Search

Recent comments

- trumpcrap....

5 hours 4 min ago - banditry....

13 hours 38 min ago - scripted news....

17 hours 22 min ago - pigs...

20 hours 43 min ago - dump trump...

1 day 8 hours ago - merde-a-lago...

1 day 14 hours ago - targets....

1 day 15 hours ago - WW2

1 day 15 hours ago - lawlessness....

1 day 16 hours ago - superman....

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

the greed new deal...

buffett

buffett

The quickest way to loose or make money is to bet money on an outcome against another betting agent, hoping that the bank/other party/betting agent isn’t going to go broke before the date of outcome, making your bet worthless. This is why you can bet against this eventuality with another party, like an insurance in reverse such as default swaps, that is to say you get money from the insurer, rather than paying an insurance fee. Unfortunately, should you loose on your bet, you will have to repay all the moneys plus a massive penalty to the insurers, on top of the payout agreed with your counter-betting agent. This game is not for bleeding hearts, nor paupers.

To state that such ventures can soon become a set of entangled complexities in order to minimise the risks, would be an understatement. Every bet is a minuscule atom is a bigger picture of generalised gambling madness. We don’t know the future. If we did, we would not bet on such outcomes.

In nature the relationship between prey and predator balances out by the numbers of preys versus the numbers of predators. The more prey is caught, the less predators there can be in a natural confined environment. Betting derivatives beats this balance by only placing a time limit on an unlimited amount of prey-catching possibilities that reduces to two options: you win or you loose. “Faîtes vos Jeux!”. Here the odds are only time limited not value restricted. In order to play the game, one needs LOTS of cash reserve, that make a crown casino look like a pauper’s homeless abode. Owning a bank or a hedge fund is a plus.

So far, our financial institutions have been established on the concept that there is no limit — only "conflation" of the ever expanding system. This is growth like cancer. Our greed is thus transmigrated by hypocritical sociopathy through gains and losses of mega-magnitude that demands no restraint. We live or die (we soon recover with a successful bet) financially with hope of richness rather than feeding a need. This has been the human condition for millennia, leading to wars, structural hierarchies (royal and religious) and robbery. And “we” (our leaders, our institutions and most of us) love it… Of course we have created laws that are somewhat interpretable by lawyers to give the illusion of stability and control in the pandemonium — all designed to keep the majority of humans in a submissive situation, in order for the rarified elites to play on the chessboard of amusingly loaded deception.

In most (all) cases, betting involves some kind of deception and manipulation of the outcomes. Poker face isn’t a signal for nothing. Luck has little to do with the results — as manipulation of perception through media and opinions can lower or raise the value of what we bet for, before the “échéance” (due settlement date of the bet). We, the plebs, are not pawns, but the derivative-illiterate squares of the playing field, used as stepping stones by the greedy. We don’t fall to the enemy. We just plod solidly.

This would be infinitely entertaining if the cost was merely fictitious cash, and only related to human desires in an infinite universe… But the bets are destroying the planet...

The biggest bet of course has been about the notion of god. There is no limit on “His” (god is a male) bounty and “His” wrath. We bet on the notion of eternity with ignorant fervour. This has been the greatest deception imposed on the plebs by the controllers.

Big Brother is as ancient as Babylon, 3,000 BC. Rather than being a novel about the future, 1984 was a looking glass futuristically illustrating the past. But we were (and still are) too proud and illused in our freedom-tight-butt to understand this… We saw 1984 as an amusing warning about things to come rather than a situation of where we were at, and came from… Doublespeak is the language of religious beliefs and of economists.

At present, there is an “alien revival”… We’re bombarded by a few movies and mediatic visions about “alien things” in the sky mostly in the US — though the Rooskies are also giving their two bobs worth about the “possibility" of being visited by “aliens”. You mean some super-intelligent beings visiting Planet Stupido? Some people (tall- and short-story tellers) would even venture that the presence of aliens is to warn us about what we’re doing wrong to this place. According to Gus precise calculations, the chance of aliens visiting us is about ZERO in a hundred trillion billion precisely. Our better venture is to play our own gambling games with delusions. As Caitlin Johnstone writes, seconded by Gustaphian himself, this floury of alien news is designed to increase the budgets of armies… You can bet on that...

“I binged watching Dr Who all night”… is a line in the Icelandic series, Stella Blomkvist, presently on SBS… You work it out...

Since awakening to economic values, beyond stealing from each other, and from religious submission, the new big game has thus been “democratic economics”… Same "spiritual” (filling our mind with) important bullshit than the godly adventures, this new level of thoughts gives us all, a chance to participate on a equal footing to the general looting, in order to loose our pants at the profit of the clever manipulators nonetheless. The rich get richer, the poor stay poor… We’re mugged as we “hope” we will benefit from playing… We should realise the dices are crooked and the cards are marked… But we play anyway. We’re born suckers and most of the time we smugly love the thrill of the risks. We go and break a leg on the ski slopes thinking we’re Olympic champs...

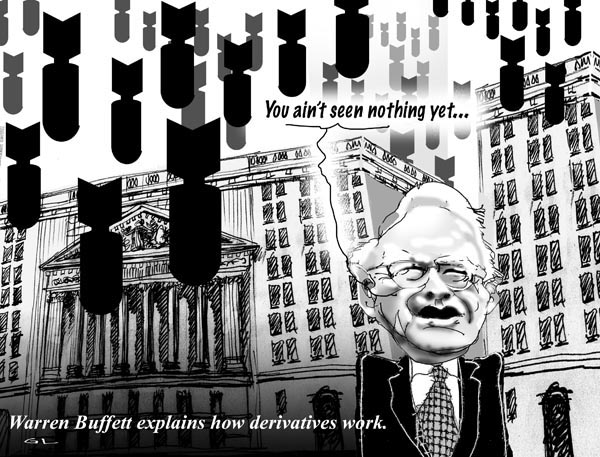

Many expert have no clue about “derivatives” either. They are nuclear bombs. This market of risky big potatoes overlays the annual world economy by more than 3,000 per cent. One can only win as long as someone else loses. Not everyone can win, but everyone can loose even if you win, should one of the players become insolvent (rare). A deviation of 2 percent losses on the derivative market could lead to loosing more than half of the world economy overnight. Risk is massive — and only the best mathematicians who have the skill to counter-bet their own adventures can manage this game of economic suicide.

What Is a Derivative?

A derivative is a "contract” (a serious bet) between two or more parties, the value of which is based on an agreed-upon underlying financial value such as an asset (like a security) or set of assets (like an index) reaching (being at) a certain trending level — at maturity (due date). Common valued items include bonds, commodities, currencies, interest rates, market indexes, and stocks. The contract is in the form of a precisely time-defined bet.

Derivatives either mitigate risk (hedging) or assume risk with the expectation of commensurate reward (speculation).

The fluctuations of the values of the asset will eventually be judged at maturity of the bet, not at the end of time… And your bet could be a few hours out. The trend being up one minute and down the next. People sweat.

Derivatives were originally used to ensure exchange rates more or less balanced the value of goods internationally traded. With the fluctuating values of national currencies, international traders needed a system to account for differences. Today, derivatives are based upon a wide variety of transactions and have many more uses. There are even derivatives based on weather data, such as the amount of rain or the number of sunny days in a region.

And all this “economic” activity has so far being blind to the environmental damage they have done by promoting industrialisation and the burning of fossil fuels. And some Elon talks about Bitcoin using too much energy? Bitcoin is a small trillion dollar operator when considering the derivative market...

Meanwhile, according to Gus’ calculations, we have no more than 11 years before the grand fall of the cliff in regard to global warming. Should we let the derivatives be involved in reducing our emissions of CO2? Is it to late? or can we mitigate the risks? The future will tell us sooner than we think as Nature does not bet, but we do.

Gus Leonisky

Dorky old kook...

- By Gus Leonisky at 6 Jun 2021 - 9:20pm

- Gus Leonisky's blog

- Login or register to post comments

good luck...

An extinct creature sometimes described as a “Siberian unicorn” roamed the Earth for much longer than scientists previously thought, and may have lived alongside humans, according to a study in the American Journal of Applied Science.

Scientists believed Elasmotherium sibiricum went extinct 350,000 years ago. But the discovery of a skull in the Pavlodar region of Kazakhstan provides evidence that they only died out about 29,000 years ago.

Unfortunately, despite its sizable horn, the “Siberian unicorn” looked more like a rhinoceros than the mythical creature its nickname refers to. It was about 6 feet tall, 15 feet long, and weighed about 9,000 pounds, making it more comparable to a woolly mammoth than a horse.

https://www.theguardian.com/science/2016/mar/29/siberian-unicorn-extinct-humans-fossil-kazakhstan

---------------------

Gamma is the rate of change in an option's delta per 1-point move in the underlying asset's price. Gamma is an important measure of the convexity of a derivative's value, in relation to the underlying. A delta hedge strategy seeks to reduce gamma in order to maintain a hedge over a wider price range. A consequence of reducing gamma, however, is that alpha will also be reduced.

Basics of Gamma

Gamma is the first derivative of delta and is used when trying to gauge the price movement of an option, relative to the amount it is in or out of the money. In that same regard, gamma is the second derivative of an option's price with respect to the underlying's price. When the option being measured is deep in or out-of-the-money, gamma is small. When the option is near or at the money, gamma is at its largest. All options that are a long position have a positive gamma, while all short options have a negative gamma.

Gamma Behavior

Since an option's delta measure is only valid for short period of time, gamma gives traders a more precise picture of how the option's delta will change over time as the underlying price changes. Delta is how much the option price changes in respect to a change in the underlying asset's price.

As an analogy to physics, the delta of an option is its "speed," while the gamma of an option is its "acceleration."

Gamma decreases, approaching zero, as an option gets deeper in the money and delta approaches one. Gamma also approaches zero the deeper an option gets out-of-the-money. Gamma is at its highest when the price is at-the-money.

The calculation of gamma is complex and requires financial software or spreadsheets to find a precise value. However, the following demonstrates an approximate calculation of gamma. Consider a call option on an underlying stock that currently has a delta of 0.4. If the stock value increases by $1, the option will increase in value by $0.40, and its delta will also change. After the $1 increase, assume the option's delta is now 0.53. The 0.13 difference in deltas can be considered an approximate value of gamma.

https://www.investopedia.com/terms/g/gamma.asp

If it appears that these two stories have no relation whatsoever, beware. The link is obvious(!??). We are chasing unicorns… Michael Brooks, a quantum physicist, denied the existence of unicorns when talking to the ghost of Cardano, Jerome Cardano (1501-1576) in his book “The QUANTUM ASTROLOGER’S HANDBOOK. But Michael Brooks was quite happy mentioning psi and "imaginary numbers". Hello? Cardano is well-known for having “invented” probable solutions to the uncertainty of gambling (playing with the derivative market is gambling) and the mathematical foundation for quantum physics. We have already mentioned Cardano here: https://www.yourdemocracy.net.au/drupal/node/35460

Meanwhile:

In mathematical logic and set theory, an ordinal collapsing function (or projection function) is a technique for defining (notations for) certain recursive large countable ordinals, whose principle is to give names to certain ordinals much larger than the one being defined, perhaps even large cardinals (though they can be replaced with recursively large ordinals at the cost of extra technical difficulty), and then “collapse” them down to a system of notations for the sought-after ordinal. For this reason, ordinal collapsing functions are described as an impredicative manner of naming ordinals.

The details of the definition of ordinal collapsing functions vary, and get more complicated as greater ordinals are being defined, but the typical idea is that whenever the notation system “runs out of fuel” and cannot name a certain ordinal, a much larger ordinal is brought “from above” to give a name to that critical point. An example of how this works will be detailed below, for an ordinal collapsing function defining the Bachmann–Howard ordinal (i.e., defining a system of notations up to the Bachmann–Howard ordinal).

The use and definition of ordinal collapsing functions is inextricably intertwined with the theory of ordinal analysis, since the large countable ordinals defined and denoted by a given collapse are used to describe the ordinal-theoretic strength of certain formal systems, typically[1][2] subsystems of analysis (such as those seen in the light of reverse mathematics), extensions of Kripke–Platek set theory, Bishop-style systems of constructive mathematics or Martin-Löf-style systems of intuitionistic type theory.

Ordinal collapsing functions are typically denoted using some variation of either the Greek letter (psi) or (theta).

https://en.wikipedia.org/wiki/Ordinal_collapsing_function

Now if you thought that the loonies playing the derivative market were dumb, think again. It takes an enormous amount of calculations, including intuitionistic type theory plus hope (vague thingy) based on complex trends, before placing a bet. We, the ordinary moron of Mugsville, would not have a clue as to throw the first dart in an English pub's bull's eye. We'd hit the door frame... Playing snooker to the highest level demands skills and understandings that bypass simple luck. Yet, THERE WILL BE WINNERS AND LOSERS... Cardano worked out the numbers and his “system” made him a superior gambler. And unicorns (Elasmotherium sibiricum) were a figment of nature’s imagination before the extinction of the beasts…

We know nofin’. Nature to a great extend had played the same game for more than 4 billion years, and randomly gambles with better limits (birth and death, with time limits for different species) — and this is why LIFE HAS BEEN SO SUCCESSFUL. We've been trying to muck this up, possibly because homo sapiens is an unfinished inferior species that only managed to survived by the skills of deceit... Good luck anyway.

Free JULIAN ASSANGE NOW ®∑∑∑∑∑∑∑¨¨¨ÁÁÁÁÁØØØØØØ!!!!

the derivative casino....

By Ellen Brown / Original to ScheerPost

“It was not the highly visible acts of Congress but the seemingly mundane and often nontransparent actions of regulatory agencies that empowered the great transformation of the U.S. commercial banks from traditionally conservative deposit-taking and lending businesses into providers of wholesale financial risk management and intermediation services.”

— Professor Saule Omarova, “The Quiet Metamorphosis, How Derivatives Changed the Business of Banking” University of Miami Law Review, 2009

While the world is absorbed in the U.S. election drama, the derivatives time bomb continues to tick menacingly backstage. No one knows the actual size of the derivatives market, since a major portion of it is traded over-the-counter, hidden in off-balance-sheet special purpose vehicles. However, when Warren Buffet famously labeled derivatives “financial weapons of mass destruction” in 2002, its “notional value” was estimated at $56 trillion. Twenty years later, the Bank for International Settlements estimated that value at $610 trillion. And financial commentators have put it as high as $2.3 quadrillion or even $3.7 quadrillion, far exceeding global GDP, which was about $100 trillion in 2022. A quadrillion is 1,000 trillion.

Most of this casino is run through the same banks that hold our deposits for safekeeping. Derivatives are sold as “insurance” against risk, but they actually add a heavy layer of risk because the market is so interconnected that any failure can have a domino effect. Most of the banks involved are also designated “too big to fail,” which means we the people will be bailing them out if they do fail.

Derivatives are considered so risky that the Bankruptcy Act of 2005 and the Uniform Commercial Code grant them (along with repo trades) “super-priority” in bankruptcy. That means if a bank goes bankrupt, derivative and repo claims are settled first, drawing from the same pool of liquidity that holds our deposits. (See David Rogers Webb’s The Great Taking and my earlier articles here and here.) A derivatives crisis could easily vacuum up that pool, leaving nothing for us as depositors — or for the “secured” creditors who are junior to derivative and repo claimants in bankruptcy, including state and local governments.

As detailed by Pam and Russ Martens, publisher and editor, respectively of Wall Street on Parade, as of Dec. 31, 2023, Goldman Sachs Bank USA, JPMorgan Chase Bank N.A., Citigroup’s Citibank and Bank of America held a total of $168.26 trillion in derivatives out of a total of $192.46 trillion at all U.S. banks, savings associations and trust companies. That’s four banks holding 87 percent of all derivatives at all 4,587 federally-insured institutions then in the U.S.

In June 2024, the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Board jointly released their findings on the eight U.S. megabanks’ “living wills” – their resolution or wind-down plans in the event of bankruptcy. The Fed and FDIC faulted all of the four largest derivative banks on shortcomings in how they planned to wind down their derivatives.

How Banks Guarding Our Deposits Became the Biggest Gamblers in the Derivatives CasinoBanks are not just middlemen in the derivatives market. They are active players taking speculative positions. In this century, writes Professor Omarova, the largest U.S. commercial banks have emerged “as a new breed of financial super-intermediary—a wholesale dealer in financial risk, conducting a wide variety of capital markets and derivatives activities, trading physical commodities, and even marketing electricity.” She notes that the Federal Reserve has allowed several financial holding companies to purchase and sell physical commodities (including oil, natural gas, agricultural products and electricity) in the spot market to hedge their commodity derivative activities, and to take or make delivery of those commodities to settle the transactions.

It was not Congress that authorized that expansive definition of permitted banking activities. It was the Office of the Comptroller of the Currency (OCC), part of the “administrative deep state,” that permanent body of unelected regulators who carry on while politicians come and go. As Omarova explains:

Through seemingly routine and often nontransparent administrative actions, the OCC effectively enabled large U.S. commercial banks to transform themselves from the traditionally conservative deposit-taking and lending institutions, whose safety and soundness were guarded through statutory and regulatory restrictions on potentially risky activities, into a new breed of financial “super-intermediaries,” or wholesale dealers in pure financial risk. …

Moreover, some of the most influential of those decisions escaped public scrutiny because they were made in the subterranean world of administrative action invisible to the public, through agency interpretation and policy guidance.

The OCC’s authority to regulate banks dates back to the National Bank Act of 1863, which grants national banks general authority to engage in activities necessary to carry on the “business of banking,” including “such incidental powers as shall be necessary to carry on the business of banking.” The “business of banking” is not defined in the statute. Omarova writes:

Section 24 (Seventh) of the National Bank Act grants national banks the power to exercise all such incidental powers as shall be necessary to carry on the business of banking; by discounting and negotiating promissory notes, drafts, bills of exchange, and other evidences of debt; by receiving deposits; by buying and selling exchange, coin, and bullion; by loaning money on personal security; and by obtaining, issuing, and circulating notes.

No mention is made of derivatives trading or dealing.

The powers of banks were further limited by Congress in the Glass-Steagall Act of 1933, which explicitly prohibited banks from dealing in corporate equity securities, and by other statutes passed thereafter. However, the portion of the Glass-Steagall Act separating depository from investment banking was reversed in the Commodity Futures Modernization Act in 2000. Omarova writes that this allowed the OCC to articulate “an overly expansive definition of the ‘business of banking’ as financial intermediation and dealing in financial risk, in all of its forms, and … this pattern of analysis allowed the OCC to expand the range of bank-permissible activities virtually without any statutory constraint.”

What Then Can Be Done?The 2008 financial crisis is now acknowledged to have been largely a derivatives crisis. But massive efforts at financial reform in the following years have failed to fix the underlying problem. In a Forbes article titled “Big Banks and Derivatives: Why Another Financial Crisis Is Inevitable,” Steve Denning writes:

Banks today are bigger and more opaque than ever, and they continue to trade in derivatives in many of the same ways they did before the crash, but on a larger scale and with precisely the same unknown risks.

Most of this derivative trading is conducted through the biggest banks. A commonly held assumption is that the real derivative risk is much smaller than the “notional amount” stated on the banks’ balance sheets, but Denning observes:

[A]s we learned in 2008, it is possible to lose a large portion of the “notional amount” of a derivatives trade if the bet goes terribly wrong, particularly if the bet is linked to other bets, resulting in losses by other organizations occurring at the same time. The ripple effects can be massive and unpredictable.

In 2008, governments had enough resources to avert total calamity. Today’s cash-strapped governments are in no position to cope with another massive bailout.

He concludes:

Regulation and enforcement will only work if it is accompanied by a paradigm shift in the banking sector that changes the context in which banks operate and the way they are run, so that banks shift their goal from making money to adding value to stakeholders, particularly customers. This would require action from the legislature, the SEC, the stock market and the business schools, as well as of course the banks themselves.

A Paradigm Shift in “the Business of Banking”In a September 2023 paper titled “Rebuilding Banking Law: Banks as Public Utilities,” Yale law professor Lev Menand and Vanderbilt law professor Morgan Ricks propose shifting the goal of banking so that chartered private banks are “not mere for-profit businesses; they have affirmative obligations to the public.” The authors observe that under the New Deal framework, which was rooted in the National Bank Act of 1864, banks were largely governed as public utilities. Charters were granted only where consistent with public convenience and need, and only chartered banks could expand the money supply by extending loans.

The Menand/Ricks proposal is quite detailed and includes much more than regulating derivatives, but on that specific issue they propose:

While member banks are permitted to enter into interest-rate swaps to hedge rate risk, they are not allowed to engage in derivatives dealing (intermediation or market making) or take directional bets in the derivatives markets. Derivatives dealing and speculation do not advance member banks’ monetary function. Apart from loan commitments, member banks would not be in the business of offering guarantees or other forms of insurance.

Would that mean the end of the derivatives casino? No – it would just be moved out of the banks charged with protecting our deposits:

The blueprint above says nothing about what activities can take place outside the member banking system. It says only that those activities can’t be financed with run-prone debt [meaning chiefly deposits]. In principle, we could imagine a very wide degree of latitude for non bank firms, subject of course to appropriate standards of disclosure, antifraud, and consumer and investor protection. So securities firms and other nonbanks might be given free rein to engage in structured finance, derivatives, proprietary trading, and so forth. But they would not be allowed to “fund short.”

By “funding short,” the authors mean basically “creating money,” for example through repo trades in which short-term loans are rolled over and over. In their proposal, only chartered banks are delegated the power to create money as loans.

Expanding the ModelUniversity of Southampton business school professor Richard Werner, who has written extensively on this subject, adds that banks should be required to concentrate their lending on productive ventures that create new goods and services and avoid inflating existing assets such as housing and corporate stock.

Speculative derivatives are a form of “financialization” – money making money without producing anything. The winners just take money from the losers. Gambling is not illegal under federal law, but the chips in the casino should not be our deposits or loans made with the backing of our deposits.

The Menand/Ricks proposal is for private banks, but banks can also be made “public utilities” through direct ownership by the government. The stellar model is the Bank of North Dakota, which does not speculate in derivatives, cannot go bankrupt, makes productive loans, and has been highly successful. (See earlier article here.) The public utility model could also include a national infrastructure bank, as proposed in H.R. 4052, which currently has 37 co-sponsors.

The “business of banking” can include making money for private shareholders and executives, but that business should be junior to the public interest, which would prevail when they conflict.

Unfortunately, only Congress can change the language of the controlling statute; and Congress has been motivated historically to make major changes in the banking system only in response to a Great Depression or Great Recession that exposes the fatal flaws in the existing system. With the reversal of “Chevron deference,” however, the OCC’s rules can now be challenged in court. A powerful citizen’s movement might be able to catalyze needed changes before the next Great Depression strikes.

A financialized economy is not sustainable and not competitive. The emphasis should be on investment in the real economy. That is the sort of paradigm shift that is necessary if the U.S. is to survive and prosper.

https://scheerpost.com/2024/08/03/how-unelected-regulators-unleashed-the-derivatives-monster-and-how-it-might-be-tamed/

READ FROM TOP (WE'VE BEEN ON THE CASE)

SEE ALSO: https://yourdemocracy.net/drupal/node/48070

SEE ALSO: https://yourdemocracy.net/drupal/node/31779

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.