Search

Democracy Links

Member's Off-site Blogs

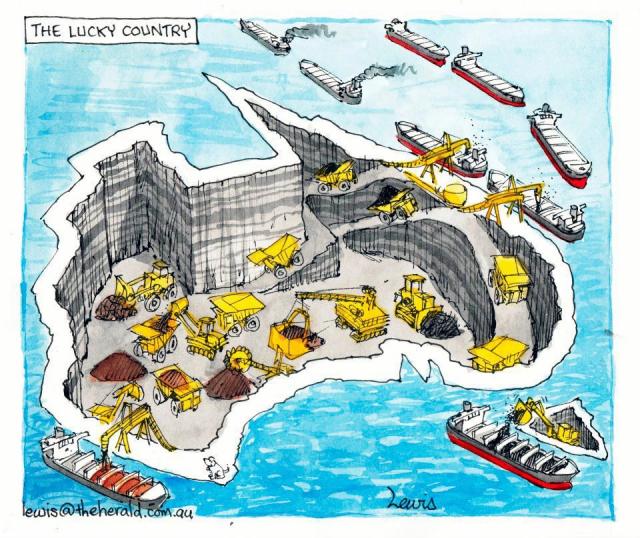

luck is never enough ...

The countries that have mastered the development of their resources, most notably Norway, worked out long ago that to truly prosper in the long run, the citizens who own these assets are entitled to share in the super profits derived from extracting their finite resource wealth.

You know when public policy debate is in the doldrums when a resource rich country like Australia is having a dollars and cents debate about how to tax its vast iron ore riches.

The countries that have mastered the development of their resources, most notably Norway, worked out long ago that to truly prosper in the long run, the citizens who own these assets are entitled to share in the super profits derived from extracting their finite resource wealth.

But not in Australia, where our coal, iron ore and petroleum resources are subjected to modest mineral royalties that don’t return a share of super profits, while artful tax dodging by the big multinationals allows them to minimise corporate tax.

Unlike Norway, there’s no super profits tax on mineral production, while the offshore rent tax has proved to be a soft touch.

Just look at the tax rates paid by some of these businesses. Over the past 10 years, Rio Tinto has paid an average tax rate of 13 per cent tax rate despite earning super profits in many of those years, according to Commsec data. The Tax Office has shown how Rio booked $3.6bn in profits through Singapore marketing hubs, which are taxed at 2.5 per cent.

Chevron Australia, which is developing Gorgon, Australia’s single biggest resource project, has lowered its Australian tax by booking billions of dollars of interest expense to an overseas entity that pays no tax.

So you’d think that any attempt to claw back some of this lost revenue would be welcomed in the cash-strapped state of Western Australia, but a plan by Nationals leader Brendan Grylls to increase production leases charged to big miners is another example of this dollars and cents approach.

Grylls, whose seat is centred on the Pilbara region, has long been concerned about the way his region has been plundered by the miners and has proposed a steep increase in the rental leases imposed by the state when the mines were first developed. Someone in Treasury obviously overlooked the need to index the 25c per tonne charge when it was introduced in the 1960s, so it can be argued that an increase is long overdue. Grylls has proposed a $5 per tonne fee.

The really important point is that Grylls isn’t planning to use the revenue haul - $7.2 billion over four years - for an election cash splash. No, he wants to do some much-needed budget repair, which is something that former Treasury secretary Ken Henry highlighted last week as one of the pressing priorities for government in Australia.

Despite this worthy aim, Grylls has been either disowned or lambasted by just about everyone, including the Liberals, Labor and the CFMEU, which has previously supported the principal of a super profits tax on minerals. Most vicious of all has been the Financial Review which publishes endless gushing copy about mining executives and their digging.

And now, just like the Kevin Rudd episode of 2010, Grylls is the target of a very expensive advertising blitz funded by the mining companies that tells voters how the overdue increase will cost jobs and investment. Remember how the miners spent $22 million in 2010 to kill off a super profits tax that could have raised $100 billion over a decade, according to Treasury analysis. And they also killed off a prime minister, thanks in part to focus group research that was forward to the Labor powerbrokers who executed Rudd.

Grylls’s political career is hanging in the balance as the PR war has clearly spooked voters. It need not be the case if politicians would realise the importance of having an effective and efficient tax regime on our precious mineral resources. The existing regime is neither efficient not effective.

Minerals taxation in this country is a mess, and it’s a problem that we need to revisit, especially the inefficient royalties imposed by the states, and the absence of an effective super-profits tax.

As I explain in my new book on Norway, the country had a fairly weak fiscal regime in place when it discovered oil in 1969. The only additional tax was a 10 per cent royalty on production. In the wake of the first OPEC oil shock in 1973, Norway’s economic advisers quickly realised that this regime wouldn’t collect the super profits, or rents, earned from sky high oil prices.

So they proposed an additional profits tax which was initially set at 40 per cent, and then reduced to 25 per cent. When the tax came in, there was a notable absence of political infighting. The conservatives supported it.

Today, the rate sits at 28 per cent, on top of the 50 per cent corporate tax rate, and it still has the support of Norway’s new far-right party, and the conservatives. And note that from 1987 onwards, Norway phased out production royalties because it realised that it needed to grab a big share of profits rather than a small share of production.

This tax, together with earnings from state equity participation, have underpinned a phenomenal revenue flow over the past 21 years, thus creating Norway’s trillion dollar baby, a sovereign wealth fund worth around $US900 billion. It’s on track to hit the trillion dollar mark in 2020.

So Brendan Grylls should be commended for having a go. But one of the lessons from this episode is that dollars and cents simply won’t do it. Western Australia should be having a debate about a hybrid royalty on iron ore and gas which takes a cut of the above-normal profits earned by their miners and gas producers.

Profits based royalties apply in the Northern Territory, and one was in place in the original tax regime for Olympic Dam. A bybrid royalty would in fact be less painful than the $5 a tonne charge, but it could have the benefit of earning the state a much bigger revenue flow in the decades to come.

Paul Cleary is a senior journalist at The Australia, and the author of five books. His latest book, Trillion Dollar Baby - How Norway Beat the Oil Giants and Won a Lasting Fortune, is published by Black Inc. and Biteback (UK). It was recently shortlisted for the Ashurst prize for business literature.

How Australia wasted the mining boom

- By John Richardson at 1 Mar 2017 - 12:20pm

- John Richardson's blog

- Login or register to post comments

Recent comments

3 min 17 sec ago

1 hour 9 min ago

1 hour 15 min ago

1 hour 37 min ago

3 hours 31 min ago

5 hours 2 min ago

7 hours 46 min ago

7 hours 52 min ago

8 hours 4 min ago

10 hours 42 min ago