Search

Recent comments

- "benevolence"....

36 min 49 sec ago - trump's BoP is worse....

9 hours 57 sec ago - luce's....

11 hours 1 min ago - dystopian....

20 hours 50 min ago - the fascists....

21 hours 33 min ago - not peaceful....

23 hours 25 min ago - 25 big helpers....

23 hours 38 min ago - courage....

1 day 50 min ago - going nuts....

1 day 1 hour ago - oily law....

1 day 1 hour ago

Democracy Links

Member's Off-site Blogs

the future of finance on a globally warming planet...

rock

rock

A virtually unregulated investment firm today exercises more political and financial influence than the Federal Reserve and most governments on this planet. The firm, BlackRock Inc., the world’s largest asset manager, invests a staggering $9 trillion in client funds worldwide, a sum more than double the annual GDP of the Federal Republic of Germany.

This colossus sits atop the pyramid of world corporate ownership, including in China most recently. Since 1988 the company has put itself in a position to de facto control the Federal Reserve, most Wall Street mega-banks, including Goldman Sachs, the Davos World Economic Forum Great Reset, the Biden Administration and, if left unchecked, the economic future of our world. BlackRock is the epitome of what Mussolini called Corporatism, where an unelected corporate elite dictates top down to the population.

How the world’s largest “shadow bank” exercises this enormous power over the world ought to concern us. BlackRock since Larry Fink founded it in 1988 has managed to assemble unique financial software and assets that no other entity has. BlackRock’s Aladdin risk-management system, a software tool that can track and analyze trading, monitors more than $18 trillion in assets for 200 financial firms including the Federal Reserve and European central banks. He who “monitors” also knows, we can imagine. BlackRock has been called a financial “Swiss Army Knife — institutional investor, money manager, private equity firm, and global government partner rolled into one.” Yet mainstream media treats the company as just another Wall Street financial firm.

There is a seamless interface that ties the UN Agenda 2030 with the Davos World Economic Forum Great Reset and the nascent economic policies of the Biden Administration. That interface is BlackRock.

Team Biden and BlackRock

By now it should be clear to anyone who bothers to look, that the person who claims to be US President, 78-year old Joe Biden, is not making any decisions. He even has difficulty reading a teleprompter or answering prepared questions from friendly media without confusing Syria and Libya or even whether he is President. He is being micromanaged by a group of handlers to maintain a scripted “image” of a President while policy is made behind the scenes by others. It eerily reminds of the 1979 Peter Sellers film character, Chauncey Gardiner, in Being There.

What is less public are the key policy persons running economic policy for Biden Inc. They are simply said, BlackRock. Much as Goldman Sachs ran economic policy under Obama and also Trump, today BlackRock is filling that key role. The deal apparently was sealed in January, 2019 when Joe Biden, then-candidate and long-shot chance to defeat Trump, went to meet with Larry Fink in New York, who reportedly told “working class Joe,” that, “I’m here to help.”

Now as President in one of his first appointees, Biden named Brian Deese to be the Director of the National Economic Council, the President’s main adviser for economic policy. One of the early Presidential Executive Orders dealt with economics and climate policy. That’s not surprising, as Deese came from Fink’s BlackRock where he was Global Head of Sustainable Investing. Before joining BlackRock, Deese held senior economic posts under Obama, including replacing John Podesta as Senior Adviser to the President where he worked alongside Valerie Jarrett. Under Obama, Deese played a key role in negotiating the Global Warming Paris Accords.

In the key policy post as Deputy Treasury Secretary under Secretary Janet Yellen, we find Nigerian-born Adewale “Wally” Adeyemo. Adeyemo also comes from BlackRock where from 2017 to 2019 he was a senior adviser and Chief of Staff to BlackRock CEO Larry Fink, after leaving the Obama Administration. His personal ties to Obama are strong, as Obama named him the first President of the Obama Foundation in 2019.

And a third senior BlackRock person running economic policy in the Administration now is also unusual in several respects. Michael Pyle is the Senior Economic Adviser to Vice President Kamala Harris. He came to Washington from the position as the Global Chief Investment Strategist at BlackRock where he oversaw the strategy for investing some $9 trillion of funds. Before joining BlackRock at the highest level, he had also been in the Obama Administration as a senior adviser to the Undersecretary of the Treasury for International Affairs, and in 2015 became an adviser to the Hillary Clinton presidential bid.

The fact that three of the most influential economic appointees of the Biden Administration come from BlackRock, and before that all from the Obama Administration, is noteworthy. There is a definite pattern and suggests that the role of BlackRock in Washington is far larger than we are being told.

What is BlackRock?

Never before has a financial company with so much influence over world markets been so hidden from public scrutiny. That’s no accident. As it is technically not a bank making bank loans or taking deposits, it evades the regulation oversight from the Federal Reserve even though it does what most mega banks like HSBC or JP MorganChase do—buy, sell securities for profit. When there was a Congressional push to include asset managers such as BlackRock and Vanguard Funds under the post-2008 Dodd-Frank law as “systemically important financial institutions” or SIFIs, a huge lobbying push from BlackRock ended the threat. BlackRock is essentially a law onto itself. And indeed it is “systemically important” as no other, with possible exception of Vanguard, which is said to also be a major shareholder in BlackRock.

BlackRock founder and CEO Larry Fink is clearly interested in buying influence globally. He made former German CDU MP Friederich Merz head of BlackRock Germany when it looked as if he might succeed Chancellor Merkel, and former British Chancellor of Exchequer George Osborne as “political consultant.” Fink named former Hillary Clinton Chief of Staff Cheryl Mills to the BlackRock board when it seemed certain Hillary would soon be in the White House.

He has named former central bankers to his board and gone on to secure lucrative contracts with their former institutions. Stanley Fisher, former head of the Bank of Israel and also later Vice Chairman of the Federal Reserve is now Senior Adviser at BlackRock. Philipp Hildebrand, former Swiss National Bank president, is vice chairman at BlackRock, where he oversees the BlackRock Investment Institute. Jean Boivin, the former deputy governor of the Bank of Canada, is the global head of research at BlackRock’s investment institute.

BlackRock and the Fed

It was this ex-central bank team at BlackRock that developed an “emergency” bailout plan for Fed chairman Powell in March 2019 as financial markets appeared on the brink of another 2008 “Lehman crisis” meltdown. As “thank you,” the Fed chairman Jerome Powell named BlackRock in a no-bid role to manage all of the Fed’s corporate bond purchase programs, including bonds where BlackRock itself invests. Conflict of interest? A group of some 30 NGOs wrote to Fed Chairman Powell, “By giving BlackRock full control of this debt buyout program, the Fed… makes BlackRock even more systemically important to the financial system. Yet BlackRock is not subject to the regulatory scrutiny of even smaller systemically important financial institutions.”

In a detailed report in 2019, a Washington non-profit research group, Campaign for Accountability, noted that, “BlackRock, the world’s largest asset manager, implemented a strategy of lobbying, campaign contributions, and revolving door hires to fight off government regulation and establish itself as one of the most powerful financial companies in the world.”

The New York Fed hired BlackRock in March 2019 to manage its commercial mortgage-backed securities program and its $750 billion primary and secondary purchases of corporate bonds and ETFs in no-bid contracts. US financial journalists Pam and Russ Martens in critiquing that murky 2019 Fed bailout of Wall Street remarked, “for the first time in history, the Fed has hired BlackRock to “go direct” and buy up $750 billion in both primary and secondary corporate bonds and bond ETFs (Exchange Traded Funds), a product of which BlackRock is one of the largest purveyors in the world.” They went on, “Adding further outrage, the BlackRock-run program will get $75 billion of the $454 billion in taxpayers’ money to eat the losses on its corporate bond purchases, which will include its own ETFs, which the Fed is allowing it to buy…”

Fed head Jerome Powell and Larry Fink know each other well, apparently. Even after Powell gave BlackRock the hugely lucrative no-bid “go direct” deal, Powell continued to have the same BlackRock manage an estimated $25 million of Powell’s private securities investments. Public records show that in this time Powell held direct confidential phone calls with BlackRock CEO Fink. According to required financial disclosure, BlackRock managed to double the value of Powell’s investments from the year before! No conflict of interest, or?

A Very BlackRock in Mexico

BlackRock’s murky history in Mexico shows that conflicts of interest and influence-building with leading government agencies is not restricted to just the USA. PRI Presidential candidate Peña Nieto went to Wall Street during his campaign in November 2011. There he met Larry Fink. What followed the Nieto victory in 2012 was a tight relationship between Fink and Nieto that was riddled with conflict of interest, cronyism and corruption.

Most likely to be certain BlackRock was on the winning side in the corrupt new Nieto regime, Fink named 52-year-old Marcos Antonio Slim Domit, billionaire son of Mexico’s wealthiest and arguably most corrupt man, Carlos Slim, to BlackRock’s Board. Marcos Antonio, along with his brother Carlos Slim Domit, run the father’s huge business empire today. Carlos Slim Domit, the eldest son, was Co-Chair of the World Economic Forum Latin America in 2015, and currently serves as chairman of the board of America Movil where BlackRock is a major investor. Small cozy world.

The father, Carlos Slim, at the time named by Forbes as World’s Richest Person, built an empire based around his sweetheart acquisition of Telemex (later America Movil). Then President, Carlos Salinas de Gortari, in effect gifted the telecom empire to Slim in 1989. Salinas later fled Mexico on charges of stealing more than $10 billion from state coffers.

As with much in Mexico since the 1980s drug money apparently played a huge role with the elder Carlos Slim, father of BlackRock director Marcos Slim. In 2015 WikiLeaks released company internal emails from the private intelligence corporation, Stratfor. Stratfor writes in an April 2011 email, the time BlackRock is establishing its Mexico plans, that a US DEA Special Agent, William F. Dionne confirmed Carlos Slim’s ties to the Mexican drug cartels. Stratfor asks Dionne, “Billy, is the MX (Mexican) billionaire Carlos Slim linked to the narcos?” Dionne replies, “Regarding your question, the MX telecommunication billionaire is.” In a country where 44% of the population lives in poverty you don’t become the world’s richest man in just two decades selling Girl Scout cookies.

Fink and Mexican PPP

With Marcos Slim on his BlackRock board and new president Enrique Peña Nieto, Larry Fink’s Mexican partner in Nieto Peña’s $590 billion PublicPrivatePartnership (PPP) alliance, BlackRock, was ready to reap the harvest. To fine-tune his new Mexican operations, Fink named former Mexican Undersecretary of Finance Gerardo Rodriguez Regordosa to direct BlackRock Emerging Market Strategy in 2013. Then in 2016 Peña Nieto appointed Isaac Volin, then head of BlackRock Mexico to be No. 2 at PEMEX where he presided over corruption, scandals and the largest loss in PEMEX history, $38 billion.

Peña Nieto had opened the huge oil state monopoly, PEMEX, to private investors for the first time since nationalization in the 1930s. The first to benefit was Fink’s BlackRock. Within seven months, BlackRock had secured $1 billion in PEMEX energy projects, many as the only bidder. During the tenure of Peña Nieto, one of the most controversial and least popular presidents, BlackRock prospered by the cozy ties. It soon was engaged in highly profitable (and corrupt) infrastructure projects under Peña Nieto including not only oil and gas pipelines and wells but also including toll roads, hospitals, gas pipelines and even prisons.

Notably, BlackRock’s Mexican “friend” Peña Nieto was also “friends” not only with Carlos Slim but with the head of the notorious Sinaloa Cartel, “El Chapo” Guzman. In court testimony in 2019 in New York Alex Cifuentes, a Colombian drug lord who has described himself as El Chapo’s “right-hand man,” testified that just after his election in 2012, Peña Nieto had requested $250 million from the Sinaloa Cartel before settling on $100 million. We can only guess what for.

Larry Fink and WEF Great Reset

In 2019 Larry Fink joined the Board of the Davos World Economic Forum, the Swiss-based organization that for some 40 years has advanced economic globalization. Fink, who is close to the WEF’s technocrat head, Klaus Schwab, of Great Reset notoriety, now stands positioned to use the huge weight of BlackRock to create what is potentially, if it doesn’t collapse before, the world’s largest Ponzi scam, ESG corporate investing. Fink with $9 trillion to leverage is pushing the greatest shift of capital in history into a scam known as ESG Investing. The UN “sustainable economy” agenda is being realized quietly by the very same global banks which have created the financial crises in 2008. This time they are preparing the Klaus Schwab WEF Great Reset by steering hundreds of billions and soon trillions in investment to their hand-picked “woke” companies, and away from the “not woke” such as oil and gas companies or coal. BlackRock since 2018 has been in the forefront to create a new investment infrastructure that picks “winners” or “losers” for investment according to how serious that company is about ESG—Environment, Social values and Governance.

For example a company gets positive ratings for the seriousness of its hiring gender diverse management and employees, or takes measures to eliminate their carbon “footprint” by making their energy sources green or sustainable to use the UN term. How corporations contribute to a global sustainable governance is the most vague of the ESG, and could include anything from corporate donations to Black Lives Matter to supporting UN agencies such as WHO. Oil companies like ExxonMobil or coal companies no matter how clear are doomed as Fink and friends now promote their financial Great Reset or Green New Deal. This is why he cut a deal with the Biden presidency in 2019.

Follow the money. And we can expect that the New York Times will cheer BlackRock on as it destroys the world financial structures. Since 2017 BlackRock has been the paper’s largest shareholder. Carlos Slim was second largest. Even Carl Icahn, a ruthless Wall Street asset stripper, once called BlackRock, “an extremely dangerous company… I used to say, you know, the mafia has a better code of ethics than you guys.”

F. William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook”.

Read more:

https://journal-neo.org/2021/06/18/there-is-more-to-blackrock-than-you-might-imagine/

FREE JULIAN ASSANGE NOW !!!!

- By Gus Leonisky at 20 Jun 2021 - 6:49am

- Gus Leonisky's blog

- Login or register to post comments

globally-hot money...

From Worth...

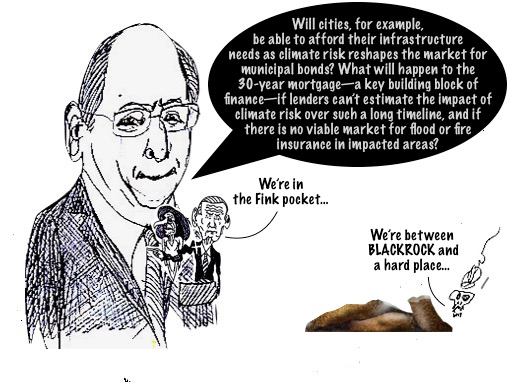

BlackRock CEO Larry Fink’s annual letters to chief executives have become something of a clarion call for social change in the corporate world, as the head of the nearly $7 trillion [now 9 trillion since this article was written] investment management business has tried to explain that “embracing purpose” is good for business.

In this year’s letter, Fink has gone a step further—tackling the crisis of climate change, which he believes will upend the world of finance.

“Climate risk is investment risk,” he wrote in the letter, released Jan. 14. “In the near future—and sooner than most anticipate—there will be a significant reallocation of capital.”

Fink argued that sustainability, and climate-integrated portfolios, can provide better risk-adjusted returns to investors—and that BlackRock’s clients want them. As a consequence, he said that BlackRock will be getting out of coal investments while launching new investment products that screen fossil fuels.

The gigantic financial institution, which invests in virtually every public company as a result of its ETFs and index funds, has recently found itself the target of activists picketing its offices to demand more action on climate change. “Young people have been at the forefront of calling on institutions—including BlackRock—to address the new challenges associated with climate change. They are asking more of companies and of governments, in both transparency and in action,” he wrote.

Fink, who is looking ahead to the time when millennials will be running the corporate world, freely admits that “BlackRock itself is not yet where we want to be.”

In the meantime, BlackRock’s size and Fink’s prominence in the world of finance may help change the conversation—and behavior—of other investors and corporations in the U.S. and beyond.

BlackRock has already joined with other companies and countries in tackling the topic of climate change at a time when President Trump and the Republicans in Congress are moving in the opposite direction—slashing environmental regulations and exiting the Paris Agreement on climate change.

For example, BlackRock was a founding member of the Task Force on Climate-Related Financial Disclosures. This year, Fink said, BlackRock will ask the companies it invests in to make more disclosures on climate-related risks in line with that group’s recommendations.

And Fink issued a warning to those who ignore the issue, saying BlackRock is likely to vote against management and board directors if not enough progress is being made on climate change at their companies.

Read more:

https://www.worth.com/larry-fink-how-climate-change-will-upend-the-world-of-finance/

FREE JULIAN ASSANGE NOW %%%%%%%%!!!!!

gambling the planet away...

The Climate Innovation Forum is less than two weeks away! Connect and collaborate with policy, finance and innovation leaders to advance the green economy agenda ahead of COP26.

Join us between 29 June - 1 July and hear from inspirational leaders as they reflect and examine the challenges, barriers and business opportunities presented by the UK’s Ten Point Plan.

Close the gap between ambition and action.

-------------------

Tourists line the air-conditioned casino labyrinths amid record temperatures – but many locals are not able to take cover indoors

Sat 19 Jun 2021 15.00 AESTBy midnight on Wednesday, two days into a scorching heat wave to hit the US west, the air in Las Vegas had barely cooled.

Throughout the day and for the days that followed, temperatures in the desert city hovered close to historic highs, peaking at 116 degrees Fahrenheit (46.6 Celsius), and setting a new record for such dangerously hot weather so early in the year. Meanwhile, dust and smoke from nearby wildfires hung in the stiff hot air, casting a brown haze over the valley.

Throngs of tourists still ambled along scorching-hot sidewalks on the Vegas Strip, and many others lined the labyrinths of slot machines, restaurants and shops inside air conditioned casinos. But not everyone is able to escape indoors.

“I am dying – I feel like I’m going to pass out,” said Violet, a woman clad in a denim thong and crop top.

Violet makes her living outside on the strip, posing for pictures with passersby. She was glistening, both from the body glitter covering her arms and chest and the beads of sweat collecting on her face in the midday sun. She has a heart condition, she said while leaning against a planter where she and several other women had stored water bottles to empty in-between selfies. “I am out here because I have to pay rent, but it is so hot and I get dehydrated so quickly.”

Read more:

https://www.theguardian.com/us-news/2021/jun/19/las-vegas-heatwave-nevada-us-west-temperatures

Read from top.

FREE JULIAN ASSANGE TODAY @@@@@@@@@@@@@@∞∞∞∞∞∞∞!!!!!

selling money...

by Helen Buyniski

As the US runs out of concrete resources to sell, bankers have had to get clever - whether this means repackaging assets already sold six times over or inventing new ways to cash in on items once considered intangible.By the time Americans realized that the promised ‘trickle-down’ theory of neoliberal economics was in fact more of a speedy trickle-up, the government had all but destroyed the reputation of unions and the public sector that employed many of them, convincing the average American that these were corrupt and bad. Indeed, the whole public sector was supposed to be corrupt and bad, in the messaging of the Reagan era, but that corruption was somehow negated when offset by private corporations engaged in so-called public-private partnerships.

But far from attempting to reverse the financial bleed of money for social programs into private corporations, politicians have embraced the public-private partnership with a vengeance. This is unsurprising, given the generous handouts they receive from the non-profits who have cast themselves as the only truly righteous replacement for those government programs.

Concrete AssetsThis may sound like old news, but the extent to which those firms have morphed into horrifically powerful entities with trillions of dollars under management – including, most likely, your pension or the retirement savings of someone in your family – capable of setting international policy with a mere yearly memo, remains stubbornly unacknowledged by millions. Perhaps for the sake of their sanity, they just can’t admit their retirement is in the hands of men who see nothing wrong with gambling away millions of Americans’ savings in precarious financial instruments just because they can. The kind of people who’d buy a boat with ill-gotten foreclosure gains, then spit in the face of those ex-homeowners by naming the boat ‘Su casa es mi casa’ (that’s ‘your house is my house’, for those not up on their grade-school Spanish.

In the aftermath of the 2008 mortgage crisis, private equity firms realized they could package and sell anything they wanted – and it doesn’t seem they’ve stopped. Blackstone became notorious for slurping up foreclosed homes at below-market rates, then juicing rent and fees as they turned around to rent out those same properties, in some cases back to the same people. But Blackstone is far from the only private equity firm to participate in these loathsome schemes.

Vertical IntegrationBut fiendishly huge as their profits have been, the private equity bunch were still responsible for keeping the properties they rented in some degree of habitability - sometimes even for answering to angry retirement fund execs when the vultures gambled away their money. In order to further shore up profits, the firms have bought big into vertically integrated predation. Blackstone bought up an entire chain of self-storage units to complement its continuing acquisition of houses. The continued inflation of the already precariously bloated real estate bubble (and the mathematical certainty of time running out for the Covid-19 eviction moratorium) means people are going to have to throw their stuff somewhere when the financial feces hit the fan. Other private equity funds have gotten their blood funnels into the hospital system – where the profits, driven by Covid-19, truly have no end.

Blackstone has also been buying up life insurance businesses, no doubt understanding that medical bills are the chief cause of bankruptcy in America – and bankruptcy itself is a stress-fuelled shortcut to an early grave. Even the history of the dead isn’t safe from the hungry tentacles of private equity – Blackstone bought genealogy site Ancestry.com last year, meaning (at least hypothetically, given the pattern of other tech firms in which Blackstone and its ilk own controlling shares) you could actually be deplatformed from your own family history (and perhaps given an outstanding genetic link with a cold-case murderer) if you say the wrong thing online.

Fun with FraudSuch firms seem to have dispensed with any notion that they’re actually trying to safeguard the trillions of assets they manage for massive retirement and pension funds, opting to blame losses on easy scapegoats like the Covid-19 pandemic (an event many large corporations, including private equity giants like BlackRock, have actually made money on following a brief slump). Rather than dutifully ensuring millions of aging public sector employees have a healthy nest egg waiting for them at the end of their careers, the private equity industry – where the majority of these funds stash their cash – is bristling with fraudulent fees, according to the Securities and Exchange Commission. The problem is so bad that only half the fees involved in the system are even being reported, let alone paid, according to industry publication CEM Benchmarking – and Uncle Sam is consistently left holding the bag.

According to a recent study cited in the New York Times, private equity as an industry is dodging a whopping $75 billion a year in taxes. This money, once saved from Uncle Sam’s clutches, can be used to further enrich Wall Street by enveloping their rapine in warm fuzzy buzzwords like ‘sustainability’ and ‘good governance’. Such tactics permit them to con the same middle-class holdouts having their assets wiped out by the housing bubble and other schemes into a sort of fiscal Stockholm syndrome, where they remain in stasis, working dutifully to fight their best interests.

Everyone ‘knows’ the rich are ripping off the taxman, and yet – government and the industry will literally say with a straight face – no one’s arresting them, so they must be staying within the law, right? At least three whistleblowers known to the public have come forward to tip off the Internal Revenue Service about rampant tax-cheating in private equity – potentially forsaking their own share of the trillions of dollars at play here – but politicians still won’t touch the industry. It’s the equivalent of a school bus full of Mafia capos disembarking in front of FBI Headquarters with proof of dozens of murders – only for the G-men to look the other way while the big payouts go to FBI head Christopher Wray.

Don’t Forget Feudalism!The irony is thick, given what central bankers are determined to inflict on the “little guy” financially while letting private equity skate on its own taxes. Agustin Carstens, general manager of the Bank of International Settlements – the central bank of central banks – gushed in an interview last year about the impending arrival of CBDCs (central bank digital currencies – essentially bitcoin minus the privacy rhetoric), complaining that while “In cash we don’t know for example who’s using a 100 bill today, we don’t know who’s using a 1000 peso bill today, a key difference with the CBDC is that a central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability and also we will have the technology to enforce that. Makes a huge difference to what cash is.”

Put more simply, that’s “taxpaying for thee, but not for me.”

That the “ESG (environmental, social and governance)” category that has become the buzzword to end all buzzwords as the global financial system struggles to merge with the new cashless model promised for so long by bottom-feeders like Carstens is not reflected at all in how a company actually treats its employees. Nor do they show in the way these firms treat the money they manage, as the state of Rhode Island discovered earlier this year after private equity firm Leonard Green & Partners asset-stripped an entire hospital chain and tried to fob the debt off back on the state.

This should not come as a surprise, but the glacial pace with which it has occurred to state treasurers and others who sit in positions to do something about private equity’s stranglehold over the US does not bode well for the country’s future. Deep investments by private equity in every mainstream media organization in existence all but seal the West’s fate as a glorified slave colony, with Wall St holding the whip.

Read more:

https://www.rt.com/op-ed/528842-private-equity-pension-vultures-reset/

"Botton-of-the-Harbour" financial schemes haven't disappeared... They have turned into "bottom-of-the-Mariana-Trench" on a worldwide scale...

Read more:

fair contracts...

It’s been four months since over 1,000 union coal miners at Warrior Met Coal in Brookwood, Alabama, went on strike to demand a fair contract that includes better pay, benefits, and more time for workers to spend with their families. Faced with intransigence from the company and increasing hostility on the picket line, a caravan of striking miners and their supporters came back to New York City to voice their demands and hold a rally on July 28 in front of the NYC headquarters of BlackRock, the world’s largest asset manager and Warrior Met’s biggest investor. In this TRNN report, part of our ongoing series “Battleground Brookwood,” we give an update on the strike and hear directly from striking miner Mike Wright.

See more:

https://therealnews.com/striking-alabama-coal-miners-hit-streets-of-nyc-to-protest-corporate-greed

Read from top.

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!!!!!!!!!!!!!

under a blackrock...

BlackRock CEO Larry Fink, whose firm oversees investments equivalent to about half of US GDP, has predicted that efforts to punish Russia over its invasion of Ukraine would lead to the unraveling of globalism as decision-makers reconsider their foreign vulnerabilities.

“The Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades,” Fink said on Thursday in a letter to investors. “We had already seen connectivity between nations, companies and even people strained by two years of the pandemic. It has left many communities and people feeling isolated and looking inward. I believe this has exacerbated the polarization and extremist behavior we are seeing across society today.”

Western nations responded to the Ukraine crisis by launching an “economic war” against Moscow, including the unprecedented step of barring the Russian central bank from deploying its foreign currency reserves, Fink noted. Capital markets, financial institutions and other businesses have gone beyond the sanctions imposed by their governments, cutting off their Russian ties and operations.

“Russia’s aggression in Ukraine and its subsequent decoupling from the global economy is going to prompt companies and governments worldwide to re-evaluate their dependencies and re-analyze their manufacturing and assembly footprints – something that Covid had already spurred many to start doing,” Fink said. As a result, he added, companies will move more operations to their home countries or to neighboring nations, leading to higher costs and prices.

The Russia-Ukraine conflict has “upended the world order” that has been in place since the Cold War ended and will require BlackRock to adjust to “long-term structural changes,” such as deglobalization and higher inflation, Fink said. He added that central banks will have to either accept increased inflation – even beyond the 40-year high that was set last month in the US – or reduced economic activity and employment.

READ MORE:

https://www.rt.com/news/552720-blackrock-sees-globalism-ending/

READ FROM TOP.

FREE JULIAN ASSANGE NOW...

who owns the world? not you and me…….

https://scheerpost.com/2022/07/29/the-shadow-bank-that-owns-the-world/

READ FROM TOP.

FREE JULIAN ASSANGE NOW ##############################

greening down.....

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name.

To receive Global Research’s Daily Newsletter (selected articles), click here.

Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

First published by Global Research on November 16, 2022

By F. William Engdahl

***

Most people are bewildered by what is a global energy crisis, with prices for oil, gas and coal simultaneously soaring and even forcing closure of major industrial plants such as chemicals or aluminum or steel. The Biden Administration and EU have insisted that all is because of Putin and Russia’s military actions in Ukraine. This is not the case. The energy crisis is a long-planned strategy of western corporate and political circles to dismantle industrial economies in the name of a dystopian Green Agenda. That has its roots in the period years well before February 2022, when Russia launched its military action in Ukraine.

Blackrock pushes ESGIn January, 2020 on the eve of the economically and socially devastating covid lockdowns, the CEO of the world’s largest investment fund, Larry Fink of Blackrock, issued a letter to Wall Street colleagues and corporate CEOs on the future of investment flows. In the document, modestly titled “A Fundamental Reshaping of Finance”, Fink, who manages the world’s largest investment fund with some $7 trillion then under management, announced a radical departure for corporate investment. Money would “go green.” In his closely-followed 2020 letter Fink declared,

“In the near future – and sooner than most anticipate – there will be a significant re-allocation of capital…Climate risk is investment risk.” Further he stated, “Every government, company, and shareholder must confront climate change.” [i]

In a separate letter to Blackrock investor clients, Fink delivered the new agenda for capital investing. He declared that Blackrock will exit certain high-carbon investments such as coal, the largest source of electricity for the USA and many other countries. He added that Blackrock would screen new investment in oil, gas and coal to determine their adherence to the UN Agenda 2030 “sustainability.”

Fink made clear the world’s largest fund would begin to disinvest in oil, gas and coal. “Over time,” Fink wrote, “companies and governments that do not respond to stakeholders and address sustainability risks will encounter growing skepticism from the markets, and in turn, a higher cost of capital.” He added that, “Climate change has become a defining factor in companies’ long-term prospects… we are on the edge of a fundamental reshaping of finance.” [ii]

From that point on the so-called ESG investing, penalizing CO2 emitting companies like ExxonMobil, has become all the fashion among hedge funds and Wall Street banks and investment funds including State Street and Vanguard. Such is the power of Blackrock. Fink was also able to get four new board members in ExxonMobil committed to end the company’s oil and gas business.

Follow the “Real Money” Behind the “New Green Agenda”The January 2020 Fink letter was a declaration of war by big finance against the conventional energy industry. BlackRock was a founding member of the Task Force on Climate-related Financial Disclosures (the TCFD) and is a signatory of the UN PRI— Principles for Responsible Investing, a UN-supported network of investors pushing zero carbon investing using the highly-corrupt ESG criteria—Environmental, Social and Governance factors into investment decisions. There is no objective control over fake data for a company’s ESG. As well Blackrock signed the Vatican’s 2019 statement advocating carbon pricing regimes. BlackRock in 2020 also joined Climate Action 100, a coalition of almost 400 investment managers managing US$40 trillion.

With that fateful January 2020 CEO letter, Larry Fink set in motion a colossal disinvestment in the trillion-dollar global oil and gas sector.Notably, that same year BlackRock’s Fink was named to the Board of Trustees of Klaus Schwab’s dystopian World Economic Forum, the corporate and political nexus of the Zero Carbon UN Agenda 2030. In June 2019, the World Economic Forum and the United Nations signed a strategic partnership framework to accelerate the implementation of the 2030 Agenda. WEF has a Strategic Intelligence platform which includes Agenda 2030’s 17 Sustainable Development Goals.

In his 2021 CEO letter, Fink doubled down on the attack on oil, gas and coal. “Given how central the energy transition will be to every company’s growth prospects, we are asking companies to disclose a plan for how their business model will be compatible with a net zero economy,” Fink wrote. Another BlackRock officer told a recent energy conference, “where BlackRock goes, others will follow.” [iii]

In just two years, by 2022 an estimated $1 trillion has exited investment in oil and gas exploration and development globally. Oil extraction is an expensive business and cut-off of external investment by BlackRock and other Wall Street investors spells the slow death of the industry.

Biden—A BlackRock President?Early in his then-lackluster Presidential bid, Biden had a closed door meeting in late 2019 with Fink who reportedly told the candidate that, “I’m here to help.” After his fateful meeting with BlackRock’s Fink, candidate Biden announced, “We are going to get rid of fossil fuels…” In December 2020, even before Biden was inaugurated in January 2021, he named BlackRock Global Head of Sustainable Investing, Brian Deese, to be Assistant to the President and Director of the National Economic Council. Here, Deese, who played a key role for Obama in drafting the Paris Climate Agreement in 2015, has quietly shaped the Biden war on energy.

This has been catastrophic for the oil and gas industry. Fink’s man Deese was active in giving the new President Biden a list of anti-oil measures to sign by Executive Order beginning day one in January 2021. That included closing the huge Keystone XL oil pipeline that would bring 830,000 barrels per day from Canada as far as Texas refineries, and halting any new leases in the Arctic National Wildlife Refuge (ANWR). Biden also rejoined the Paris Climate Accord that Deese had negotiated for Obama in 2015 and Trump cancelled.

The same day, Biden set in motion a change of the so-called “Social Cost of Carbon” that imposes a punitive $51 a ton of CO2 on the oil and gas industry. That one move, established under purely executive-branch authority without the consent of Congress, is dealing a devastating cost to investment in oil and gas in the US, a country only two years before that was the world’s largest oil producer.[iv]

Killing refinery capacityEven worse, Biden’s aggressive environmental rules and BlackRock ESG investing mandates are killing the US refinery capacity. Without refineries it doesn’t matter how many barrels of oil you take from the Strategic Petroleum Reserve. In the first two years of Biden’s Presidency the US has shut down some 1 million barrels a day of gasoline and diesel refining capacity, some due to covid demand collapse, the fastest decline in US history. The shutdowns are permanent. In 2023 an added 1.7 million bpd of capacity is set to close as a result of BlackRock and Wall Street ESG disinvesting and Biden regulations. [v]

Citing the heavy Wall Street disinvestment in oil and the Biden anti-oil policies, the CEO of Chevron in June 2022 declared that he doesn’t believe the US will ever build another new refinery.[vi]

Larry Fink, Board member of Klaus Schwab’s World Economic Forum, is joined by the EU whose President of the EU Commission, the notoriously corrupt Ursula von der Leyen left the WEF Board in 2019 to become EU Commission head. Her first major act in Brussels was to push through the EU Zero Carbon Fit for 55 agenda. That has imposed major carbon taxes and other constraints on oil, gas and coal in the EU well before the February 2022 Russian actions in Ukraine. The combined impact of the Fink fraudulent ESG agenda in the Biden administration and the EU Zero Carbon madness is creating the worst energy and inflation crisis in history.

*

Note to readers: Please click the share buttons above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

F. William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics.

He is a Research Associate of the Centre for Research on Globalization.

READ MORE:

https://www.globalresearch.ca/how-blackrock-larry-fink-created-global-energy-crisis/5799286

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

blackfoxrock...

APPARENTLY BLACKROCK BOUGHT MORE SHARE IN FOX... FOX NEWS — recently.

TUCKER CARLSON HAS BEEN CRITICAL OF BLACKROCK MANY TIMES — ESPECIALLY IN REGARD TO UKRAINE:

Okay, the gist is that "Ukraine" is being demolished by an American proxy war... We blame Putin for it, but the USA created the situation. We know this, blah blah blah, as exposed on this site many times.... BlackRock has money to spend. "Ukraine" is broke beyond broke. Zelensky and BlackRock officals recently met to discuss the "reconstruction" of "Ukraine" after "Ukraine"'s victory against Russia. There is oodles of profits to be made.... AND OODLES OF LANDS TO ACQUIRE on top of what the Western banks and funds ALREADY OWN.

So apparently, Clayton Morris from REDACTED, made a search of Tucker's segments on BlackRock on the FoxNews archives and NONE ARE TO BE FOUND... ZERO.

IS THERE A CONNECTION BETWEEN BLACK ROCK AND TUCKER'S EXIT?

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

busy blackrock......

https://www.youtube.com/watch?v=KRa4kkW-nEQ

It's happening! Ukraine's President Zelensky has met with executives from BlackRock to auction off Ukraine for profit. He solicited this in a recent speech and now it is happening. In case you were wondering who would be enriched by this war: big business. Not you.

IS THIS CONFIRMING WHAT WE HAVE ALREADY EXPOSED?

IS THIS DEMOCRACY AT WORK?

READ FROM TOP.

FREE JULIAN ASSANGE NOW....

war vultures....

BY Phil Butler

Ukraine has become a symbol for all those who understand the war; there is money for blood. And there has been no negotiation to end hostilities because the money is and will continue to flow by the tanker load. Let’s briefly examine who stands to gain from the death of hundreds of thousands.

BlackRock and JPMorgan top a list of banking pirates raking in profits because of the shifted economics of the Ukraine conflict. Prices for commodities tied to Ukraine and Russia are making investors in these and other firms ecstatic. However, real profit is on the horizon when government and public sector investments in the war-torn country have soaked up all the financial losses. Financial Times writer Brooke Masters says BlackRock, JPMorgan, and others will step in and take a privileged deal based on their “donation” of advising services. This is how Masters framed the current situation:

“No formal fundraising target has been set, but people familiar with the discussions say the fund seeks to raise low-cost capital from governments, donors, and international financial institutions and leverage it to attract between five and 10 times as much private investment.”

JPMorgan already has Ukraine as a client since 2010 over raising monies to alleviate the country’s previous debt. BlackRock, which currently has $9.4 trillion in assets under management (AUM), makes a killing across every market in the world. A big chunk of BlackRock’s earnings comes from investments in things like Mexico’s local debt.

Modern Diplomacy recently reported that more than 500 global businesses from 42 countries have signed the Ukraine Business Compact. This group stands in the wings, waiting to take possession of or make huge profits on construction, materials, agricultural processing, and logistics. For those unfamiliar, Ukraine is the world’s top producer of sunflower meal, oil, and seed and one of the biggest exporters of corn and wheat. Since Zelensky repealed a law on selling agricultural land in Ukraine, U.S. and Western European agribusinesses are buying millions of hectares of Ukraine’s farmland. According to the reports from the IMF, ten private companies control most of it.

Let’s summarize a scenario where BlackRock and others of Zelensky’s backers work to ensure their profits. So, Russian President Vladimir Putin was considering discontinuing the grain corridor from Ukraine through the Black Sea. Eyeballing staggering market changes, Larry Fink of Blackrock gets on the horn and calls his puppet in the White House. To make damn sure Putin has no choice but to nix the deal, the U.S. and the Brits orchestrate blowing up the Kerch Bridge again. Only this time, much more effectively using either advanced sea drones (or U.S. Navy SEAL divers on leave from Little Creek, Virginia). Boom! Bread prices in Germany and the rest of the EU jump, but the U.S. State Department and the new European Nazis holler, “Putin is starving Africa!”

Fortunately, most of us know the grain goes to the EU first and to starving people in Africa last. Meanwhile, Egypt bought 600,000 tons of Russian grain in May, and its ministers say, “Russia’s withdrawal from the grain agreement will not have a major impact on the market.”

Blackrock, Cargill, Monsanto, and others make more money (see 2014 report), the devastating Kremlin reprisal will destroy more infrastructure for loans to rebuild, and the blood continues to be the chief exchange medium for Larry Fink (see his donations to Zelensky visitor Lisa Murkowski and others) and the other finks in the West.

Phil Butler, is a policy investigator and analyst, a political scientist and expert on Eastern Europe, he’s an author of the recent bestseller “Putin’s Praetorians” and other books. He writes exclusively for the online magazine “New Eastern Outlook”.

READ MORE: https://journal-neo.org/2023/07/24/blood-commodities-blackrocks-role-in-the-ukraine-carnage/

IS THIS CONFIRMING WHAT WE HAVE ALREADY EXPOSED?

IS THIS DEMOCRACY AT WORK?

READ FROM TOP.

FREE JULIAN ASSANGE NOW....