Search

Recent comments

- more bombs....

8 hours 36 min ago - the middle-arse....

8 hours 51 min ago - AI trump?....

12 hours 51 min ago - meanwhile....

14 hours 17 min ago - drones....

14 hours 23 min ago - propagandum....

14 hours 46 min ago - bread and butter....

16 hours 39 min ago - activism....

18 hours 10 min ago - start writing!....

20 hours 54 min ago - beyond arrogance....

21 hours 9 sec ago

Democracy Links

Member's Off-site Blogs

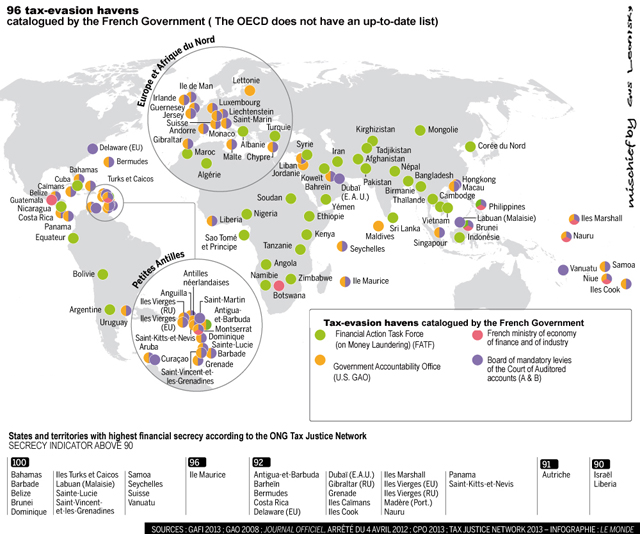

nearly no tax in 96 paradise...

Map published in Le Monde — mischief by Gus leonisky...

The [UK] coalition's plans to crack down on Britain's tax havens were discussed at a meeting between David Cameron and chancellor Angela Merkel, amid growing concerns in Germany. Merkel is understood to have had questions about the monitoring of British sovereign territories used as tax havens by the rich.

The German public has been alarmed in recent weeks about reports of its citizens using havens to avoid paying taxes at home, and the matter has become an electoral issue. But sources close to Cameron said that he was first to raise the future of the territories in order to spell out how his government was cracking down on tax avoidance in places such as Jersey and Guernsey.

A Downing Street spokesman said the prime minister was keen, ahead of June's G8 summit in Northern Ireland, to stress that the UK and others "should show global leadership by taking concrete action on tax evasion and aggressive tax avoidance and making clear that everyone must pay their fair share of taxes"

red more: http://www.guardian.co.uk/business/2013/apr/14/david-cameron-angela-merkel-eu-talks

-----------------------------------------

MIRED in a scandal over an ex-minister's secret Swiss bank account, French President Francois Hollande has vowed to "eradicate" tax havens, increase checks on officials' finances and crack down on tax cheats.

Laying out a series of measures just over a week after his former budget minister Jerome Cahuzac was charged with tax fraud, Hollande promised "a relentless battle against the excesses of money, greed and secret finance."

The new "moralisation" drive will include measures to limit the use of tax havens by forcing banks to expose their foreign activities, Hollande told a post-cabinet press conference on Wednesday.

"Tax havens must be eradicated in Europe and the world," Hollande said.

----------------------------------------

Tax Law - Vanuatu and the use of overseas tax havens

Date: May 08, 2008

Authors: Frank Egan B.A., LL.B., A.C.L.A., F.T.I.A. (Notary)

For many years now a number of Australian taxpayers have been using overseas tax havens to shield their wealth from the Australian Taxation Office. Although there is nothing new in this it has come to greater prominence with the advent of Project Wickenby. Project Wickenby is focused on activities of Philip Egglishaw and any number of non-complying taxpayers who have availed themselves of his services. More recently there have been a raft of names including a large number of people in public life who have relied upon overseas arrangements to avoid paying their full amount of tax.

The proximity of Vanuatu to Australia together with the Cook Islands has made them a favourite destination for Australian taxpayers seeking to avoid paying their full rate of tax. It is particularly attractive because it has an english speaking common law system and its official languages are English and French which makes it very attractive to Europeans. Interestingly it offers a number of products through its onshore professional establishment including international business companies, exempt insurance companies and exempt offshore international bank licensing. One of its great attractions is it is a tax-free tax haven

read more: http://www.laclawyers.com.au/document/Tax-Law-__-Vanuatu-and-the-use-of-overseas-tax-havens.aspx

---------------------------------------------

By encouraging multinational corporations to use accounting techniques to shift their profits to foreign tax havens, the U.S. tax code invites tax avoidance by corporations.

The extent of this profit shifting was made clear by a recent Congressional Research Service analysis that found that U.S. multinationals reported 43 percent of their overseas profits came from tax havens like Bermuda, even though few of their actual foreign investments (7 percent) or foreign workers (4 percent) were in those countries.

- By Gus Leonisky at 14 Apr 2013 - 4:24pm

- Gus Leonisky's blog

- Login or register to post comments

an uneven playing field...

First, if you live in a developed country, your taxes are probably much lower today than they were 30 years ago, thanks in part to tax havens. In 1980, top personal income tax rates in OECD countries averaged more than 67 percent, and corporate rates that year averaged nearly 50 percent. To compound the damage, countries routinely imposed extra layers of tax on capital, including dividend taxes, capital gains taxes, inheritance taxes, and wealth taxes. These policies discouraged saving and investment, stifling economic growth and causing significant economic hardship.

Beginning with Reagan and Thatcher, however, governments have been racing to cut tax rates and reform tax regimes. Top personal tax rates now average only about 40 percent, and corporate rates have been reduced to an average of about 27 percent. It is largely globalization—not ideology—that has driven this virtuous “race to the bottom.” Governments are cutting taxes because they fear that jobs and investment will flee across national borders. Tax havens, by providing a safe refuge for people seeking to dodge confiscatory tax rates, have played a critical role in these positive developments. Better to get some revenue with modest tax rates, lawmakers have concluded, than impose high tax rates and lose out.

Second, European duchies and Caribbean isles aren’t the only places that welcome tax refugees. The United States, for instance, could be considered the world’s largest tax haven. The U.S. government generally does not tax interest and capital gains received by foreigners who invest in America. And since the IRS does not collect data on those payments, there is rarely any information to share with foreign tax collectors. Moreover, U.S. corporate structures, such as Delaware and Nevada companies, are excellent vehicles for foreigners to manage their investments. Thanks in part to these attractive policies, foreigners today have more than $12 trillion invested in the United States. Yet if Merkel’s efforts are successful and all nations are saddled with the obligation to help enforce foreign tax laws, it is quite likely that a substantial share of that job-creating capital will flee the United States.

read more: http://www.cato.org/publications/commentary/why-tax-havens-are-blessing

-------------------------

The recent disclosure by a journalistic consortium of 2.5 million leaked files from offshore bank accounts and shell companies provided stunning insight into the estimated $21 trillion held in secretive offshore tax havens, like the Cayman Islands.

Are these havens essential to a smooth-running world economy or just a tax dodge that benefits the rich and should be more tightly regulated? Can the U.S. government rein in their use?

read more: http://www.nytimes.com/roomfordebate/2013/04/11/global-tax-dodge-or-economic-boon

there's gold in them shop...

Sales of gold bullion and gold chains are boiling over as Sydney buyers rush to buy at bargain prices of around $1332 an ounce, about $200 cheaper than four days ago and $400 cheaper than when the price peaked two years ago.

Not since the global financial crisis have the phones rung so hot from gold buyers, said Jordan Eliseo, chief economist of the Australian Bullion Company on Pitt Street.

Read more: http://www.smh.com.au/business/markets/bargain-hunters-join-the-gold-rush-as-prices-drop-20130417-2i0m8.html#ixzz2QlaLsgIp

-------------------------------------------

Oi!

I knew this would happen.... My mate who trades mostly in gold and gold mines is still smiling despite the drop in price... Because he can buy more gold CHEAPER now and he knows the price will go stratospheric again...

doing the email rounds...

anger extremely warranted...

PUBLIC anger over Apple's tax arrangements is "extremely warranted", according to the tech giant's tax co-founder.

Steve Wozniak, who formed the company in the 1970s with Steve Jobs before leaving in the 1980s, acknowledged the public were furious with Apple amid reports they had paid just 2 per cent tax on £94bn in overseas income – making them one of America's biggest tax avoiders.

But he said there was "an explanation" for Apple's behaviour, reports the Daily Telegraph. "I know some people who are lawyers. They work in California, but they pretend, they make it seem like they work in Nevada, so they can avoid the high state income tax," he said at a conference in Northern Ireland yesterday. "It's like you will do anything, any scheme you can, to maximise your profits."

Wozniak added he believed corporations should be treated the same way as people by the tax authorities.

"People are not taxed on profit. They are taxed on income," he said. "Corporations should be taxed the same as people, in my mind that is how it should be, that would make things fair and right."

Read more: http://www.theweek.co.uk/business/tax-avoidance/53337/apple-founder-steve-wozniak-tax-rage#ixzz2Urv5QvSW

pumping the fountain of tax shelters...

From Der Spiegel

Singapore has become an increasingly popular haven for money laundering and tax evasion. But now it faces calls for reform and a difficult dilemma: Can it be both a home for fortune hunters and a bastion of integrity?

A yellowish-brown fog has settled in the urban canyons of Singapore's financial district. From a skyscraper high above the harbor, you can hardly make out the endless rows of containers in the port terminals. A cloud of smog locally referred to as the "haze" -- caused by the slash-and-burn farming methods of the palm oil barons in neighboring Indonesia -- regularly darkens the skies of the wealthy city-state of Singapore, at the southern tip of the Malaysian Peninsula. But the air has never been as bad as it is now.

Local critics see the haze as a symbol of how nearby filth has dirtied the city-state's business model. The city-state has made itself dependent on global trade, the growth of Asia's rising economies and on the patronage of wealthy people from around the world, who use the discreet financial center as a hub and storage site for their riches.And now Singapore faces a delicate conundrum: There have been recent signs of crisis in emerging economies like India and Indonesia, and Singapore is under growing pressure from Europe and the United States not to create unfair advantages for itself in the competition among tax havens.Critical voices are rare in this country accustomed to success, which has almost no unemployment. It has grown steadily for many years in its role as a platform for global companies seeking to do business in Asia while paying little in taxes. The companies produce their goods in the surrounding countries, where production costs are lower.

...

When authorities in the United States and Europe began hunting down tax evaders in recent years and chipping away at Switzerland's banking secrecy, many of the super-rich moved their assets to Singapore.

Whenever bankers like Pattijn are asked about possible illicit money from Europe, their answers are quick and mechanical. "We don't want that kind of money," Pattijn says. "We have no appetite for that." But the revelations the emerged from Offshore Leaks -- an April report by the International Consortium of Investigative Journalists which revealed the details of 130,000 offshore accounts -- put Singapore in a tight spot. The data trails of the report led directly to Singapore or, more specifically, to Temasek Boulevard.

The Fountain of Wealth, the world's largest fountain, is a bronze monstrosity located on the boulevard and surrounded by five gray office buildings, the Suntec Towers. The firm Portcullis Trustnet has its headquarters there. Portcullis builds what amount to virtual catch basins for fountains of wealth, establishes trust companies and moves assets to tax shelters.

http://www.spiegel.de/international/world/the-singapore-banking-sector-is-a-tax-haven-that-now-faces-reform-a-930998.html

See map and article at top...

a magical industrial tax fairyland...

A Guardian analysis has found:

Stephen Shay, a Harvard Law School professor who has held senior tax roles in the US Treasury and who last year gave expert testimony on Apple’s tax avoidance structures in a Senate investigation, said: “Clearly the database is evidencing a pervasive enabling by Luxembourg of multinationals’ avoidance of taxes [around the world].” He described the Grand Duchy as being “like a magical fairyland.”

read more: http://www.theguardian.com/business/2014/nov/05/-sp-luxembourg-tax-files-tax-avoidance-industrial-scale

The documents include future fund fiddles...

The documents include details of a deal struck in 2010 between the Future Fund and Luxembourg that appears to limit income tax on trades in specific distressed debts on a $500m European portfolio to just $136,000 a year.

A management buyout deal negotiated for Lend Lease in 2003 by the accounting firm PriceWaterhouseCoopers saw lucrative management fees routed from Luxembourg through Bermuda and subcontracted back to Europe, cutting the tax rate on these payments to less than 3%.

Lend Lease was bought out of the business by Macquarie Group, which sold its 56% stake to the American funds manager BlackRock last year. Both Australian companies said they comply with domestic and international tax laws.

The secret tax arrangements of many of the world’s largest companies are contained in the leak, including Pepsi, AIG, Coach and Deutsche Bank. The documents show one Luxembourg address, 5 rue Guillame Kroll, is registered to more than 1,600 businesses.

Schemes such as these are legal, but their exposure will build momentum for a crackdown on global tax avoidance at this month’s G20 meeting in Brisbane.

The treasurer, Joe Hockey, has labelled “tax cheats” thieves and already agreed to increase transparency and crack down on profit shifting by having tax authorities share more information across borders.

But Labor said the government rejected measures that would prevent an additional $1.1bn being sent offshore, and cut more than $180m from the Australian Tax Office’s staff budget.

Tax minimisation strategies employed by Australia’s largest companies cost the federal government more than $8bn in revenue a year, a report by the union United Voice and the Tax Justice Network found.

Oxfam estimated similar techniques deprived developing nations of $114bn a year.

http://www.theguardian.com/business/2014/nov/06/luxembourg-tax-files-the-australian-companies-engaged-in-tax-avoidance

May be we should have a Royal Commission into these GIANT rorts, Mr Abbott?

if I were a rich man...

New details about how HSBC bank helped tax evaders and money-launderers – from political figures to celebrities to arms dealers – conceal billions of dollars in assets have sparked international condemnation, from elected officials as well as public interest groups around the world, writes Dierdre Fulton from Common Dreams.

Documents leaked by whistleblower Hervé Falciani, who worked for HSBC, show how a Swiss division of the UK-headquartered bank routinely allowed clients to withdraw bricks of cash, often in foreign currencies of little use in Switzerland; aggressively marketed schemes likely to enable wealthy clients to avoid European and U.S. taxes; colluded with some clients to conceal undeclared "black" accounts from their domestic tax authorities; and provided accounts to international criminals, corrupt businessmen, and other high-risk individuals.

"This exposes once again the rotten core of banking — it would be shocking if it weren't for the frequency with which we hear of such scandals," said David Hillman, spokesperson for the UK-based Robin Hood Tax campaign.

read more:

https://independentaustralia.net/business/business-display/rotten-core-o...

shifting profits...

An energy company operating in Australia transferred more than $11 billion to the low-tax jurisdiction of Singapore in a single year, heightening concerns that Australia is being duped by tax-minimising multinationals.

The extraordinary scale of funds being moved out of the country by individual companies is revealed in an internal Australian Tax Office memo, obtained under Freedom of Information.

It lists 10 companies that channelled a combined $31.4 billion from Australia to Singapore in the 2011-2012 financial year.

An estimated $60 billion in so-called "related parties" transactions went from Australia to tax havens in the same year.

Tax Commissioner Chris Jordan and a number of his senior colleagues have recently flagged concerns about cross-border transfers and intra-company refinancing and the potential that they are linked to tax avoidance.

The Tax Office is particularly concerned about mining and energy companies extracting Australian minerals which have established "marketing hubs" in Singapore that appear to have little use other than as a destination for shifted profits.

read more: http://www.smh.com.au/federal-politics/political-news/energy-companys-11-billion-transfer-to-singapore-rings-tax-avoidance-alarm-bells-20150403-1me7ij.html

an old tax scheme...

A financial transaction tax — a per-trade charge on the buying and selling of stocks, bonds and derivatives — is an idea whose time has finally come. It has begun percolating in the Democratic presidential campaign, with all three candidates offering proposals.

Hillary Clinton and Martin O’Malley have proposed a worthy but narrow tax on certain high-frequency trades, which generate windfall profits on small and fleeting differences in prices at the expense of ordinary investors and market stability. Bernie Sanders supports a hefty tax on a broader range of transactions to raise revenue from Wall Street, also a worthy goal, but his proposal would be likely to squeeze investors too hard. Republicans have not engaged the debate, except to say no to taxes no matter what.

A well-designed financial transaction tax — one that applies a tiny tax rate to an array of transactions and is split between buyers and sellers — would be a progressive way to raise substantial revenue without damaging the markets. A new study by researchers at the nonpartisan Tax Policy Center has found that a 0.1 percent tax rate could bring in $66 billion a year, with 40 percent coming from the top 1 percent of income earners and 75 percent from the top 20 percent. As the rate rises, however, traders would most likely curtail their activity. The tax could bring in $76 billion a year if it was set at 0.3 percent, but above that rate, trading would probably decrease and the total revenue raised would start to fall.

The burden of this tax would be concentrated at the top, because that’s where the ownership of financial assets is concentrated. However, individuals who buy and hold investments, including those who invest in index funds that trade infrequently, would be largely unaffected. Pension funds that devote a portion of their portfolios to speculative trading, often through hedge funds, would be hit, but some pension funds have already stopped using hedge funds because the returns do not justify the costs. A financial transaction tax that encouraged other pension funds to follow suit could actually benefit pension participants in the long run.

read more: http://www.nytimes.com/2016/01/28/opinion/the-need-for-a-tax-on-financial-trading.html

the dutch and irish sandwich...

Billions of euros escape every year from the various European tax systems in a completely legal way. In 2015, Google has escaped €3.6 billion in taxes thanks to well-established tax optimization techniques.

On 12 December a Dutch subsidiary of the Google company told the Dutch Chamber of Commerce to transfer € 14.9 billion in 2015 to another subsidiary of Google based in Ireland but governed by the law of Bermuda, a Caribbean tax haven where corporate taxes do not exist.

According to Dutch documents, published on 20 December by the newspaper Het Financieele Dagblad,, Google will have succeeded in 2015 in avoiding the payment of 3.6 billion euros of taxes, thanks to a complex scheme of tax optimization which allowed To Google to reduce in 2015 to 6.4% the tax rate on its profits realized outside the United States.

read more:

RT special encryption...

tax fraud in germany...

A report by German media on Wednesday claims that the German state lost at least €31.8 billion since 2001 through tricks by banker and brokers to manipulate tax payments and refunds.

Research by Mannheim University professor Christoph Spengel shared with Die Zeit and broadcaster ARD shows that the German state has lost at least €31.8 billion since 2001 through certain banking and broker practices called “cum/cum” and “ex/cum” trades.

“Cum-cum” trades are when German banks borrow a foreign investor’s shares in a company right before a dividend payment, which means they can use a loophole in German law that allows domestic investors to claim a credit on taxes on dividends that foreign investors cannot claim. Basically, this means the foreign investor can avoid the tax on dividends.

These deals are estimated to have cost Germany €24.6 billion since 2001, according to Spengel.

“Cum-ex” trades are similar, but essentially allow for there to be multiple refunds filed on capital gains taxes that were only paid once to tax authorities.

Spengel calculates that these deals cost the German state €7.2 billion between 2005 and 2012.

Cum-ex trades were prohibited in 2012, cum-cum trades in 2016.

Over the course of about six months, the German reporters found evidence of a presumed criminal network of about a dozen investment bankers in London who were at the root of most of the billion-euro losses.

Several of them are currently testifying to Cologne public prosecutors.

"This is the biggest tax scandal in the history of the Federal Republic of Germany," said Spengel.

read more:

https://www.thelocal.de/20170608/germany-lost-32-billion-to-banking-and-...

tax havens, where their piles accumulate...

It’s not enough to say, in response to the Paradise Papers revelations, that we already knew that rich people parked their money in offshore tax havens, where their piles accumulate far from the scrutiny of our government. Nor is it enough to say that we were already aware that we live in a time of “inequality.”

What we have learned this week is the clinical definition of the word. What we have learned is how much the rich and the virtuous have been hiding away and where they’re hiding it. Yes, there are sinister-looking Russian capitalists involved. But there’s also our favorite actors and singers. Our beloved alma mater, supposedly a charitable institution. Everyone with money seems to be in on it.

We’re also learning that maybe we’ve had it backwards all along. Tax havens on some tropical island aren’t some sideshow to western capitalism; they are a central reality. Those hidden billions are like an unseen planet whose gravity is pulling our politics and our economy always in a certain direction. And this week we finally began to understand what that uncharted planet looks like; we started to grasp its mass and its power.

read more:

https://www.theguardian.com/commentisfree/2017/nov/09/paradise-papers-of...

Read from top...

protecting their tax evasion racket...

The world’s biggest mining company has sought an injunction against Australia’s tax commissioner to force him to return documents it claims were obtained illegally in last year’s Paradise Papers leak.

The Swiss-based multinational Glencore lodged a writ with the high court last week against the ATO commissioner, Chris Jordan, and two of Jordan’s colleagues.

It is trying to prevent the ATO from using documents contained in last year’s huge “Paradise Papers” leak to pursue any tax matters against the miner.

It asserts the documents in question – which were leaked from the Bermuda law firm Appleby – are subject to legal professional privilege so the ATO has no right to rely on them. It has asked the ATO to return the documents multiple times but the ATO has not cooperated.

It hopes the court action will set a legal precedent on the right of the ATO to rely on documents that have been obtained without a company’s consent and which are subject to legal professional privilege.

“Glencore has commenced proceedings in the high court of Australia against the commissioner of taxation seeking an injunction for the return of certain illegally obtained documents now in the possession of the ATO which Glencore considers are subject to legal professional privilege,” a Glencore spokesman told Guardian Australia. “Glencore is also seeking an injunction against the commissioner of taxation from using these documents.

“The decision to commence proceedings follows multiple occasions on which Glencore has written to the ATO asserting privilege over and seeking the return of the documents.

“Legal professional privilege is a fundamental right that protects legal advice provided between lawyer and client. We, like anybody else, have the right to seek legal advice from our lawyers and for that advice to remain between lawyer and client.”

Glencore’s court action was first reported by Fairfax Media.

The “Paradise Papers” was a leak of 13.4m files from two offshore service providers, and the company registries of 19 tax havens. They were obtained by the German newspaper Süddeutsche Zeitung and shared by the International Consortium of Investigative Journalists with partners including the Guardian, the BBC and the New York Times.

Read more:

https://www.theguardian.com/business/2018/oct/03/glencore-seeks-injuncti...

Read from top.

Read also:

http://www.yourdemocracy.net.au/drupal/node/31721

http://www.abc.net.au/news/2017-11-06/ato-investigating-multinationals-a...

the USA is a tax haven...

Nervous About Trump

EU Fearful of Including U.S. on Tax-Haven List

Although the United States fits the definition of a tax haven, EU officials in Brussels are weary of publicly shaming it on a "black list" of countries that allow companies to avoid taxes. Given Trump's harsh rhetoric, the Europeans are worried about a further deterioration of ties.

It sounded like a historical moment was in the offing. For the first time, Europe's finance ministers were seriously planning on publicly denouncing tax havens by presenting a black list of countries that lure companies through tax-saving schemes. French Finance Minister Bruno Le Maire said the countries on the list were "not doing enough to fight tax evasion." Fellow Frenchman Pierre Moscovici, the European Union's commissioner for economic and monetary affairs, called for vigorous sanctions.

The scandals surrounding Lux Leaks and the Panama Papers in recent years revealed how brazenly some states allow tax dumping at the expense of their neighbors. The EU then declared that it would force those countries to increase transparency by exchanging tax data.

That was one and a half years ago, and that momentum has largely disappeared. This is partly because the black list had several fundamental shortcomings from the beginning. EU member states, for example, don't appear on the list, even though Luxembourg, Malta and the Netherlands are often criticized for attracting companies with low taxes.

More recently, the EU also seemed to be hesitating to include other countries where tax dumping was clearly taking place -- most prominently, the United States.

Internal documents from the European Council working group responsible for the issue suggest that the United States ignored a late June deadline to avoid being included on the list. DER SPIEGEL has seen the ("EU restricted") internal documents.

The U.S. had multiple concrete opportunities to address the issue: It could have signed onto an agreement of the Organization for Economic Co-Operation and Development (OECD) allowing for automatic information exchange. Or it could have reached a deal on its last outstanding bilateral agreement with an EU country, in this case Croatia. Thus far, it has done neither.

The U.S. negotiator told his EU counterparts in a conference call on July 18 that there are "political reservations" in the U.S. Senate -- especially when it comes to the automatic exchange of information about financial accounts in accordance with OECD standards. The U.S. gains a competitive advantage when it doesn't follow the strict transparency rules of the OECD, because those rules make it harder for companies to hide money from the local tax authorities outside of their home country.

The EU negotiators want to compel the U.S. to at least try to find a solution. The next revision of the list is expected to take place in early 2020. In the EU Council, which represents the leaders of the EU member states, people believe that "nothing will change before then." And afterward? It's unclear.

Fears of Tension

Although the U.S. has long enjoyed crusading against international tax havens and, at one point, placed heightened pressure on Swiss banks, it allows tax competition between individual states in the U.S. to proceed freely. This has allowed U.S. states like Delaware to become the "favored haven of companies listed on the DAX," Germany's blue chip stock index, "with generous protection for offshore shell companies," as the German business monthly Manager Magazin describes it.

One reason for the Europeans' restraint could be the growing economic conflicts with the Trump administration. The U.S. president is assiduously threatening to apply punitive tariffs on car imports from the EU, and he is particularly angry at the French, who recently and unilaterally introduced a digital tax on large internet companies. Trump sees it as a hostile act against U.S. internet giants like Amazon and Google.

If the U.S. were black-listed alongside Belize and the United Arab Emirates, it would be seen as a serious escalation. Even now, EU diplomats are worried that the U.S. president will air his grievances during the G-7 meeting this weekend in the French resort city Biarritz.

Read more:

https://www.spiegel.de/international/business/eu-fearful-of-including-u-...

Read from top.

Read also:

http://www.yourdemocracy.net.au/drupal/node/31721