Search

Recent comments

- AI trump?....

2 hours 58 min ago - meanwhile....

4 hours 25 min ago - drones....

4 hours 30 min ago - propagandum....

4 hours 53 min ago - bread and butter....

6 hours 46 min ago - activism....

8 hours 17 min ago - start writing!....

11 hours 1 min ago - beyond arrogance....

11 hours 7 min ago - historians...

11 hours 20 min ago - replaced.....

13 hours 57 min ago

Democracy Links

Member's Off-site Blogs

how law enforcement works ....

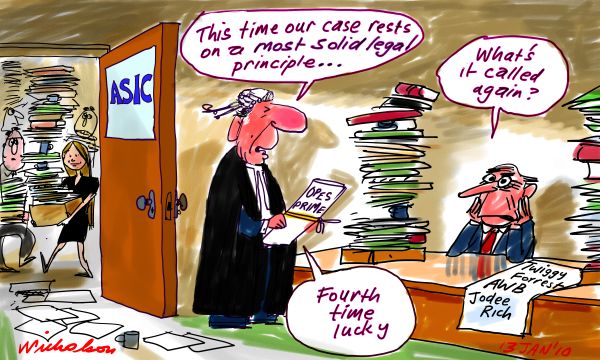

The corporate watchdog will face a Senate inquiry into its performance that is likely to embroil the Commonwealth Bank and raise questions about the effectiveness of new financial reforms.

A notice of motion was put in the Senate this afternoon by Nationals senator John Williams and supported by ALP senator Doug Cameron and Greens Senate leader Christine Milne, showing unanimous support from all sides of politics.

Senator Cameron said the inquiry into the Australian Securities and Investment Commission will be wide ranging, and given the scale of the problem, it is "appropriate for the Senate to investigate a range of issues including financial planners, the Commonwealth Bank and ASIC".

The motion, expected to pass unopposed, will be voted on in the Senate on Thursday following revelations in Fairfax Media that the regulator took 16 months to act on information from whistleblowers about serious misconduct inside the Commonwealth Bank's financial planning unit.

It also failed to act for three and a half years on information provided by CBA in June 2009 about serious allegations of forgery and fraud by a planner, who was allowed to continue to work in the industry during the regulator's inaction.

“I will suggest to the committee that submissions open next month and we can expect to have public hearings later this year,” Senator Williams said. The committee is expected to report to the senate in March 2014.

The inquiry's terms of reference are wide ranging, including an examination of corporations legislation and whether it needs to be changed; a review of the accountability of the regulator; the effectiveness of its complaints management policies and practices and its approach to corporate and private whistleblowers.

Jeff Morris, a CBA insider who revealed his identity to Fairfax Media said whistleblower protection in his case consisted of "advising me to get out with what I had left".

"When you choose to tread the path of the whistleblower you knowingly 'take arms against a sea of troubles'," he said. "What you don’t expect though is for the odds against you to be lengthened by a Monty Pythonesque regulator."

The CBA whistleblowers repeatedly contacted ASIC starting in late 2008 but were never asked to participate in an investigation or reveal their identity.

According to Mr Morris, the whistleblowers visited the headquarters of the regulator 16 months later after becoming ‘‘sick of waiting’’ for action. Within a month, ASIC had moved to seize CBA files. An investigator later told Mr Morris that if they hadn’t forced the issue their report might still be ‘‘bouncing around’’.

Senator Williams said it was clearly a situation that ASIC is far too slow to act. "The result is financial loss and stress placed on many Australians," he said.

"Sixteen months to act on the Commonwealth Financial Planning issue is too long. Years to act on Stuart Ariff [a liquidator who is currently serving six years in jail] is too late. ASIC needs to lift its game and I am hopeful that this enquiry will result in improvements to ASIC and how it performs.”

But despite the wide-ranging political support for the inquiry, some senators are demanding to know what role the Labor government has played in allowing ASIC to become a ‘‘kangaroo court’’.

‘‘ASIC is a problem as an agency. It’s administration and management has been of very serious concern to many in this parliament, and particularly in this senate chamber, for some time now,’’ Liberal senator David Johnston said in the Senate today.

Senator Johnston questioned the Prime Minster Julia Gillard’s decision to give Greg Medcraft, ‘‘a mate’’, the $700,000 year job as chairman of ASIC in violation of the government’s own merit-based public sector appointment process.

‘‘What on earth is going on here? The corporate regulator is run by someone who has a cloud over them. This kangaroo court of ASIC needs to confront a parliamentary inquiry.’’

The looming inquiry comes as ASIC has acknowledged that ‘‘unacceptable and unlawful conduct’’ had occurred inside the financial planning arm of the Commonwealth Bank.

But deputy chairman Peter Kell has defended the regulator’s delay in investigating the CBA matter as ‘‘how law enforcement works’’.

‘‘I can understand why any investigation, whether it takes 12 months or 12 days, is never going to seem fast enough for those suffering the stress of lost money. But CFP was a complex matter and cases like this involve much background work before a public result is achieved,’’ Mr Kell wrote in an opinion piece published by Fairfax Media on today.

The inquiry is likely to also investigate new financial reforms that will come into effect on July 1 known as the Future of Financial Advice.

- By John Richardson at 20 Jun 2013 - 1:43pm

- John Richardson's blog

- Login or register to post comments

the usual suspects ....

If deputy chairman of ASIC, Peter Kell, is the best that organisation has to offer, then it’s hardly surprising that its investigation of the CBA took 17 months to get off the ground.

ASIC’s performance seems reminiscent to that of some of our religious institutions in their pursuit of paedophile priests … we’ll get to it one day as well. And ASIC will no doubt get to the CBA, the Reserve Bank, OZ Minerals, Cochlear … one day. In the words of Mr Kell: ‘That’s how law enforcement works’.

But, to be fair to ASIC, let’s not forget the antics of those other well-known serial offenders - the AFP, ASIO & Australian Customs – all charged with keeping us safe & all routinely bungling their responsibilities at great expense to Australian taxpayers.

And, of course, how could we forget that other well-known member of the “gang that can’t shoot straight”, Labor funster & federal Attorney-General, Jason Clare, who held the nation in thrall with his unsubstantiated & completely irresponsible allegations about drug use in sport, that had the effect of damaging the reputation of hundreds of thousands of Australians, whilst garnering him a bit of cheap publicity.

It would be entirely irresponsible to leave any of them in charge of a broken parking meter.

as crook as rookwood ....

What a night of nights it must have been last May: the music, the champagne, the chatter and laughter, the bursts of applause. See the merry throng of gentlemen elegant in best black tie, the ladies soignee in satins and silks, a soft light sparkling on silver and pearls, on diamonds and gold.

We are at Ivy on George Street - ''a sophisticated urban playground for grown-ups'' - and it's the 23rd annual Australian Banking & Finance Awards, 2013. The Oscars, the Grammys, the Logies for the banking business. How thrilling. And the winner of the hotly contested, highly coveted award for Australian Financial Institution of the Year (Major Banks)? Come on down, the Commonwealth Bank of Australia! Lord knows who chooses these things, or what the criteria might be. It seems unlikely, though, that anyone consulted the 725 and more clients of the CBA who lost hundreds of millions of dollars as a result of dodgy practices of financial planners at the bank over the years since 2007.

This is - or should be - one of the great banking scandals of our time. In a nutshell, at least seven CBA advisers shoved their customers into disastrously high-risk investments without their knowledge or understanding. All the while, of course, charging humungous fees for doing so.

Many of those dudded were elderly or infirm. Mervyn Blanch, aged 81, saw the value of his life savings with the CBA nosedive from $260,000 to just $92,000. He and his wife were forced onto the cold charity of Centrelink. Mrs Patricia Babbage, a widow and the mother-in-law of the federal shadow treasurer, Joe Hockey, lost more than half her investment of $200,000 even as she was dealing with the trauma of bowel cancer. There are hundreds of similar stories.

The kingpin in this outrage was a planner named Don Nguyen, a CBA hotshot who has since been banned from the industry for seven years. Another was a spiv named Ricky Gillespie, who forged clients' signatures and is now out for life, although he denies any wrongdoing and is appealing. Nobody, though, has been to jail.

We know much of this from a handful of brave whistleblowers at the bank who, aghast at what was happening, went first to the finance industry watchdog ASIC, the Australian Securities and Investment Commission, and then to their bosses. Gradually, the truth began to emerge. So all's well that ends well, you might think.

But no. It's just the start. The Commonwealth Bank writhed and wriggled, pulling every trick in the book to get out from under its responsibilities. Distressed clients were fobbed off with evasions and, at times, outright lies. Eventually, derisory amounts of compensation were offered. ASIC - famously about as useful as a fish on a bicycle - dithered and sat on its hands from October 2008 until March 2010, despite having been given chapter and verse by the whistleblowers.

The Fairfax Media business writer Adele Ferguson has been reporting this scandal for months, with admirable clarity and resolve. On Thursday there was a result. The Senate agreed to run an inquiry into the fraud and forgery at the CBA and the hand-wringing indolence at ASIC.

Already, of course, the arse-covering has started. The CBA wrote to the Herald claiming that ''everything we do is focused on securing and enhancing our customers' financial wellbeing''. Bollocks. And ASIC's deputy chairman, Peter Kell, stoutly maintains that his outfit ''took serious enforcement action''. Codswallop.

This affair has a long way to run. For the moment, the Commonwealth Bank might like to hand back its glittering prize.

Mike Carlton

the missing moral compass ....

So, reflecting on the criminal & immoral behaviour of the financial planning cabal at CBA, Geoff Derrick, national assistant secretary at the Finance sector Union, reckons that some people in the industry “have lost their moral compass”.

I wonder if that’s the same ‘moral compass’ that the rest of our society, including the trade union movement, the Australian Labor Party & numerous other institutions, has lost as a result of embracing neo-liberalism & its core ideology of “everyone for themselves”?