Search

Recent comments

- losses....

29 min 14 sec ago - board of war....

1 hour 51 min ago - help...

3 hours 33 min ago - APOLOGY....

4 hours 11 min ago - humanoids....

6 hours 12 min ago - refugees....

8 hours 12 min ago - tonight....

8 hours 22 min ago - 10 days?....

8 hours 32 min ago - MI6 parrot.....

9 hours 25 min ago - not sorry....

9 hours 50 min ago

Democracy Links

Member's Off-site Blogs

it's in their genes for profits...

- By Gus Leonisky at 13 Feb 2015 - 7:59pm

- Gus Leonisky's blog

- Login or register to post comments

readying to mug the sick, the blind and the poor... and you...

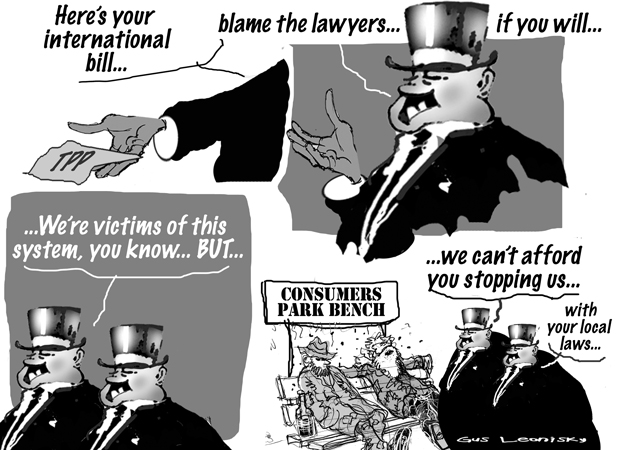

The controversial top-secret Trans-Pacific Partnership is due to be signed very soon and is likely to have negative impacts upon many areas of ordinary Australian's lives without any financial gain whatsoever, writes Dr Matthew Mitchell.

The Trans-Pacific Partnership (TPP)is a global trade agreement being pushed by the United States onto nations around the Pacific. What is so disturbing about the TPP compared with other trade agreements is that it covers so many areas. Its breadth means it will affect many aspects not only of Australian business, but also of everyday Australian life.

How will the TPP affect Australians? Well, for one, it has the potential to make people much more wary about using the internet. I say potential, because we do not really know what will be in the final agreement as it is all being discussed in secrecy, but thanks to some brave leakers we have some idea of what to expect — and what we have seen is very disturbing.

In relation to internet use, there is potential that laws regarding fair-use may be changed so that even downloading a web page could be considered a breach of copyright and a punishable offence. Now, it is not likely that corporations are going to go around and fine people for accessing their webpages — unless perhaps you are involved in public campaign against that corporation for some reason and then accessing and using information from that company’s web-page may be something they decide to prosecute you on. Sounds unbelievable doesn’t it? Yet, this is a possibility evident from the leaked text.

Another risk is that the TPP will require internet service providers to policecopyright infringements — that is, inform companies when users download illegal copies who in turn may require the internet service provider (ISP) to terminate your account.

But the TPP is not limited to digital goods and copyright. It ranges across areas from agriculture to other areas of intellectual property, thereby impacting on many industries, including food (and food labelling) and pharmaceuticals. Thus, another risk is that the price of medicines may rise.

read more: https://independentaustralia.net/life/life-display/why-the-tpp-would-be-a-disaster-for-australia,7368

tax the rich...

the bushit school of economics .....autumn sale .....

I am a former Assistant Commissioner of Taxation in charge of international tax reform in the ATO. I retired in 2008. I am currently a casual tutor in the School of Humanities and Social Inquiry at the University of Wollongong. I am also a unionist, activist and socialist.

I will be talking later this month at the University of Wollongong about stopping the government cuts and taxing the rich. Australia is a low tax and low spending OECD country. In fact just raising our tax level to the OECD average would raise in the abstract an extra $100 billion. The question is who to raise it from. My view is that the money is there to fund better public health, education, transport, social welfare, pensions and Universities, and to take urgent action to address climate change (among other things.

I will argue that the rich and capital are capable of paying much more in taxes to fund a fair and equitable society in Australia.

To take one simple example. Paul Wellings is the Vice-Chancellor of the University of Wollongong. According to the Illawarra Daily Mercury, in 2012 his salary was more than $650,000. Let’s assume after 3 years it is now around $700,000.

The top one and a bit percent of income earners earn more than $250,000. So why not tax any income greater than that at 100 percent? Paul Wellings would be contributing $450,000 in tax on the $450,000 above $250,000 he earns.

Sound far fetched? Left wing French presidential candidate Jean-Luc Melenchon argued for the same sort of tax. He won 11% of the vote (down from earlier polls showing up to 17%) and forced the Socialist Party’s ultimately successful candidate to adopt a watered down version.

read more: http://enpassant.com.au/2015/04/08/stop-the-cuts-tax-the-rich-one-socialists-view/

pernicious plutocracy...

The Pernicious Math Of Plutocracy

By Romi Mahajan

23 August, 2015

Countercurrents.org

Recently, the shares of a large public company based in Seattle rose enough in a day to net the CEO and largest shareholder of the firm about $5 Billion in one day. While certainly such windfalls are rare, the occasion got me to thinking through the implications of such a wild example of wealth gain.

If one breaks $5 Billion in a day down to a work-day of 12 hours, one can say, conservatively that on that day, the person made about $400 Million an hour or about $7 Million a minute. That translates to approximately $100 thousand a second.

As we know, there is indeed another side of the world in which such luxuries are unimaginable. In fact, as we know through countless reports, statistics, and anecdotes, there are a good number of people who earn in the vicinity of $300 a year. In a working life-time of, say, sixty years, that person might earn just about $20 thousand for his or her entire life.

A working life equal to one-fifth of a second for the lucky recipient of that share-based windfall!

One can argue the relative merits of systems of personal gain versus systems of equality, of capitalism versus socialism, of private profit versus public investment. Such arguments will never cease. But can anyone who is heir to even an elemental decency or ethical framework deny that this equation is pernicious and inhumane?

We have gotten to a point in which the “facts” of the world read like fiction of the absurd. One person’s blink of the eye is equivalent to another’s life of toil.

This is the pernicious math of plutocracy and it has to be undone.

http://www.countercurrents.org/mahajan240815.htm