Search

Recent comments

- a long day....

1 hour 21 min ago - pressure....

2 hours 9 min ago - peer pressure....

17 hours 28 min ago - strike back....

17 hours 34 min ago - israel paid....

18 hours 36 min ago - on earth....

23 hours 6 min ago - distraction....

1 day 16 min ago - on the brink....

1 day 26 min ago - witkoff BS....

1 day 1 hour ago - new dump....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

a strategic dead end...

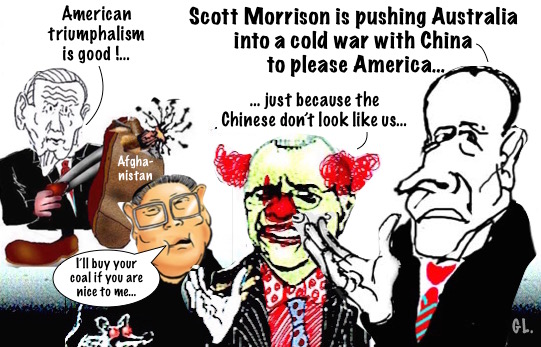

usFormer Australian Prime Minister Paul Keating has accused current leader Scott Morrison of pushing the country into a “cold war” with China and damaging relations with Beijing in a “fawning” effort to please Washington.

usFormer Australian Prime Minister Paul Keating has accused current leader Scott Morrison of pushing the country into a “cold war” with China and damaging relations with Beijing in a “fawning” effort to please Washington. In an interview with the Australian Financial Review, Keating argued that the Morrison government’s confrontational stance with China was absurd, given that Australia “is a continent sharing a border with no other state” and “has no territorial disputes with China.”

Keating pointed out that China is “12 flying hours away from the Australian coast,” yet the current government, “through its foreign policy incompetence and fawning compulsion to please America, effectively has us in a cold war with China.” Keating served as prime minister and leader of the Australian Labor Party between December 1991 and March 1996.

The former PM warned that Morrison is leading Australia into a “strategic dead end” with its “needless provocations” against Beijing.

The Morrison government is needlessly and irresponsibly pushing Australia towards a headlong confrontation with China, and doing it, in the main, to be seen in Washington as America’s fawning acolyte.

As to why US “warmongering” is currently focused on China, Keating argued Washington is upset that the Asian giant “is now a state as large as the United States, and with the potential of being much larger”– something he described as “an unforgivable sin for American triumphalists.”

Read more:

https://www.rt.com/news/533899-paul-keating-scott-morrison-china/

- By Gus Leonisky at 4 Sep 2021 - 5:47am

- Gus Leonisky's blog

- Login or register to post comments

ASPI: hate-tank...

In an important but shocking article in Michael West Media (MWM) on 21 August, journalist Marcus Reubenstein has exposed a pernicious practice by which supporters of the Australian Strategic Policy Institute (ASPI) have assiduously removed all negative criticism of ASPI from Wikipedia’s ASPI page, and added fawning praise of ASPI which renders the page, in Wikipedia’s judgment, to be “ranked ‘C’ on the Quality Scale, which is the lowest ranking for an established Wikipedia page.”

Reubenstein quotes Wikipedia as saying that the page is “missing important content or contains much irrelevant material”, has insufficient references to “reliable sources” and “would not provide a complete picture for even a moderately detailed study”.

Reubenstein has exposed an appalling situation.

The removed material has included references to critical articles in the Australian Financial Review (AFR), the Canberra Times and comments by Bruce Haigh in Pearls and Irritations. The Haigh’s comments included that ASPI is exaggerating the threat China poses to Australia and that ASPI’s advice has resulted in China freezing Australia out of “significant bilateral trade, economic and diplomatic relationships.”

As the editor of MWM points out, ASPI is Australia’s most influential and aggressive crafter of anti-China propaganda, funded by more than $11 million by the Federal Government in 2020-21. In addition it receives millions of dollars from foreign arms manufacturers and – curiously – Twitter.

Why does the Federal Government subsidise ASPI to attack our biggest trading partner? There are few more important issues on the Australian political agenda than our relations with China.

According to Reubenstein, Wikipedia has identified that some of the ASPI-favouring censorship has been done by dubious characters using multiple accounts: one of those, who has edited the page 11 times, uses “an IP (Internet Protocol) Address which points directly to the ASPI computer server.” A second user, who given their facility for the covert, might be better suited to a life in espionage, named their account as ASPI org.

Not in his article, but Reubenstein has told me that a report he wrote on the ASPI Wikipedia page was added to the page and then magically deleted the following day by “Horse Eye’s Back”. The day after that, the story was restored, and two minutes later was deleted again by “Horse Eye’s Back”. It was then restored for the third time before a Wikipedia Administrator jumped in and locked the page for five days. That has all happened this month.

Reubenstein quotes a “clearly annoyed [Wikipedia] editor writing in response to the removal of material from the ASPI page: “Stop removing referenced content that details funding outside the Australian government. This is highly relevant and proven, and any attempts to remove can only be assumed to be in bad faith.” Not a good look for an influential organisation which asserts that it is a pillar of integrity.

As Reubenstein says, mainstream media have given ASPI a great amount of positive media coverage in recent years. To its shame, those media have included the ABC, as well as the usual suspects. The media coverage, including on the ABC, would have the casual observer believe ASPI’s own PR – that it is independent, unbiased, free of influence and has true integrity.

By contrast, Reubenstein quotes another AFR story which found that “A report from influential think tank the Australian Strategic Policy Institute that criticised government departments for giving too much business to a dominant provider of cloud computing capacity was paid for by a lobbying firm engaged by three of the market leader’s rivals.” Who pays the piper, calls the tune, according to the hard-nosed, real politic ASPI. Is that how it works too when the US State Department or a US arms manufacturer is the client?

Reubenstein points out that Wikipedia’s ASPI page contains no reference to that damning assessment by the AFR.

Right wing Senator James Paterson has used the Coward’s Castle of Parliamentary privilege to launch an attack apparently aimed at Reubenstein as being, in effect, a catspaw of the Chinese Government. In a video message by Michael West accompanying Reubenstein’s article, West discloses that Reubenstein has actually doorknocked for the Liberal Party and is a long-time friend of Tony Abbott. We live in strange times!

Catspaws of any foreign government are required, under legislation passed by the coalition Federal Government to register as such; and are liable to be prosecuted on the say-so of the Federal Attorney-General for the very serious crime of engaging in foreign interference. The crime carries a penalty of twenty years imprisonment. As I have written previously in Pearls + Irritations, the criminal provision has major drafting problems. Those problems make it very difficult to say precisely what activities the prohibition on engaging in foreign interference extends to.

ASPI has registered under the Foreign Influence Transparency Scheme for its relationships with the US State Department and the Government of Japan, the Netherlands, a NATO arm and others. Being registered does not confer protection from being guilty of the crime of engaging in foreign interference. One no-no under the criminal provision is engaging in conduct which “is covert or involves deception”. Being covert or deceptive could render a person’s actions criminal foreign interference. Like surreptitiously fiddling with Wikipedia, perhaps. Or pushing a line on 7.30 or in the Australian at the behest of the US State Department or a US arms manufacturer. Serious stuff.

I don’t consider that Reubenstein needs to be worried. ASPI might if we ever get prosecuting authorities which are independent.

Here is Reubenstein’s most recent piece on ASPI ‘Credibility Tanked‘:

ASPI consistently cites an annual review by the University of Pennsylvania as proof its global credentials are “gold standard” but a closer look at the report hardly supports ASPI’s claim

Ian Cunliffe

Lawyer, formerly senior federal public servant (CEO Constitutional Commission, CEO Law Reform Commission, Department of PM&C, Protective Security Review and first Royal Commission on Intelligence and Security; High Court Associate (1971) ; partner of major law firms. Awarded Premier's Award (2018) and Law Institute of Victoria's President's Award for pro bono work (2005).

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!!!!!!!

feeding the air conditioners...

Soaring demand for electricity in China and India has put a rocket under the coal market with prices for the fossil fuel hitting a record high despite efforts to de-carbonise the global economy.

Key points:Australian miners have been fetching up to $US180 a tonne for their benchmark thermal coal deliveries this week, setting a new high of more than $240/t in Australian dollar terms.

The record comes barely six months since prices plumbed lows of just $US50/t as miners dealt with the twin blows of a COVID-induced economic downturn and China's unofficial decision to ban Australian imports.

Viktor Tanevski, the principle coal research analyst at consultancy Wood Mackenzie, said there had been a surge in power use — which was closely tied to coal consumption — as major Asian economies reopened.

Asia ignites price 'fireworks'Mr Tanevski said the market had been further propelled by problems among major coal producers such as Indonesia, starving supply and driving prices higher.

"Consequently, we've had fireworks in the thermal coal pricing indices," Mr Tanevski said.

Read more:

https://www.abc.net.au/news/rural/2021-09-05/resurgent-coal-market-hits-new-high/100431418

FREE JULIAN ASSANGE NOW...

chinese fireworks...

One of the curious developments of the past few months is that the slump in iron ore prices hasn’t been accompanied by similar falls in the prices of other key steelmaking ingredient, metallurgical coal.

Indeed, while the iron ore price has fallen about 34 per cent, from just under $US220 a tonne in mid-July to around $US145 a tonne, Australian metallurgical coal prices have soared from around $US100 a tonne at the start of this year to about $US220 a tonne. In China, the steel mills have been paying as much as $US440 a tonne for metallurgical, or coking, coal.

Read more:

https://www.smh.com.au/business/markets/china-s-ban-on-australian-coal-has-an-expensive-sting-in-its-tail-20210907-p58pij.html

Editor's Note: China has become the top foreign direct investment destination as well as the top source of outward foreign direct investment in the world, but Chinese companies should strive to understand the laws and sociopolitical situations in the countries they decide to invest in, so as to avoid losses, writes a veteran journalist with China Daily in the third of a series of commentaries.

Despite becoming the top source of foreign direct investment last year, China is a newcomer to the world of investment and still has a lot to learn in the field of global investment. When China began measuring its overseas foreign direct investment (OFDI) in 2002, its total OFDI amount was a mere $2.7 billion. In 2020, however, China's total OFDI had reached $133 billion, more than the United States'.

But with more countries eager to increase their OFDI, it's time Chinese companies focused on how to minimize the risks.

In the two decades since they started investing abroad, Chinese investors have suffered billions of dollars in losses because of the internal strifes in some countries and the change of regime in others, mostly in Africa and the Middle East. On many occasions, the Chinese investors had to not only abandon the almost completed or half-completed projects but also spend huge amounts to shift their workers and equipment from war-torn areas.

Read more:

http://www.chinadaily.com.cn/a/202108/17/WS611af55ea310efa1bd669238.html

It's one of Hemingway's best lines, from The Sun Also Rises. [We've already mentioned this quote here]

"How did you go broke?" Bill asked.

"Two ways," said Mike. "Gradually and then suddenly."

It is a passage to which Xu Jiayin, founder of China Evergrande, China's biggest property group and the world's 122nd largest company by sales, can relate.

For most of this year, his firm has been floundering, fighting off hordes of angry creditors, defending court actions and desperately trying to secure enough finance to survive. Now the situation has taken a sudden turn for the worse.

At its peak, three years ago, the Hong Kong-listed China Evergrande was the world's most valuable real estate group. It's now better known as the world's most indebted property developer, owing more than $US300 billion ($403 billion).

Once a symbol of glittering success in the most exciting property market on the planet, China Evergrande is now tanking, and dragging many of its competitors with it, as global investors and creditors desperately attempt to parachute out of the troubled Chinese property sector.

Read more:

https://www.abc.net.au/news/2021-09-06/china-property-bubble-may-be-about-to-burst-hurting-australia/100435868

Read from top.