Search

Recent comments

- wanton barbarism....

3 hours 14 min ago - little nazi....

5 hours 19 min ago - arm-wrestling....

5 hours 45 min ago - decision.....

5 hours 48 min ago - unhinged....

8 hours 27 min ago - nasty frog....

8 hours 38 min ago - words....

8 hours 46 min ago - The Seth Rich Question 15

9 hours 11 min ago - very serious....

9 hours 23 min ago - propaganda....

9 hours 28 min ago

Democracy Links

Member's Off-site Blogs

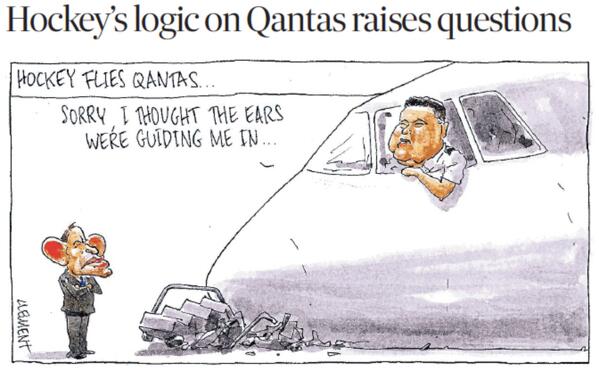

flying quaint arse .....

from the 730 report …..

JOE HOCKEY: Well, Labor have no Plan B. Labor have no Plan B. We have laid down...

SARAH FERGUSON: Do you have a Plan B?

JOE HOCKEY: We - our Plan B is our Plan A……

Can’t wait for the Budget!!!

- By John Richardson at 6 Mar 2014 - 12:51pm

- John Richardson's blog

- Login or register to post comments

who owns qantas?...

Who owns Qantas?

By James Cogan31 October 2011

Qantas CEO Alan Joyce has made repeated reference to the “96 percent support” he received from shareholders at the company’s annual general meeting on October 28—the day before he and the Qantas board grounded the airlines’ entire global fleet.

He did not mention that the biggest 20 shareholders control 80.3 percent of total voting shares, and that just the top four, a group of major global financial conglomerates, hold over 70 percent.

Qantas is an example of how the most powerful financial interests exert sway over the commanding heights of the economy. Just 240 of the company’s 133,392 shareholders own 82.49 percent of the stock. Contrary to claims that some type of “shareholders democracy” exists, small investors have no say in the company’s direction or conduct.

The largest Qantas shareholder—with 22.72 percent of the company—is J. P. Morgan Nominees Australia, a division of the global J. P. Morgan investment house.

The second largest is HSBC Custody Nominees with 18.91 percent. Next is National Nominees with an 18.26 percent stake. The fourth largest is Citicorp Nominees.

These four investment funds are also among the largest shareholders of Australia’s four major banks, the Commonwealth Bank, National Australia Bank, Westpac Bank and ANZ Bank, which in turn are large shareholders of the investment funds.

J. P. Morgan, HSBC, National Nominees and Citicorp are also the top four shareholders of Australia’s two largest resource companies, BHP-Billiton and Rio Tinto. They appear prominently in the top 20 list of shareholders of numerous companies, ranging from oil corporation Caltex to construction and property giants Leighton Holdings and Lend Lease.

This web of interconnections guarantees that the executives of any company serve as the direct representatives of finance and carry out their dictates. They move seamlessly between different companies, serving the same essential masters.

Qantas chairman Leigh Clifford, for example, was previously the CEO of Rio Tinto. The other board members include former executives of the banks, mining conglomerates, industrial companies and global equity funds, as well as retired military chief General Peter Cosgrove, who commanded the neo-colonial Australian intervention into East Timor in 1999.

https://www.wsws.org/en/articles/2011/10/qown-o31.html

the golden goose...

In a recent interview on the ABC's 7.30, Opposition transport spokesman Anthony Albanese said: "There's a reason why around the world national governments have carriers that they support, either directly through government ownership - and eight out of 10 are majority government-owned of the world's top 10 airlines."

The verdict: None of the top 10 rankings of airlines based on passenger traffic, capacity, financial results, fleet size, employee numbers and customer feedback consistently include a majority of government-owned airlines. Mr Albanese is wrong.

----------------------

I believe the fact-checker has erred a bit because this is the list HE SUPPLIES in regard to the customer feedback as:

1Emirates

Majority government owned

2Qatar AirwaysMajority government owned

3Singapore AirlinesMajority government owned

4ANA All Nippon AirlinesPrivately owned

5Asiana AirwaysSome government ownership

6Cathay Pacific AirwaysSome government ownership

7Etihad AirwaysMajority government owned

8Garuda IndonesiaMajority government owned

9Turkish AirlinesSome government ownership

10Qantas AirwaysPrivately owned-------------------------

Well at least FOUR government sponsored airlines appear in nearly ALL the lists of best... and the last one for customer satisfaction shows 8 airlines being government sponsored... Sure Albanese may have "exaggerated a bit" but should we extend the list a bit further, we might see some other government stuff...

And should we include the acid test, NO airline in the US provides any decent inflight service for cattle class... All of them work on the Virgin principle for passenger to bring their own garlic salami lunch and charge for loo sessions.

Now why has Qantas gone into such a tail spin?... Qantas has been in a tail spin BEFORE the day Alan Joyce got appointed following the previous CEO, Dixon, who — if my memory is correct — wanted to sell the airline at a peppercorn price to a private consortium which would have netted HIM about 11 million bucks... So there could have been a bit of value less added to the airline in this process.

But one can wonder how Qantas has been able to go down the drain for so long... Competition? Nupe... IMAGE? Yup... Banking? Yup... Wonky website? Yup... Management aura? Yup... Desecration of working practices by going "overseas"?... Yup... Customer loyalty? of course... The Carbon Tax?... Get a life...

Alan Joyce tampered with the bizo, including the complete shut down of the airline for nearly 48 hours like a petulant child, was the deciding factor of many customers going else where. But really, most the Qantas planes are still near full. An airline such as Qantas could survive easily with 60 per cent fill. SO what is happening? The cost of staff? Nupe... Discounts? If Qantas manages its discounts like the European rail network does, then the airline is going to loose money. No fast train, full or not, ever makes a profit...

Qantas has only two way to go... improve or disappear. Improvement under Joyce won't happen. As soon as a foreign majority ownership is mooted, Joyce will be on his arse with a golden watch... Let's say, the shareholders have no confidence in the management — and "should they have", they would have rocks in their head to do so at the moment. They are bleeding....

The major shareholders are no dummies. They can see thus a flying golden goose coming their way at a beautifully discounted price with foreign ownership, with which they can fiddle their taxation all Apple... A goose they can do whatever they like with...

Qantas the flying kangaroo? nupe: Qantas the golden goose...

And who will be left high and dry?... The image of Australia, yet again going in tatters for the benefit of foreign profiteers...

I could be wrong but... I can smell it like kerosene...

what carbon tax ....

Political debate has focused on whether Qantas has changed its tune about the impact of an “unrecovered” $106m carbon tax bill on its current financial difficulties – a tax bill the government insists is a direct “hit” on Qantas and its workers.

But on closer questioning it turns out Qantas does not have a $106m “unrecovered” carbon tax bill at all.

According to a spokesman, Qantas recovered all of that $106m through the ticket surcharge it imposed at the time of the carbon tax introduction. The net effect of the carbon tax itself on the airline’s bottom line was therefore zero. Qantas maintains the sum is “unrecovered” because its ticket prices have fallen by more than the surcharge due to the fierce capacity war it is waging with arch rival Virgin.

But the chairman of the Australian Competition and Consumer Commission, Rod Sims, has suggested that if the carbon tax is repealed, airlines such as Qantas are also likely to be forced to remove the surcharges they are levying to pay for it – which would mean the airline’s bottom line would be no better off after repeal.

Qantas’s chief executive, Alan Joyce, said this week “the carbon tax has been a big cost for us. It’s $106m last year. It’s going to be over that again this year. And it is absolutely one of the factors that is impacting the airline.”

The Qantas website says “when the carbon price was introduced, Qantas added a small surcharge to domestic fares to reflect the impact on our cost base and attempt to recover some of that cost. Since 1 July 2012, this cost recovery has been unsustainable due to the challenging conditions in the Australian aviation industry. The table below indicates the estimated impact of the carbon price on Qantas per passenger, per sector, rather than any additional revenue we are collecting,” it says above a table showing a surcharge of between $1.93 and $7.25 depending on the length of the flight.

Sims, who is charged by the government with ensuring the carbon tax repeal is passed through to consumers, said that “as a general rule” any surcharges imposed due to the carbon tax should be removed once the tax was abolished.

“We would have to look at the individual circumstances but we would assume that any surcharge imposed because of the tax would come off. We will engage with airlines to work out the details of their situation,” he told Guardian Australia.

Tony Abbott told the house of representatives on Thursday the government was seeking to repeal the tax because “the carbon tax has been a $106m hit on jobs at Qantas in the last financial year and a $58m hit on jobs at Qantas in the current half year. That’s the truth.”

And on Wednesday he said: “Just so that members of this house should know what the situation is, Qantas has today put out a statement to say: we have said that the price on carbon is a cost to our business that we have not been able to recover through fare increases … So there we have it: the carbon tax is a drag on Qantas that it does not need. It is a $106m hit on jobs at Qantas. We will get rid of the carbon tax, but the leader of the opposition wants to leave this $106m-a-year hit on Qantas in place.”

Qantas Carbon Tax Bill Has Been Covered By Ticket Surcharge