks of financial stability and price stability for the West, then you can also trust unicorns.”

Unicorns are a trademark of the massive NATOstan psyops apparatus, lavishly illustrated by the staged, completely fake “summit” in Kiev between Comedian Ze and the Prime Ministers of Poland, Slovenia and the Czech Republic, thoroughly debunked by John Helmer and Polish sources.

Poznar, a realist, hinted in fact at the ritual burial of the financial chapter of the “rules-based international order” in place since the early Cold War years: “After the end of this war [in Ukraine], ‘money’ will never be the same.” Especially when the Hegemon demonstrates its “rules” by encroaching on other people’s money.

And that configures the central tenet of 21st century martial geopolitics as monetary/ideological. The world, especially the Global South, will have to decide whether “money” is represented by the virtual, turbo-charged casino privileged by the Americans or by real, tangible assets such as energy sources. A bipolar financial world – U.S. dollar vs. yuan – is at hand.

There’s no surefire evidence – yet. But the Kremlin may have certainly gamed that by using Russia’s foreign reserves as bait, likely to be frozen by sanctions, the end result could be the smashing of the petrodollar. After all the overwhelming majority of the Global South by now has fully understood that the backed-by-nothing U.S. dollar as “money” – according to Poznar – is absolutely untrustworthy.

If that’s the case, talk about a Putin ippon from hell.

It’s gold robbery time

As I outlined the emergence of the new paradigm, from the new monetary system to be designed by a cooperation between the EAEU and China to the advent of the petroyuan, a serious informed discussion erupted about a crucial part of the puzzle: the fate of the Russian gold reserves.

Doubts swirled around the Russian Central Bank’s arguably suicidal policy of keeping assets in foreign securities or in banks vulnerable to Western sanctions.

Of course there’s always the possibility Moscow calculated that nations holding Russian reserves – such as Germany and France – have assets in Russia that can be easily nationalized. And that the total debt of the state plus Russian companies even exceeds the amount of frozen reserves.

But what about the gold?

As of February 1, three weeks before the start of Operation Z, the Russian Central Bank held $630.2 billion in reserves. Almost half –

$311.2 billion – were placed in foreign securities, and a quarter – $151.9 billion – on deposits with foreign commercial and Central Banks. Not exactly a brilliant strategy. As of June last year, strategic partner China held 13.8% of Russia’s reserves, in gold and foreign currency.

As for the physical gold, $132.2 billion – 21% of total reserves – remains in vaultsin Moscow (two-thirds) and St. Petersburg (one-third).

So no Russian gold has been frozen? Well, it’s complicated.

The key problem is that more than 75% of Russian Central Bank reserves are in foreign currency. Half of these are securities, like government bonds: they never leave the nation that issued them. Roughly 25% of the reserves are linked to foreign banks, mostly private, as well as the BIS and the IMF.

Once again it’s essential to remember Sergei Glazyev in his groundbreaking essay Sanctions and Sovereignty: “It is necessary to complete the de-dollarization of our foreign exchange reserves, replacing the dollar, euro and pound with gold. In the current conditions of the expected explosive growth in the price of gold, its mass export abroad is akin to treason and it is high time for the regulator to stop it.”

This is a powerful indictment of the Russian Central Bank – which was borrowing against gold and exporting it. For all practical purposes, the Central Bank could be accused of perpetrating an inside job. And subsequently they were caught flat-footed by the devastating American sanctions.

As a Moscow analyst puts it, the Central Bank “had delivered some volumes of gold to London in 2020-2021. This decision was motivated by a high price of gold at that time (near $2000 per ounce) and could hardly be initiated by Putin. If so, this decision can be qualified as very stupid, or even part of a diversionist tactic (…) Most of the gold delivered to London was not stored but sold and transferred into foreign currency reserves (in euro or pounds) which were frozen later.”

No wonder a lot of people in Russia are livid. A quick flashback is in order. In June last year, Putin signed a law canceling requirements for the repatriation of foreign exchange earnings from gold exports. Five months later, Russia’s gold miners were exporting like crazy. A month later, the Duma wanted to know why the Central Bank had stopped buying gold. No wonder Russia media erupted with accusations of “an unprecedented [gold] robbery”.

Now it’s way more dramatic: RIA Novosti described the American-dictated freeze as – what else – a “robbery” and duly predicted global economic chaos. As for the Central Bank, it’s back on the gold buying business.

None of the above though explains some “missing” gold that de facto is not under the possession of the Russian Central Bank. And that’s where a somewhat shady character such as Herman Gref comes in.

Let’s check this out with State Duma deputy Mikhail Delyagin, who had a few things to say about the gold-exported-to-London bonanza:

“This process has been going on for the past year. Exported, according to some estimates, 600 tons. [Head of Russian Central Bank] Nabiullina said – whoever wants to sell gold to get cash, or if you mine gold and trade it, keep in mind that the state, in my person, will not buy gold from you at a market price. We will take it at a big discount. If you want to get honest money for it, please export it. The world center of gold trading is London. Accordingly, everyone began to export and sell gold there. Including Mr. [Herman] Gref. The head of the formally state-owned Sberbank sold a huge part of his gold reserves.”

Look here for fascinating details about Sberbank’s Gref shenanigans.

Watch for the gold-backed ruble

It may be a case of too little too late, but at least the Kremlin has now established a committee – with authority over the Central Bank nerds – to handle the serious stuff.

It boggles the mind that the Russian Central Bank does not answer to the Russian constitution as well as to the judicial system, but in fact is subordinated to the IMF. A case can be made that this cartel-designed financial system – implying zero sovereignty – simply cannot be tackled head on by any nation on the planet, and Putin has been trying to undermine it step by step. That includes, of course, keeping Elvira Nabiullina on the job even as she duly follows the Washington consensus to the letter.

And that brings us back to the ultra high stakes possibility that the Kremlin may have wanted from the start to go no holds barred, forcing the Atlanticists to reveal their true hand, and exposing their system in a “The King is Naked” spectacular for a worldwide audience.

And that’s where the EAEU/China new monetary/financial system comes in, under Glazyev supervision. We can certainly envision Russia, China and vast swathes of Eurasia progressively divorcing from casino capitalism; the ruble reconverted to a gold-backed currency; and Russia focused on self-sufficiency, productive domestic investment and trade connectivity with most of the Global South.

Way beyond its confiscated foreign reserves and tons of gold sold in London, what matters is that Russia remains the ultimate natural resource powerhouse. Shortages? A little austerity for a little while will take care of it: nothing as dramatic as the national impoverishment under the neoliberal 1990s. And extra boost would come from exporting natural resources at premium discount prices to other BRICS and most of Eurasia and the Global South.

The collective West has just fabricated a new, tawdry East-West divide. Russia is turning it upside down, to its own profit: after all the multipolar world is rising in the East.

The Empire of Lies won’t back down, because it does not have a Plan B. Plan A is to “cancel” Russia across the – Western – spectrum. So what? Russophobia, racism, 24/7 psyops, propaganda overdrive, cancel culture online mobs, that don’t mean a thing.

Facts matter: the Bear has enough nuclear/hypersonic hardware to shatter NATO in a few minutes before breakfast and teach a lesson to the collective West before pre-dinner cocktails. There will come a time when some exceptionalist with a decent IQ will finally understand the meaning of “indivisibility of security”.

READ MORE:

https://www.strategic-culture.org/news/2022/03/17/all-that-glitters-is-not-necessarily-russian-gold/

FREE JULIAN ASSANGE NOW ∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞!!!!

- By Gus Leonisky at 21 Mar 2022 - 3:24pm

- Gus Leonisky's blog

- Login or register to post comments

US fanned the flames...

Beijing's vice foreign minister blames NATO for stoking the instability that led to the Russia-Ukraine conflictChinese Vice Foreign Minister Le Yucheng has said globalization should not be “weaponized” and military-bloc politics must be “rejected.” The comments come one day after US President Joe Biden warned his Chinese counterpart Xi Jinping of “consequences” if Beijing supports Russia's military action in Ukraine.

Speaking at the Fourth International Forum on Security and Strategy in Beijing on Saturday, the Chinese official agreed with Moscow’s assessment that NATO’s unchecked expansion in Eastern Europe and the failure to address Russia’s national security concerns had paved the way for the current crisis. He said a simple “commitment of no eastward expansion could have easily ended the crisis and stopped the suffering.”

“Instead, one chose to fan the flames at a safe distance, watching its own arms dealers, bankers and oil tycoons make a fortune out of the war, while leaving the people of a small country with the wounds of war that would take years to heal,” he said.

NATO’s pursuit of “absolute security” leads to “absolute non-security,” Le added.

The consequences of forcing a major power, especially a nuclear power, into a corner are even more unimaginable.

Moscow has vehemently opposed NATO’s presence close to its borders, and embarked on a mission to obtain written guarantees that would halt the US-led military bloc’s expansion and bar Ukraine from joining its ranks. However, the West ignored Russia’s concerns.

READ MORE:

https://www.rt.com/news/552317-china-nato-russia-consequences-unimaginable/

READ FROM TOP

FREE JULIAN ASSANGE NOW !~!!!~!~!~!~!!!!!!

devils, according to freedom house…..

by Doug Bandow Posted on March 21, 2022

Even before its attack on Ukraine, the Russian Federation was reviled in the US for abandoning the pretense that its political system was open or free. Freedom House rates Russia as "Not Free," earning a paltry 19 out of 200 points. Fearing opposition to his invasion of Ukraine, Putin has moved much closer to a totalitarian system. Even so opponents to the war are breaking through intermittently, more than in some other unfree systems.

Yet President Biden is turning to some of the worst human rights abusers for help against Russia and its war on Ukraine. It’s a bit like empowering a gaggle of demons to fight the devil, a dubious decision in the best of circumstances.

For instance, President Joe Biden spoke with Chinese President Xi Jinping, supposedly to warn the latter against aiding Moscow economically or militarily. Despite the public threat of sanctions against the People’s Republic of China, implicit likely was the promise that the US would soften its campaign against Beijing. The administration can’t very well treat the PRC as a political piñata if the US expects China to leave Russia, recently declared to be a partner without limits, in the lurch.

In fact, China hawks overestimate Beijing’s power and risk turning the Chinese people as well as government into an enemy. However, treating the PRC better in order to wage fiercer economic war on Moscow is doing the right thing for the wrong reason. On human rights, China is significantly worse than Russia.

The PRC’s Freedom House rating is a dismal 9. Of the People’s Republic, said Freedom House: "China’s authoritarian regime has become increasingly repressive in recent years. The ruling Chinese Communist Party (CCP) continues to tighten control over all aspects of life and governance, including the state bureaucracy, the media, online speech, religious practice, universities, businesses, and civil society associations, and it has undermined an earlier series of modest rule-of-law reforms. The CCP leader and state president, Xi Jinping, has consolidated personal power to a degree not seen in China for decades. Human rights activists and lawyers continue to speak out, though at great personal cost."

Turkey is another autocracy whose support is being sought against Russia. President Recep Tayyip Erdogan has forged a working relationship with Putin, despite differences on important issues. That has created huge problems for the US and NATO, since the latter can ill afford a 5th column within the alliance. Washington has pressed Ankara for support, but the latter opposes sanctions on Russia. Although the Biden administration previously criticized Erdogan for his domestic repression and dalliance with Moscow, those issues appear to have dropped from the two nations’ ongoing dialogue.

Turkey also is not a free society, rating 32 from Freedom House. This undercuts the moral preening which NATO regularly engages in. Explained Freedom House: "President Recep Tayyip Erdogan’s Justice and Development Party (AKP) has ruled Turkey since 2002. After initially passing some liberalizing reforms, the AKP government showed growing contempt for political rights and civil liberties and has pursued a wide-ranging crackdown on critics and opponents since 2016. Constitutional changes in 2017 concentrated power in the hands of the president, removing key checks and balances. While Erdogan continues to dominate Turkish politics, a deepening economic crisis and opportunities to further consolidate political power have given the government new incentives to suppress dissent and limit public discourse."

The Biden administration also has been circling the globe attempting to find new oil supplies to make up for prohibiting the purchase of Russian oil. Selective boycotts rarely work in an international market since oil is fungible and can be resold by third parties. Nevertheless, an oil ban makes for good political theater and if widespread could seriously inconvenience the Kremlin.

Alas, in its search the Biden administration is abandoning the pretense that it cares about human rights. For instance, US officials flew to Caracas to seek a deal with Venezuela. Sanctions should be lifted – but in principle, not to strengthen the economic attack on Russia. The Trump administration policy of starving people who already were starving was a moral abomination and, unsurprisingly, failed to convince the Maduro government to surrender. If Washington simply dropped sanctions, oil would again flow freely.

There was more than a little irony in Biden’s approach. Venezuela enjoys a Freedom House rating of just 14, worse than Russia. Detailed the organization: "Venezuela’s democratic institutions have deteriorated since 1999, but conditions have grown sharply worse in recent years due to harsher crackdowns on the opposition and the ruling party relying on widely condemned elections to control all government branches. The authorities have closed off virtually all channels for political dissent, restricting civil liberties and prosecuting perceived opponents without regard for due process. The country’s severe humanitarian crisis has left millions struggling to meet basic needs, and driven mass emigration."

Even more shameful was the Biden administration playing supplicant to Saudi Arabia and United Arab Emirates and asking them to hike oil production. Unsurprisingly, they dismissed the request. Of course, higher prices are in their interest, and they are used to Washington fulfilling their every wish. Trump administration officials traveling to Riyadh began every visit by kissing the feet of Crown Prince Mohammed "Slice ‘n Dice" bin Salman and maintained an appropriately submissive posture throughout. Apparently, the royals refused to take Biden’s calls and indicated that they expected a return to groveling as usual to simply consider Washington’s request.

This should come as no surprise. The Kingdom of Saudi Arabia gets just 7 points from Freedom House, placing it in the bottom ten of 210 countries and territories. Its practices are awful, as one would expect from a country whose ruler turned a consulate into an abattoir and murdered and dismembered a journalist critical of the regime. Explained Freedom House: "Saudi Arabia’s absolute monarchy restricts almost all political rights and civil liberties. No officials at the national level are elected. The regime relies on pervasive surveillance, the criminalization of dissent, appeals to sectarianism and ethnicity, and public spending supported by oil revenues to maintain power. Women and religious minorities face extensive discrimination in law and in practice. Working conditions for the large expatriate labor force are often exploitative."

United Arab Emirates did better, but still came in below Russia, at 17. Despite its sophisticated image, largely derived from the modern territory of Dubai, UAE is an oppressive dictatorship. Said Freedom House: "Limited elections are held for a federal advisory body, but political parties are banned, and all executive, legislative, and judicial authority ultimately rests with the seven hereditary rulers. The civil liberties of both citizens and noncitizens, who make up an overwhelming majority of the population, are subject to significant restrictions."

Even worse, the KSA and UAE have spent more than seven years waging a vicious war against Yemen, the poorest nation in the Mideast even before the conflict. Although the insurgents, led by Ansar Allah, or the Houthis, are no friends of liberty, human rights groups affirm that the vast majority of the nearly 400,000 civilian deaths are attributable to the royal alliance and its hirelings. Absent Russian use of nuclear weapons, it is very unlikely that the Ukraine war will come anywhere close to that many casualties, let alone deaths.

Finally, the Biden administration is attempting to revive the Joint Comprehensive Plan of Action with Iran. In fact, there is good reason to do sosince the Trump administration’s "maximum pressure" campaign turned into a complete bust, a foolish favor to the Saudi and Israeli governments, whose preference always was for an American war against Tehran. Still, to the extent Biden is making additional concessions to close the deal in hopes of applying more pressure on Russia, he is helping tyranny to punish tyranny.

Freedom House gave Iran a 14 rating. The group explained its assessment: "The Islamic Republic of Iran holds elections regularly, but they fall short of democratic standards due in part to the influence of the hard-line Guardian Council, an unelected body that disqualifies all candidates it deems insufficiently loyal to the clerical establishment. Ultimate power rests in the hands of the country’s supreme leader, Ayatollah Ali Khamenei, and the unelected institutions under his control. These institutions, including the security forces and the judiciary, play a major role in the suppression of dissent and other restrictions on civil liberties."

In short, the Biden administration has turned to a real rogue’s gallery of oppressive and criminal regimes to punish Russia. Most actually are worse than Moscow, or at least were until Putin launched his brutal crackdown to squelch criticism of his invasion of Ukraine. Hopefully Biden will ultimately end sanctions and other restrictions that should have been removed long ago, but his reasons for doing so are making a mockery of his professed support for human rights.

Some on the right denounced Biden for daring to speak the truth about America’s unsavory friends. Wrote the Hudson Institute’s Peter Rough: "The Biden administration is developing policy for a world that no longer exists. The era when the United States could badger its allies one moment and demand cooperation from them the next is over. A new Sino-Russian axis has formed to challenge the United States. To treat our allies with contempt only encourages them to hedge at a time when we can afford it least."

In his view, apparently, Washington must become what it claims to oppose and embrace the worst oppressors and war criminals to gain international advantage. Such benefits are likely to prove transitory. For its principles to be taken seriously, the US must at least criticize killers and other miscreants, even if holding them responsible proves impractical. Ignoring such misbehavior is to treat the victims with contempt.

Anyway, despite their displeasure at US officials speaking the truth, such states still usually remain within Washington’s orbit since they benefit greatly from its patronage. Sure, they often play footsie with Moscow or Beijing hoping to get the US to up its offer. But which among would prefer to become satellites of Beijing or Moscow?

Rough complained about the administration’s failure to envelop the KSA, UAE, Turkey, and Poland with love and bestow sufficient hugs and kisses. However, who needs whom more? The foregoing governments remain the supplicants, not the superpower. If nothing else, the Saudi and Emirati royals remain dependent on American weapons, which fill their arsenals. Erdogan had good reason not to fall into Russia’s orbit even before the Ukraine war. Poland has nowhere to go, especially when requesting a NATO garrison. Will Warsaw ask Luxembourg or Montenegro to step in instead?

Moreover, if Washington fails to criticize allied regimes for their brutality, then it will earn the wrath of victims who eventually free themselves. And the US will lack credibility in criticizing adversaries for their human rights violations. For instance, Secretary of State Mike Pompeo consistently treated human rights as a political weapon, dissipating his credibility. The Trump administration’s policy of ostentatiously protecting Crown Prince Slice ‘n Dice from accountability for his crimes while denouncing the Iranians abusing their people highlighted American favoritism and hypocrisy.

The Biden administration hopes to increase pressure on Russia. However, Moscow’s attack on Ukraine, though criminal and unprovoked aggression, poses no meaningful security threat to America. Washington must consider the price that it is paying to enlist and empower a gaggle of even more oppressive regimes in order to punish Russia. Why not do the right thing for the right reason for a change?

Doug Bandow is a Senior Fellow at the Cato Institute. A former Special Assistant to President Ronald Reagan, he is author of Foreign Follies: America’s New Global Empire.

READ MORE:

https://original.antiwar.com/doug-bandow/2022/03/20/biden-administration-pretends-to-support-human-rights-turns-to-abusers-for-help-against-russia/

READ ALSO:

our nazi boy….

9/11 saudis' hand…..

READ FROM TOP.

FREE JULIAN ASSANGE NOW ∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞

destroying the US dollar…..

The Coming Global Financial Revolution Russia Is Following the American Playbook ELLEN BROWNNo country has successfully challenged the U.S. dollar’s global hegemony—until now. How did this happen and what will it mean?

Foreign critics have long chafed at the “exorbitant privilege” of the U.S. dollar as global reserve currency. The U.S. can issue this currency backed by nothing but the “full faith and credit of the United States.” Foreign governments, needing dollars, not only accept them in trade but buy U.S. securities with them, effectively funding the U.S. government and its foreign wars. But no government has been powerful enough to break that arrangement – until now. How did that happen and what will it mean for the U.S. and global economies?

The Rise and Fall of the PetroDollar

First, some history: The U.S. dollar was adopted as the global reserve currency at the Bretton Woods Conference in 1944, when the dollar was still backed by gold on global markets. The agreement was that gold and the dollar would be accepted interchangeably as global reserves, the dollars to be redeemable in gold on demand at $35 an ounce. Exchange rates of other currencies were fixed against the dollar.

But that deal was broken after President Lyndon Johnson’s “guns and butter” policy exhausted the U.S. kitty by funding war in Vietnam along with his “Great Society” social programs at home. French President Charles de Gaulle, suspecting the U.S. was running out of money, cashed in a major portion of France’s dollars for gold and threatened to cash in the rest; and other countries followed suit or threatened to.

In 1971, President Richard Nixon ended the convertibility of the dollar to gold internationally (known as “closing the gold window”), in order to avoid draining U.S. gold reserves. The value of the dollar then plummeted relative to other currencies on global exchanges. To prop it up, Nixon and Secretary of State Henry Kissinger made a deal with Saudi Arabia and the OPEC countries that OPEC would sell oil only in dollars, and that the dollars would be deposited in Wall Street and City of London banks. In return, the U.S. would defend the OPEC countries militarily. Economic researcher William Engdahl also presents evidence of a promise that the price of oil would be quadrupled. An oil crisis triggered by a brief Middle Eastern war did cause the price of oil to quadruple, and the OPEC agreement was finalized in 1974.

The deal held firm until 2000, when Saddam Hussein broke it by selling Iraqi oil in euros. Libyan president Muammar Qaddafi followed suit. Both presidents wound up assassinated, and their countries were decimated in war with the United States. Canadian researcher Matthew Ehret observes:

We should not forget that the Sudan-Libya-Egypt alliance under the combined leadership of Mubarak, Qadhafi and Bashir, had moved to establish a new gold-backed financial system outside of the IMF/World Bank to fund large scale development in Africa. Had this program not been undermined by a NATO-led destruction of Libya, the carving up of Sudan and regime change in Egypt, then the world would have seen the emergence of a major regional block of African states shaping their own destinies outside of the rigged game of Anglo-American controlled finance for the first time in history.

The Rise of the PetroRuble

The first challenge by a major power to what became known as the petrodollar has come in 2022. In the month after the Ukraine conflict began, the U.S. and its European allies imposed heavy financial sanctions on Russia in response to the illegal military invasion. The Western measures included freezing nearly half of the Russian central bank’s 640 billion U.S. dollars in financial reserves, expelling several of Russia’s largest banks from the SWIFT global payment system, imposing export controls aimed at limiting Russia’s access to advanced technologies, closing down their airspace and ports to Russian planes and ships, and instituting personal sanctions against senior Russian officials and high-profile tycoons. Worried Russians rushed to withdraw rubles from their banks, and the value of the ruble plunged on global markets just as the U.S. dollar had in the early 1970s.

The trust placed in the U.S. dollar as global reserve currency, backed by “the full faith and credit of the United States,” had finally been fully broken. Russian President Vladimir Putin said in a speech on March 16 that the U.S. and EU had defaulted on their obligations, and that freezing Russia’s reserves marks the end of the reliability of so-called first class assets. On March 23, Putin announced that Russia’s natural gas would be sold to “unfriendly countries” only in Russian rubles, rather than the euros or dollars currently used. Forty-eight nations are counted by Russia as “unfriendly,” including the United States, Britain, Ukraine, Switzerland, South Korea, Singapore, Norway, Canada and Japan.

Putin noted that more than half the global population remains “friendly” to Russia. Countries not voting to support the sanctions include two major powers – China and India – along with major oil producer Venezuela, Turkey, and other countries in the “Global South.” “Friendly” countries, said Putin, could now buy from Russia in various currencies.

On March 24, Russian lawmaker Pavel Zavalny said at a news conference that gas could be sold to the West for rubles or gold, and to “friendly” countries for either national currency or bitcoin.

Energy ministers from the G7 nations rejected Putin’s demand, claiming it violated gas contract terms requiring sale in euros or dollars. But on March 28, Kremlin spokesman Dmitry Peskov said Russia was “not engaged in charity” and won’t supply gas to Europe for free (which it would be doing if sales were in euros or dollars it cannot currently use in trade). Sanctions themselves are a breach of the agreement to honor the currencies on global markets.

Bloomberg reports that on March 30, Vyacheslav Volodin, speaker of the lower Russian house of parliament, suggested in a Telegram post that Russia may expand the list of commodities for which it demands payment from the West in rubles (or gold) to include grain, oil, metals and more. Russia’s economy is much smaller than that of the U.S. and the European Union, but Russia is a major global supplier of key commodities – including not just oil, natural gas and grains, but timber, fertilizers, nickel, titanium, palladium, coal, nitrogen, and rare earth metals used in the production of computer chips, electric vehicles and airplanes.

On April 2, Russian gas giant Gazprom officially halted all deliveries to Europe via the Yamal-Europe pipeline, a critical artery for European energy supplies.

U.K. professor of economics Richard Werner calls the Russian move a clever one – a replay of what the U.S. did in the 1970s. To get Russian commodities, “unfriendly” countries will have to buy rubles, driving up the value of the ruble on global exchanges just as the need for petrodollars propped up the U.S. dollar after 1974. Indeed, by March 30, the ruble had already risen to where it was a month earlier.

A Page Out of the “American System” Playbook

Russia is following the U.S. not just in hitching its national currency to sales of a critical commodity but in an earlier protocol – what 19th century American leaders called the “American System” of sovereign money and credit. Its three pillars were (a) federal subsidies for internal improvements and to nurture the nation’s fledgling industries, (b) tariffs to protect those industries, and (c) easy credit issued by a national bank.

Michael Hudson, a research professor of economics and author of “Super-Imperialism: The Economic Strategy of American Empire” among many other books, notes that the sanctions are forcing Russia to do what it has been reluctant to do itself – cut reliance on imports and develop its own industries and infrastructure. The effect, he says, is equivalent to that of protective tariffs. In an article titled “The American Empire Self-destructs,” Hudson writes of the Russian sanctions (which actually date back to 2014):

Russia had remained too enthralled by free-market ideology to take steps to protect its own agriculture or industry. The United States provided the help that was needed by imposing domestic self-reliance on Russia (via sanctions). When the Baltic states lost the Russian market for cheese and other farm products, Russia quickly created its own cheese and dairy sector – while becoming the world’s leading grain exporter.

Russia is discovering (or is on the verge of discovering) that it does not need U.S. dollars as backing for the ruble’s exchange rate. Its central bank can create the rubles needed to pay domestic wages and finance capital formation. The U.S. confiscations thus may finally lead Russia to end neoliberal monetary philosophy, as Sergei Glaziev has long been advocating in favor of MMT [Modern Monetary Theory]. …

What foreign countries have not done for themselves – replacing the IMF, World Bank and other arms of U.S. diplomacy – American politicians are forcing them to do. Instead of European, Near Eastern and Global South countries breaking away out of their own calculation of their long-term economic interests, America is driving them away, as it has done with Russia and China.

Glazyev and the Eurasian Reset

Sergei Glazyev, mentioned by Hudson above, is a former adviser to President Vladimir Putin and the Minister for Integration and Macroeconomics of the Eurasia Economic Commission, the regulatory body of the Eurasian Economic Union (EAEU). He has proposed using tools similar to those of the “American System,” including converting the Central Bank of Russia to a “national bank” issuing Russia’s own currency and credit for internal development. On February 25, Glazyev published an analysis of U.S. sanctions titled “Sanctions and Sovereignty,” in which he stated:

[T]he damage caused by US financial sanctions is inextricably linked to the monetary policy of the Bank of Russia …. Its essence boils down to a tight binding of the ruble issue to export earnings, and the ruble exchange rate to the dollar. In fact, an artificial shortage of money is being created in the economy, and the strict policy of the Central Bank leads to an increase in the cost of lending, which kills business activity and hinders the development of infrastructure in the country.

Glazyev said that if the central bank replaced the loans withdrawn by its Western partners with its own loans, Russian credit capacity would greatly increase, preventing a decline in economic activity without creating inflation.

Russia has agreed to sell oil to India in India’s own sovereign currency, the rupee; to China in yuan; and to Turkey in lira. These national currencies can then be spent on the goods and services sold by those countries. Arguably, every country should be able to trade in global markets in its own sovereign currency; that is what a fiat currency is – a medium of exchange backed by the agreement of the people to accept it at value for their goods and services, backed by the “full faith and credit” of the nation.

But that sort of global barter system would break down just as local barter systems do, if one party to the trade did not want the goods or services of the other party. In that case, some intermediate reserve currency would be necessary to serve as a medium of exchange.

Glazyev and his counterparts are working on that. In a translated interview posted on The Saker, Glazyev stated:

We are currently working on a draft international agreement on the introduction of a new world settlement currency, pegged to the national currencies of the participating countries and to exchange-traded goods that determine real values. We won’t need American and European banks. A new payment system based on modern digital technologies with a blockchain is developing in the world, where banks are losing their importance.

Russia and China have both developed alternatives to the SWIFT messaging system from which certain Russian banks have been blocked. London-based commentator Alexander Mercouris makes the interesting observation that going outside SWIFT means Western banks cannot track Russian and Chinese trades.

Geopolitical analyst Pepe Escobar sums up the plans for a Eurasian/China financial reset in an article titled “Say Hello to Russian Gold and Chinese Petroyuan.” He writes:

It was a long time coming, but finally some key lineaments of the multipolar world’s new foundations are being revealed.

On Friday [March 11], after a videoconference meeting, the Eurasian Economic Union (EAEU) and China agreed to design the mechanism for an independent international monetary and financial system. The EAEU consists of Russia, Kazakhstan, Kyrgyzstan, Belarus and Armenia, is establishing free trade deals with other Eurasian nations, and is progressively interconnecting with the Chinese Belt and Road Initiative (BRI).

For all practical purposes, the idea comes from Sergei Glazyev, Russia’s foremost independent economist ….

Quite diplomatically, Glazyev attributed the fruition of the idea to “the common challenges and risks associated with the global economic slowdown and restrictive measures against the EAEU states and China.”

Translation: as China is as much a Eurasian power as Russia, they need to coordinate their strategies to bypass the US unipolar system.

The Eurasian system will be based on “a new international currency,” most probably with the yuan as reference, calculated as an index of the national currencies of the participating countries, as well as commodity prices. …

The Eurasian system is bound to become a serious alternative to the US dollar, as the EAEU may attract not only nations that have joined BRI … but also the leading players in the Shanghai Cooperation Organization (SCO) as well as ASEAN. West Asian actors – Iran, Iraq, Syria, Lebanon – will be inevitably interested.

Exorbitant Privilege or Exorbitant Burden?

If that system succeeds, what will the effect be on the U.S. economy? Investment strategist Lynn Alden writes in a detailed analysis titled “The Fraying of the US Global Currency Reserve System” that there will be short-term pain, but, in the long run, it will benefit the U.S. economy. The subject is complicated, but the bottom line is that reserve currency dominance has resulted in the destruction of our manufacturing base and the buildup of a massive federal debt. Sharing the reserve currency load would have the effect that sanctions are having on the Russian economy – nurturing domestic industries as a tariff would, allowing the American manufacturing base to be rebuilt.

Other commentators also say that being the sole global reserve currency is less an exorbitant privilege than an exorbitant burden. Losing that status would not end the importance of the U.S. dollar, which is too heavily embedded in global finance to be dislodged. But it could well mean the end of the petrodollar as sole global reserve currency, and the end of the devastating petroleum wars it has funded to maintain its dominance.

This article was first posted on ScheerPost. Ellen Brown is an attorney, chair of the Public Banking Institute, and author of thirteen books including Web of Debt, The Public Bank Solution, and Banking on the People: Democratizing Money in the Digital Age. She also co-hosts a radio program on PRN.FM called “It’s Our Money.” Her 300+ blog articles are posted at EllenBrown.com.

READ MORE:

https://www.unz.com/article/the-coming-global-financial-revolution-russia-is-following-the-american-playbook/

READ FROM TOP.

FREE JULIN ASSANGE NOW !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!