Search

Recent comments

- bread and butter....

22 min 22 sec ago - activism....

1 hour 53 min ago - start writing!....

4 hours 37 min ago - beyond arrogance....

4 hours 43 min ago - historians...

4 hours 56 min ago - replaced.....

7 hours 33 min ago - same shit....

7 hours 56 min ago - sadistic arrogance....

9 hours 59 min ago - prayers?...

11 hours 26 min ago - religious war....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

fractured fairytales .....

The much vaunted mining sector, often credited with getting Australia through the global financial crisis, is ripping us off. That's the message from last week's budget.

And the message from the Leader of the Opposition, Tony Abbott’s Budget reply is that he will help it continue to do so.

(One can only sympathise with Gina Rinehart's plea on Friday that she has difficulty paying taxes and applaud Mr Abbott for taking it seriously.)

The budget papers point out mining accounts for about 30 per cent of gross operating surplus (profits), but contributes only 15 per cent of company tax.

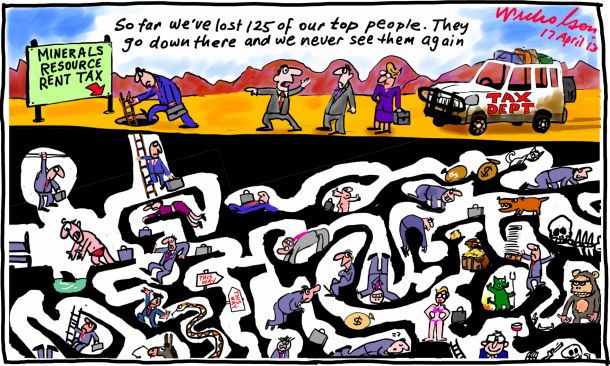

On top of that, the industry pays the much-discussed Minerals Resource Rent Tax (MRRT), which is estimated to deliver about $200 million this financial year.

Mr Abbott confirmed on Thursday that, should he win government, the Coalition would remove this tax, giving the industry a few hundred million more each year to distribute to its mostly foreign shareholders, (and of course Ms Rinehart, Clive Palmer and other struggling billionaires).

In confirming the Coalition's commitment to abolish the MRRT, Mr Abbott dismissively stated it contributed nothing to revenue.

It's true the tax is delivering much less than expected. But $200 million this year is nothing to be sneezed at, never mind the $700 million Treasury estimates it will raise next financial year and the $1 billion in 2014-15.

These sums are well short of Treasury's estimates in last year's budget, which forecast it would raise $3 billion this year, $3.5 billion in 2013/14 and $3.2 billion in 2014/15.

We don't know precisely how, but evidence of a mining industry tax fiddle is now emerging.

Treasury, it seems, was naive in its initial negotiations with the industry on the MRRT.

The head of the department, Martin Parkinson, told a Senate estimates committee hearing in February Treasury's initial estimate for MRRT revenue drew heavily on information provided by the sector itself.

Another factor in the over-estimate was the slide in coal and iron ore prices from their 2011 peak. Here Treasury could be accused of having been over-optimistic in the prices it selected for its 2012 budget calculations.

But on top of that, something else is going on which raises questions about the wisdom of having taxes that look good in economic theory, but which in practice are too complicated and give industry too many opportunities to avoid.

Reviewing last year's budget, I wrote: "The fear is that the Minerals Resource Rent Tax will not generate significant revenue because the companies subject to it will employ every possible strategy to minimise their tax."

This is not to say that such a tax is not justified. In theory it's ideal. Companies pay the tax when they have huge profits and don't pay it when their profits are low.

But setting this type of tax encourages companies to do everything in their power to ensure that they rarely exceed the threshold that triggers the tax.

Perhaps a simple royalties system on tonnages - as now collected by the states - is in the end a better way to go.

(It should be noted that the MRRT is not the only economists' bright idea that is not working according to plan. Contrary to the way the issue is being presented in the media, the carbon tax is doing what it is supposed to do - applying a penalty to the generation of C02 pollution. What is not working is the market solution proposed by market economists and supported, at one time, by both the Labor government and the Coalition opposition.)

What is happening is mining companies, in their high investment phase, are making the highest possible capital expenditure deductions. It is claimed that when they move into the production phase and these large deductions no longer apply, their profits will rise and they will pay more tax.

Some might think this will result in their paying more MRRT as their future deductions will be smaller. But if, for example, commodity prices fall back in line with their long-term downward trend, the miners might never generate enough profits to take them over the MRRT payment threshold.

Clever accountants will also be employed to find every possible way to avoid reaching the threshold.

One tax-avoidance loophole which the government is now seeking to close is debt loading. In this process, a foreign multinational lends money to its Australian subsidiary to buy company "X" in another country. Company "X" pays tax-free dividends to its Australian parent, while the Australian parent pays interest on its loan to its multinational parent. The end result is that the Australian subsidiary makes no contribution to Australian tax revenue from its ownership of "X" but gets an Australian tax deduction for the interest it pays to its parent.

While we have all been made to feel beholden to the mining sector in recent years, it should be noted that it employs only a tiny proportion of the workforce - 2 per cent.

In addition, in making the major contribution to our export revenues it has - with the assistance of the Reserve Bank and its high interest policy - pushed up the value of the Australian dollar, thus damaging every other trade-exposed industry - manufacturing, tourism and agriculture.

As a result the Australian economy is growing in an unbalanced way - something we will all come to regret as the boom busts.

Labor will almost certainly lose the coming election and, if the Coalition is true to its word, we will see miners given a free hand. This will be to the detriment of the trade-exposed sectors of our economy - manufacturing, agriculture and tourism - which employ vastly more people. But it seems voters in these sectors are not aware of the threat.

- By John Richardson at 20 May 2013 - 12:51am

- John Richardson's blog

- Login or register to post comments

all smoke & mirrors .....

Paul Malone’s speculation that the mining sector successfully out-manoeuvred the federal government in negotiating the failed Mineral Resources Rent Tax, might have substance however, so to would my thesis that the government was entirely happy with the outcome, having spared yet another major rent-seeker from having to pay its way, on the one hand, whilst having conned the electorate into thinking that it had ‘done something’ to stop the rip-off of this country’s natural resources by largely foreign-owned multinationals, on the other.

The simple truth is that if Julia Gillard had been sincere in wishing to impose a genuine super-profits tax on the mining sector, we would have one. The proof of this argument lies in the fact that successive Labor governments since Gough Whitlam have presided over a substantial increase in the percentage of national income going to corporate profits, whilst both the incidence & quantum of company tax being paid by the corporate sector has steadily declined along the way.

At the end of the day, the only difference between Gillard & Abbott or Labor & the Coalition, is a matter of degree.

real vision ....

So Labor is running a scare campaign on what the Liberals might do with the goods and services tax. Of course the Liberals want to broaden the base to include fresh food, health and education in the regressive tax and increase the rate from 10% to 12.5%. So too secretly would Labor if there were no political impediments. The extra $20 billion appeals to both sides and to the States and Territories in whose name the tax is notionally levied.

Instead of arguing over keeping a highly regressive tax or making it even worse, I have an alternative suggestion. Abolish the GST. Get rid of it. Send it to hell.

Replace the GST with a wealth tax and increased income tax rates on the rich and capital.

Why? Because workers and the poor would be better off overnight - Lenin put the case well when he said:

We see that the demand put forward by the Social-Democrats - the complete abolition of all indirect taxes and their replacement by a real progressive income tax and not one that merely plays at it - is fully realisable. Such a measure would, without affecting the foundations of capitalism, give tremendous immediate relief to nine-tenths of the population; and, secondly, it would serve as a gigantic impetus to the development of the productive forces of society by expanding the home market and liberating the state from the nonsensical hindrances to economic life that have been introduced for the purpose of levying indirect taxes.

Here are a few examples with very rough guesses about revenue to make up for the loss of GST revenue of around $45 billion.

The top 20% own 62% of Australia’s wealth, which is in total about $6 trillion. So they own roughly $4 trillion. The bottom 20% own less than 1%.

So a wealth tax of 1% on the top 20% (none of whom will be workers but rather capitalists and their managerial class and upper middle class) would yield, by my calculations, $40 billion a year. What better way to get those who have benefited the most from the 2 decade long boom to help all of us survive the coming recession?

According to Essential Vision 64% of Australians support increasing taxes on big business. We could increase the company tax rate to 35% from its current 30%.

There’s $10 billion. Now, this gain would be offset by an automatic increase in tax credits for shareholders, known as dividend imputation. So halve dividend imputation. Billions.

61% of business is non-taxable, with mining companies on 73% the highest non-taxables. Twiggy Forrest’s Fortescue Metal’s Group has paid no income tax in the last 16 years and with accumulated losses and credits is unlikely to pay any income tax before is 20th anniversary of tax free status.

During the battle over the Resource Super Profits tax the Treasurer estimated that the effective tax rate (tax as a percentage of accounting income) of mining companies was between 13% and 17%, the difference depending on whether they were foreign owned or Australian owned. The company tax rate (tax as a percentage of taxable income) is 30%. Now there is debate about the accuracy of these figures but they might hint at the general direction of the mining companies low contribution to the income tax coffers.

As Martin Parkinson, the Secretary to the Treasury, has said:

Mining companies account for about a fifth of gross operating surplus, yet only around a tenth of company tax receipts, primarily because tax receipts from the industry are affected by the high levels of investment occurring in the sector and the consequent level of depreciation deductions.

In other words the effective tax rate of mining companies is about half the 30% company tax rate.

It is not just mining companies. Starbucks has paid no income tax since it set up in Australia in 2000. Google has revenue in Australia of between $1 billion and $2 billion for Australian sources but paid., according to some reports, only $74000 tax in Australia last year.

Between 2005 and 2008 40% of big business paid no income tax and after the GFC the figure is likely to be higher.

A minimum company tax based on turnover would get some money out of these tax bludgers. Billions.

Labor could abolish tax concessions for the rich and big business. $20 billion. This includes the superannuation tax rort for the rich.

What about quarantining rental negative gearing losses to be offset only against future rental income? Billions.

Tax capital gains like all other income and abolish the 50% general concession to bring in $5 billion.

Make the income tax rate steeply progressive by increasing tax on income over $120,000 a year rapidly and impose a 100% rate on incomes greater than $210,000. Those earning $210,000 make up 1% of personal income tax payers, the top 1%.

Impose not only a one percent wealth tax on the rich. Impose a wealth transfer tax on them. Tax the gains on their homes. Billions.

Impose a super profits tax on all super profits – not just coal and iron ore but all minerals and other industries like the banks. $20 billion.

This gives you enough money not only to fund socially necessary activity on public education, health and transport, and addressing climate change. It also gives you enough to abolish the regressive the GST. That would cost $45 billion.

There are many more progressive tax changes I or others could suggest.

This isn’t ‘socialism’ but it will make life better for workers and the poor. Enough of the charades Labor and the Liberals are playing over tax. Abolish the GST and soak the rich till their pips squeak.

Abolish The GST & Tax The Rich Instead