Search

Recent comments

- epibatidine....

3 hours 22 min ago - cryptohubs...

4 hours 20 min ago - jackboots....

4 hours 28 min ago - horrid....

4 hours 36 min ago - nothing....

6 hours 59 min ago - daily tally....

8 hours 21 min ago - new tariffs....

10 hours 13 min ago - crummy....

1 day 4 hours ago - RC into A....

1 day 6 hours ago - destabilising....

1 day 7 hours ago

Democracy Links

Member's Off-site Blogs

poetic justice .....

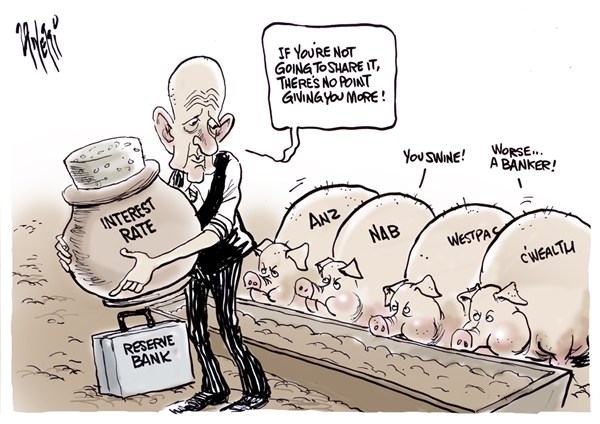

The UBS banking analyst Jonathan Mott has started 2012 with a bang - telling us first the banks were about to slash thousands of jobs and, this month, that the poor dears are likely losing money on new mortgages.

Homebuyers covering this month's payment might say ''welcome to the club'', but if Mott is right, yesterday's decision by the Reserve Bank board not to budge (yet) on the benchmark cash rate has probably saved the banks some money.

Not only do they not have to shave their mortgage rates, they do not have to endure the political acrimony if they elect to keep some profit margin by not reducing their lending rates by the same amount as the RBA.

Then again, they quite probably lost some of those imputed gains on their currency trading desks, as the Australian dollar bolted into the stratosphere.

The Treasurer, Wayne Swan, on the other hand, was likely underwhelmed with the RBA's call not to cut rates - removing as it did one of the favourite distractions in the political armoury, a good old bank bashing.

As for Mott's theory on job cuts that sparked a run of front page stories in January, the major banks have been carefully elliptical about confirming or denying that they will adopt the most tried and true method business managers have of quickly cutting their overheads - booting staff out the door.

The National Australia Bank chief, Cameron Clyne, said while being questioned about his bank's December quarter results that ''we're not flagging any major cost initiatives''. Earlier in the day the Commonwealth Bank's new chief, Ian Narev, was reported to have sent a memo to staff indicating no major job cuts were on the agenda.

Insider guesses those answers hinge on your definition of ''major'' when you have about 45,000 workers.

On the $1.4 billion of cash earnings released by Clyne yesterday, NAB's quarterly profit per employee blipped above $31,000 a head - a far cry from the depressed $24,500 it was getting from them in the December quarter of 2009. That would seem reasonable productivity growth.

Since 2009, when NAB and the other Australian banks started reporting quarterly figures to reassure regulators, customers and investors, its profit per day has gone from a shade under $12 million to yesterday's number of about $15.2 million. That is a gain of 27 per cent, in spite of inflation and those frequently bewailed, nasty and near frozen international money markets charging so much for the cash NAB borrows and then lends here to fund mortgages and businesses.

One last one for the statistics lovers: on that basis, NAB is making a profit equivalent to about $62 for every child, woman and man in this country in the quarter - compared with closer to $54 per capita in the same period of 2009.

Meanwhile, in Rwanda where the per capita gross domestic product is $US1300 ($1200) a year, the Finance and Economic Planning Minister, John Rwangombwa, reckons they have reduced the number of people living in poverty by more than 1 million over the past five years. Apparently only 45 per cent of the East African nation's 11 million people are now under the line, compared with 57 per cent in 2007.

Pack runs awry

In spite of that old aphorism about laying all economists end to end, and them all pointing in different directions, it seems that even when most are pointing in the same direction, they are wrong.

Wire services were yesterday reporting that 13 out of 14 surveyed economists were wrong about the RBA's ''steady as she goes'' decision, with most having followed usual financial market practice of running with the herd in tipping a 0.25 percentage point reduction.

HSBC Australia's chief economist, Paul Bloxham, noted 24 out of 27 of his profession were wrong. Insider reckons Bloxham's own call on Monday was close to being correct: ''Combined with steadier global data and the significant upside surprise to US payrolls, these data are certainly going to make tomorrow's RBA meeting a close call. We still expect a cut tomorrow, but it is a line ball decision,'' Bloxham said after writing up the downbeat retail trade numbers for Christmas.

The RBA governor, Glenn Stevens, seemed to express similar views, judging that markets and consumer behaviour had stabilised sufficiently to come up with a ''first, do no harm'' approach - albeit noting that while his eyes are busily calculating whether there are economic storm clouds on the horizon, he has a finger hovering above the interest rate button.

Stevens might be using his discretion, but the outcome was a bad day for most discretionary retail stocks which were probably hoping the previous day's depressing sales figures had cemented the case for a drop in rates.

David Jones, Myer, JB Hi-Fi, Woolworths and The Reject Shop all shed value yesterday. Harvey Norman, judged by some to be one of the more vulnerable groups, rose. Maybe its founder, Gerry Harvey, who has been buying the shares because he thinks they are undervalued, was back in the market.

No love lost

Elsewhere in retail, a Malaysian Muslim youth group's campaign to have Valentine's Day outlawed gets some sympathy from Insider, whose many inboxes are groaning under the weight of clever gift ideas.

Aside from statistical freaks at IBISWorld, who are tipping Australians will spend almost $910 million on food, travel, flowers and sparkly things, there are a couple of standouts.

The electrical consumer goods maker Philips has a nice line in passive-aggressive gifts, starting with headphones and a permanent body-hair removal system, through to oral care and ending on a shaver - for him, presumably to avoid gravel rash.

First place for wacky opportunist, though, has to go to an online ''hub'' offering young and hip marriage celebrants. Insider divorced the site when it claimed that the average age of the 10,000 registered marriage celebrants in Australia was 83. Really?

- By John Richardson at 8 Feb 2012 - 7:01pm

- John Richardson's blog

- Login or register to post comments

voting with one's feet .....

Weasel words, phone calls at dinner time: call this service?

Banks tend to shy away from those nasty words ''rise'' or ''increase'' so in recent years, when the NAB has written to say it is jacking up fees on one of my mortgages, it has used the weasel word ''change''.

In 2010, for example, it was ''Warren Shaw, executive general manager, NAB retail'' who advised that, ''following our annual review of your loan, your required repayment amount needs to change''.

Warren said monthly repayment would henceforth be $1789.35, but I had to dig out my bank statements to confirm that this in fact was a $12 rise.

Last year it was ''NAB executive general manager Chris Bayliss'' whose letter lobbed in the mailbox. Yes, it was that ol' annual review again and, yes, my ''required repayment amount needs to change''. It was now $1809.21 and, although Chris didn't say so, this was another rise - up $19.86.

Small beer, perhaps, in the hyperventilated property world but it was somewhat irritating to see the NAB, within months, launch one of the biggest and most expensive advertising campaigns in memory, portraying itself as the people's friend among the big four banks. ''The other banks don't like us any more'' was the claim on billboards, the sides of trams, in the press, on radio and TV.

But, frankly, I didn't give a hoot what the other banks thought of the NAB, but I did care about that monthly bite. Instead of the advertising blitz, I would have preferred no ''change'' in my mortgage repayments.

There were other irritations, too. Last year we began to receive dinner-time phone calls at home from NAB ''customer service'' people, anxious to confirm that I was happy with my loan and asking if the bank could help me with any other financing or a higher credit card limit. ''No'' was the answer. And please stop calling.

However, it was the Reserve Bank rate cut of 25 points before Christmas that popped my cork. The big four, having moved faster than the Caped Crusader to jack up rates in the past whenever the RBA upped the numbers, hummed and hawed. It was possible, they said (until public outrage forced a retreat), that they might not pass on the cut.

Really? At the NAB the CEO was sitting happily on a annual salary of $5.3 million, and God only knows what was spent on the sniffly ''other banks don't like us'' campaign. Moreover, the NAB had saved many millions shutting down suburban branches, so my nearest branch was now 10 minutes' drive away. Yet the bank dithered when it came to passing on this small saving to the customer.

Treasurer Wayne Swan - with few other weapons at his disposal - had been exhorting disgruntled banking clients to ''switch lenders'' so, as a Christmas present to self, I decided to dip a toe in the water.

My credit union, which had just become a community bank, has a branch five minutes walk away, so I dropped in. They mulled over the $217,000 still owing - scribble-scribble k'ching: round it out to $220,000 and that would be $1653.60 plus $8 monthly service fee over 20 years. Really? That much less? And more than a year faster? What about annual fees, I asked, because the NAB charged an ''annual package fee'' despite the fact that the ''package'' had been signed and sealed more than eight years ago. ''No,'' said the bankmecu lady, ''no annual fees, no ongoing fees.'' And the cost of switching mortgages? Mortgage discharge, establishment and registration fees totalling $1047.40.

When I got home I grabbed the calculator: with 259 monthly repayments still owing on my NAB loan I would have paid - at the current rate of $1809.21 - $468,585. And the 21 remaining ''annual package fees'' would have totalled $8295. Paying off the NAB loan at current rates would have cost $476,880.

On the other hand, the switch to bankmecu - 238 monthly payments at $1653.60, one at $1652.93 and $1920 in monthly fees - would require payments (at present rates) totalling $397,129.73.

Hang on, I'll just check that again. Yes, that is correct: $79,751 less. A no-brainer really.

And I liked the way the paperwork for the new loan came through last week just as the Reserve Bank decided to leave the cash rate on hold - while the big four began squawking about why they were having to jack up their interest rates anyhow.

Confessions Of A Bank Victim: How I Switched & Saved