Search

Recent comments

- peace boom...

1 hour 2 min ago - brave losers....

1 hour 44 min ago - lights out....

1 hour 55 min ago - multi-survival....

3 hours 1 min ago - oh sy !!!!

6 hours 6 min ago - fraud....

7 hours 54 min ago - germany's gold.....

8 hours 16 min ago - divorce....

8 hours 54 min ago - augustus....

9 hours 1 min ago - russia's gold....

9 hours 13 min ago

Democracy Links

Member's Off-site Blogs

from the cheap seats .....

Only nine of the 62 apartments sold in One Hyde Park - the world's most expensive residential block - have been registered for council tax.

The ownership of the Knightsbridge apartments, which range in price from £3.6m for a one-bedroom flat to £136m for a penthouse, is now under investigation by Westminster city council, which is determined to pursue the monies owed by the secretive owners of the apartments.

Council records show that only four owners are paying the full council tax of £755.60 a year plus £619.64 to the Greater London Authority, while five are paying the 50% discounted council tax owed on a second home.

Westminster has received no response from the developer of One Hyde Park, Project Grande (Guernsey), managed by billionaire brothers Nick and Christian Candy, to a written request sent two weeks ago asking for the names of the remaining apartment owners. Officials are now researching Land Registry records for the exclusive block, sandwiched between Harvey Nichols and the Serpentine. However, the myriad offshore companies protecting the identities of residents are, according to sources at the council, likely to defeat them.

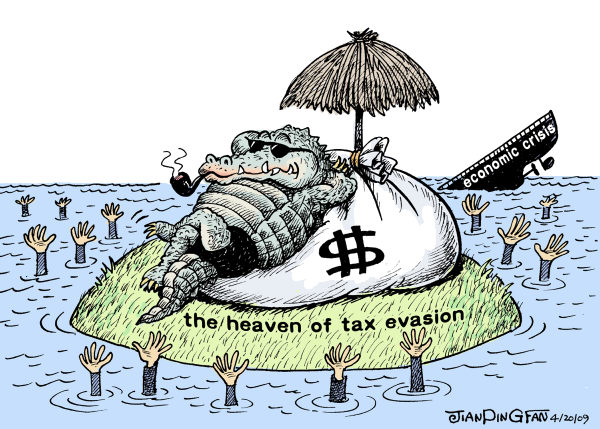

An analysis of the records by the Observer shows that 25 of the flats' registered owners are companies in the British Virgin Islands. Other offshore tax havens used to purchase the properties include Guernsey, the Cayman Islands, Liechtenstein and Liberia.

Council officials are now expecting to canvass the apartments door-to-door, although sources said there were concerns that the building's security, including its SAS-trained doormen, could prove an obstacle.

Karen Buck, the Labour MP for Westminster north, said she expected the council to act quickly to recoup the tax from One Hyde Park's residents. She voiced concern that the super-rich in London were not paying their way, saying: "When council spending is under unprecedented pressure, it is scandalous that residents in luxury apartments can avoid their share of council tax liability. It sometimes seems as if the more money you have the less you are required to pay."

A council may apply to a magistrate for a warrant to imprison a council tax debtor if they are refusing to pay but have the means.

The revelation follows claims by Liberal Democrats that up to £750m is lost every year to the exchequer when house purchases are hidden behind off-shore companies.

Future buyers of properties already sold at One Hyde Park have the option of avoiding stamp duty by buying the companies that own them and assuming control without triggering a taxable property transfer.

A spokeswoman for the Candy brothers denied that the developer was required to provide the identities of the owners of their apartments. She said: "Once the apartment is sold, it is not the developer's responsibility to register the new owner with the council. This is the responsibility of the owner. I have spoken with the developer and they haven't received the Westminster city council letter you are referring to but they have assured me that they will co-operate as required."

Councillor Philippa Roe, Westminster council's cabinet member for strategic finance, said: "In instances where a developer has sold a number of new flats but has not informed the local authority for tax purposes, the council would write to the developer and ask for details of the new owners, including the dates when the properties were sold.

"If we do not receive a response from the developers, we would use other methods to get this information such as Land Registry searches and visits to the property. Any council tax owed to the local authority will be back dated and collected accordingly."

http://www.guardian.co.uk/uk/2011/nov/26/one-hyde-park-council-tax

"For the first time in the 200 year run of the free market system, we have built & expanded an entire integrated global financial structure, the basic purpose of which is to shift money from poor to rich. (It is) the ugliest chapter in global economic affairs since slavery ...."

Raymond W. Baker, a senior fellow at the US Center for International Policy & guest scholar at the Brookings Institution.

- By John Richardson at 28 Nov 2011 - 10:19am

- John Richardson's blog

- Login or register to post comments

labour's supine indulgence of the globalised wealthy …..

The behaviour of journalists has been truly shocking. I'm not talking, for once, about phone hacking, the paparazzi and the Leveson Inquiry. I'm talking about expenses claims. The profession was a market leader. Two of the more colourful cases I can recall were for an entire family's ski trip and for a lawnmower, even though the claimant lived high up in a block of flats. One was technically permitted, the other was technically fraudulent.

Why, on the eve of the Chancellor's important economic statement and a potentially debilitating strike, do I bring up details such as these? I do this to show that most people try to get away with it most of the time - if they are allowed to. Good behaviour is usually the result of rules and peer pressure.

The story of the reckless bankers is well known. The enormous pay rises for FTSE chief executives have left a similarly sickening taste. The public sector has seen quango chiefs and council bosses on silly money. As for the BBC and its army of managers, they used the spurious excuse that they had to pay each other exorbitant salaries to stop them from fleeing to rivals. Nobody has yet managed to identify a single competitor prepared to hand over such cash, but snouts remain in troughs. I nearly forgot our estimable Members of Parliament.

As the vast majority of Britons face, according to George Osborne, another six years of austerity, it is worth remembering that Gordon Brown's spending boom was based on greed and borrowing. His deal with the super-rich was to leave them untouched, relying on their very limited largesse to fund investment in his pet public-service projects: trickle-down economics, traditional Thatcherite values in a modern setting.

Labour's supine indulgence of the globalised wealthy - prompted by fear in Brown's case, envy in Tony Blair's - was one of the reasons I lost whatever sympathy I still had for it following the Iraq war. The nightmare of the 1980s, when the party allowed itself to be seen as anti-entrepreneurship, rightly led to a rethink. John Smith's "prawn cocktail" offensive was designed to show business it had nothing to fear from a Labour government.

From the moment Blair took over that message morphed from accommodation to admiration. Every time I mentioned tax avoidance to treasury ministers - from the non-doms, to the various wheezes that made London such an attractive home for anyone with a private jet - I was told to get real. In one respect they were right. Britain was in the midst of a boom and nobody was complaining much.

The country's economic prospects may now be different, but to what extent has the mood changed? There is more circumspection in the public sector about pay at the top (but still not enough); in the private sector nothing seems to have changed. Rewards for success - and failure - remain limitless. Revelations in recent days about the rich not paying their council tax and stamp duty, using various off-shore scams, are shrugged away with ministerial platitudes.

In some ways, the Coalition has cracked down harder than its predecessor, but that is not saying much. The bar was set absurdly low. There is far more that the present government should do, but David Cameron is wary of going any further. Not only is he resisting external pressure for a tax on the banks, the so-called Tobin tax that the French and Germans would like to apply EU-wide, but he is also keen to reassure his friends in the City and in the boardroom that his Government will treat them well. Osborne is said to be more amenable to further steps.

This is an area which Nick Clegg should make his own. The Deputy Prime Minister knows that, with Labour still frightened of accusations of "anti-business", there is ample political space for someone to represent the mass of British opinion that deeply resents making sacrifices while a tiny minority gets away with it. Some Conservative MPs are beginning to understand too. In a newspaper article on Sunday, Dominic Raab and Matthew Hancock called for greater shareholder involvement to prevent soaring pay, including an employee representative on remuneration committees - albeit in an advisory capacity. Small it might sound in practice, but that is some ideological shift.

In the past few weeks, Clegg has made a series of announcements of investment projects designed to slow down the inexorable rise in unemployment. Plan A is not being abandoned - Osborne and Cameron are unlikely to bend their public spending targets - but it is being tweaked. Labour's critique over the past 18 months has been half right, half wrong. Ed Miliband and Ed Balls have consistently warned of the dangers posed by an excessive squeeze, both on growth and on meeting deficit-reduction targets. One of the ironies of politics post-crash is that, even though the folly of the unbridled free market has been laid bare, parties of the centre-left have suffered at the polls.

On the basis of Nixon in China, perhaps a centre-right coalition can do what Labour was too frightened to try - to begin to re-balance a pay scale that makes no economic or political, let alone moral sense. To do so would require measures that go far beyond the piecemeal changes already flagged. The danger for politicians, if they don't embrace the new mood, is not Greek-style militancy. Wednesday's public-sector strike will lead to mutterings of annoyance from the millions affected by school closures and predicted airport chaos. Apart from the odd march, the odd protest outside St Paul's and the odd strike, British docility is entrenched.

More dangerous is a mood of sullen defeatism. Few voters believe Cameron's mantra that "we are all in it together". He calculates that, for as long as Labour is not trusted in times of hardship, he will scrape through in 2015 with or without recourse to the Liberal Democrats. Forecasts of an economic upswing have been postponed until a second term.

Then he hopes business will return to usual. Most people will be a bit better off; the "1 per cent" will continue to rake it in - because nothing is done to impede this base human instinct. Grab it while you can and look after your own. It is in times of trouble that real change usually takes place. But this time does anyone have the courage?

John Kampfner is the author of 'Freedom For Sale'.

http://www.independent.co.uk/opinion/commentators/john-kampfner-which-of-our-leaders-has-really-got-the-courage-to-care-6268909.html

but is tax evasion an art form?...

By DAVID KOCIENIEWSKIAs he stood in the opulent marble foyer of a Fifth Avenue mansion late last month, greeting the coterie of prominent guests arriving at his private art gallery, Ronald S. Lauder was doing more than just being a gracious host.

To celebrate the 10th anniversary of the Neue Galerie, Mr. Lauder’s museum of Austrian and German art, he exhibited many of the treasures of a personal collection valued at more than $1 billion, including works by Van Gogh, Cézanne and Matisse, and a Klimt portrait he bought five years ago for $135 million.

Yet for Mr. Lauder, an heir to the Estée Lauder fortune whose net worth is estimated at more than $3.1 billion, the evening went beyond social and cultural significance. As is often the case with his activities, just beneath the surface was a shrewd use of the United States tax code. By donating his art to his private foundation, Mr. Lauder has qualified for deductions worth tens of millions of dollars in federal income taxes over the years, savings that help defray the hundreds of millions he has spent creating one of New York City’s cultural gems.

The charitable deductions generated by Mr. Lauder — whose donations have aided causes as varied as hospitals and efforts to rebuild Jewish identity in Eastern Europe — are just one facet of a sophisticated tax strategy used to preserve a fortune that Forbes magazine says makes him the world’s 362nd wealthiest person. From offshore havens to a tax-sheltering stock deal so audacious that Congress later enacted a law forbidding the tactic, Mr. Lauder has for decades aggressively taken advantage of tax breaks that are useful only for the most affluent.

The debate over whether to reduce tax shelters and preferences for the rich is one of the most volatile in Washington and will move to the presidential campaign, now that repeated attempts in Congress to strike a grand bargain over spending cuts and an overhaul of the tax code have failed.

http://www.nytimes.com/2011/11/27/business/estee-lauder-heirs-tax-strategies-typify-advantages-for-wealthy.html?ref=general&src=me&pagewanted=print