Search

Recent comments

- journalism....

4 hours 9 min ago - day three.....

4 hours 53 min ago - lawful law?....

5 hours 12 min ago - insurance....

5 hours 19 min ago - terrorists....

5 hours 30 min ago - nukes?...

7 hours 38 min ago - rape....

8 hours 16 min ago - devastation.....

10 hours 28 min ago - bibi's dream....

12 hours 17 min ago - thus war....

16 hours 29 min ago

Democracy Links

Member's Off-site Blogs

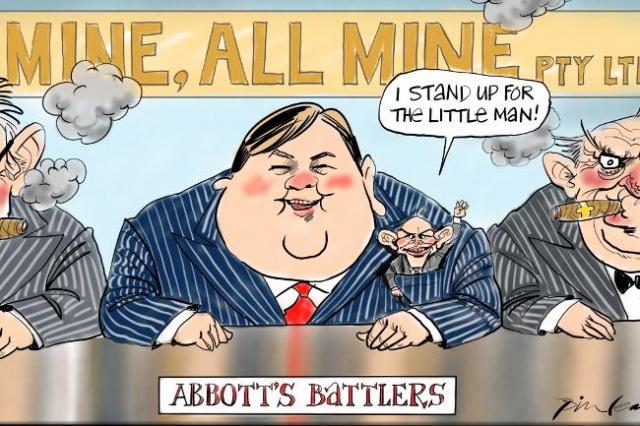

the real culture of entitlement .....

Australians are routinely being told that hefty mining taxes would hinder the country’s largest exports of coal and iron ore. This concern about the competitiveness of the industry has been the basis of the Abbott government’s drive to abolish the mining tax. However, it is hard to reconcile this view (key player Gina Rinehart, for example, claimed that Australia was “too expensive to do export orientated business”) with news this week that mining giant BHP Billiton recently increased its profits by 83% to US$8.1bn.

Within the last year alone, there has been a 20% increase in BHP Billiton’s Western Australian iron ore exports. In spite of this enormous growth, the company only paid US$29m in minerals resource rent tax (MRRT). As it stands, the tax is in no way making BHP uncompetitive – its bumper profits are a testament to that.

While mining companies such as BHP Billiton are making a motza, we need to be reminded that 83% of Australian mining operations are foreign owned. The net income balance – the difference between the profits of Australian investing overseas, and profits made by foreign companies in Australia – has suffered as a result of mining companies extracting greater amounts of Australian mineral wealth for foreign owners.

From 2003 to 2011, the net income balance reduced from minus 2% to - 6% of Australian GDP. In other words, Australia is being held at gun point by day light robbers.

Unlike Australia, Norway has kept their resource extraction wealth in their control without it fattening up a capitalist exploiting of finite mineral resources. Norway has a 78% tax on oil and gas revenues – unlike Australia, where the effective tax rate is a mere 13%. $60bn from gas sales to continental Europe is annually deposited in the Norwegian sovereign wealth fund. The fund has 5.11 trillion Krone (AU$930bn), or twice Norway’s GDP.

Pal Haugerud, director general of the asset management in the department of the Norwegian ministry of finance, has explained Norway’s policy:

It is a fund for future generations, both current and future. And that’s a responsibility for us to make sure that not only this generation, but also future generations get their fair share of the wealth because it is a one off. It is a transformation of wealth. We used to have wealth beyond the North Sea and now we are transferring that into financial assets.

If the Norwegian experience has demonstrated anything it is that resources cannot move, unlike factory operations which can move to a jurisdiction with the lowest regulation, wage or taxation level. If taxed heavily, corporations have no option but to pay a fair price for those resources. If a company threatens to cease operation, government should offer to nationalise the operation at a fair price, so a public company similar to Statoil can extract the profits and deposit them in a sovereign wealth fund, reduce taxation or improve infrastructure and social spending. Norway’s example demonstrates that, after 20 years, private companies will remain and continue to make a profit – with margins reduced.

But while Norway has been prudent with its resource bounty of $185,000 for every citizen, Australia has not.

Fairfax economics editor Ross Gittins notes that Australia’s structural deficit emerged in 2002, when the Howard government slashed taxes and increased spending. This spending took the form middle class welfare: the baby bonus, private education and health care costs, superannuation concessions, etc (no wonder the IMF identified the Howard government in this period as one the two profligate government in the last 200 years of Australian history). What does Australia have to show for the mining boom? A few extra flag poles in schools and a $800bn infrastructure deficit – which the Coalition is now using as an excuse to flog off everything from Australia Post to Medibank Private and even incentivise the offloading of state government assets.

From 2012 to 2016, up to $50bn of dividends of Australian wealth will leave Australia. What could that buy? If we increased taxation rates to Norwegian levels, imagine what that would purchase.

It is not xenophobic to believe that Australians should receive the maximum benefit from their property. Australia’s mineral wealth is owned by the Crown; the Crown holds those resources in trust so they may benefit citizens. Those resources ought to be exploited by the Australian citizenry because they belong to them.

Resources are a special case for protection because they are finite and owned by the collective. For the sale of any property, one would expect to get a fair price for it. The Crown holds those resources for the collective which a majority of Australians (54%) presently expect to receive significantly more tax, according to a recent UMR Research poll. Foreign multinational mining companies such as BHP Billiton and Rio Tinto pay a mere 13% tax on the profits (not the value) of our property; the middle man pockets the difference.

Still think we’re getting a good deal? Imagine the sale of another form of property. Say you want to sell your family home say for a million dollars, the real estate agent takes a 87% commission and you receive a mere $130,000 from the sale. Would you be fuming with rage, foaming at the mouth, gnashing your teeth? That $870,000 is now in the pocket of someone else, and you cannot get it back ever again; most of it will flow overseas. That is the sort of loss of wealth Australia is experiencing.

The historian Philip Mirowski has argued the past three decades have been about using the powers of the state to divert more resources to the wealthy. In Australia’s case, a lot of the wealthiest do not even call Australia home. Meanwhile, all Australians are ripped off. It’s time to change that.

Mining Tax: It's Time For All Australians To Realise They Are Being Ripped Off

- By John Richardson at 19 Feb 2014 - 1:07pm

- John Richardson's blog

- Login or register to post comments

mining profit surge...

Australia's third largest iron ore miner, Fortescue Metals, has almost quadrupled profits as it ramps up output.

Fortescue's half-year profit surged 259 per cent from the same period a year ago to $US1.71 billion ($1.9 billion), which is in line with market expectations.

The miner lifted shipments of ore by 51 per cent over the period as the first ore from its new Kings mine in Western Australia was delivered.

The company's revenue rose 77 per cent on solid iron ore prices and rising production.

Costs of production also fell 34 per cent, which the company contributes to savings initiatives and a lower Australian dollar.

Fortescue's chief executive Nev Power says it vindicates the company's rapid expansion strategy.

http://www.abc.net.au/news/2014-02-19/fortescue-almost-quadruples-profit-on-output-price-and-cost-cuts/5269686breaking up to split the profits...

BHP Billiton will push ahead with a demerger of non-core assets that will include coal mines in Australia's Illawarra region, after reporting an improved full year profit.

The natural resources giant reported underlying earnings of $US13.4 billion, which was narrowly below the $US13.58 billion predicted by a consensus of analysts surveyed by Bloomberg.

The result was about 14 per cent better than last year, despite prices for some of BHP's most important commodities - particularly iron ore and copper - trending lower during the 2014 financial year.

BHP was able to boost exports and cut costs sufficiently to overcome the slide in commodity prices.

AdvertisementThe focus now turns to the package of shareholder returns announced on Tuesday, particularly the demerger.

The new entity will be chaired by long serving director David Crawford and will house BHP's existing aluminium, manganese and nickel assets.

As predicted, BHP chief financial officer Graham Kerr will switch to become chief executive of the spun-out entity and will be replaced at BHP by copper boss Peter Beaven.

Read more: http://www.smh.com.au/business/mining-and-resources/bhp-billiton-posts-us134b-profit-pushes-ahead-with-demerger-20140819-105soi.html#ixzz3AoyPn8J2