Search

Recent comments

- war council.....

7 hours 14 min ago - flying saucers....

7 hours 25 min ago - casualties....

7 hours 37 min ago - dystopian....

8 hours 36 min ago - losses....

9 hours 26 min ago - board of war....

10 hours 48 min ago - help...

12 hours 30 min ago - APOLOGY....

13 hours 8 min ago - humanoids....

15 hours 9 min ago - refugees....

17 hours 9 min ago

Democracy Links

Member's Off-site Blogs

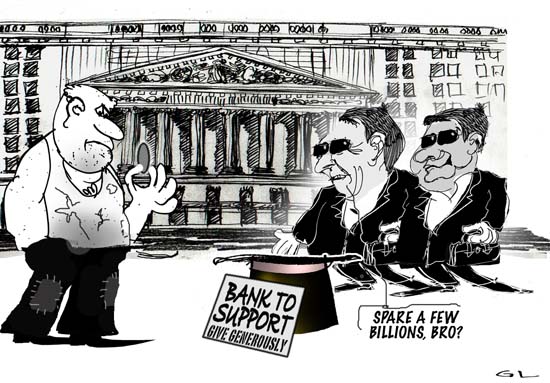

the governments and the responsible central banks have not done their homework...

Eleven years of endless “bank bailout”How to prepare for the time after

Anyone who has followed the reports and comments from the financial sector over the past few years cannot help but notice, behind the curtain of the ongoing success reports from the stock market, increasingly critical voices that provide cause for more serious and further considerations.

rt. Bustling Christine Lagarde (former French Minister, former President of the IMF) has been appointed President of the European Central Bank ECB in a roundabout way, thus inheriting Mario Draghi, a former Goldman Sachs manager, in his role. Both are from the high finance personnel pool (cf. Current Concerns No. 16 of 25 July) and stand for the so-called expansive monetary policy. This means that money is spent without return service and the savings rate is brought down to zero.

Old-age provision destroyedThis financial policy, which was launched to “rescue” the big banks run into difficulties in 2008/2009, is not without consequences:

- Savings and old-age provision are reduced by the zero interest rate policy.

- Saving money for bad times no longer pays off. The money is invested in real estate, shares and bonds in order to maintain its value.

- This fuels the speculative bubble on the stock market and the real estate market. The prices there no longer reflect reality.

- Unprofitable companies can only survive on cheap loans. Their bankruptcy will finally come when the low interest rate policy ends. Similarly, there will be major problems on the mortgage market as soon as interest rates rise and subsequently the value of the properties falls.

The original rationale of this expansive monetary policy, to rescue “systemically important” banks in order to prevent a global economic crisis as in the 1930s, was achieved. However, the problem discussed in 2009 of how the huge amount of money can subsequently be taken off the market again to prevent inflation has not been tackled.

After the banks had been rescued with even more money, it was said that the economy had to be boosted with a lot of money in order not to fall into recession. The most recent reason for the constant increase of the money stock through bond and equity purchases is that inflation of 2 per cent is needed to prevent deflation.

Whichever way you look at it, the governments and the responsible central banks have not done their homework. Not even the mandatory separation of business and investment was enforced at the banks. Interestingly, in recent years some states such as Russia and China have increasingly switched to secure their currencies by buying huge amounts of gold.

The crashThe fact that a change in monetary policy has been delayed for eleven long years and is being delayed further means that debt is rising to ever more astronomical heights. Today, no one claims that this money will ever be repaid. A crash becomes inevitable. But this also narrows the possibilities for an “exit” from this mismanagement:

- A global economic crisis with economic stagnation, unemployment, deflation, impoverishment and subsequent inflation (currency devaluation) or expropriation through a currency reform.

- The transition to a state-run economy with wage dictates, compulsory levies and job allocations is fluent. This also includes the abolition of cash, supported by Christine Lagarde.

- Such a development was often legitimised by emergency rule, for example by a war, with a state command economy and food ration coupons.

We do not know whether and who is dealing with such scenarios in government agencies or at international level and whether meaningful preparations are being made.

What to do?Of course, one can still hope that what has worked for eleven years now will continue to work for the next years. One can also feel that considerations of this kind are burdensome and hope for a “solution” from a different side. Another possibility, which corresponds more to us as forward-thinking and planning beings, is to think about the future.

CooperationSimilar to natural disasters, of which one does not know if and when they will occur, every individual, every family or every larger group can take precautions.

Since life in a crisis requires increased cooperation in the wider environment, it is important to consider this before an emergency occurs. Cooperation in the neighbourhood, in the community or in association with other communities will make sense. Personal contacts play an important role in this. Some already exist, they can be intensified or new relationships can be established. Human misunderstandings and conflicts should be clarified or left aside.

Rural areas are often at an advantage when it comes to cooperation, as people there have often learned to work more closely together. We know from various crises, such as the Argentine currency crisis of 2001 in Buenos Aires, that this is also possible readily in cities.

Considerations on alternative payment systems (e.g. Wörgl 1934 or Chiemgauer) have existed for quite some time. It may be necessary to fall back on them. Here you can also find various current examples.

A return to self-sufficiency in food is important and should never disappear from view (urban gardening, allotment gardens). Here, too, broad cooperation is necessary. Here it is possible to draw on historical experiences without wanting to transfer them one to one (“Plan Wahlen”).

In addition to the supply situation and an emergency currency, practicable voluntary economic forms of cooperation must be considered, which make a quick “reset” possible. Appropriated cooperatives with broad membership offer an approach to larger projects. They are already enjoying increasing popularity.

The rich wealth of experience in areas such as civil protection, food sovereignty and self-help in the country must be consciously strengthened. The question of how, for example, to protect sick and elderly people should also be reflected in advance on a larger scale.

If the self-determination (sovereignty) of the citizens is threatened to be lost through negligent or deliberately brought about crises, then it is necessary to enforce the basic democratic rights and to secure them for the future.

Current wrong political and economic decisions, as we can now observe in many areas, are often due to a retreat of direct democracy with respect to power and manipulation. Increasingly, decisions are no longer made where the consequences are to be borne (e.g. financial, immigration or electricity market policy), but at “intermediate” or “higher” levels.

It is precisely at such levels that wrong decisions are made, for example in the financial sector, which ultimately affect millions of individual fates without people ever having been questioned about them.

Read more:

https://www.zeit-fragen.ch/en/numbers/2019/no-17-7-august-2011/eleven-years-of-endless-bank-bailout.html

- By Gus Leonisky at 18 Aug 2019 - 7:04am

- Gus Leonisky's blog

- Login or register to post comments

at the heart of the capitalist economy...

Slavery did not end with abolition in the 19th century. Instead, it changed its forms and continues to harm people in every country in the world.

Whether they are women forced into prostitution, men forced to work in agriculture or construction, children in sweatshops or girls forced to marry older men, their lives are controlled by their exploiters, they no longer have a free choice and they have to do as they’re told. They are in slavery.

There are estimated 40.3 million people in modern slavery around the world.Today slavery is less about people literally owning other people – although that still exists – but more about being exploited and completely controlled by someone else, without being able to leave.

Someone is in slavery if they are:

- forced to work – through coercion, or mental or physical threat;

- trapped and controlled by an ’employer’, through mental or physical abuse or the threat of abuse;

- dehumanised, treated as a commodity or bought and sold as ‘property’;

- physically constrained or have restrictions placed on their freedom of movement.

Forms of modern slavery- Forced labour – any work or services which people are forced to do against their will under the threat of some form of punishment.

- Debt bondage or bonded labour – the world’s most widespread form of slavery, when people borrow money they cannot repay and are required to work to pay off the debt, then losing control over the conditions of both their employment and the debt.

- Human trafficking– involves transporting, recruiting or harbouring people for the purpose of exploitation, using violence, threats or coercion.

- Descent-based slavery – where people are born into slavery because their ancestors were captured and enslaved; they remain in slavery by descent.

- Child slavery – many people often confuse child slavery with child labour, but it is much worse. Whilst child labour is harmful for children and hinders their education and development, child slavery occurs when a child is exploited for someone else’s gain. It can include child trafficking, child soldiers, child marriage and child domestic slavery.

- Forced and early marriage – when someone is married against their will and cannot leave the marriage. Most child marriages can be considered slavery.

Read more:https://www.antislavery.org/slavery-today/modern-slavery/

To this we have to add "underemployment", unpaid overtime, and low wages to workers...:

Australian workers are donating an estimated $130 billion a year to their employers through unpaid overtime, according to a leading workplace thinktank.

Key points:The Australia Institute's Centre for Future Work released the research to coincide with its annual "Go Home On Time Day" where it encourages workers not to stay back late at their workplace.

The centre's survey found the average worker was doing 5.1 hours a week in unpaid work.

"That includes everything from going in early or staying late at work, to working through breaks, working through lunch, taking work home, answering emails in the middle of the night," the centre's director Jim Stanford told ABC News.

"All the different ways that work is trickling into our everyday lives adds up to quite a bit of time.

Dr Stanford said that was half an hour more than the findings from the centre's survey last year.

He believes that the increase in unpaid work reflects "the profound insecurity that most Australians feel about their jobs."

"People are staying late because they want to keep their employer happy, they want to show they've got a good work ethic, they're hoping that they'll be able to keep their jobs.

Read more:

https://www.abc.net.au/news/2017-11-22/australian-workers-gift-130-billi...

Read also:

https://redflag.org.au/index.php/node/6866

burning the underpants of bonds...

The weirdness in financial markets at the moment seems boundless.

In the past two weeks the proliferation of negative-yielding bonds has erupted — 30 per cent of the global, tradeable bond universe is being sold with a guaranteed loss attached to the coupon.

That's an eye-watering $US16.7 trillion dollars' worth; $25 trillion in Australian dollars.

The bizarre concept that the safest bet in the market — holding a bond to maturity — costs you money mutated out of the global financial crisis as several, notably European, central banks kept cutting interest rates all the way below zero.

The Bank of Japan joined in five years ago and the new financial black hole started to expand — at first sucking in billions, now trillions from large financial institutions such as pension funds and insurers.

In effect, creditors willingly enter a deal with debtors knowing they are going to get burnt.

Read more:

https://www.abc.net.au/news/2019-08-18/a-third-of-global-bonds-17-trilli...

Read from top.

when usury is going into debt...

What's that old saying about wood and trees?

For most of us, most of the time, it's not all that apparent when you're at a pivotal point in history.

Last week, however, appeared to be one of those moments when everyone was in a flap over the inverted yield curve.

Until last Thursday, it was an obscure term mentioned in hushed tones among economists and bond market traders. Then, suddenly, it was splashed across the newspapers and all over the evening news.

Every time since World War II, whenever long-term interest rates dropped below short-term rates, recession was sure to follow. That's exactly what happened on Wall Street the previous night when the 10-year US government bond rate went below the two-year rate.

Stock markets duly took fright, investors hit the ejector buttons and trillions of dollars globally were expunged from the value of listed companies.

Read more:

https://www.abc.net.au/news/2019-08-19/forget-inverted-yield-curve-time-...

Read from top.

... and trump blames the fed bank for his golf handicap...

“The only problem we have is Jay Powell and the Fed. He’s like a golfer who can’t putt, has no touch,” the US president proclaimed in his tweet on Wednesday. Taking another jab at the Fed chairman, Trump tweeted that “so far he has called it wrong, and only let us down.”

Read more:

https://www.rt.com/business/466987-trump-powell-fed-blame/

Read from top.