Search

Recent comments

- crummy....

17 hours 15 min ago - RC into A....

19 hours 8 min ago - destabilising....

20 hours 12 min ago - lowe blow....

20 hours 44 min ago - names....

21 hours 21 min ago - sad sy....

21 hours 46 min ago - terrible pollies....

21 hours 56 min ago - illegal....

23 hours 8 min ago - sinister....

1 day 1 hour ago - war council.....

1 day 11 hours ago

Democracy Links

Member's Off-site Blogs

false prophets .....

Writing from the very region that produces more clichés per square foot than any other "story" – the Middle East – I should perhaps pause before I say I have never read so much garbage, so much utter drivel, as I have about the world financial crisis.

But I will not hold my fire. It seems to me that the reporting of the collapse of capitalism has reached a new low which even the Middle East cannot surpass for sheer unadulterated obedience to the very institutions and Harvard "experts" who have helped to bring about the whole criminal disaster.

Let's kick off with the "Arab Spring" – in itself a grotesque verbal distortion of the great Arab/Muslim awakening which is shaking the Middle East – and the trashy parallels with the social protests in Western capitals. We've been deluged with reports of how the poor or the disadvantaged in the West have "taken a leaf" out of the "Arab spring" book, how demonstrators in America, Canada, Britain, Spain and Greece have been "inspired" by the huge demonstrations that brought down the regimes in Egypt, Tunisia and – up to a point – Libya. But this is nonsense.

The real comparison, needless to say, has been dodged by Western reporters, so keen to extol the anti-dictator rebellions of the Arabs, so anxious to ignore protests against "democratic" Western governments, so desperate to disparage these demonstrations, to suggest that they are merely picking up on the latest fad in the Arab world. The truth is somewhat different. What drove the Arabs in their tens of thousands and then their millions on to the streets of Middle East capitals was a demand for dignity and a refusal to accept that the local family-ruled dictators actually owned their countries. The Mubaraks and the Ben Alis and the Gaddafis and the kings and emirs of the Gulf (and Jordan) and the Assads all believed that they had property rights to their entire nations. Egypt belonged to Mubarak Inc, Tunisia to Ben Ali Inc (and the Traboulsi family), Libya to Gaddafi Inc. And so on. The Arab martyrs against dictatorship died to prove that their countries belonged to their own people.

And that is the true parallel in the West. The protest movements are indeed against Big Business – a perfectly justified cause – and against "governments". What they have really divined, however, albeit a bit late in the day, is that they have for decades bought into a fraudulent democracy: they dutifully vote for political parties – which then hand their democratic mandate and people's power to the banks and the derivative traders and the rating agencies, all three backed up by the slovenly and dishonest coterie of "experts" from America's top universities and "think tanks", who maintain the fiction that this is a crisis of globalisation rather than a massive financial con trick foisted on the voters.

The banks and the rating agencies have become the dictators of the West. Like the Mubaraks and Ben Alis, the banks believed – and still believe – they are owners of their countries. The elections which give them power have – through the gutlessness and collusion of governments – become as false as the polls to which the Arabs were forced to troop decade after decade to anoint their own national property owners. Goldman Sachs and the Royal Bank of Scotland became the Mubaraks and Ben Alis of the US and the UK, each gobbling up the people's wealth in bogus rewards and bonuses for their vicious bosses on a scale infinitely more rapacious than their greedy Arab dictator-brothers could imagine.

I didn't need Charles Ferguson's Inside Job on BBC2 this week – though it helped – to teach me that the ratings agencies and the US banks are interchangeable, that their personnel move seamlessly between agency, bank and US government. The ratings lads (almost always lads, of course) who AAA-rated sub-prime loans and derivatives in America are now – via their poisonous influence on the markets – clawing down the people of Europe by threatening to lower or withdraw the very same ratings from European nations which they lavished upon criminals before the financial crash in the US. I believe that understatement tends to win arguments. But, forgive me, who are these creatures whose ratings agencies now put more fear into the French than Rommel did in 1940?

Why don't my journalist mates in Wall Street tell me? How come the BBC and CNN and – oh, dear, even al-Jazeera – treat these criminal communities as unquestionable institutions of power? Why no investigations – Inside Job started along the path – into these scandalous double-dealers? It reminds me so much of the equally craven way that so many American reporters cover the Middle East, eerily avoiding any direct criticism of Israel, abetted by an army of pro-Likud lobbyists to explain to viewers why American "peacemaking" in the Israeli-Palestinian conflict can be trusted, why the good guys are "moderates", the bad guys "terrorists".

The Arabs have at least begun to shrug off this nonsense. But when the Wall Street protesters do the same, they become "anarchists", the social "terrorists" of American streets who dare to demand that the Bernankes and Geithners should face the same kind of trial as Hosni Mubarak. We in the West – our governments – have created our dictators. But, unlike the Arabs, we can't touch them.

The Irish Taoiseach, Enda Kenny, solemnly informed his people this week that they were not responsible for the crisis in which they found themselves. They already knew that, of course. What he did not tell them was who was to blame. Isn't it time he and his fellow EU prime ministers did tell us? And our reporters, too?

- By John Richardson at 11 Dec 2011 - 10:08am

- John Richardson's blog

- Login or register to post comments

bankster games .....

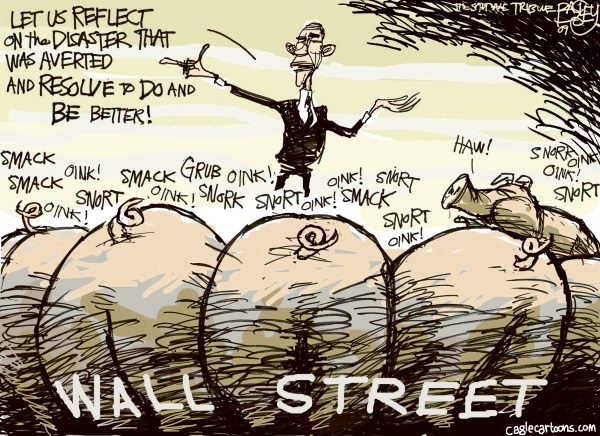

Wall Street is its own worst enemy. It should have welcomed new financial regulation as a means of restoring public trust. Instead, it’s busily shredding new regulations and making the public more distrustful than ever.

The Street’s biggest lobbying groups have just filed a lawsuit against the Commodities Futures Trading Commission, seeking to overturn its new rule limiting speculative trading.

For years Wall Street has speculated like mad in futures markets – food, oil, other commodities – causing prices to fluctuate wildly. The Street makes bundles from these gyrations, but they have raised costs for consumers.

In other words, a small portion of what you and I pay for food and energy has been going into the pockets of Wall Street. It’s just another hidden redistribution from the middle class to the rich.

The new Dodd-Frank law authorizes the Commodity Futures Trading Commission to limit such speculative trading. The commission considered 15,000 comments, largely from the Street. It compromised on key provisions. It weighed the benefits to the public of the new regulation against its costs to the Street. It did numerous economic and policy analyses. It even agreed to delay enforcement of the new rule for at least a year.

But this wasn’t enough for the Street. The new regulation would still put a crimp in Wall Street’s profits.

So the Street is going to court. What’s its argument? The commission’s cost-benefit analysis wasn’t adequate.

At first blush it’s a clever ploy. There’s no clear legal standard for an “adequate” weighing of costs and benefits of financial regulations, since both are so difficult to measure. And putting the question into the laps of federal judges gives the Street a huge tactical advantage because the Street has almost an infinite amount of money to hire so-called “experts” (some academics are not exactly prostitutes but they have their price) who will use elaborate methodologies to show benefits have been exaggerated and costs underestimated.

It’s not the first time the Street has used this ploy. Last year, when the Securities and Exchange Commission tried to implement a Dodd-Frank policy making it easier for shareholder to nominate company directors, Wall Street sued the SEC. It alleged the commission’s cost-benefit analysis for the new rule was inadequate. Last July, a federal appeals court – inundated by Wall Street lawyers and hired-gun “experts” – agreed with the Street.

So much for shareholders nominating company directors.

Obviously, government should weigh the costs against the benefits of anything it does. But when it comes to the regulation of Wall Street, one overriding cost doesn’t make it into any individual weighing: The public’s mounting distrust of the entire economic system, generated by the Street’s repeated abuse of the public’s trust.

Wall Street’s shenanigans have convinced a large portion of America that the game is rigged.

Yet capitalism depends on trust. Without trust, people avoid even sensible economic risks. They also begin trading in gray markets and black markets. They think that if the big guys cheat in big ways, they might as well begin cheating in small ways. And they’re easy prey for political demagogues with fast tongues and vacuous solutions.

Tally up these costs and it’s a whopper.

Wall Street has blanketed America in a miasma of cynicism. Most Americans assume the reason the Street got its taxpayer-funded bailout without strings in the first place was because of its political clout. That must be why the banks didn’t have to renegotiate the mortgages of Americans – who, because of the economic collapse brought on by the Street’s excesses, are still under water and many are drowning.

That must be why taxpayers didn’t get equity stakes in the banks we bailed out – as Warren Buffet got when he bailed out Goldman Sachs. So when the banks became profitable gain we didn’t get any of the upside gains; we just padded the Street’s downside risks.

That must be why most top Wall Street executives who were bailed out by taxpayers still have their jobs, have still avoided prosecution, are still making vast fortunes – while tens of millions of average Americans continue to lose their jobs, their wages, their medical coverage, or their homes.

The cost of such cynicism has leeched deep into America, causing so much suspicion and anger that our politics has become a cauldron of rage. It’s found expression in Tea Partiers and Occupiers, and millions of others who think the people in charge have sold us out.

Every week, it seems, we learn something new about how Wall Street has screwed us. Last week we heard from Bloomberg News (that had to go to court for the information) that in 2009 the Street’s six largest banks borrowed almost half a trillion dollars from the Fed at nearly zero cost – but never disclosed it.

In early 2009, after Citigroup tapped the Fed for almost $100 billion, the bank’s CEO, Vikram Pandit, had the temerity to call Citi’s first quarter the best since 2007. Is there another word for fraud?

Finally, everyone knows the biggest banks are too big to fail — and yet, despite this, Congress won’t put a cap on the size of the banks. The assets of the four biggest – J.P. Morgan Chase, Bank of America, Citigroup and Wells Fargo – now equal 62 percent of total commercial bank assets. That’s up from 54 percent five years ago. Throw in Goldman Sachs and Morgan Stanley, and these six leviathans preside over the American economy like Roman emperors.

If Greece defaults and Europe’s major banks can’t make payments on their debts to Wall Street, another bailout will be required. And the politics won’t be pretty.

There you have it. A federal court will now weigh costs and benefits of a modest rule designed to limit speculative trading in food and energy.

But in coming months and years, the American public will weigh the social costs and social benefits of Wall Street itself. And it wouldn’t surprise me if they decide the costs of the Street as it is far outweigh the benefits. If so, the Street has only itself to blame.

Latest Shameless Ploy To Fleece You?

saving main street .....

On November 27, Bloomberg News reported the results of its successful case to force the Federal Reserve to reveal the lending details of its 2008-09 bank bailout. Bloomberg reported that by March 2009, the Fed had committed $7.77 trillion in below-market loans and guarantees to rescuing the financial system, and that these nearly interest-free loans came without strings attached.

The Fed insisted that the loans were repaid and there have been no losses, but the Bloomberg report said the banks reaped a $13 billion windfall in profits; and "details suggest taxpayers paid a price beyond dollars as the secret funding helped preserve a broken status quo and enabled the biggest banks to grow even bigger."

The revelations provoked shock and outrage among commentators. But in a letter to the leaders of the House and Senate Committees focused on the financial services industry, Fed Chairman Ben Bernanke responded on December 6 that the figures were greatly exaggerated. He said the loans were being double-counted: short-term loans rolled over from day to day were counted as separate cumulative loans rather than as a single extended loan.

Bloomberg was quick to rebut, denying any exaggerated claims. But either way, the banks were clearly getting perks not available to the rest of us. As Alan Grayson observed in a December 5 editorial:

The main, if not the sole, qualification for getting help from the Fed was to have lost huge amounts of money. The Fed bailouts rewarded failure, and penalized success....

During all the time that the Fed was stuffing money into the pockets of failed banks, many Americans couldn't borrow a dime for a home, a car, or anything else. If the Fed had extended $26 trillion in credit to the American people instead of Wall Street, would there be 24 million Americans today who can't find a full-time job?

All in the Name of Liquidity

It was all explained, said Grayson, with "the Fed's all-time favorite rationale for everything it does, 'increasing liquidity.'" In 2008, bank liquidity dried up after Lehman Brothers collapsed, and the banks could not get the cheap, ready credit on which their lending scheme depends. The Fed then stepped in as "lender of last resort," doing what it had to do to keep the banking scheme going.

Left unexplained is why the banks' need for "liquidity" justifies such extraordinary measures. Why do banks need cheap and ready access to funds? Aren't they the lenders rather than the borrowers of funds? Don't they simply take in deposits and lend them out?

The Fed, it seems, was doing only what banks and the money market do for each other every day: making "liquidity" available at very low interest rates. In 2008, bank liquidity dried up after Lehman Brothers collapsed, and the banks could not get the cheap, ready credit on which their lending scheme depends. The Fed then stepped in as "lender of last resort," doing what it had to do to keep the banking scheme going.

What is this need for "liquidity" that justifies such extraordinary measures on behalf of the banks? Why do banks need cheap and ready access to funds? Aren't they the lenders rather than the borrowers of funds? Don't they simply take in deposits and lend them out?

The answer is no. Today, when banks make loans, they extend credit FIRST, then fund the loans by borrowing from the cheapest available source. If deposits are not available, they borrow from another bank, the money market or the Federal Reserve.

Rather than loans being created from deposits, loans actually CREATE deposits. They create deposits when checks are drawn on the borrower's account and deposited in another bank. These deposits can then be borrowed back at the Fed funds rate - currently a very low 0.25 percent. A bank can thus create money in the form of "bank credit"; lend it to a customer at high interest; and borrow it back at very low interest, pocketing the difference as its profit.

If all this looks like sleight of hand, it is. The process has been compared to "check kiting," defined in Barron's "Business Dictionary" as:

[An] illegal scheme that establishes a false line of credit by the exchange of worthless checks between two banks. For instance, a check kiter might have empty checking accounts at two different banks, A and B. The kiter writes a check for $50,000 on the bank A account and deposits it in the bank B account. If the kiter has good credit at bank B, he will be able to draw funds against the deposited check before it clears, that is, is forwarded to bank A for payment and paid by bank A. Since the clearing process usually takes a few days, the kiter can use the $50,000 for a few days and then deposit it in the bank A account before the $50,000 check drawn on that account clears.

Setting Things Right

As suspicious as all this appears, the economy actually needs an expandable credit system, and an expandable credit system needs a lender of last resort. What is wrong with the current scheme is that it discriminates against Main Street in favor of Wall Street. Banks can borrow very cheaply, while individuals, corporations and governments pay "whatever the market will bear." The banker middlemen take their cut in a scheme in which money is actually manufactured in the process of lending it. The profits are siphoned off to the 1 percent at the expense of the 99 percent.

To fix the system, the profits need to be returned to the 99 percent. How that could be done was suggested by Thom Hartmann in a recent editorial:

Have the central bank owned by the US government and run by the Treasury Department, so all the profits ... go directly into the Treasury and you and I pay less in taxes....

For a model on the local level, he pointed to the Bank of North Dakota:

The good people of North Dakota ... established something very much like this - the Bank of North Dakota - and it's kept the state in the black, and kept its farmers, manufacturers and students protected from the predations of New York banksters for nearly a century.

It's time for every state to charter their own state bank, just like North Dakota did, and for the Treasury Department to either buy the Fed from the for-profit banks that own it, or simply nationalize it.

We have been distracted here and in Europe by a sudden panic over our "sovereign debt" crises, when the real crisis is that our debt is NOT sovereign. We are indentured to a Wall Street money machine that creates our money and lends it back to us at interest, money our sovereign government could be creating itself, with full democratic oversight and accountability to the people. We have forgotten our roots, when the American colonists thrived on a system of money created by the people themselves, debt-free and interest-free. The continued dominance of the Wall Street money machine depends on that collective amnesia. The fact that this memory is surfacing again may be the machine's greatest threat - and our greatest hope as a nation.

Pulling Back the Curtain on the Wall Street Money Machine

climate banksters...

The majority of directors at the world’s biggest banks have affiliations to polluting companies and organisations, a DeSmog investigation shows. The findings raise concerns over a systemic conflict of interest at a time when the international financial sector is under increasing pressure to stop funding fossil fuels.

DeSmog’s analysis found 65 percent of directors from 39 banks had 940 past or current connections to industries that could be considered climate-conflicted.

Directors with affiliations to companies involved in extracting oil, gas and coal – the world’s most polluting energy sources – were well-represented across bank boardrooms, with 16 percent of all board members having current or previous roles in the polluting energy sector.

There were also significant ties to banks and investment vehicles supporting polluting industries, as well as to thinktanks and lobbying groups with a history of campaigning against climate action.

Geoffrey Supran, Research Associate in the Department of the History of Science at Harvard University, said the existence of such ties is “predictable, yet shocking”.

“The fossil fuel industry has a well-established track record of ingratiating itself with society’s opinion leaders and decision makers, and because of the revolving doors between the corporate leaderships of incumbent industries,” he told DeSmog.

“Having its fingers in all the pies allows the fossil fuel industry to quietly put its thumb on the scales of institutional decision making, helping delay action and protect the status quo.”

Systemic problemThe investigation assessed the employment history and affiliations of 565 bank directors from the boards of major retail banks in the UK, US, Canada, Europe, South Africa, China and Japan.

Directors were found to have a wide range of experience in high carbon sectors, including in polluting energy, aviation, mining, manufacturing, and banks and investment companies known to support the fossil fuel industry. These positions ranged from director and advisory roles, to employment by the companies, and trade association or thintank memberships or affiliations (with data collected up to January 31, 2021).

Banks are increasingly saying they will decarbonise by 2050, yet a large number continue to finance fossil fuels, the primary source of carbon emissions. To accelerate action, shareholder activists have filed climate resolutions for upcoming AGMs at three of the institutions analysed. UK bank Barclays and Japan’s biggest bank Mitsubishi UFJ (MUFJ) are considering resolutions for stricter regulations on lending. US bank Wells Fargo is facing a resolution to remove its Chair.

The resolutions come as a report by Rainforest Action Network showed that some of the world’s largest commercial and investment banks had invested $3.8 trillion into fossil fuel companies in the five years since the Paris Agreement, the global commitment to limit temperature rise to 2C and preferably to 1.5C by 2100.

Simon Youel, of advocacy group Positive Money, said the banks’ failure to act showed they could not be trusted to “go green” of their own accord.

“Bankers too often have vested interests in pumping up the carbon bubble, which is why we need central banks to play their role as regulators of the financial system and stamp out risky fossil fuel lending,” he told DeSmog.

Climate conflicted banksDeSmog’s analysis found that 15 percent of directors had worked with companies identified by the Climate Action 100+ initiative as some of the world’s worst polluters, and one in 20 (six percent) had ties to companies financing extraction of coal, the most polluting fossil fuel.

The research also found that more than one in five directors (28 percent) had worked at other banks known to support fossil fuel extraction, and that 16 percent had been involved with investment vehicles supporting polluting industries.

Read more:

https://www.desmogblog.com/2021/04/06/revealed-climate-conflicted-directors-leading-the-worlds-top-banks/

Read from top...