Search

Recent comments

- brave losers....

1 min 35 sec ago - lights out....

12 min 26 sec ago - multi-survival....

1 hour 19 min ago - oh sy !!!!

4 hours 23 min ago - fraud....

6 hours 12 min ago - germany's gold.....

6 hours 33 min ago - divorce....

7 hours 12 min ago - augustus....

7 hours 18 min ago - russia's gold....

7 hours 30 min ago - the obvious....

8 hours 30 min ago

Democracy Links

Member's Off-site Blogs

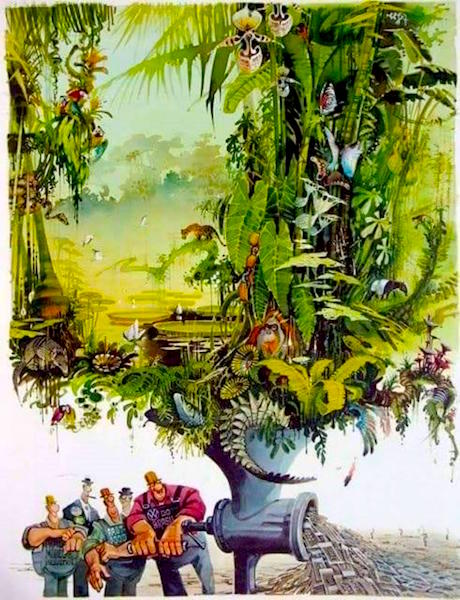

the money in nature...

mincer

mincer

It’s called a Natural Asset Company. With it the New York Stock Exchange has unveiled the most radical and potentially most destructive plan yet to make literally trillions of dollars on something that is the natural right and heritage of the entire human race [species] — nature itself, all nature, from air, fresh water to rainforests to even farmland. It is being promoted as a way to incentivize the preservation of nature. In fact it is a diabolical scheme to financialize potentially trillions of dollars of nature, ultimately allowing a globalist financial elite to control even this. And the Rockefeller Foundation is a founding partner. The combination of the NYSE and that foundation ought to sound loud alarm bells.

Wall Street’s Diabolical Plan to Financialize All Nature

The term financialize refers to the act of converting intangible value into financial instruments. Now hiding behind the fake facade of the Green Agenda that the UN and Davos WEF are promoting along with major OECD governments, Wall Street and the world’s largest financial institutions are promoting a scheme to financialize virtually all of nature. They even hired McKinsey and others to put a dollar value on it. They claim it all is worth 4 Quadrillion dollars or 4000 trillion dollars. Yet how can we put a dollar price on something given by nature?

Rockefeller Foundation is Behind it Too

The NYSE project to create a new class of stocks—NACs or Natural Asset Companies, to be traded alongside stocks like Apple or Boeing or Chevron—was developed in a collaboration by the Rockefeller Foundation and something they founded known as the IEG group or Intrinsic Exchange Group.

What is the IEG? To quote from their website, IEG was created by the Rockefeller Foundation together with World Bank affiliate IDB of Latin America. Two years ago IEG began work on the NYSE project. Their “Strategic Advisor”, Robert Herz, was Chairman of the Financial Accounting Standards Board (FASB) from 2002 to 2010. That says volumes about the thinking behind the IEG project. Herz today sits on the boards of many corporations including Morgan Stanley bank and US Government-sponsored real estate enterprise, Fannie Mae.

As they state on their website, IEG has created “a new asset class based on nature and the benefits that nature provides (termed ecosystem services). These services include carbon capture, soil fertility and water purification, amongst others.” They plan to bring this about by creation of the NYSE-recognized “new form of corporation called a ‘Natural Asset Company’ (NAC). The NYSE agreement will serve as their “platform to list these companies for trading, enabling the conversion of natural assets into financial capital. The NAC’s equity captures the intrinsic and productive value of nature and provides a store of value based on the vital assets that underpin our entire economy and make life on earth possible.” They further state, “IEG is proposing a transformational solution whereby natural ecosystems are not simply a cost to manage, but rather, an investible productive asset which provides financial capital and a source of wealth for governments and its citizens.” Note the “source of wealth for governments and it’s citizens.”

Nothing can go wrong here, or? The same Rockefellers who created the oil trust and the deadly GMO patented seeds now want to put a price on all nature. This is the financialization of nature and it is not going to be for charity or good-hearted motives, but rather for profit of investors, lots of it. The key to it all is who defines the “nature agenda” and you can be sure it is the corrupt UN Agenda 2030 “sustainable” goals and its cousin the Davos WEF Great Reset of the world economy. The agenda is imposed top down and it is not good.

How it Works

The NAC is to be created through an IPO like any new stock listing. The NAC then publicly sells shares to investors who could include Institutional Investors such as BlackRock–the $9.5 trillion asset manager, the world’s largest–or Vanguard Group or, say, the Norwegian or Chinese Sovereign Wealth funds. BlackRock CEO Larry Fink conveniently sits on the board of Klaus Schwab’s World Economic Forum, promoters of UN Agenda 2030 and of the Great Reset of the global financial system to a “sustainable” one.

The IEG describes the possibilities: “…as the natural asset prospers, providing a steady or increasing flow of ecosystem services, the company’s equity should appreciate accordingly providing investment returns. Shareholders and investors in the company through secondary offers, can take profit by selling shares. These sales can be gauged to reflect the increase in capital value of the stock, roughly in-line with its profitability, creating cash-flow based on the health of the company and its assets.”

Where the Money Goes

Shares in the NAC can be bought by others but it will clearly be dominated by big financial actors as are all important stocks. The new company, say one which claims ownership of a part of the Amazon Rain Forest, will then be subject to accounting standards including a new IEG-created “Statement of Ecological Performance: The financial value of the flow of ecosystem services and the assets that produce them.” The value placed on the flow of ecosystem services is the key, and that is being controlled by people like IEG’s Robert Herz, a board member of Morgan Stanley bank.

As IEG states, via the NYSE platform, “IEG converts natural asset value to financial capital in order to provide owners a way to financially benefit from the value of their natural assets.” But the rewards would also go to the shareholders like BlackRock or others by creating “financial transactions valuing natural assets that allow institutional investors to recognize, participate in and preserve nature’s value.” That means to make a profit on their stocks. Here the door is wide open to manipulation.

According to the statement of the IEG the proceeds from the NAC stock offering or IPO can be used by the sponsoring government to invest as it will. That means a corrupt regime in say, Ukraine or Mexico or Lebanon could use it to buy arms or whatever. The opportunities for misuse are staggering.

The fact that this NAC scam is being orchestrated by the Rockefeller Foundation is more than revealing. That foundation has been behind every major transformation of the global economy since more than a century to bring control into the hands of a global oligarchy committed to population reduction. The Rockefeller Foundation created the destructive GMO patented plants coupled with the toxic glyphosate weed killers that are ruining out food supply and poisoning our waters. The foundation is playing a key role in the covid pandemic lockdown strategy, as well as in reorganizing the world food production to destroy self-sufficient farming in favor of “sustainable” carbon free farming. The New York Stock Exchange and its project with the Rockefeller Foundation does not promise benefit for mankind or nature, only for the money trust.

F. William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook”.

READ MORE: https://journal-neo.org/2021/11/23/wall-street-s-diabolical-plan-to-financialize-all-nature/

The natural right and heritage of the entire human species — AND OF OTHER SPECIES...

FREE JULIAN ASSANGE NOWWWWWW !!!!

- By Gus Leonisky at 25 Nov 2021 - 5:53am

- Gus Leonisky's blog

- Login or register to post comments

subsidised destruction...

Despite calls to vote down the reforms from environmental groups, EU lawmakers have adopted the bloc's reformed Common Agricultural Policy — which will give €270 billion in aid directly to farmers in Europe.

After years of negotiations, European lawmakers voted to reform the bloc's huge farming subsidy program — the Common Agricultural Policy (CAP).

The farm deal worth €386.6 billion will be implemented from January 1, 2023, and makes up one-third of the EU's budget. It will be the bloc's farming policy till 2027 and aims to meet the EU's climate sustainability goals and support rural development.

It will also ensure fairer payments to farmers by giving €270 billion in direct aid.

"We are ensuring that farmers will be rewarded for their performance, their results," said German Member of the European Parliament Ulrike Müller, speaking at a press conference after the vote.

Speaking to members of the European Parliament in Strasbourg, Janusz Wojciechowski, the European Commissioner for Agriculture, welcomed the CAP reforms. "It will foster a sustainable and competitive agricultural sector that can support the livelihoods of farmers and provide healthy and sustainable food for society, while delivering significantly more in terms of environment and climate," he said.

Green backlashBut the CAP reforms have not been embraced by every EU lawmaker with some of them arguing that it doesn't align with global climate goals and also goes against the interest of small farmers.

German politician and Member of the European Green Party Martin Häusling said, "This is a dark day for environmental policy and EU farmers.”

Michal Wiezik, a Slovak member of the center-right European People's Party, shared a similar sentiment arguing that the only winners of the CAP reforms are oligarchs. "The reform fails to tie into the Biodiversity strategies. This reform should've been the solution, not a source of the problem," he said.

A week before the crucial vote, Swedish environmental activist Greta Thunberg also urged the EU to vote the CAP down.

Many environmental activists and EU officials are unhappy about how the CAP reforms do not align with the EU's Green Deal — a set of proposals unveiled by the European Commission in 2020, to ensure the bloc's climate, energy, transport and taxation policies reduce net greenhouse gas emissions by at least 55% by 2030, compared to the 1990 levels.

The new CAP's eco schemes specify that 22% of all CAP payments will cater to green farming from 2023-2024. This threshold will be raised to 25% from 2025-2027. Sommer Ackerman, 24, a young farmer and climate activist based in Finland says, "This deal claims to be 'green,' which is almost laughable."

"Currently, roughly one-third of the EU's budget is being spent on accelerating destruction, making this just another deal on the list of the EU's greenwashing projects. The intensive agricultural model is fueling the climate crisis by causing biodiversity loss, soil degradation, adding to water and air pollution and over extracting natural resources," she told DW.

Read more:

https://www.dw.com/en/eu-lawmakers-pass-common-agricultural-policy-deal-but-green-critics-sound-alarm/a-59912440

FREE JULIAN ASSANGE NOWWWWWW !!!!