Search

Recent comments

- devastation.....

1 hour 6 min ago - bibi's dream....

2 hours 54 min ago - thus war....

7 hours 6 min ago - trump's gift....

8 hours 23 min ago - friendly fire....

8 hours 28 min ago - energy vs energy....

19 hours 14 min ago - killing kids....

22 hours 11 min ago - the die is cast....

1 day 3 min ago - SICKO.....

1 day 24 min ago - be brave, albo....

1 day 2 hours ago

Democracy Links

Member's Off-site Blogs

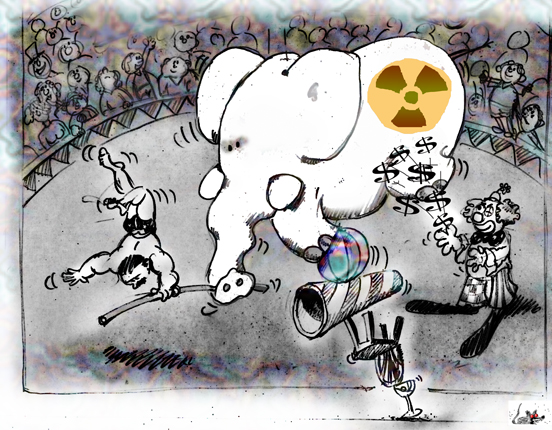

the nuclear circus attraction was a white elephant at which a clown was throwing money...

EDF, the company at the heart of the Somerset project that is 85% owned by the French government, has brought in Chinese state-owned firms as partners and negotiated generous subsidies with the UK government.

However, the resignation of EDF’s finance director, Thomas Piquemal, shows nervousness at the top of the group about the dangers of a project of this magnitude, even though chief executive Jean-Bernard Levy insisted on Monday that he still wanted to reach a final decision on the Hinkley investment soon.

EDF is under tremendous pressurefrom inside the company to stop but also to proceed, with the British government desperate to avoid a flagship energy project being abandoned at a time when few other schemes seem to be going right.

The French president, François Hollande, told UK PM David Cameron last week that he wanted to see Hinkley go ahead, but he has loaded EDF with added financial responsibilities at a time when it could least manage them.

Hinkley Point in 2012 might have looked like just another ambitious but doable scheme. But the intervening years have brought trouble – a lot of it – to the French company.

Flamanville

EDF has been building a European pressurised reactor (EPR) plant in Normandy, France. The latest EPR has been dreamed up by EDF in conjunction with its engineering partner Areva.

It was meant to be a showcase to the world, allowing EDF and Areva to market and build these plants globally, not least at Hinkley in Somerset. But Flamanville has turned into a nightmare project with endless delays, regulatory problems and cost overruns.

The situation has been made worse by another scheme involving EPRs at Olkiluoto in Finland. This too has turned into a huge public relations embarrassment. It has been plagued with contract disputes, broken budgets and is 10 years behind schedule.

Fukushima

The Japanese nuclear disaster that occurred five years ago this Saturday has badly dented confidence in nuclear power, the technology that EDF specialises in. Germany has decided to abandon atomic power in the aftermath of Fukushima.

France relies on it for almost all of its electricity and will continue to do so. But the Paris government has insisted EDF must introduce new safety mechanisms on its reactors in France. The cost of these changes have been estimated by some experts at up to €50bn (£38.7bn).

Energy prices

The wholesale cost of electricity has been tumbling in Britain and the rest of Europe, making it harder for relatively higher-cost nuclear to compete.

Some of this is temporary, due to falling oil and gas prices, and some is more permanent because of subsidised renewable power. Wind and solar technologies are developing fast and reducing in price, which puts more pressure on rival energy sources.

EDF, which has already large debts, has already been forced to borrow money to pay for dividends to shareholders, notably the French government. The share price has been hammered by these financial stresses and is now almost 90% lower than it was in 2007.

News of the finance director’s resignation led EDF shares to plunge 10% in early trading on Monday. Even many financial analysts in the City of London have concluded that Hinkley would be a step too far.

RBC Capital Markets said: “To proceed with Hinkley Point C at this juncture would be verging on insanity.”

EDF has in turn said it is willing to sell a bundle of €6bn worth of assets to raise cash in the meantime. Among the stakes that could be sold is a 30% holding in EDF Energy in Britain, the formal developer of Hinkley. It is not clear at this time who would want to buy these assets and what price they would pay.

Areva

A lot of EDF’s problems have been caused by the near financial collapse at its nuclear engineering partner, Areva. This company designed the EPR and has been at the heart of the Olkiluoto plant delays. It is said to need a €7bn cash injection over the next couple of years to keep going.

The French government has in effect demanded that EDF take over Areva – putting even more pressure on EDF’s finances. Areva has designed the proposed new Hinkley reactors and was meant to be lined up to win some of the biggest contracts there much to the frustration of British engineering firms.

Board warfare

The financial pressures on EDF have led to the company announcing in January a 5% reduction to its workforce.

The French unions, who have places on the group board, are furious and blame Hinkley for some of the problems. They want the Somerset project ditched to avoid further difficulties.

They are accused by some nuclear industry experts of leaking negative information from board meetings to try to undermine the Hinkley plans further.

The resignation of Piquemal, which apparently happened last week but was only confirmed on Monday, suggests even he believes Hinkley could break the EDF camel’s back. For such a senior executive to walk out at such a crucial point puts enormous pressure on Levy not to proceed too quickly.

Piquemal is believed to have wanted to delay the decision on Hinkley until new money was successfully raised from the proposed asset sales. Levy may yet get his way over the dissenters inside the board but the stakes are now very, very high.

http://www.theguardian.com/business/2016/mar/07/edfs-hinkley-point-dilemma-adds-to-project-woes

- By Gus Leonisky at 21 Mar 2016 - 1:32pm

- Gus Leonisky's blog

- Login or register to post comments

nuclear energy is too expensive...

As I have mentioned many times on this site, there is not a single nuclear energy company that makes a profit, unless it is heavily subsidised by government — any governments. These subsidies include start up cash in the form of grants, loans that are never repaid because of exclusive tax break, clean up bill arrangements and "recycling facilities such as buying weapon grade plutonium (about $4,000 a gram). Even though, as seen with EDF, the company has to borrow money to pay dividend to some of the "private" shareholders considering the company is about 85 per cent owned by the government. It is a scandal of massive proportion. The secrecy around the nuclear industry "deals" is also a scandal.

And it seems this is the kind of crap that the South Australian Government is contemplating... Get out before you can't, says Gus. The secret in confidence clauses will kill you...

The South Australian Government scheme to import international nuclear waste has a major flaw in common with the UK's Hinkley Point C project — secret contracts with foreign organisations, writes Noel Wauchope.

THESE TWO PLANS have something in common. Both the UK's Hinkley Point C plan and South Australia's nuclear waste plan are grandiose and very expensive to set up.

But, more than that, they both require the involvement of foreign governments and companies, in secret arrangements.

The South Australian Nuclear Royal Commission‘s plan for importing international wastes already involves confidential communications from foreign companies. Put into operation, the plan will mean secret contracts — South Australia being beholden to the provisions of foreign laws regarding disclosure, shipping and transport security, insurance and other matters relating to a client nation’s high level nuclear wastes (HLNW).

Plans have been suggested for foreign companies paying up front towards the setting up of the waste facility, in exchange for “ironclad contracts” tolater set up “Generation IV” nuclear reactors. With foreign governments and companies involved, South Australia is very likely to become locked in to a deal from which it cannot escape. A later decision to pull out of the scheme would certainly entail heavy compensation payments to foreign companies.

Britain’s Hinkley Point C nuclear project is thoroughly embroiled in complicated negotiations with the government-owned companies of China and France.

read more: https://independentaustralia.net/politics/politics-display/secret-deals-australias-nuclear-waste-plan-and-the-uks-hinkley-project,8797